Escape To The Country: How Nicki Chapman Made £700,000 On A Property Investment

Table of Contents

Nicki Chapman's Property Investment Strategy: A Deep Dive

Nicki Chapman's success in rural property investment didn't happen by chance. It was the result of a carefully crafted strategy focused on identifying undervalued properties, strategic renovation, and impeccable market timing. Let's break down the key components:

Identifying Profitable Rural Properties:

Finding undervalued properties in desirable rural locations is the cornerstone of successful rural property investment. This requires meticulous research and a keen eye for potential.

- Location, Location, Location: Prioritize areas with strong community spirit, good transport links, and proximity to amenities. Consider future development plans and potential growth in the local area.

- Property Potential: Look beyond cosmetic flaws. Identify properties with sound structural integrity but requiring modernisation. The potential for renovation and value enhancement is key.

- Market Analysis: Conduct thorough research using online property portals, local estate agents, and comparable property sales data. Understand the local property market trends and identify properties priced below their true market value. Keywords: Rural property investment, property market analysis, undervalued properties, location analysis.

Renovation and Enhancement for Maximum ROI:

Smart renovation choices are crucial for maximizing your return on investment. Nicki Chapman likely focused on cost-effective strategies that added significant value without breaking the bank.

- Prioritize Key Areas: Focus on renovations that deliver the biggest impact, such as kitchen and bathroom upgrades, efficient energy improvements, and modernizing outdated features.

- Cost Management: Create a detailed budget and stick to it. Source materials cost-effectively and consider DIY where possible, while maintaining professional standards.

- Value-Adding Improvements: Enhance the property's curb appeal, add modern conveniences, and create a desirable living space. These improvements directly translate to a higher selling price. Keywords: Property renovation, ROI (Return on Investment), cost-effective renovations, property value increase.

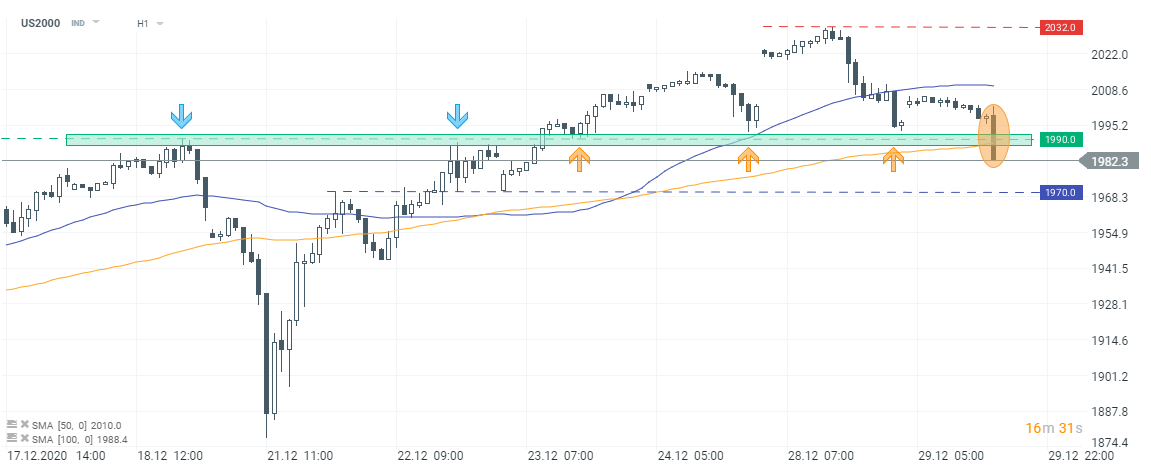

Strategic Timing and Market Conditions:

Understanding property market cycles is paramount. Successful investors like Nicki Chapman recognize opportune moments to buy low and sell high.

- Market Cycles: Familiarize yourself with the ups and downs of the property market. Buying during periods of lower demand can lead to significant savings.

- Patience and Timing: Avoid impulsive decisions. Wait for the right property at the right price. A well-timed purchase and sale can significantly impact profitability.

- Market Trends: Stay informed about local and national market trends. Understanding factors like interest rates and economic conditions can help you make informed decisions. Keywords: Property market cycles, market timing, buying low, selling high, property market trends.

Lessons Learned from Nicki Chapman's Success:

Nicki Chapman's journey highlights several essential lessons for aspiring property investors:

The Importance of Due Diligence:

Thorough research is critical before investing in any property. Cutting corners can lead to costly mistakes.

- Professional Advice: Engage qualified professionals, including surveyors and solicitors, to conduct thorough property inspections and legal reviews.

- Property Surveys: Don't skip a structural survey. It can uncover hidden problems that could significantly impact the renovation budget and overall profitability.

- Comprehensive Research: Investigate the property's history, including any potential issues or legal encumbrances. Keywords: Due diligence, property surveys, legal advice, property inspection.

Risk Management in Property Investment:

The property market inherently involves risks. A sound risk management strategy is essential.

- Diversification: Don't put all your eggs in one basket. Spread your investments across multiple properties to mitigate potential losses.

- Contingency Planning: Always have a financial buffer to cover unexpected costs or market fluctuations.

- Realistic Expectations: Understand that property investments don't always guarantee immediate profits. Keywords: Risk management, property investment risks, diversification, contingency planning.

The Emotional Aspect of Property Investment:

Separating emotions from financial decisions is crucial for rational decision-making.

- Objective Analysis: Focus on the numbers and potential ROI, not personal preferences or emotional attachments to a particular property.

- Financial Goals: Define your financial objectives clearly before starting your investment journey. This will guide your decisions and help you stay focused.

- Professional Advice: Seek guidance from financial advisors to help manage the emotional aspects of investment. Keywords: Emotional investment, financial decisions, objective analysis, property investment strategies.

Your Escape to the Country Awaits: Replicating Nicki Chapman's Success

Nicki Chapman's success in rural property investment underscores the potential rewards of strategic planning, diligent research, and careful execution. By following her example and applying the lessons outlined above, you can significantly increase your chances of achieving similar success. Start your own escape to the country journey, invest in your rural property dreams, and learn from Nicki Chapman's successful property investment strategy. Unlock the potential of rural property investment and build your own portfolio! Start your research today and embark on your own profitable "Escape to the Country" adventure!

Featured Posts

-

Social Media Storm Annie Kilners Posts On Alleged Walker Poisoning

May 24, 2025

Social Media Storm Annie Kilners Posts On Alleged Walker Poisoning

May 24, 2025 -

Dax Soars Frankfurt Equities Open Higher Record High In Sight

May 24, 2025

Dax Soars Frankfurt Equities Open Higher Record High In Sight

May 24, 2025 -

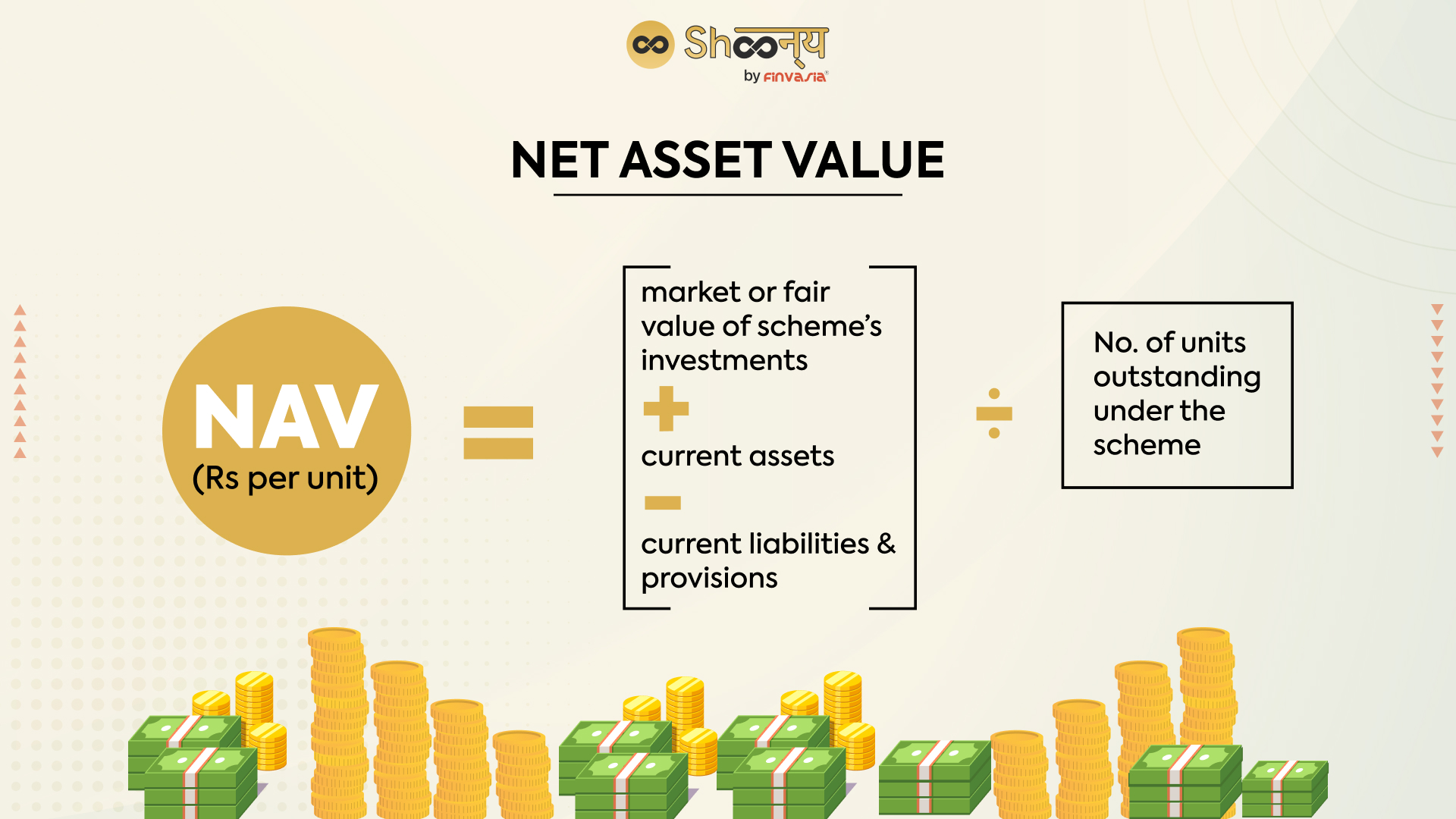

Amundi Djia Ucits Etf Distributing A Guide To Net Asset Value

May 24, 2025

Amundi Djia Ucits Etf Distributing A Guide To Net Asset Value

May 24, 2025 -

Escape To The Country Making The Move Successfully

May 24, 2025

Escape To The Country Making The Move Successfully

May 24, 2025 -

Dreyfus Affair Proposed Posthumous Promotion Highlights Frances Ongoing Reconciliation

May 24, 2025

Dreyfus Affair Proposed Posthumous Promotion Highlights Frances Ongoing Reconciliation

May 24, 2025

Latest Posts

-

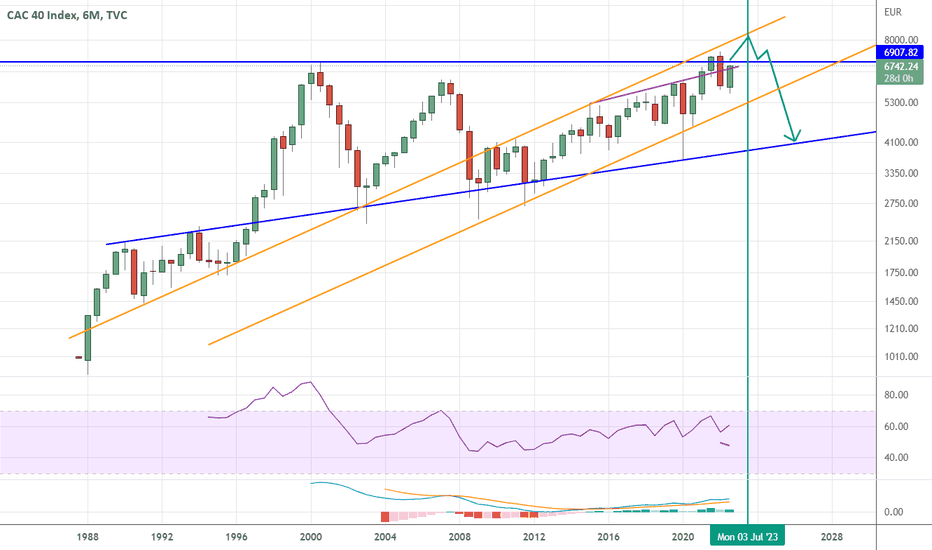

French Cac 40 Index Mixed Performance For The Week Ending March 7 2025

May 24, 2025

French Cac 40 Index Mixed Performance For The Week Ending March 7 2025

May 24, 2025 -

Slight Cac 40 Dip At Weeks End Remains Steady Overall March 7 2025

May 24, 2025

Slight Cac 40 Dip At Weeks End Remains Steady Overall March 7 2025

May 24, 2025 -

Cac 40 Index Finishes Week Lower But Shows Weekly Resilience March 7 2025

May 24, 2025

Cac 40 Index Finishes Week Lower But Shows Weekly Resilience March 7 2025

May 24, 2025 -

Cac 40 Weekly Close In Negative Territory Despite Overall Stability March 7 2025

May 24, 2025

Cac 40 Weekly Close In Negative Territory Despite Overall Stability March 7 2025

May 24, 2025 -

Crisi Moda Come I Dazi Di Trump Hanno Colpito Nike Lululemon E Il Mercato Europeo

May 24, 2025

Crisi Moda Come I Dazi Di Trump Hanno Colpito Nike Lululemon E Il Mercato Europeo

May 24, 2025