5 Key Dos And Don'ts To Succeed In The Private Credit Market

Table of Contents

Do Your Due Diligence: Thoroughly Research Potential Investments

Before committing to any private debt investments, rigorous due diligence is paramount. This involves a comprehensive evaluation of the borrower, the market conditions, and the overall investment landscape. Skipping this crucial step can lead to significant financial losses.

Understanding the Borrower's Financial Health

Effective credit analysis is the cornerstone of successful private credit investing. This requires a meticulous examination of several key factors:

- Analyze financial statements: Scrutinize balance sheets, income statements, and cash flow statements to assess the borrower's financial health and identify any potential red flags.

- Assess creditworthiness: Utilize credit scoring models and other credit analysis techniques to evaluate the borrower's ability to repay the debt.

- Investigate management team experience: Evaluate the experience, track record, and competence of the borrower's management team. Their expertise significantly impacts the success of the investment.

- Verify collateral value: If the loan is secured by collateral, conduct an independent appraisal to ensure its value accurately reflects the loan amount.

Remember, independent verification and professional advice from financial experts are crucial for a robust due diligence process. Thorough financial modeling is also essential to assess the potential risks and returns associated with each private credit investment.

Assessing Market Conditions and Competitive Landscape

A comprehensive market analysis is vital to understand the prevailing conditions and risks within the private credit market. Key considerations include:

- Analyze prevailing interest rates: Monitor interest rate trends and their potential impact on the cost of borrowing and the overall investment environment.

- Review economic forecasts: Assess the overall economic outlook and its potential influence on the borrower's ability to repay the debt.

- Research industry trends: Understand the specific industry dynamics that might affect the borrower's performance and the investment's success.

- Research competing lenders and their strategies: Analyze the competitive landscape to understand pricing strategies and identify potential advantages or disadvantages.

Understanding market cycles and their inherent risks is vital for developing effective private lending strategies.

Don't Neglect Legal and Regulatory Compliance

Navigating the regulatory landscape is crucial for success in the private credit market. Failure to comply with relevant regulations can result in significant penalties and legal issues.

Understanding Regulatory Frameworks

The private credit market is subject to various regulations and compliance requirements. Understanding these legal frameworks is essential for mitigating legal risks:

- Research relevant regulations: Stay updated on all applicable federal, state, and local regulations pertaining to private credit transactions.

- Understand compliance requirements: Ensure that all aspects of the investment comply with these regulations.

- Address legal considerations: Consider potential legal challenges and develop strategies to address them proactively.

Seeking legal counsel from experienced professionals specializing in private credit regulations is crucial.

Ensuring Contractual Clarity and Protection

Well-drafted contracts are the cornerstone of successful private credit transactions. They offer protection for both lenders and borrowers:

- Clear terms and conditions: Ensure that all terms and conditions are clear, concise, and unambiguous.

- Robust security arrangements: Establish appropriate security arrangements to protect your investment in case of default.

- Appropriate dispute resolution mechanisms: Include clauses that outline a clear process for resolving any disputes that may arise.

Experienced legal professionals can significantly assist in contract negotiation and ensure your legal agreements provide maximum protection.

Do Diversify Your Portfolio to Mitigate Risk

Diversification is a fundamental principle of successful investment management. In the private credit market, a well-diversified portfolio helps mitigate risk exposure.

Spread Investments Across Different Borrowers and Industries

Diversifying your private debt portfolio across various borrowers and industries minimizes your exposure to sector-specific risks:

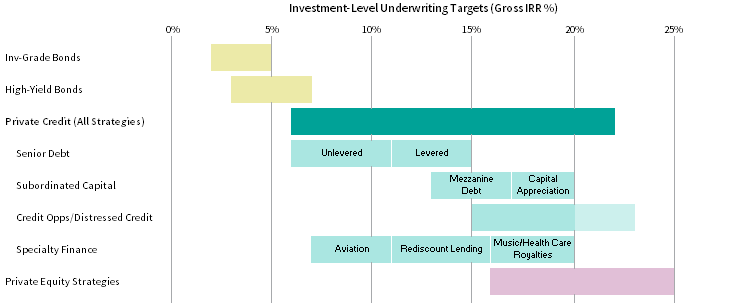

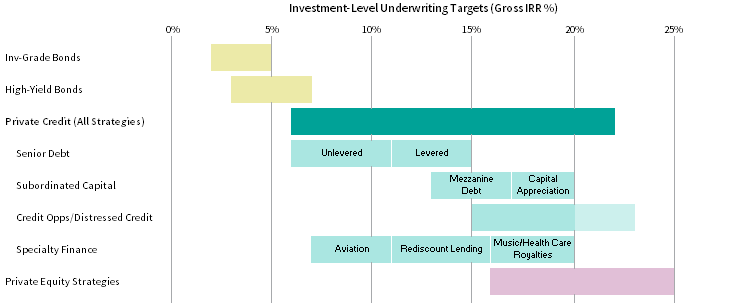

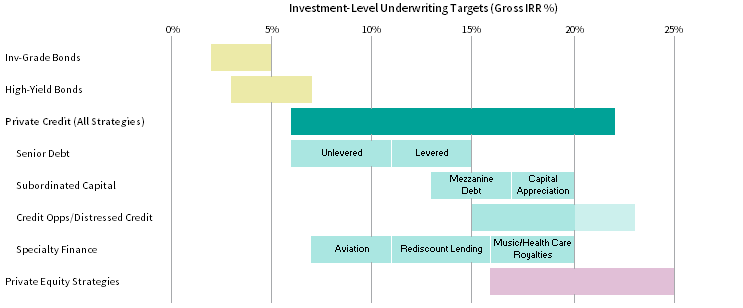

- Invest in different asset classes: Consider investing in a range of asset classes within the private credit market, including senior secured loans, mezzanine debt, and distressed debt.

- Consider different industries: Don't concentrate your investments in a single industry. Spread your investments across various sectors to reduce your risk.

Proper asset allocation is key to managing risk and enhancing potential returns in your private credit portfolio.

Regularly Rebalance Your Portfolio

Market conditions constantly evolve. Regularly rebalancing your portfolio helps adjust your exposure to changing risks and opportunities:

- Monitor investment performance: Track the performance of your investments and identify areas requiring attention.

- Adjust your portfolio: Rebalance your portfolio periodically to maintain your desired asset allocation and risk profile.

Effective portfolio rebalancing is a crucial component of a robust private credit strategy, minimizing risk and potentially maximizing returns.

Don't Underestimate the Importance of Relationship Building

Success in the private credit market hinges on building strong, trusting relationships.

Networking and Building Strong Relationships with Borrowers and Intermediaries

Developing strong relationships with key stakeholders provides numerous advantages:

- Enhanced deal flow: Strong relationships with borrowers and intermediaries can lead to exclusive deal sourcing opportunities.

- Improved communication: Open communication fosters trust and facilitates smoother transactions.

- Access to information: Close relationships often provide early access to critical information and market insights.

Attending industry events and actively participating in private credit networking initiatives are crucial for establishing valuable connections.

Transparency and Open Communication

Maintaining open and honest communication with all stakeholders builds trust and ensures successful transactions:

- Regular updates: Provide regular updates to borrowers and other stakeholders on the status of investments.

- Transparency in dealings: Maintain transparency in all aspects of the transactions to foster trust.

A strong communication strategy significantly contributes to effective relationship building within the private credit market.

Do Have a Clear Exit Strategy

Planning your exit strategy is vital, ensuring liquidity and maximizing capital returns.

Planning for Liquidity and Capital Returns

Consider various exit strategies when making private credit investments:

- Refinancing: Explore the possibility of refinancing the loan to generate returns.

- Sale to another lender: Consider selling the loan to another lender to realize profits.

- Public offering: In some cases, a public offering might be a viable exit strategy.

Understanding the liquidity characteristics of private credit investments is essential for effective planning.

Monitoring and Managing Your Investments

Continuous monitoring and management are vital for maximizing returns and minimizing risk:

- Regular performance reviews: Regularly review the performance of your investments against your expectations.

- Financial statement analysis: Continuously analyze financial statements to identify any potential issues.

- Active portfolio management: Actively manage your portfolio to optimize returns and mitigate potential risks.

Active investment monitoring is essential for ensuring the continued success of your private credit investments.

Conclusion: Mastering the Private Credit Market: Your Path to Success

Successfully navigating the private credit market requires a multi-faceted approach. This article highlighted five key dos and don’ts: conduct thorough due diligence, ensure regulatory compliance, diversify your portfolio, cultivate strong relationships, and develop a clear exit strategy. By implementing these strategies, you significantly enhance your chances of achieving strong returns in private credit investing, private debt strategies, and private lending opportunities. Remember, careful planning and execution are key to unlocking the potential of this dynamic and rewarding asset class. To learn more about maximizing your success in the private credit market, explore our resources and connect with our expert advisors today!

Featured Posts

-

5 Key Dos And Don Ts To Succeed In The Private Credit Market

Apr 22, 2025

5 Key Dos And Don Ts To Succeed In The Private Credit Market

Apr 22, 2025 -

Post Roe America How Otc Birth Control Impacts Womens Health

Apr 22, 2025

Post Roe America How Otc Birth Control Impacts Womens Health

Apr 22, 2025 -

The Zuckerberg Trump Dynamic Implications For The Tech Industry

Apr 22, 2025

The Zuckerberg Trump Dynamic Implications For The Tech Industry

Apr 22, 2025 -

Pope Franciss Legacy The Crucial Conclave Ahead

Apr 22, 2025

Pope Franciss Legacy The Crucial Conclave Ahead

Apr 22, 2025 -

Coordinating Deportees Return South Sudan And The Us Government

Apr 22, 2025

Coordinating Deportees Return South Sudan And The Us Government

Apr 22, 2025