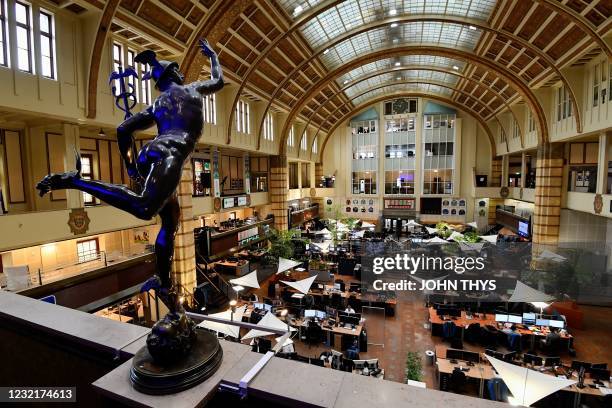

8% Stock Market Increase On Euronext Amsterdam: Impact Of Trump's Tariff Decision

Table of Contents

Trump's Tariff Decision: The Catalyst for the Surge

The unexpected 8% surge on Euronext Amsterdam was directly linked to a crucial shift in Trump's tariff policy. Instead of implementing previously threatened tariffs on European goods, particularly targeting the automotive and technology sectors, the announcement involved a significant postponement, effectively easing trade tensions. This unexpected reversal of planned punitive measures acted as the primary catalyst for the market's enthusiastic response.

- Specific Sectors Affected: The initial tariff threats heavily impacted the automotive and technology sectors in Europe. Companies producing cars and electronic components braced for significant increased costs and decreased competitiveness. The potential impact on supply chains also added to the pre-decision market anxiety.

- Pre- and Post-Decision Sentiment: Before the announcement, a palpable sense of uncertainty and pessimism pervaded the market. Many investors anticipated negative consequences, leading to a period of relatively low trading volumes and cautious investment strategies. The post-decision reaction was a stark contrast, characterized by a rush of buying activity as investor confidence surged.

- Supporting Evidence: News sources like the Financial Times, Reuters, and Bloomberg reported extensively on both the pre-decision apprehension and the post-decision euphoria. Official statements from the European Union and the US government provided further context to the evolving trade relationship and the impact of the tariff decision.

Impact on Key Sectors within Euronext Amsterdam

The positive impact of the tariff decision wasn't uniform across all sectors listed on Euronext Amsterdam. While some experienced significant gains, others saw more moderate growth or even slight declines.

- Specific Company Performances: Companies heavily exposed to the previously threatened tariffs, such as major Dutch automotive parts suppliers and technology firms, experienced the most substantial gains. For example, [insert example of a company with a significant gain and its percentage increase], while others, less directly affected, showed more moderate gains. [Insert example of a company with a more moderate gain]. Conversely, companies whose business models were less sensitive to trade tensions experienced smaller increases or remained relatively unchanged.

- Industry-Specific Analysis: The Dutch technology sector, a significant component of the Euronext Amsterdam exchange, saw a robust performance following the announcement. The automotive industry also rebounded strongly, reflecting the relief felt after the tariff threat diminished. However, specific sectors like [insert a less positively affected sector] might have experienced less significant growth due to other market factors.

- Visualizing Performance: [Include a chart or graph here if possible, showing the stock performance of key sectors after the announcement. This could be a simple line graph showing the change in indices for various sectors.]

Wider European and Global Market Reactions

The positive surge on Euronext Amsterdam didn't remain isolated; it triggered ripple effects across other European markets and the broader global financial landscape.

- Correlation with Other European Indices: The positive sentiment spread to other major European stock indices. The DAX (Germany), CAC 40 (France), and FTSE 100 (UK) all experienced increases, albeit with varying degrees of magnitude, demonstrating a clear positive correlation with the Euronext Amsterdam surge. This highlighted the interconnectedness of European markets and the shared sensitivity to global trade dynamics.

- Global Market Response: While the impact wasn't as pronounced globally as it was in Europe, several major stock markets around the world also recorded positive movements. This reflected a broader sense of optimism regarding the easing of trade tensions, although the magnitude of these increases varied significantly depending on regional economic conditions and exposure to the US-Europe trade relationship.

- Increased Volatility: While the immediate post-decision period brought a surge in positive sentiment, experts caution that increased volatility might remain in the short to medium term. The underlying uncertainties surrounding global trade remain, and future trade policy decisions could easily reverse the current positive trend.

Long-Term Implications and Future Outlook for Euronext Amsterdam

The long-term impact of Trump's (now past) tariff decision on Euronext Amsterdam and the Dutch economy depends on several factors, including the sustainability of the current de-escalation in trade tensions.

- Potential for Sustained Growth: While the 8% surge was a significant short-term boost, the potential for sustained growth is contingent on continued stability in the trade relationship between the US and Europe. Continued uncertainty or further escalation could reverse the positive momentum.

- Risks and Uncertainties: The international trade landscape remains complex and volatile. Unforeseen events or changes in trade policies could quickly impact the positive trends observed. Geopolitical factors also play a significant role in market stability.

- Expert Opinions: Financial analysts and experts express a cautious optimism. While the immediate impact is positive, the long-term outlook depends heavily on sustained political and economic stability, and continued predictable trade relations. [Quote a relevant expert opinion if available].

Conclusion

The 8% stock market increase on Euronext Amsterdam following Trump's tariff decision highlights the significant impact of trade policies on global markets. While this event resulted in a short-term surge, the long-term implications remain uncertain and require close monitoring. Understanding the intricate connections between trade policies and market volatility is crucial for investors navigating this complex landscape.

Call to Action: Stay informed about the evolving situation surrounding trade policies and their impact on the Euronext Amsterdam market. Continue to monitor the Euronext Amsterdam stock market increase and its ramifications for a comprehensive understanding of global economic trends. Regularly check reputable financial news sources for the latest updates on Trump's tariff decisions and their influence on European stocks.

Featured Posts

-

Escape To The Country Top Destinations For A Tranquil Getaway

May 24, 2025

Escape To The Country Top Destinations For A Tranquil Getaway

May 24, 2025 -

Mengungkap Sejarah Porsche 356 Di Zuffenhausen Jerman

May 24, 2025

Mengungkap Sejarah Porsche 356 Di Zuffenhausen Jerman

May 24, 2025 -

Fedor Lavrov O Pavle I Pochemu Lyudi Lyubyat Schekotat Nervy

May 24, 2025

Fedor Lavrov O Pavle I Pochemu Lyudi Lyubyat Schekotat Nervy

May 24, 2025 -

Prime Videos Picture This A Complete Guide To The Music

May 24, 2025

Prime Videos Picture This A Complete Guide To The Music

May 24, 2025 -

Buffetts Succession At Berkshire Hathaway What Happens To Apples Stock

May 24, 2025

Buffetts Succession At Berkshire Hathaway What Happens To Apples Stock

May 24, 2025

Latest Posts

-

Analyzing The Impact Of Federal Funding Cuts On Museum Operations

May 24, 2025

Analyzing The Impact Of Federal Funding Cuts On Museum Operations

May 24, 2025 -

The Long Term Effects Of Reduced Funding On Us Museum Programs

May 24, 2025

The Long Term Effects Of Reduced Funding On Us Museum Programs

May 24, 2025 -

Are Museum Programs Sustainable After Trumps Funding Cuts

May 24, 2025

Are Museum Programs Sustainable After Trumps Funding Cuts

May 24, 2025 -

Using Ai To Transform Repetitive Scatological Writing Into A Podcast

May 24, 2025

Using Ai To Transform Repetitive Scatological Writing Into A Podcast

May 24, 2025 -

How Trumps Budget Cuts Could Reshape Museum Programming In The Us

May 24, 2025

How Trumps Budget Cuts Could Reshape Museum Programming In The Us

May 24, 2025