40% Up In 2025? A Deep Dive Into Palantir Stock Investment

Table of Contents

A bold prediction claims Palantir stock could surge by 40% by 2025. Is this ambitious forecast realistic? This article delves into the potential for Palantir Technologies, Inc. (PLTR) stock investment, examining the factors that could drive—or hinder—such explosive growth. Palantir, a leading provider of big data analytics platforms, primarily serves government agencies and commercial enterprises worldwide. We'll analyze Palantir's current financial performance, future growth prospects, and inherent risks to determine if this investment opportunity aligns with your risk tolerance and investment goals. Keywords throughout this analysis will include: Palantir stock, Palantir investment, Palantir stock price prediction, Palantir growth potential, big data analytics, government contracts, and artificial intelligence (AI).

2. Main Points:

2.1 Analyzing Palantir's Current Financial Performance and Market Position:

H3: Revenue Growth and Profitability: Palantir's recent financial reports reveal a trajectory of impressive revenue growth, though profitability remains a key area of focus. Let's analyze some key performance indicators (KPIs):

- Year-over-Year Revenue Growth: While specific figures fluctuate quarter to quarter, consistent growth is a positive indicator for potential investors. Examining this trend provides insight into Palantir's ability to acquire and retain clients.

- Net Income: Palantir's path to profitability is a crucial factor influencing stock price. Analyzing net income trends, coupled with operating margins, paints a clearer picture of the company's financial health and sustainability.

- Market Position: Palantir holds a significant position in the big data analytics market, particularly within the government sector. However, intense competition from established tech giants like Microsoft and Amazon necessitates consistent innovation and market share expansion.

H3: Government Contracts and Commercial Expansion: Government contracts have historically formed a substantial part of Palantir's revenue. Diversification into the commercial sector is crucial for long-term growth and stability:

- Government Contracts: Examples of large-scale government contracts, such as those with intelligence agencies and defense departments, illustrate the scale of Palantir's involvement and their impact on revenue.

- Commercial Expansion: Palantir's success in expanding its commercial client base, particularly within sectors like finance, healthcare, and cybersecurity, will be key to reducing reliance on government contracts.

- Risk Mitigation: Over-reliance on government contracts presents a significant risk. Geopolitical shifts and changes in government spending can significantly impact Palantir's revenue stream.

2.2 Factors Contributing to Potential 40% Growth by 2025:

H3: Technological Innovation and Product Development: Palantir's continued investment in R&D is a crucial driver of its future growth.

- New Technologies: Advancements in AI, machine learning, and data visualization are key to enhancing Palantir's platform and attracting new clients. Specific examples of new product releases and their market impact should be considered.

- Innovation Pipeline: A robust innovation pipeline is essential for sustaining long-term growth and maintaining a competitive edge in the rapidly evolving big data analytics landscape. Analyzing Palantir's future product roadmap is therefore crucial.

H3: Expanding Market Opportunities: The market for big data analytics is expanding rapidly, presenting significant opportunities for Palantir.

- Growth Sectors: Healthcare, finance, and cybersecurity present lucrative opportunities for Palantir's platform. Analyzing the growth potential within these sectors will help assess the company's potential market share expansion.

- International Expansion: Palantir's potential for international expansion and market penetration is a critical factor to consider. This includes assessing market entry strategies and regulatory hurdles.

H3: Strategic Partnerships and Acquisitions: Strategic partnerships and acquisitions can significantly impact Palantir's growth trajectory.

- Successful Partnerships: Analyzing successful past partnerships and their contribution to Palantir's growth can indicate the effectiveness of this strategy.

- Potential Acquisitions: Examining potential acquisition targets and their potential synergies with Palantir's existing business model will illustrate growth potential.

2.3 Risks and Challenges to Consider:

H3: Competition and Market Saturation: The big data analytics market is fiercely competitive.

- Major Competitors: Companies like Microsoft, Amazon, Google, and IBM pose significant competitive challenges. Understanding their strengths and weaknesses is vital to assess Palantir's market share potential.

- Market Saturation: The potential for market saturation in certain segments needs to be analyzed. This includes strategies to maintain growth and avoid price wars.

H3: Economic and Geopolitical Factors: Macroeconomic factors and geopolitical events can significantly influence Palantir's stock price.

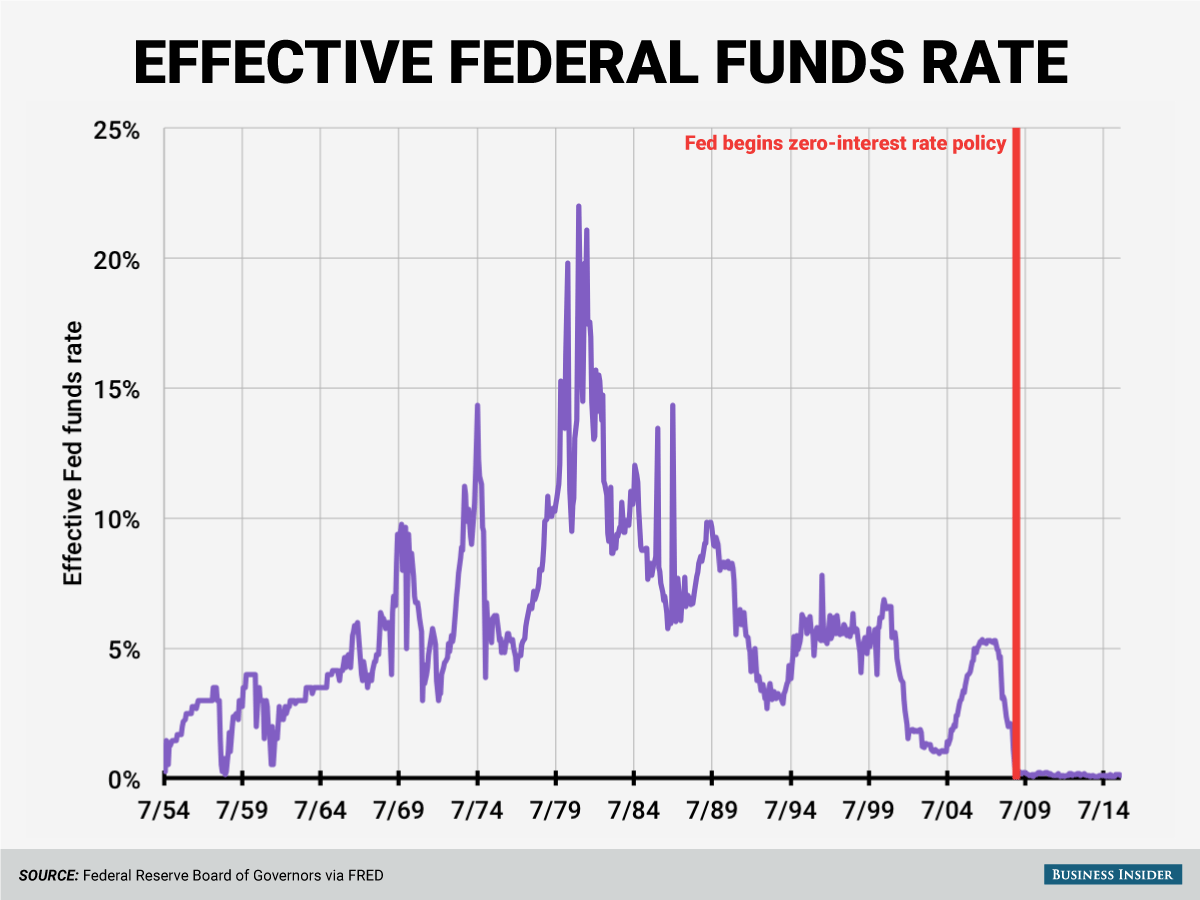

- Economic Downturns: Analyzing Palantir's resilience to economic downturns is crucial, as government and commercial spending can be affected by economic cycles.

- Regulatory Changes: Regulatory changes impacting data privacy and security could significantly affect Palantir's operations and market access.

H3: Dependence on Key Clients: Palantir's reliance on a limited number of large clients creates risk.

- Contract Losses: The potential impact of losing key contracts needs to be assessed, along with strategies to mitigate this risk, such as diversifying the client base and developing new revenue streams.

3. Conclusion: Is Investing in Palantir Stock Right for You?

Investing in Palantir stock presents both significant potential for growth and substantial risks. While the 40% growth prediction by 2025 is ambitious, Palantir's technological innovation, expanding market opportunities, and strategic partnerships contribute to its positive outlook. However, intense competition, economic uncertainties, and dependence on key clients are significant factors to consider. Thorough due diligence, an understanding of market dynamics, and a realistic assessment of your risk tolerance are essential before investing in Palantir stock. Should you invest in Palantir stock? The answer depends entirely on your individual circumstances and investment strategy. Conduct further research and assess your risk tolerance before making any investment decisions. Learn more about Palantir stock investment opportunities and make informed choices that align with your financial goals.

Featured Posts

-

Snls Failed Harry Styles Impression How He Really Felt

May 10, 2025

Snls Failed Harry Styles Impression How He Really Felt

May 10, 2025 -

000 Guest Capacity A Tour Of The Transformed Queen Elizabeth 2

May 10, 2025

000 Guest Capacity A Tour Of The Transformed Queen Elizabeth 2

May 10, 2025 -

Nhl Kucherovs Lightning Shut Out Oilers 4 1

May 10, 2025

Nhl Kucherovs Lightning Shut Out Oilers 4 1

May 10, 2025 -

U S Federal Reserve Rate Decision Economic Uncertainty And The Path Forward

May 10, 2025

U S Federal Reserve Rate Decision Economic Uncertainty And The Path Forward

May 10, 2025 -

Discussions On Transgender Equality Intensify Bangkok Post Reports

May 10, 2025

Discussions On Transgender Equality Intensify Bangkok Post Reports

May 10, 2025