6% Kering Share Slump After Weak First Quarter Performance

Table of Contents

Analysis of Kering's Weak First-Quarter Performance

The 6% share price drop reflects a confluence of factors impacting Kering's first-quarter performance. Let's examine the key contributors:

Decreased Sales in Key Markets

Kering reported significant sales declines in several key markets during the first quarter. This market performance was weaker than anticipated, contributing significantly to the overall stock slump.

- Europe: Economic uncertainty and geopolitical instability in certain European regions impacted consumer spending on luxury goods, leading to a noticeable decrease in sales for several Kering brands.

- China: While still a significant market, China experienced a slowdown in luxury goods purchases due to lingering effects of COVID-19 restrictions and a shift in consumer preferences. The percentage decrease in sales for Gucci in China, for example, was particularly noteworthy.

- North America: While not as drastic as in other regions, the North American market also witnessed a slight decline in sales, potentially due to inflationary pressures and concerns about a potential recession.

These sales declines highlight the vulnerability of the luxury goods sector to macroeconomic factors and changing consumer spending habits. The economic impact on high-end purchases is clearly evident in Kering's first-quarter results. Analyzing these trends is crucial to understanding the broader context of the Kering share price decline.

Impact of Supply Chain Disruptions

Ongoing supply chain disruptions played a significant role in Kering's weaker-than-expected performance. These disruptions impacted both production and sales.

- Raw Material Shortages: Difficulties sourcing certain raw materials, essential for the production of luxury goods, led to production delays and impacted inventory levels.

- Logistical Issues: Global shipping delays and increased transportation costs further exacerbated the problem, affecting the timely delivery of products to retailers and consumers.

- Inventory Management Challenges: The combination of production delays and fluctuating demand made effective inventory management incredibly difficult, potentially leading to stockouts or excess inventory.

The ripple effect of supply chain disruption is clearly evident, contributing to the overall weakness in Kering's first-quarter results and impacting the Kering share price negatively. Efficient supply chain management will be crucial for future recovery.

Changing Consumer Preferences and Brand Performance

The performance of individual brands within the Kering portfolio varied significantly, reflecting shifts in consumer preferences and fashion trends within the luxury goods market.

- Gucci's Slowdown: Gucci, a major contributor to Kering's revenue, experienced a relative slowdown in growth compared to previous periods. This may be attributed to changing consumer preferences and the need for the brand to adapt to evolving trends.

- Stronger Performance of Other Brands: While Gucci faced challenges, other brands within the Kering portfolio, such as Yves Saint Laurent and Balenciaga, demonstrated relatively stronger performance, showcasing the importance of a diversified brand portfolio.

- Need for Brand Repositioning: Some analysts suggest that certain Kering brands may require strategic repositioning or a refreshed creative direction to better resonate with evolving consumer tastes and preferences.

Understanding the nuances of brand performance within the Kering group is essential for predicting future stock performance. The luxury goods market is dynamic and brands must continually adapt to shifting consumer trends.

Investor Reaction and Market Impact of the Kering Share Slump

The weak first-quarter results and the subsequent 6% slump in Kering's share price triggered a significant reaction within the investment community.

Stock Market Response

The announcement of Kering's disappointing results immediately sent shockwaves through the stock market.

- Share Price Volatility: Kering's share price experienced considerable volatility in the days following the announcement, reflecting investor uncertainty and concerns about the company's future prospects.

- Increased Trading Volume: Trading volume for Kering shares increased significantly, indicating heightened investor activity and interest in the company's performance.

- Negative Investor Sentiment: The overall investor sentiment towards Kering shifted negatively, reflecting the disappointment with the first-quarter results and concerns about the company's ability to meet future growth targets.

The market's immediate reaction underscores the sensitivity of luxury goods stocks to economic conditions and company performance.

Analyst Predictions and Future Outlook

Financial analysts offered mixed predictions regarding Kering's future performance, highlighting the uncertainty surrounding the company's prospects.

- Cautious Optimism: Many analysts expressed cautious optimism, believing that Kering has the potential to recover and regain its growth trajectory. The strength of its brand portfolio offers a strong foundation for future success.

- Emphasis on Strategic Adjustments: Several analysts emphasized the need for Kering to make strategic adjustments, particularly in terms of product innovation, marketing strategies, and supply chain optimization.

- Varying Stock Price Predictions: Analyst forecasts for Kering's future share price varied considerably, reflecting the uncertainty surrounding the company's performance and the broader economic outlook.

Conclusion: Navigating the Kering Share Slump and Future Implications

The 6% slump in Kering's share price following its weak first-quarter performance is a significant event with implications for investors and the luxury goods market. Decreased sales in key markets, supply chain disruptions, and shifting consumer preferences all contributed to this downturn. The immediate market reaction was characterized by share price volatility and negative investor sentiment. While analysts offer varying predictions, Kering's long-term success will depend on its ability to address the challenges it faces and adapt to the evolving luxury landscape. To stay informed about Kering's performance and potential recovery, follow reputable financial news sources and analyst reports for insightful Kering stock analysis and updates on luxury market trends. Keep an eye on the Kering share price and its evolution in the coming quarters.

Featured Posts

-

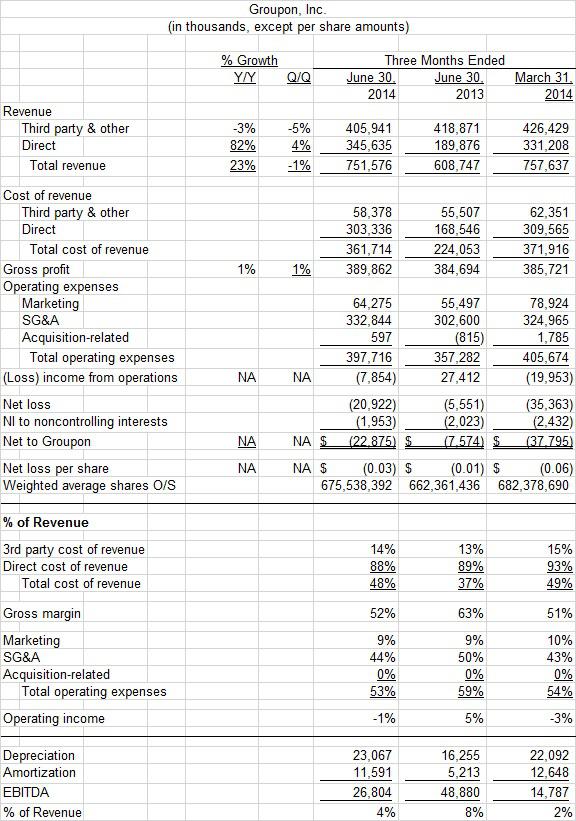

2 Fall On Amsterdam Stock Exchange Impact Of Trumps Tariff Increase

May 24, 2025

2 Fall On Amsterdam Stock Exchange Impact Of Trumps Tariff Increase

May 24, 2025 -

Lauryn Goodman And Kyle Walker Unpacking The Italian Relocation

May 24, 2025

Lauryn Goodman And Kyle Walker Unpacking The Italian Relocation

May 24, 2025 -

Mdahmat Alshrtt Alalmanyt Lmshjeyn Ryadyyn

May 24, 2025

Mdahmat Alshrtt Alalmanyt Lmshjeyn Ryadyyn

May 24, 2025 -

The Joys Of An Escape To The Country Lifestyle And Benefits

May 24, 2025

The Joys Of An Escape To The Country Lifestyle And Benefits

May 24, 2025 -

Na Kharkovschine 40 Par Sozdali Semi Foto S Torzhestva

May 24, 2025

Na Kharkovschine 40 Par Sozdali Semi Foto S Torzhestva

May 24, 2025

Latest Posts

-

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Controversy

May 24, 2025

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Controversy

May 24, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025 -

Farrow Seeks Trumps Incarceration Focus On Venezuelan Deportations

May 24, 2025

Farrow Seeks Trumps Incarceration Focus On Venezuelan Deportations

May 24, 2025