Amundi DJIA UCITS ETF (Distributing): A Guide To Net Asset Value

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the underlying value of each share in an ETF. For the Amundi DJIA UCITS ETF (Distributing), the NAV reflects the total value of the ETF's holdings in the Dow Jones Industrial Average (DJIA) constituent companies, minus any liabilities. It's different from the market price, which fluctuates throughout the trading day based on supply and demand. The NAV, on the other hand, is a more fundamental measure of the ETF's intrinsic worth.

- NAV is calculated daily: The Amundi DJIA UCITS ETF NAV is calculated at the close of each trading day, reflecting the closing prices of all the DJIA components.

- NAV reflects the total value of the ETF's holdings: This includes the market value of all the stocks the ETF owns, weighted according to their representation in the DJIA.

- Understanding NAV helps in evaluating ETF performance: Comparing the NAV over time provides a clear picture of the ETF's growth, irrespective of short-term market fluctuations.

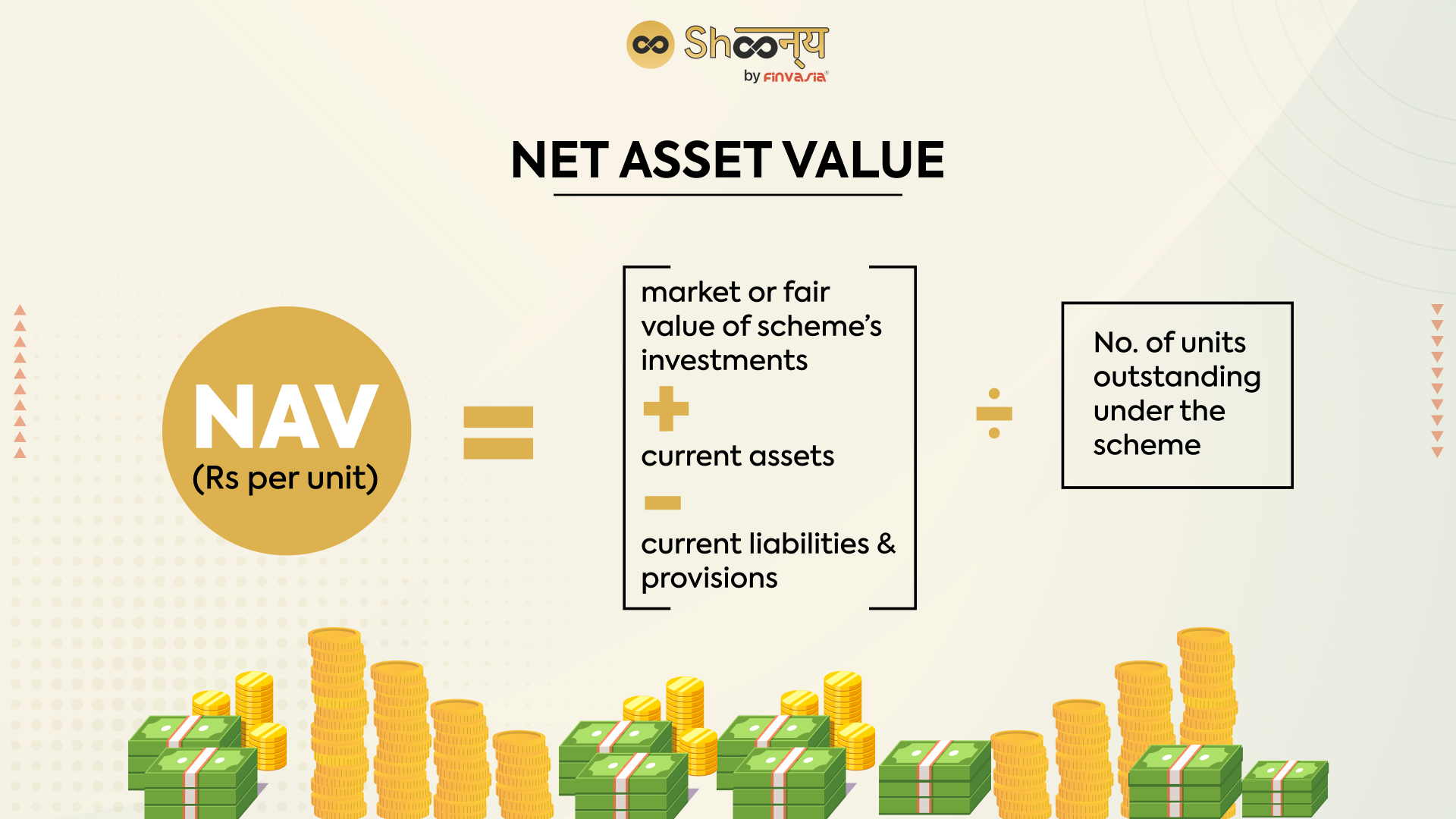

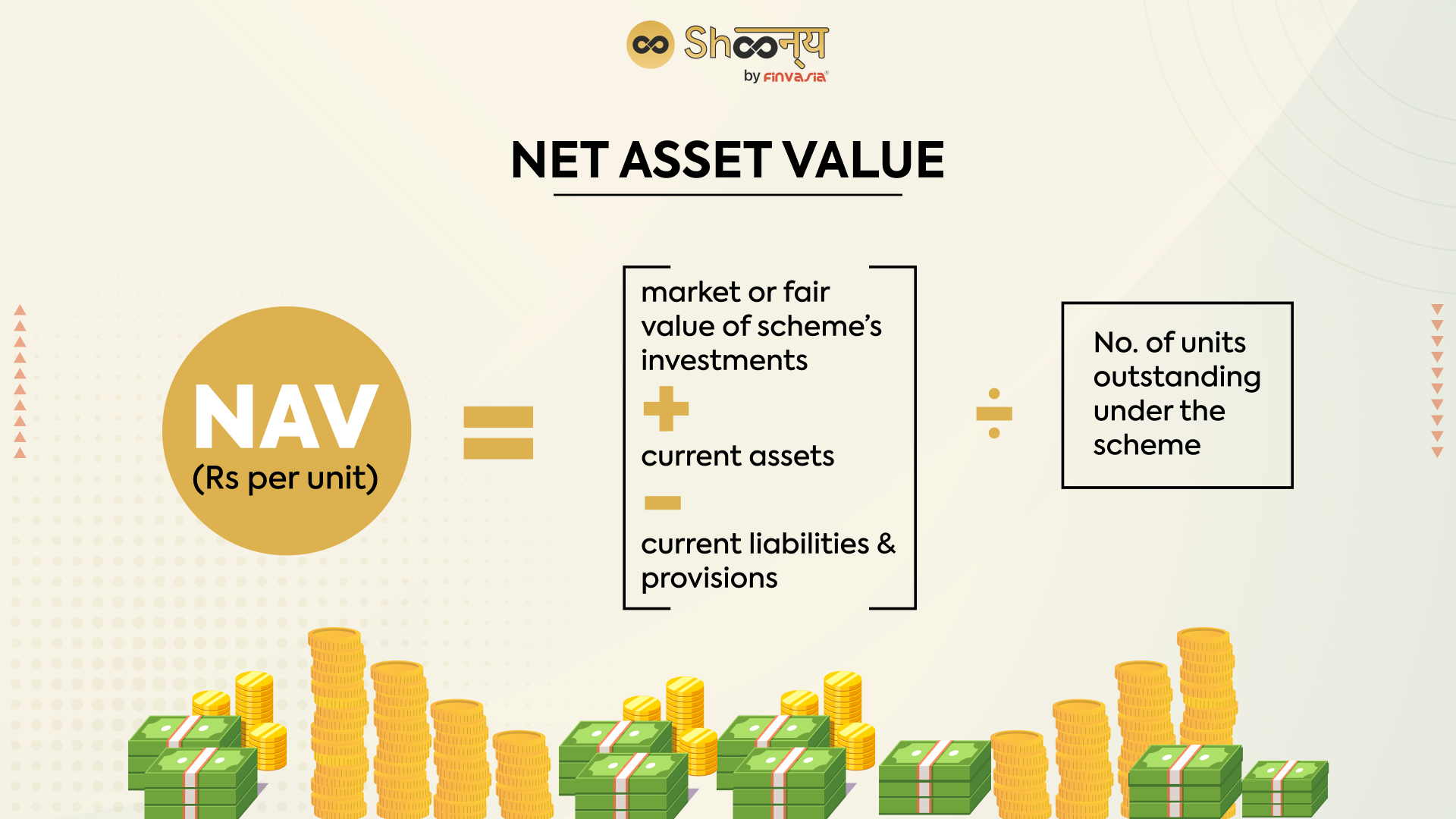

Calculating the NAV of the Amundi DJIA UCITS ETF (Distributing)

Calculating the Amundi DJIA UCITS ETF NAV involves a straightforward process:

- NAV = (Total Asset Value - Liabilities) / Number of Outstanding Shares

This formula considers several key factors:

- Includes the value of all DJIA constituent stocks held by the ETF: The ETF aims to replicate the DJIA, so the NAV directly reflects the performance of these 30 major US companies.

- Management fees and other expenses are deducted: The ETF's operating expenses are subtracted from the total asset value before calculating the NAV per share.

- Dividend distributions affect the NAV: When the ETF distributes dividends earned from its holdings, the NAV is adjusted downward to reflect the distribution. Currency fluctuations between the USD and the ETF's base currency may also slightly impact the NAV calculation.

Why is NAV Important for Amundi DJIA UCITS ETF Investors?

Monitoring the Amundi DJIA UCITS ETF NAV is crucial for several reasons:

- Track the ETF's growth over time: Regularly checking the NAV allows you to track the long-term performance of your investment.

- Identify potential undervaluation or overvaluation: Comparing the NAV to the market price can reveal potential buying opportunities (when the NAV is significantly higher than the market price) or indicate a possible overvaluation.

- Compare performance against benchmarks: By tracking the NAV, you can assess the ETF's performance against the DJIA itself and other similar ETFs.

- Assess the impact of market fluctuations: While the market price can be volatile, the NAV provides a clearer picture of the underlying asset value, helping you to assess the impact of market swings on your investment.

Where to Find the Amundi DJIA UCITS ETF (Distributing) NAV?

The Amundi DJIA UCITS ETF (Distributing) NAV is readily available from various sources:

-

Amundi's official website: Check the fund's dedicated page on Amundi's website for daily updates.

-

Major financial data providers: Sites like Bloomberg, Yahoo Finance, and Google Finance typically provide real-time or end-of-day NAV data for ETFs.

-

Brokerage platforms: Most brokerage accounts will display the NAV of your held ETFs directly within your portfolio summary.

-

Usually updated at the end of each trading day: You can typically find the updated NAV shortly after the close of the relevant market.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi DJIA UCITS ETF (Distributing) is crucial for informed investment decisions. By grasping its calculation and significance, investors can better track performance, identify potential opportunities, and manage their investments effectively. Learn more about the Amundi DJIA UCITS ETF (Distributing) and its NAV to make well-informed investment choices. Regularly monitor the Amundi DJIA UCITS ETF NAV and DJIA ETF NAV for optimal portfolio management. Stay updated to maximize your investment strategy.

Featured Posts

-

Intimacy Growth And The New Album Her In Deep An Interview With Matt Maltese

May 24, 2025

Intimacy Growth And The New Album Her In Deep An Interview With Matt Maltese

May 24, 2025 -

2026 Porsche Cayenne Ev Spy Photos Reveal First Glimpses

May 24, 2025

2026 Porsche Cayenne Ev Spy Photos Reveal First Glimpses

May 24, 2025 -

Yevrobachennya 2025 Konchita Vurst Nazvala Chotirokh Potentsiynikh Peremozhtsiv

May 24, 2025

Yevrobachennya 2025 Konchita Vurst Nazvala Chotirokh Potentsiynikh Peremozhtsiv

May 24, 2025 -

Pobediteli Evrovideniya Poslednie 10 Let Gde Oni Seychas

May 24, 2025

Pobediteli Evrovideniya Poslednie 10 Let Gde Oni Seychas

May 24, 2025 -

Oleg Basilashvili Test Na Znanie Ego Filmov

May 24, 2025

Oleg Basilashvili Test Na Znanie Ego Filmov

May 24, 2025

Latest Posts

-

Amsterdam Stock Market Three Days Of Significant Losses Totaling 11

May 24, 2025

Amsterdam Stock Market Three Days Of Significant Losses Totaling 11

May 24, 2025 -

Dazi E Mercati L Unione Europea Pronta A Reagire Alla Crisi

May 24, 2025

Dazi E Mercati L Unione Europea Pronta A Reagire Alla Crisi

May 24, 2025 -

Dutch Stocks Continue Downturn As Trade War With Us Heats Up

May 24, 2025

Dutch Stocks Continue Downturn As Trade War With Us Heats Up

May 24, 2025 -

Le Borse Crollano A Causa Dei Dazi La Risposta Decisa Della Ue

May 24, 2025

Le Borse Crollano A Causa Dei Dazi La Risposta Decisa Della Ue

May 24, 2025 -

Guerra Dei Dazi Impatto Sulle Borse Europee E Reazioni Ue

May 24, 2025

Guerra Dei Dazi Impatto Sulle Borse Europee E Reazioni Ue

May 24, 2025