5 Essential Do's & Don'ts: Succeeding In The Private Credit Market

Table of Contents

Do: Conduct Thorough Due Diligence

Before investing in any private credit opportunity, comprehensive due diligence is paramount. This involves a meticulous examination of various aspects to mitigate potential risks and protect your investment.

Understanding the Borrower

A deep understanding of the borrower is the cornerstone of successful private credit investing. This requires going beyond surface-level analysis and delving into the specifics of their financial health and operational capabilities.

- Verify financial statements independently: Don't rely solely on the borrower's provided financials. Engage independent auditors or utilize specialized financial analysis tools to verify the accuracy and reliability of the information.

- Assess the borrower's industry and competitive landscape: Understanding the borrower's position within their industry, including market trends, competition, and regulatory pressures, is vital for assessing long-term viability.

- Analyze debt-to-equity ratios and other key financial metrics: Calculate and analyze key financial ratios such as debt-to-equity, interest coverage, and current ratio to gauge the borrower's financial health and ability to service debt.

- Investigate the borrower's legal and regulatory compliance history: Thoroughly review the borrower's legal history, including any past lawsuits, regulatory actions, or bankruptcies, to identify potential red flags.

Structure the Loan Agreement Carefully

The loan agreement is the legal contract that governs the terms of your investment. A well-drafted agreement is crucial for protecting your interests and mitigating potential risks.

- Define clear repayment schedules and interest rates: Establish a clear and unambiguous repayment schedule, including interest rates, fees, and penalties for default.

- Incorporate protective covenants to mitigate risk: Include covenants that restrict the borrower's actions, protecting your investment in case of financial distress. These might include limitations on debt incurrence or asset sales.

- Secure adequate collateral to safeguard your investment: Obtain sufficient collateral to secure your loan, providing a safety net in the event of default. The type and value of collateral should be carefully assessed.

- Consult with legal counsel to ensure compliance: Engage experienced legal counsel to review and negotiate the loan agreement, ensuring that it protects your interests and complies with all applicable laws and regulations.

Don't: Neglect Risk Management

While the potential returns in the private credit market are attractive, it's crucial to implement robust risk management strategies to protect your investments.

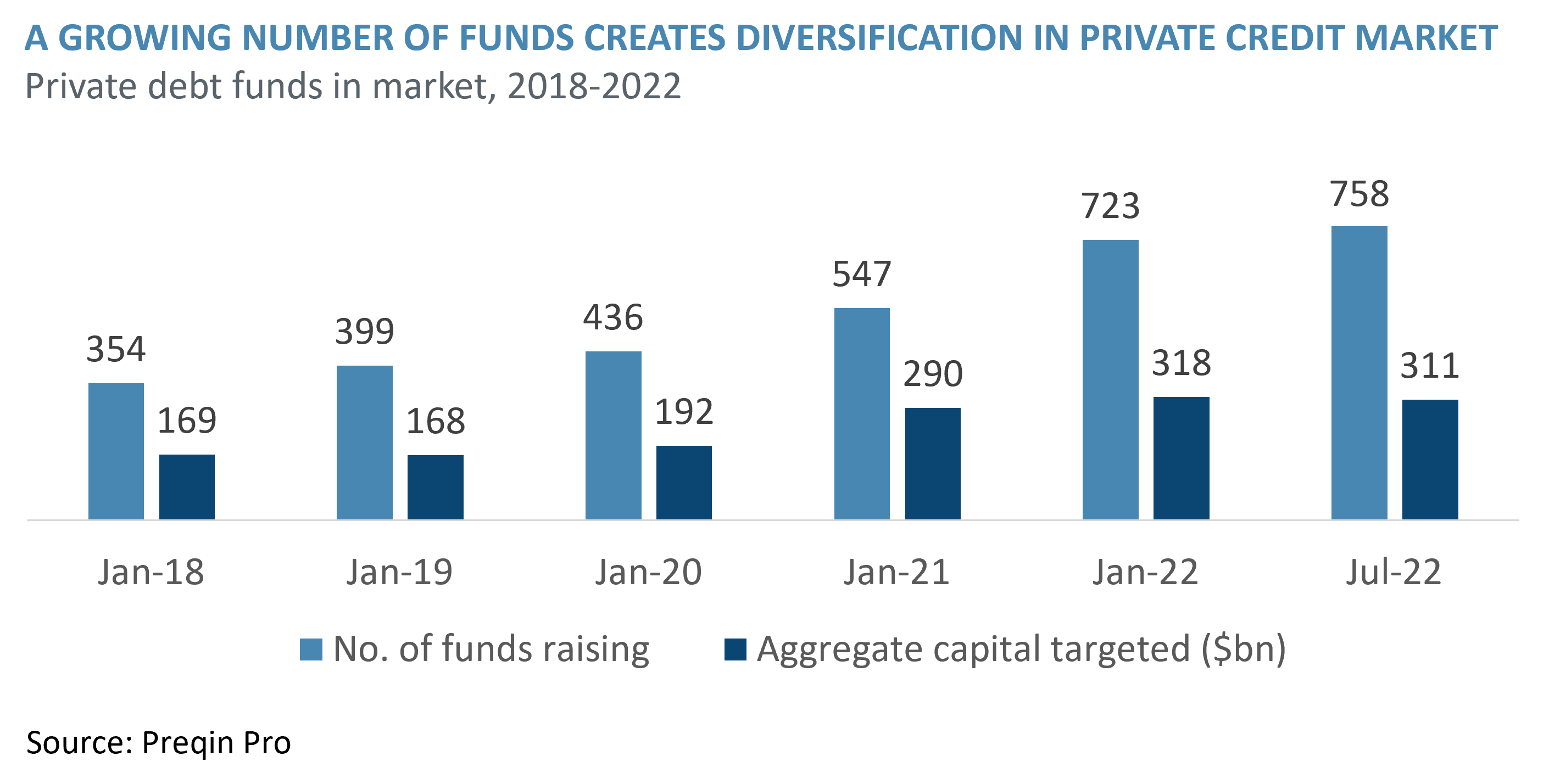

Diversify Your Portfolio

Concentrating your investments in a single borrower or sector significantly increases your exposure to risk. Diversification is key to mitigating potential losses.

- Avoid over-concentration in a single industry or borrower: Spread your investments across different industries and borrowers to reduce the impact of any single negative event.

- Consider geographic diversification for broader risk mitigation: Diversifying geographically can help mitigate risks associated with specific regional economic downturns or political instability.

- Implement robust portfolio monitoring and reporting systems: Regularly monitor your portfolio's performance, tracking key metrics and identifying potential risks early on.

Underestimate Regulatory Compliance

The private credit market is subject to various regulations, and non-compliance can lead to significant penalties and reputational damage.

- Maintain accurate records and documentation: Keep meticulous records of all transactions, communications, and agreements related to your private credit investments.

- Regularly review and update your compliance procedures: Stay abreast of changes in regulations and ensure your procedures are up-to-date and effective.

- Seek expert legal and financial advice: Consult with experienced legal and financial professionals to ensure compliance with all applicable laws and regulations.

Do: Build Strong Relationships with Borrowers

Cultivating strong relationships with borrowers is crucial for successful private credit investing. Open communication and proactive monitoring can significantly reduce risks and enhance returns.

Foster Open Communication

Maintaining regular and transparent communication with borrowers facilitates early identification of potential problems and allows for timely intervention.

- Schedule regular meetings and calls: Establish a regular communication schedule to discuss the borrower's financial performance and any emerging challenges.

- Promptly address any concerns or issues: Respond promptly to any concerns or issues raised by the borrower or identified during monitoring.

- Encourage open communication and feedback: Foster a culture of open communication and encourage the borrower to provide feedback on their financial situation.

Proactive Monitoring

Implementing proactive monitoring strategies helps identify potential problems early on, allowing for timely intervention and mitigation of potential losses.

- Track key financial performance indicators: Closely monitor key financial metrics to identify any deviations from expectations or trends that may indicate potential problems.

- Conduct regular site visits and reviews: Conduct periodic site visits and reviews to assess the borrower's operations and financial condition firsthand.

- Engage in proactive communication with borrowers: Maintain regular contact with borrowers to discuss their business performance and any potential challenges.

Don't: Underestimate the Importance of Experienced Professionals

Successfully navigating the complexities of the private credit market requires specialized expertise. Leveraging the knowledge and experience of professionals is crucial.

Leverage Expertise

Engaging experienced professionals in legal, financial, and regulatory matters can significantly enhance your investment outcomes.

- Engage experienced legal counsel for contract review: Consult with experienced legal counsel to review and negotiate loan agreements, ensuring they adequately protect your interests.

- Consult with financial professionals for portfolio management: Utilize the expertise of financial professionals to develop and manage your private credit portfolio effectively.

- Utilize industry experts for market analysis and due diligence: Leverage the knowledge of industry experts to conduct thorough due diligence and gain insights into market trends and opportunities.

Neglect Ongoing Education

The private credit market is constantly evolving. Continuous learning and professional development are crucial for staying ahead of the curve.

- Attend industry conferences and seminars: Stay informed about the latest industry trends and best practices by attending industry events.

- Subscribe to industry publications and newsletters: Keep abreast of regulatory changes and market developments by subscribing to industry publications and newsletters.

- Pursue professional certifications and training: Enhance your knowledge and skills by pursuing professional certifications and training programs.

Do: Utilize Technology to Optimize Processes

Technology plays a significant role in streamlining operations and enhancing decision-making in the private credit market.

Invest in Software and Tools

Investing in specialized software and tools can significantly improve efficiency and effectiveness.

- Utilize data analytics for improved risk assessment: Employ data analytics tools to assess risk more effectively and identify potential problems early on.

- Implement automated workflows for efficient operations: Automate repetitive tasks to free up time and resources for more strategic activities.

- Leverage technology for enhanced reporting and communication: Utilize technology to enhance reporting and communication with borrowers and other stakeholders.

Embrace Data-Driven Decision Making

Integrating data analysis into your investment process can lead to better informed decisions and improved risk management.

- Use data analytics to identify promising investment opportunities: Utilize data analysis to identify potential investment opportunities that align with your investment strategy.

- Utilize data to track portfolio performance and identify trends: Track portfolio performance using data analytics to identify trends and areas for improvement.

- Incorporate data-driven insights into decision-making processes: Make informed decisions based on data analysis and insights rather than relying solely on intuition or gut feeling.

Conclusion

Successfully navigating the private credit market requires a balanced approach, combining thorough due diligence, proactive risk management, and strong borrower relationships. By following these do's and don'ts and leveraging technology and expert advice, you can significantly increase your chances of success. Remember to continuously refine your strategies and stay informed on the latest developments within the private credit market. Don't delay, start optimizing your approach to the private credit market today!

Featured Posts

-

Columbia Student Mahmoud Khalil Denied Permission To Attend Sons Birth By Ice

Apr 24, 2025

Columbia Student Mahmoud Khalil Denied Permission To Attend Sons Birth By Ice

Apr 24, 2025 -

Liams Secrecy Steffys Rage A Bold And The Beautiful Recap April 9

Apr 24, 2025

Liams Secrecy Steffys Rage A Bold And The Beautiful Recap April 9

Apr 24, 2025 -

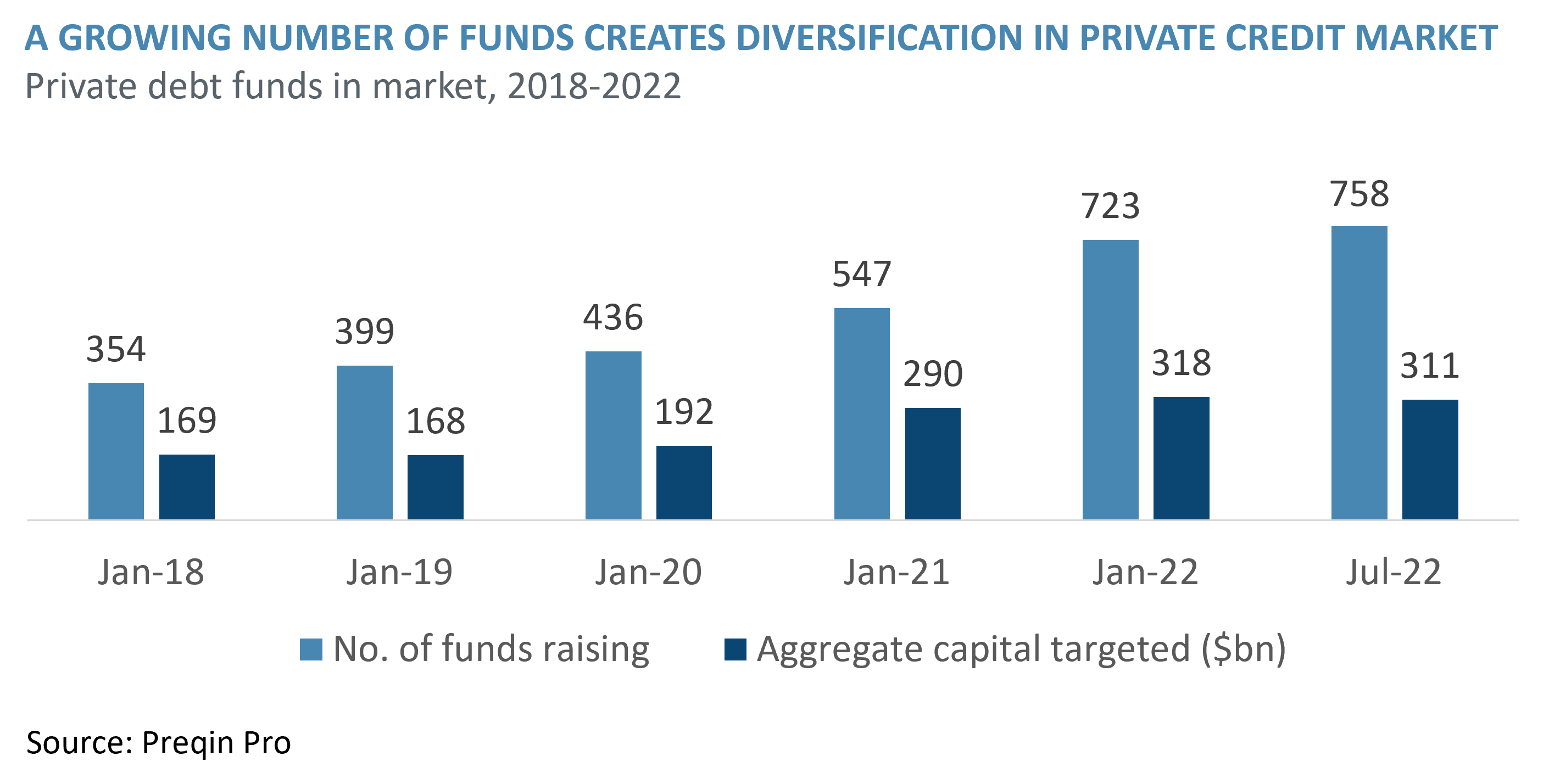

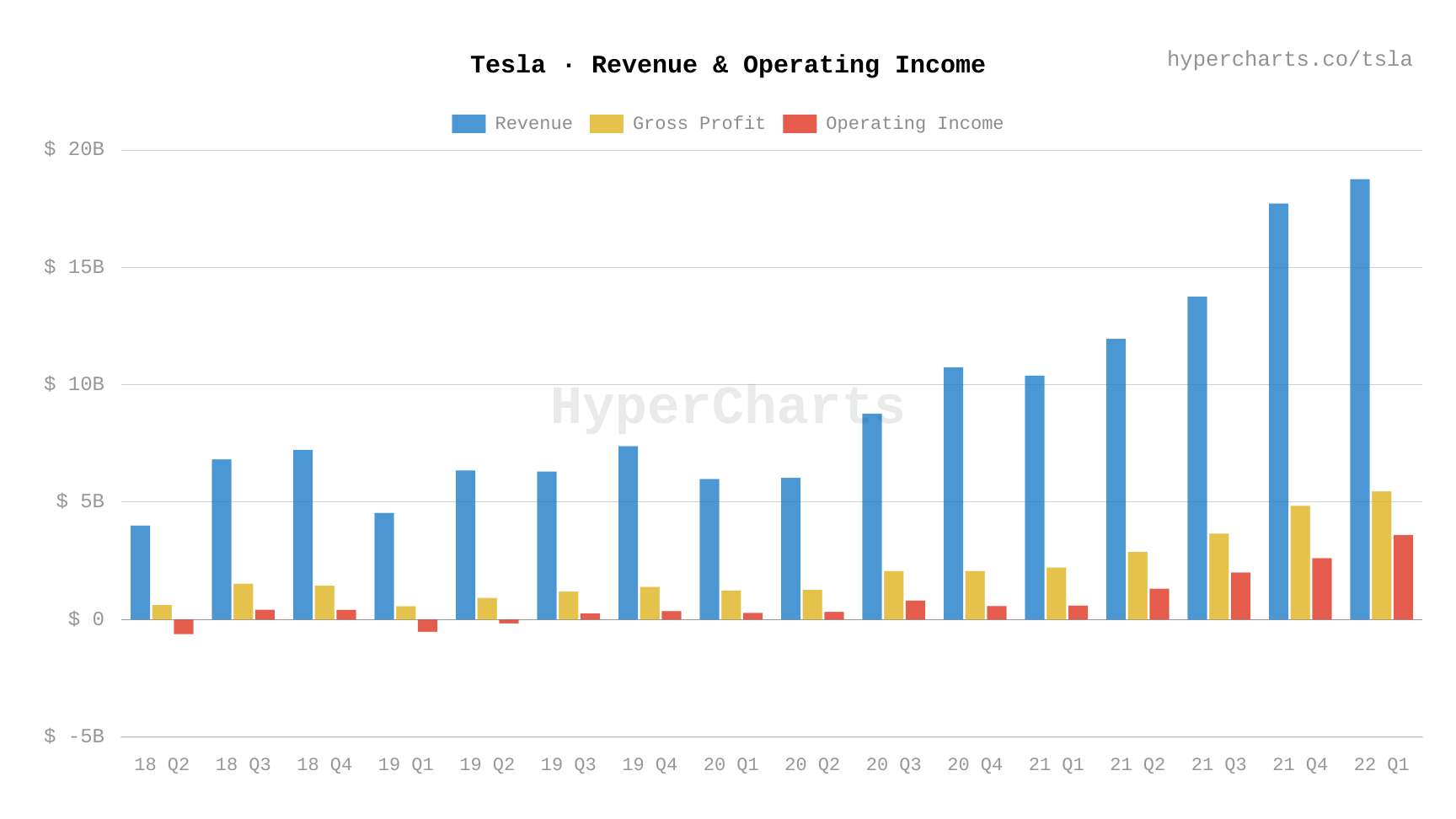

Teslas Q1 Results Lower Profits And The Fallout From Musks Actions

Apr 24, 2025

Teslas Q1 Results Lower Profits And The Fallout From Musks Actions

Apr 24, 2025 -

Trump Lawsuit Prompts 60 Minutes Executive Producer Resignation

Apr 24, 2025

Trump Lawsuit Prompts 60 Minutes Executive Producer Resignation

Apr 24, 2025 -

Hollywood Production Grinds To Halt Amidst Combined Writers And Actors Strike

Apr 24, 2025

Hollywood Production Grinds To Halt Amidst Combined Writers And Actors Strike

Apr 24, 2025

Latest Posts

-

Nicolas Cages Lawsuit Dismissal And Ongoing Claims Against Son

May 10, 2025

Nicolas Cages Lawsuit Dismissal And Ongoing Claims Against Son

May 10, 2025 -

Court Dismisses Part Of Lawsuit Against Nicolas Cage Son Weston Remains Defendant

May 10, 2025

Court Dismisses Part Of Lawsuit Against Nicolas Cage Son Weston Remains Defendant

May 10, 2025 -

Nicolas Cage Lawsuit Dismissed Son Weston Still Facing Claims

May 10, 2025

Nicolas Cage Lawsuit Dismissed Son Weston Still Facing Claims

May 10, 2025 -

Minister Announces Accelerated Timeline For 14 Edmonton School Projects

May 10, 2025

Minister Announces Accelerated Timeline For 14 Edmonton School Projects

May 10, 2025 -

14 Edmonton School Projects On The Fast Track Ministers Update

May 10, 2025

14 Edmonton School Projects On The Fast Track Ministers Update

May 10, 2025