$5.6 Billion Acquisition: Thoma Bravo Buys Boeing's Jeppesen

Table of Contents

Jeppesen's Key Role in the Aviation Industry

Jeppesen has long been a dominant player in the aviation data landscape, holding a market-leading position for decades. Its influence is deeply rooted in the provision of crucial information and software essential for safe and efficient air travel.

Navigation Data Dominance

Jeppesen's core strength lies in its provision of comprehensive and reliable aviation navigation data. This includes:

- Digital charts: Providing pilots with up-to-the-minute, digitally rendered charts for safe navigation.

- Flight planning software: Sophisticated tools that optimize flight routes, considering factors like weather, air traffic, and fuel efficiency.

- Airport information: Detailed information on airports worldwide, including runways, taxiways, and navigational aids.

- Weather data: Real-time weather updates and forecasts crucial for safe flight operations.

These services are critical for pilots, air traffic controllers, and airline operations, making Jeppesen an indispensable part of the global aviation navigation data ecosystem. Its expertise in aviation navigation data and flight planning software is unmatched.

Global Reach and Customer Base

Jeppesen boasts a truly global reach, serving a diverse range of customers across the aviation spectrum:

- Airlines: Major international and regional airlines rely on Jeppesen for flight planning, operational efficiency, and crew training.

- Airports: Airports worldwide utilize Jeppesen's data for air traffic management, optimizing airport operations, and enhancing safety.

- General aviation: Private pilots and smaller aviation companies also benefit from Jeppesen's navigation charts and flight planning tools.

This broad customer base underscores Jeppesen's pivotal role in facilitating safe and efficient air travel globally. Its influence spans global aviation, making it a key player in airline operations and airport management worldwide.

Thoma Bravo's Acquisition Strategy and Implications

Thoma Bravo's acquisition of Jeppesen fits squarely within its established investment strategy, focusing on significant players in the software and technology sectors.

Thoma Bravo's Focus on Software and Technology

Thoma Bravo has a proven track record of successfully acquiring and growing enterprise software companies. Their investment philosophy emphasizes operational improvements, technological upgrades, and strategic market expansion. This acquisition aligns perfectly with their history, adding a powerful aviation data player to their portfolio. Other similar acquisitions in related tech sectors further solidify their expertise in this area.

- Examples: (Insert examples of relevant Thoma Bravo acquisitions here – research and include 2-3 specific examples)

This focus on software acquisition and technology investment points to a future where Jeppesen’s data solutions will likely see significant technological upgrades and expansions under Thoma Bravo's ownership.

Future Growth and Innovation under Thoma Bravo

The potential for Jeppesen's growth and innovation under Thoma Bravo is immense. We can expect:

- New product development: Expansion into new areas of aviation data and software solutions, potentially leveraging emerging technologies like AI and machine learning.

- Market expansion: Increased penetration into new markets and customer segments, potentially through strategic partnerships and acquisitions.

- Operational improvements: Streamlining operations to enhance efficiency and reduce costs, leading to better value for customers.

The strategic investment by Thoma Bravo is poised to fuel significant technological innovation and market expansion for Jeppesen.

The Financial Aspects of the Deal

The $5.6 billion price tag reflects Jeppesen's substantial market value and its potential for future growth.

$5.6 Billion Valuation and Significance

The sheer size of the $5.6 billion acquisition highlights the significant value placed on Jeppesen's aviation data solutions and its market-leading position. This private equity investment is one of the largest in the aviation technology sector recently. Thoma Bravo likely sees a considerable return on investment (ROI) through future growth and cost synergies.

- Comparison: (Compare the deal size to other relevant acquisitions in the industry; research and include 1-2 examples).

The high valuation reflects the critical role Jeppesen plays in the aviation industry and the significant potential for growth and profit under Thoma Bravo's management.

Potential Synergies and Cost Savings

Thoma Bravo's expertise in operational improvement will likely lead to several cost synergies and efficiencies:

- Technology integration: Consolidating and modernizing Jeppesen's technology infrastructure, leading to reduced costs and improved performance.

- Operational streamlining: Optimizing workflows and processes to increase efficiency and reduce operational expenses.

These merger and acquisition strategies will not only save costs but also improve the overall quality and efficiency of Jeppesen's services.

Conclusion

The Thoma Bravo acquisition of Boeing's Jeppesen for $5.6 billion marks a pivotal moment for the aviation industry. Jeppesen's critical role in providing aviation navigation data, its extensive global reach, and Thoma Bravo's strategic investment strategy create a potent combination for future growth and innovation. The financial implications are substantial, with significant potential for cost synergies and increased market share. The deal underscores the importance of reliable aviation data in the modern world and promises exciting developments in aviation technology.

Call to Action: Stay updated on the latest developments surrounding the Thoma Bravo Buys Boeing's Jeppesen acquisition and learn more about Jeppesen's industry-leading aviation data solutions by visiting [insert relevant links here].

Featured Posts

-

Christelle Le Hir Enjeux Et Defis A La Presidence De La Vie Claire Et Synadis Bio

Apr 23, 2025

Christelle Le Hir Enjeux Et Defis A La Presidence De La Vie Claire Et Synadis Bio

Apr 23, 2025 -

Uk Diy Store Ratings Which Retailers Come Out On Top

Apr 23, 2025

Uk Diy Store Ratings Which Retailers Come Out On Top

Apr 23, 2025 -

The Ongoing Feud Between Trump And Powell Impact On Interest Rates And Markets

Apr 23, 2025

The Ongoing Feud Between Trump And Powell Impact On Interest Rates And Markets

Apr 23, 2025 -

Brewers Offensive Explosion Nine Stolen Bases Highlight Win Over As

Apr 23, 2025

Brewers Offensive Explosion Nine Stolen Bases Highlight Win Over As

Apr 23, 2025 -

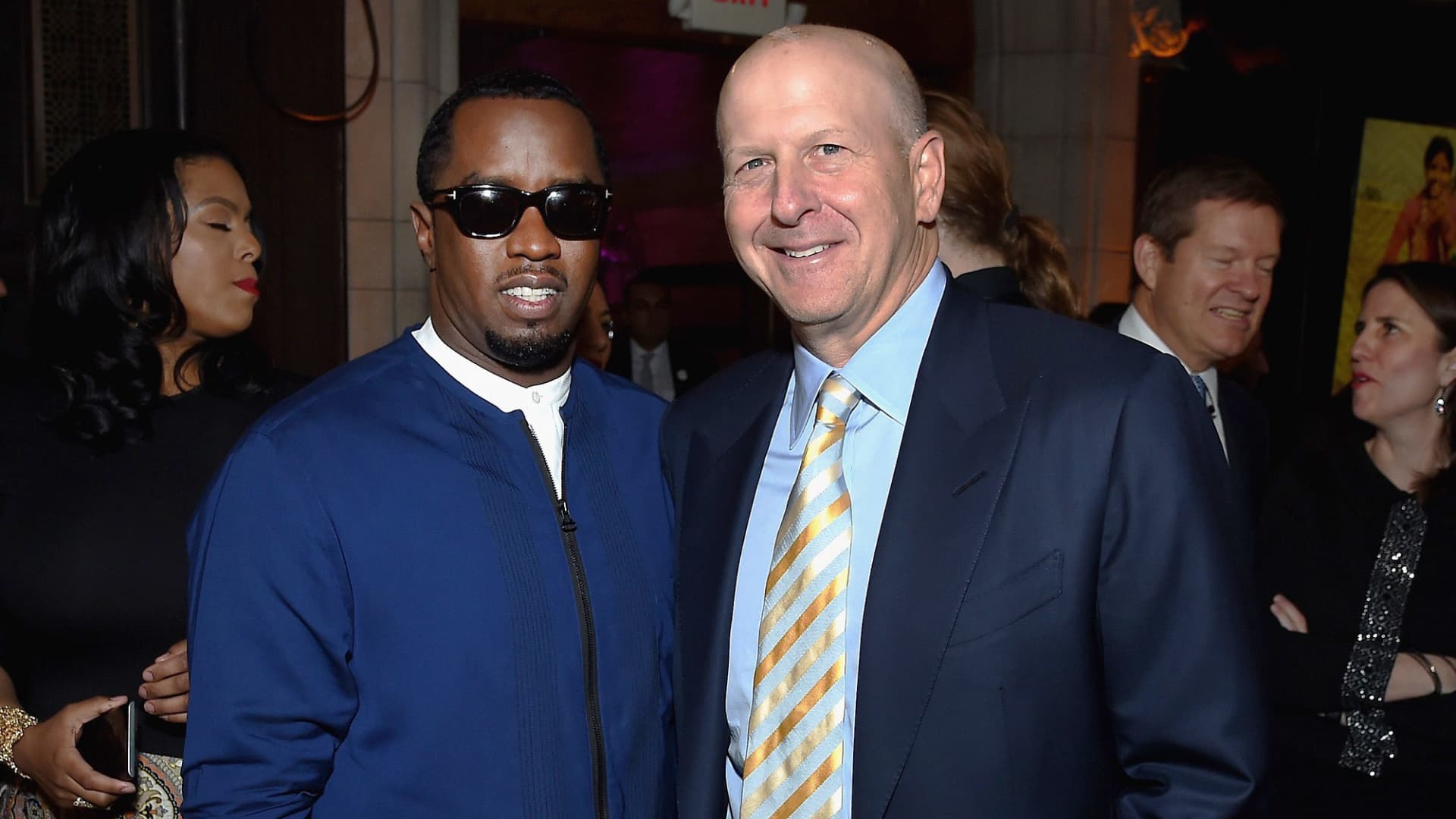

Is David Solomon A Banker Or A Private Equity Leader Goldman Sachs Pay Row Reveals Key Differences

Apr 23, 2025

Is David Solomon A Banker Or A Private Equity Leader Goldman Sachs Pay Row Reveals Key Differences

Apr 23, 2025