Buffett's Succession At Berkshire Hathaway: What Happens To Apple's Stock?

Table of Contents

Warren Buffett's impending departure from Berkshire Hathaway casts a long shadow over the investment world, particularly concerning the company's massive holdings in Apple. This raises a critical question: what happens to Apple's stock after Buffett's succession? Will Berkshire Hathaway, under new leadership, maintain its significant Apple investment, or will we see a shift in strategy with potential ramifications for Apple's stock price? This article delves into the potential impacts of Buffett's succession on Berkshire Hathaway's Apple investment and the broader implications for the stock market.

Berkshire Hathaway's Reliance on Apple

Berkshire Hathaway's investment in Apple is nothing short of monumental. It represents a significant portion of Berkshire's overall portfolio, making Apple's performance a crucial factor in Berkshire's overall financial health. This heavy reliance on Apple stock creates a fascinating dynamic as we consider the implications of Buffett's succession.

- Percentage of Berkshire's portfolio held in Apple stock: At its peak, Apple constituted a substantial percentage of Berkshire's portfolio, making it the company's largest holding by a significant margin. While the exact percentage fluctuates with market conditions, its sheer size is undeniable.

- Historical growth of Apple's stock within Berkshire's holdings: Berkshire Hathaway's investment in Apple has yielded substantial returns over the years, significantly contributing to Berkshire's overall growth. This success has cemented Apple's position as a cornerstone of Berkshire's investment strategy.

- Financial benefits Apple's stock has provided to Berkshire Hathaway: The financial benefits derived from Apple's stock have been immense, providing a steady stream of income and contributing significantly to Berkshire's impressive returns for shareholders.

- Strategic reasoning behind Berkshire's significant Apple investment: Buffett's admiration for Apple's business model, strong brand loyalty, and consistent profitability underpinned this massive investment. He viewed Apple as a fundamentally strong company with long-term growth potential.

The Succession Plan and its Potential Implications

The succession plan at Berkshire Hathaway centers around two key figures: Greg Abel and Ajit Jain. Both are long-time executives with deep understanding of Berkshire's operations and investment strategies. However, their specific approaches might differ subtly from Buffett's.

- Brief biographies of Abel and Jain and their investment philosophies: Abel is known for his operational expertise, while Jain's focus is on insurance underwriting. While both are considered capable successors, their styles may not perfectly mirror Buffett's.

- Analysis of whether their approaches differ significantly from Warren Buffett's: While the core principles of value investing are likely to remain, subtle differences in risk appetite or sector focus could emerge. This is a key area of uncertainty for investors.

- Possible scenarios for Apple's stock under new leadership: Several scenarios are plausible: maintaining the current substantial Apple holding, a partial divestment to diversify the portfolio, or a more significant reduction in Apple's weighting.

- Mention any public statements made by successors regarding Apple's stock: Any public statements by Abel or Jain regarding their future approach to Apple's stock should be closely analyzed for clues about their strategic intentions.

Market Reactions and Predictions

The market's reaction to any change in Berkshire Hathaway's Apple holdings will be swift and significant. Analyst predictions vary widely, reflecting the inherent uncertainty surrounding the succession.

- Discuss how analysts predict the stock market will respond: Some analysts anticipate a minor dip in Apple's stock price upon even a hint of reduced Berkshire holdings, while others believe Apple's intrinsic value will outweigh any concerns about Berkshire's future strategy.

- Factors that might influence investor confidence in Apple: Investor confidence will be influenced by factors such as Apple's future product roadmap, the competitive landscape, and macroeconomic conditions.

- Explore potential short-term and long-term effects on Apple's stock price: A short-term price correction is possible, but the long-term effect depends heavily on Apple's continued performance and the new leadership's actions.

- Consider the impact of broader economic factors on Apple and Berkshire Hathaway: Broader economic headwinds or tailwinds will significantly influence both Apple's performance and the market's reaction to Berkshire Hathaway's investment decisions.

The Role of Apple's Intrinsic Value

Independent of Berkshire Hathaway's holdings, Apple's intrinsic value remains a crucial factor. Its strong financial health, consistent innovation, and loyal customer base are significant assets.

- Discuss Apple’s current financial health and future growth prospects: Apple continues to demonstrate robust financial performance, and its future growth prospects remain strong, suggesting resilience even amidst uncertainty regarding Berkshire's future strategy.

- Mention any upcoming product launches or technological advancements: Upcoming product launches and technological advancements will significantly impact investor sentiment and Apple's long-term prospects.

- Assess Apple's competitive landscape and its long-term growth potential: While competition exists, Apple's strong brand recognition and ecosystem provide a significant competitive advantage.

Conclusion

Buffett's succession at Berkshire Hathaway introduces significant uncertainty regarding the future of its Apple investment. While the potential scenarios range from maintaining the current position to partial or complete divestment, Apple's intrinsic value and its continued innovation provide a buffer against dramatic negative impacts. The market's reaction will depend on the specifics of Berkshire's new strategy, Apple's own performance, and broader economic conditions. The key factors influencing the future of Apple's stock within this context are the investment philosophies of Abel and Jain, Apple's continued innovation, and the overall market environment.

Stay informed about the developments at Berkshire Hathaway and the implications for your Apple stock holdings. Continue following our analysis on Buffett's succession and its impact on Apple investment. Further research into Berkshire Hathaway's succession plan is recommended for a more comprehensive understanding of the situation and its potential effects on the future of Apple.

Featured Posts

-

Sam Altmans Exclusive Project With Jony Ive An Inside Look

May 24, 2025

Sam Altmans Exclusive Project With Jony Ive An Inside Look

May 24, 2025 -

Accessibility In Gaming Feeling The Pinch Of Industry Cuts

May 24, 2025

Accessibility In Gaming Feeling The Pinch Of Industry Cuts

May 24, 2025 -

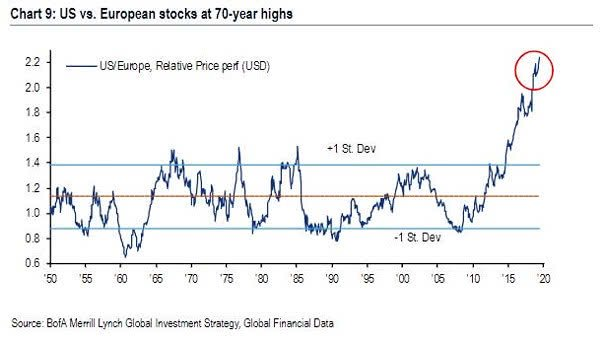

Analyse Snelle Marktdraai Europese Aandelen Tijdelijk Of Blijvend Verschil Met Wall Street

May 24, 2025

Analyse Snelle Marktdraai Europese Aandelen Tijdelijk Of Blijvend Verschil Met Wall Street

May 24, 2025 -

Tracking The Net Asset Value Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Tracking The Net Asset Value Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

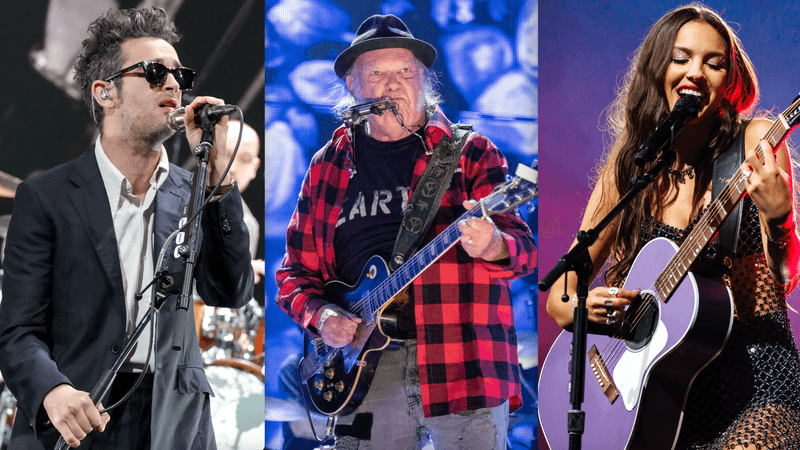

Glastonbury 2025 Lineup Olivia Rodrigo The 1975 And More Confirmed

May 24, 2025

Glastonbury 2025 Lineup Olivia Rodrigo The 1975 And More Confirmed

May 24, 2025

Latest Posts

-

Ai Powered Podcast Creation Turning Repetitive Scatological Texts Into Engaging Content

May 24, 2025

Ai Powered Podcast Creation Turning Repetitive Scatological Texts Into Engaging Content

May 24, 2025 -

Funding Cuts And The Future Of Museum Programs A Critical Analysis

May 24, 2025

Funding Cuts And The Future Of Museum Programs A Critical Analysis

May 24, 2025 -

Museum Programs At Risk Examining The Effects Of Funding Reductions

May 24, 2025

Museum Programs At Risk Examining The Effects Of Funding Reductions

May 24, 2025 -

Trumps Budget Cuts Threaten Museum Programs A Deep Dive

May 24, 2025

Trumps Budget Cuts Threaten Museum Programs A Deep Dive

May 24, 2025 -

Italian Citizenship New Path Through Great Grandparent Ancestry

May 24, 2025

Italian Citizenship New Path Through Great Grandparent Ancestry

May 24, 2025