Tesla's Q1 Results: Lower Profits And The Fallout From Musk's Actions

Table of Contents

Tesla's Q1 2024 Financial Performance: A Detailed Look

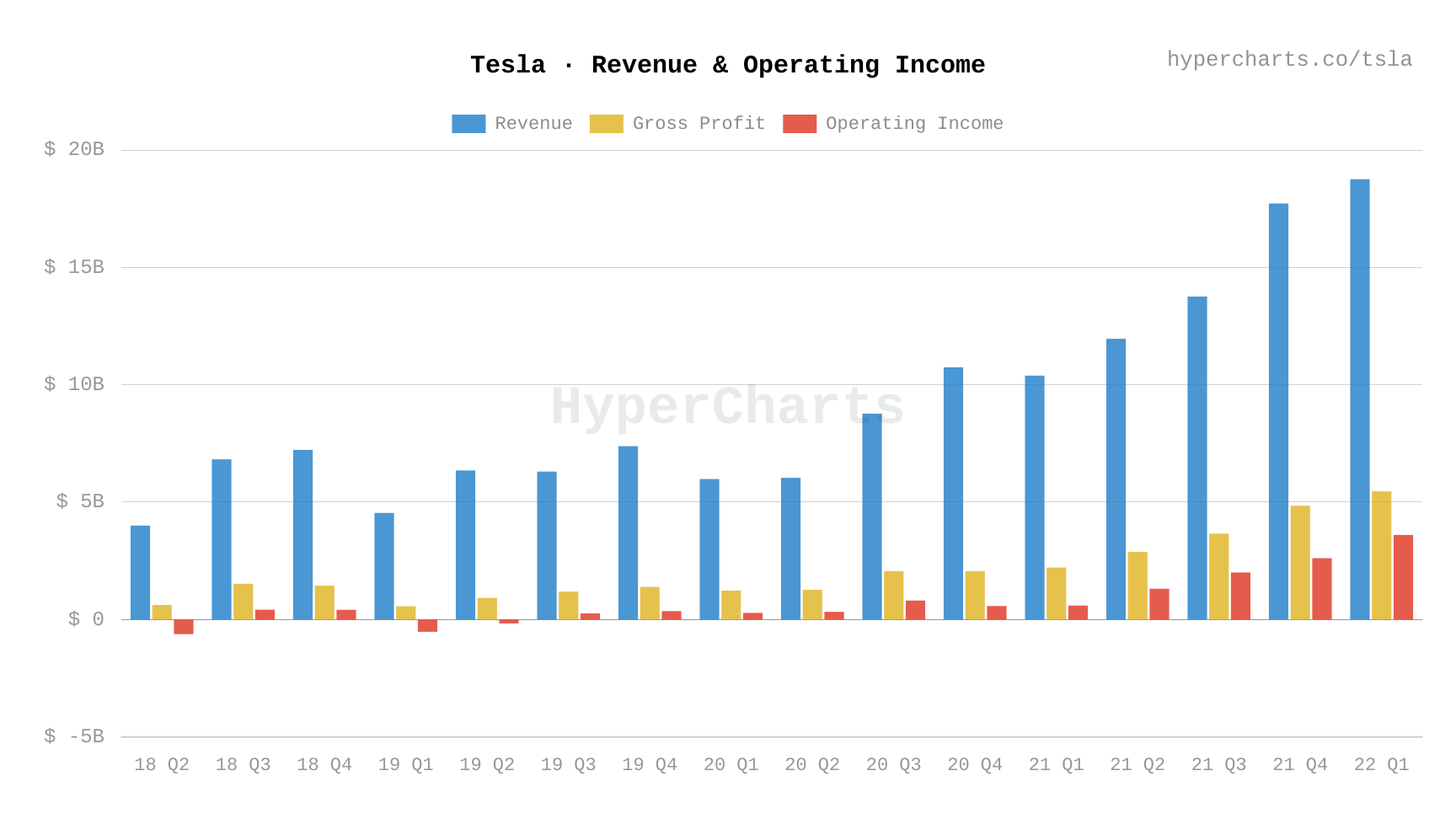

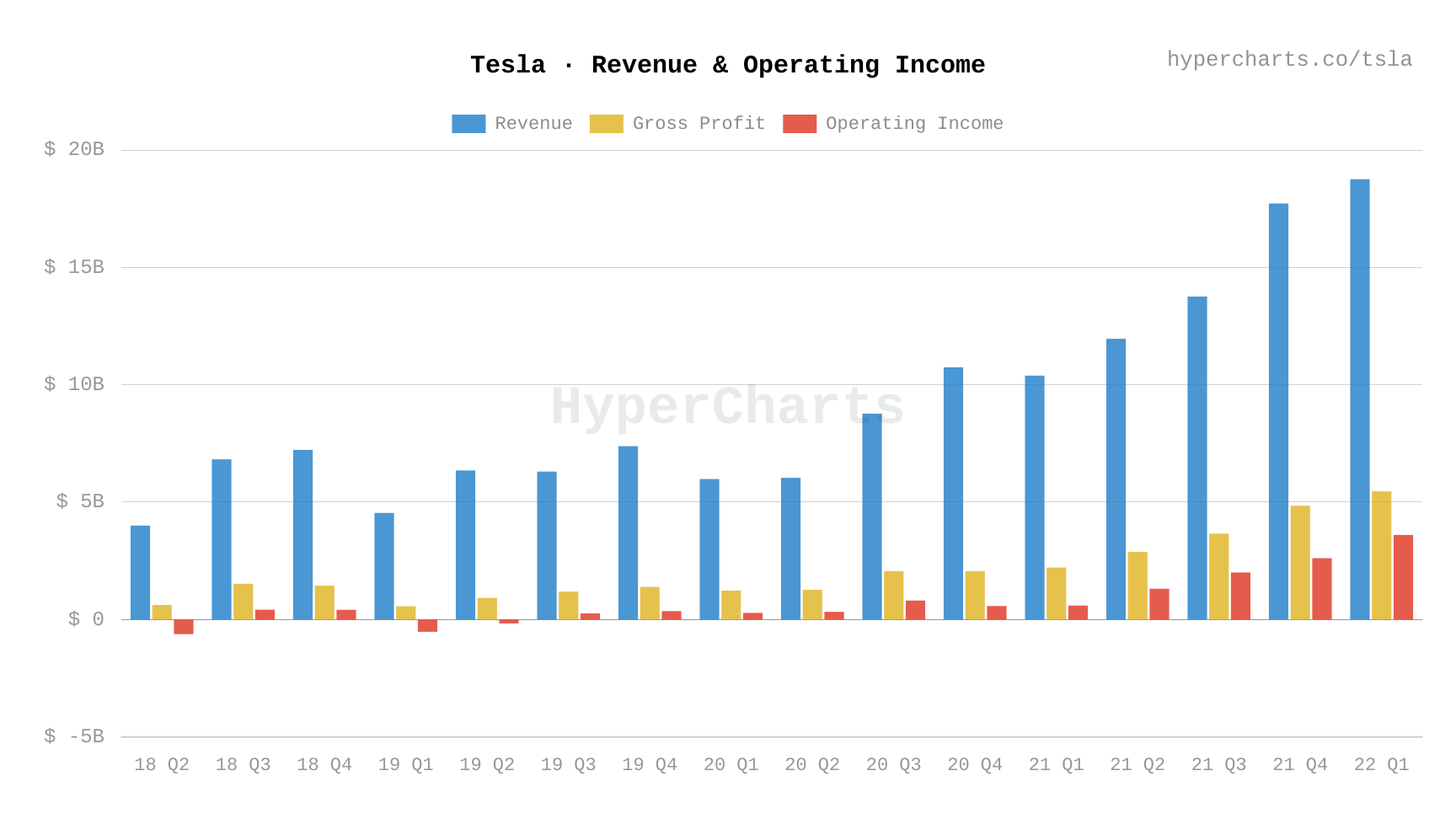

Lower-Than-Expected Profit Margins

Tesla's Q1 2024 earnings report revealed significantly lower profit margins than anticipated by analysts. While the official numbers will need to be referenced from the official Tesla financial report, the decline can be attributed to several key factors:

- Reduced pricing strategy impact: Tesla's aggressive price cuts, implemented to boost sales volume and maintain market share, directly impacted profitability. This price war strategy, while increasing sales numbers, squeezed profit margins.

- Increased production costs: Rising costs of raw materials, energy, and labor have all contributed to higher production expenses, eating into Tesla's profit margins. Supply chain disruptions, though less prevalent than in previous years, may have also played a role.

- Intensified Competition: The electric vehicle (EV) market is becoming increasingly competitive, with established automakers and new entrants launching their own EV models. This competition is forcing Tesla to adopt a more aggressive pricing strategy, impacting profitability. Analyzing the competitive landscape, including the performance of competitors like BYD, is crucial to understanding Tesla's reduced margins. Keywords: Tesla Q1 earnings, Tesla profit margin, Tesla financial report.

Sales Figures and Vehicle Deliveries

Despite the price cuts, Tesla's Q1 2024 sales figures and vehicle deliveries were strong overall. However, a detailed breakdown reveals nuances:

- Regional sales breakdowns: While overall deliveries increased, the growth wasn't uniform across all regions. Some markets showed stronger growth than others, indicating varying levels of consumer demand and market penetration.

- Model-specific performance: The performance of individual Tesla models varied. Some models saw significant sales increases due to the price reductions, while others may have experienced slower growth.

- Impact of price cuts on sales volume: The price cuts undoubtedly boosted sales volume, but the extent to which this increase offset the reduced profit margin per vehicle remains a key question. Keywords: Tesla sales Q1, Tesla deliveries, vehicle production.

The Impact of Elon Musk's Actions on Tesla's Stock and Reputation

Distraction and Negative Publicity

Elon Musk's activities, particularly his involvement with Twitter and other ventures, have generated significant controversy and negative publicity. This has undoubtedly impacted Tesla's image and investor confidence:

- Specific examples of negative publicity: Numerous instances of negative media coverage linked to Musk's actions have negatively affected Tesla's brand perception and potentially scared away some investors.

- Analysis of social media sentiment: Social media sentiment surrounding Tesla has fluctuated significantly, with periods of negative sentiment directly correlated to Musk's controversial actions.

- Impact on stock price volatility: Musk's actions have contributed to increased volatility in Tesla's stock price, creating uncertainty for investors. Keywords: Elon Musk Tesla, Musk Twitter, Tesla stock price, Tesla reputation.

The Price War Strategy and its Consequences

Tesla's aggressive price cuts constitute a significant gamble. While aimed at securing market share and stimulating demand, this "price war" strategy carries considerable risks:

- Competitive landscape analysis: The price cuts have intensified the competition in the EV market, forcing other manufacturers to respond with their own price reductions. This creates a downward pressure on industry-wide profit margins.

- Effectiveness of the price reduction strategy: While the price cuts boosted sales volume in the short term, their long-term sustainability and effectiveness remain uncertain. The question is whether increased sales will ultimately compensate for the lower profit margins.

- Long-term sustainability concerns: Maintaining this aggressive pricing strategy long-term may prove unsustainable and could negatively impact Tesla's financial health and future growth. Keywords: Tesla price cuts, Tesla price war, electric vehicle competition.

Market Reaction and Investor Sentiment

Stock Market Performance

The market reacted negatively to Tesla's Q1 2024 results, with the stock price experiencing a significant drop following the release of the earnings report.

- Stock price fluctuations: The stock price showed considerable volatility in the days following the announcement, reflecting investor uncertainty and concerns about the company's future performance.

- Analyst ratings and predictions: Many analysts revised their ratings and predictions for Tesla's stock, reflecting the impact of the lower-than-expected profits and the concerns surrounding Musk's actions.

- Investor confidence levels: Investor confidence in Tesla has decreased, as evidenced by the stock price decline and the cautious outlook expressed by many analysts. Keywords: Tesla stock forecast, Tesla investor relations, Tesla market capitalization.

Long-Term Outlook and Future Predictions

Predicting Tesla's future performance is challenging, given the complexities of the current market conditions and the uncertainties surrounding Musk's actions. However, some potential scenarios are apparent:

- Potential challenges and opportunities for Tesla: Tesla faces challenges from intensifying competition and maintaining profitability with its current pricing strategy. Opportunities lie in expanding into new markets, developing new technologies, and further improving its production efficiency.

- Predictions for future profitability and growth: The long-term profitability and growth of Tesla will depend heavily on its ability to navigate the competitive landscape, manage production costs, and maintain investor confidence.

- Expert opinions: Expert opinions are divided, with some remaining bullish on Tesla's long-term prospects while others express concerns. Keywords: Tesla future, Tesla growth prospects, Tesla long-term investment.

Tesla's Q1 Results: Looking Ahead

Tesla's Q1 2024 results paint a complex picture. Lower-than-expected profits, the significant impact of Musk's actions, and the resulting market reactions all contribute to a picture of uncertainty. The effectiveness of Tesla's price war strategy, the long-term sustainability of its current approach, and the overall influence of Elon Musk's activities on the company's future remain key questions. The electric vehicle market remains dynamic and competitive. Stay tuned for updates on Tesla's Q2 results and follow our analysis of Tesla's performance to stay informed about the evolution of this influential company and its impact on the broader EV landscape. Learn more about the impact of Elon Musk's actions on Tesla.

Featured Posts

-

India Stock Market Niftys Upward Trajectory And Market Analysis

Apr 24, 2025

India Stock Market Niftys Upward Trajectory And Market Analysis

Apr 24, 2025 -

Analyzing The Business Model Why A Startup Airline Is Utilizing Deportation Flights

Apr 24, 2025

Analyzing The Business Model Why A Startup Airline Is Utilizing Deportation Flights

Apr 24, 2025 -

Viral Whataburger Video Propels Hisd Mariachi To Uil State

Apr 24, 2025

Viral Whataburger Video Propels Hisd Mariachi To Uil State

Apr 24, 2025 -

Blue Origins Rocket Launch Cancelled Vehicle Subsystem Problem

Apr 24, 2025

Blue Origins Rocket Launch Cancelled Vehicle Subsystem Problem

Apr 24, 2025 -

Judge Abrego Garcia Condemns Stonewalling Tactics In Us Courts

Apr 24, 2025

Judge Abrego Garcia Condemns Stonewalling Tactics In Us Courts

Apr 24, 2025

Latest Posts

-

Regulatory Changes Sought By Indian Insurers For Bond Forwards

May 10, 2025

Regulatory Changes Sought By Indian Insurers For Bond Forwards

May 10, 2025 -

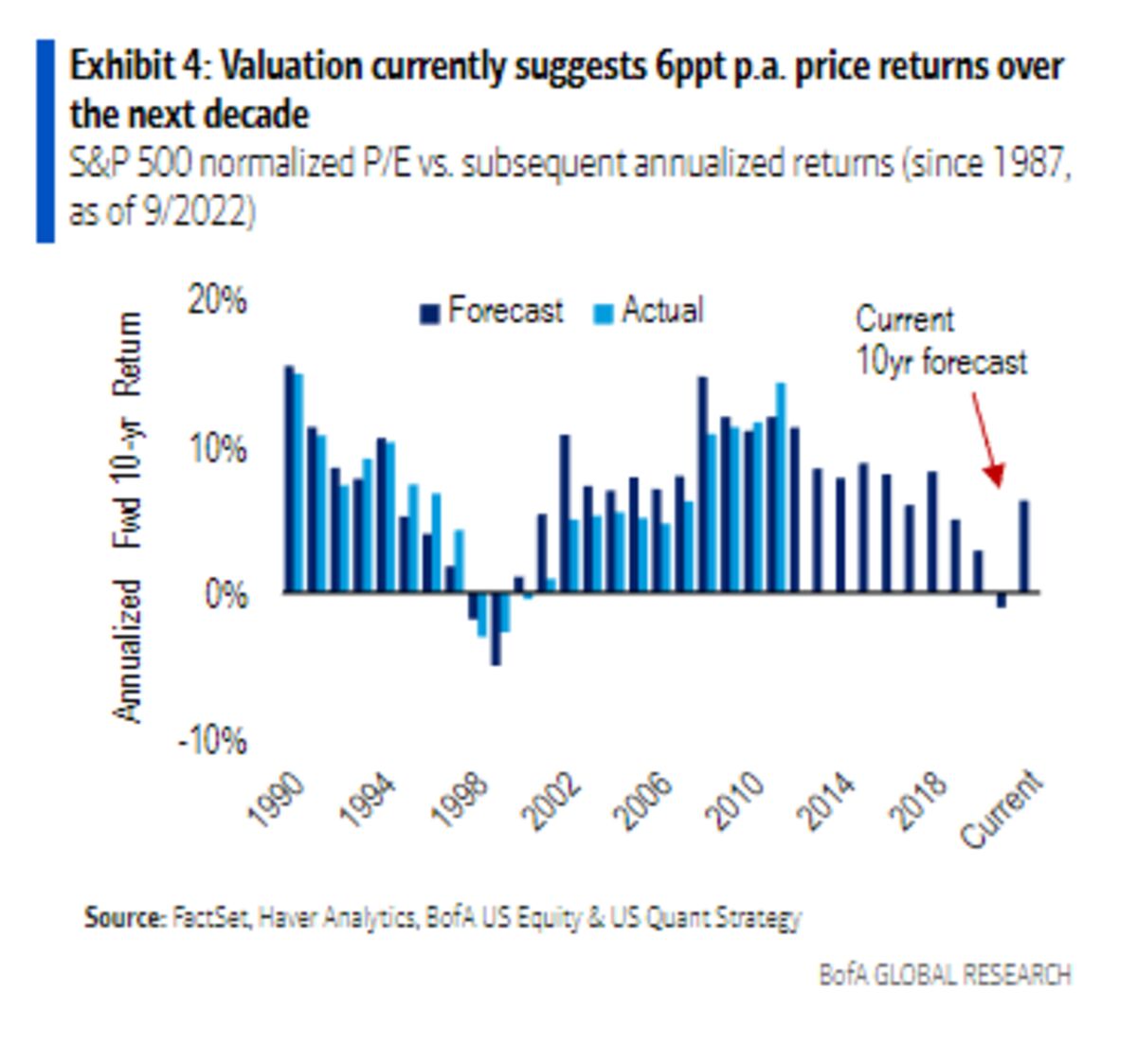

Should Investors Worry About Current Stock Market Valuations Bof As Answer

May 10, 2025

Should Investors Worry About Current Stock Market Valuations Bof As Answer

May 10, 2025 -

Indian Insurance Sector Seeks Simplification Of Bond Forward Regulations

May 10, 2025

Indian Insurance Sector Seeks Simplification Of Bond Forward Regulations

May 10, 2025 -

Call For Regulatory Reform Indian Insurers And Bond Forwards

May 10, 2025

Call For Regulatory Reform Indian Insurers And Bond Forwards

May 10, 2025 -

Indian Insurers Seek Regulatory Easing On Bond Forwards

May 10, 2025

Indian Insurers Seek Regulatory Easing On Bond Forwards

May 10, 2025