A Retrospective On Clinton's Budget Battles: The One Percent Factor

Table of Contents

The Context of Deficit Reduction

The enormous national debt inherited by the Clinton administration in 1993 set the stage for protracted budget battles. The economic climate was characterized by concerns about long-term fiscal sustainability and pressure from financial markets for deficit reduction. Competing economic philosophies – Keynesian and supply-side – further complicated the policy debate.

- High national debt levels: Decades of escalating spending under the Reagan and Bush Sr. administrations left a substantial national debt, creating a sense of urgency for fiscal responsibility.

- Pressure from financial markets: Concerns about the growing national debt led to pressure from financial markets for significant deficit reduction measures. Higher interest rates were a constant threat.

- Competing economic philosophies: The debate pitted Keynesian approaches emphasizing government intervention to stimulate demand against supply-side economics, which favored tax cuts to boost economic growth.

- The role of the CBO: The Congressional Budget Office (CBO) played a crucial role in providing independent economic projections and analyses, informing the debate but also becoming a point of contention between the parties.

Clinton's Proposed Budget Cuts and Tax Increases

To address the deficit, the Clinton administration proposed a comprehensive budget plan that included both spending cuts and tax increases. Crucially, the tax increases were targeted disproportionately at higher earners, hence the focus on the "one percent."

- Specific tax increase proposals: These included increases in income tax rates for high-income individuals, higher taxes on capital gains, and increased excise taxes (often referred to as "sin taxes") on luxury goods and tobacco.

- Proposed spending cuts: Clinton's plan also included significant spending cuts across various government programs, though these were often met with resistance from specific interest groups and members of Congress.

- Political challenges: Securing support for these measures proved incredibly difficult, given the partisan divisions in Congress and the powerful lobbying efforts of groups affected by the proposed cuts and tax increases.

- Influence of the "one percent": The wealthiest Americans played a significant role in shaping the political discourse through campaign contributions and lobbying, influencing both the debate and the outcome.

The Republican Response and the Government Shutdowns

The Republican Party, controlling Congress, largely opposed Clinton's budget proposals. Their counter-proposals generally favored greater spending cuts and resisted tax increases, particularly on higher earners. This ideological clash led to several government shutdowns.

- Republican counter-proposals: Republicans offered alternative deficit reduction plans that focused more heavily on spending cuts and less on tax increases, often targeting social programs.

- Ideological clash: The budget battles highlighted a fundamental ideological conflict between the Democrats, who favored a more active role for the government in addressing social and economic issues, and Republicans, who advocated for a smaller government and lower taxes.

- Impact of government shutdowns: The government shutdowns of 1995 and 1996 had a significant negative impact on public opinion and the economy, causing disruption to government services and undermining public confidence.

- Political fallout: The shutdowns resulted in significant political fallout for both Clinton and the Republicans, shaping public perception of each party's approach to fiscal policy.

The Role of Public Opinion in Shaping the Debate

Public opinion and media coverage significantly influenced the political dynamics of Clinton's Budget Battles. Polls showed fluctuating public support for tax increases and spending cuts, depending on the specific proposals and how they were framed in the media.

- Public opinion polls: Public opinion on taxes and government spending was often divided, making it difficult for either side to claim a clear mandate.

- Media framing: The media played a crucial role in shaping public perception of the budget debate, often framing it through a partisan lens.

- Influence of interest groups: Powerful interest groups and lobbying efforts exerted considerable influence on the legislative process, advocating for their specific interests and shaping the political discourse.

The Long-Term Impacts of the Budget Battles

The Clinton-era budget battles had lasting effects on the national debt, economic growth, and the political landscape. While the battles were intense, they ultimately contributed to a balanced budget by the end of the 1990s.

- Balanced budget: Despite the initial struggles, the Clinton administration eventually achieved a balanced federal budget, a significant accomplishment given the starting point.

- Impact on future budget negotiations: The experience shaped future budget negotiations and policy, influencing the strategies employed by both parties.

- Legacy of partisan polarization: The battles exacerbated partisan polarization, setting the stage for even more contentious budget debates in subsequent years.

Conclusion:

The battles over the federal budget during the Clinton presidency offer a valuable case study in the interplay between economic policy, political power, and public opinion. The focus on the "one percent" and their disproportionate influence reveals a critical aspect of the political maneuvering that defined Clinton's Budget Battles. Understanding this history is crucial for informed discussions on contemporary fiscal policy and the ongoing debate over taxation and government spending. Further research into the specifics of these Clinton's Budget Battles, including the minutiae of legislation and the role of individual players, will enhance our understanding of this significant period in American political and economic history. Continue exploring the complexities of Clinton's Budget Battles to gain a deeper understanding of their lasting impact.

Featured Posts

-

Wolffs Optimism A Strong F1 Season Start

May 23, 2025

Wolffs Optimism A Strong F1 Season Start

May 23, 2025 -

Dominant Zimbabwe Start Muzarabani And Masakadzas Impressive Performance

May 23, 2025

Dominant Zimbabwe Start Muzarabani And Masakadzas Impressive Performance

May 23, 2025 -

Cambridge And Somerville Your Guide To Viva Central Hot Sauce Festival And Open Studios

May 23, 2025

Cambridge And Somerville Your Guide To Viva Central Hot Sauce Festival And Open Studios

May 23, 2025 -

Edinburgh To Host The 2027 Tour De France Grand Depart

May 23, 2025

Edinburgh To Host The 2027 Tour De France Grand Depart

May 23, 2025 -

Netflix New Releases May 2025

May 23, 2025

Netflix New Releases May 2025

May 23, 2025

Latest Posts

-

Unlocking Potential The Critical Role Of Middle Managers In Modern Organizations

May 23, 2025

Unlocking Potential The Critical Role Of Middle Managers In Modern Organizations

May 23, 2025 -

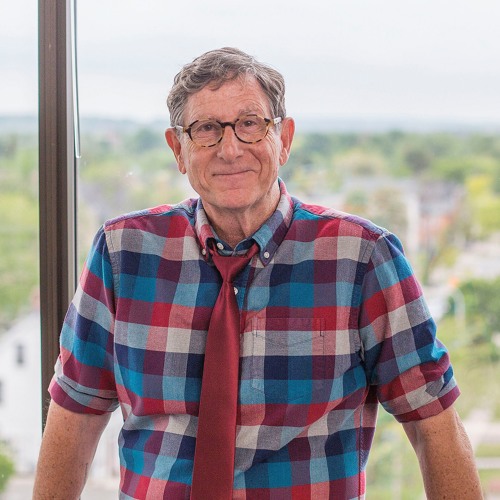

China And Us Trade A Race Against Time To Meet Trade Agreement Goals

May 23, 2025

China And Us Trade A Race Against Time To Meet Trade Agreement Goals

May 23, 2025 -

Us China Trade Soars Ahead Of Trade Truce Deadline

May 23, 2025

Us China Trade Soars Ahead Of Trade Truce Deadline

May 23, 2025 -

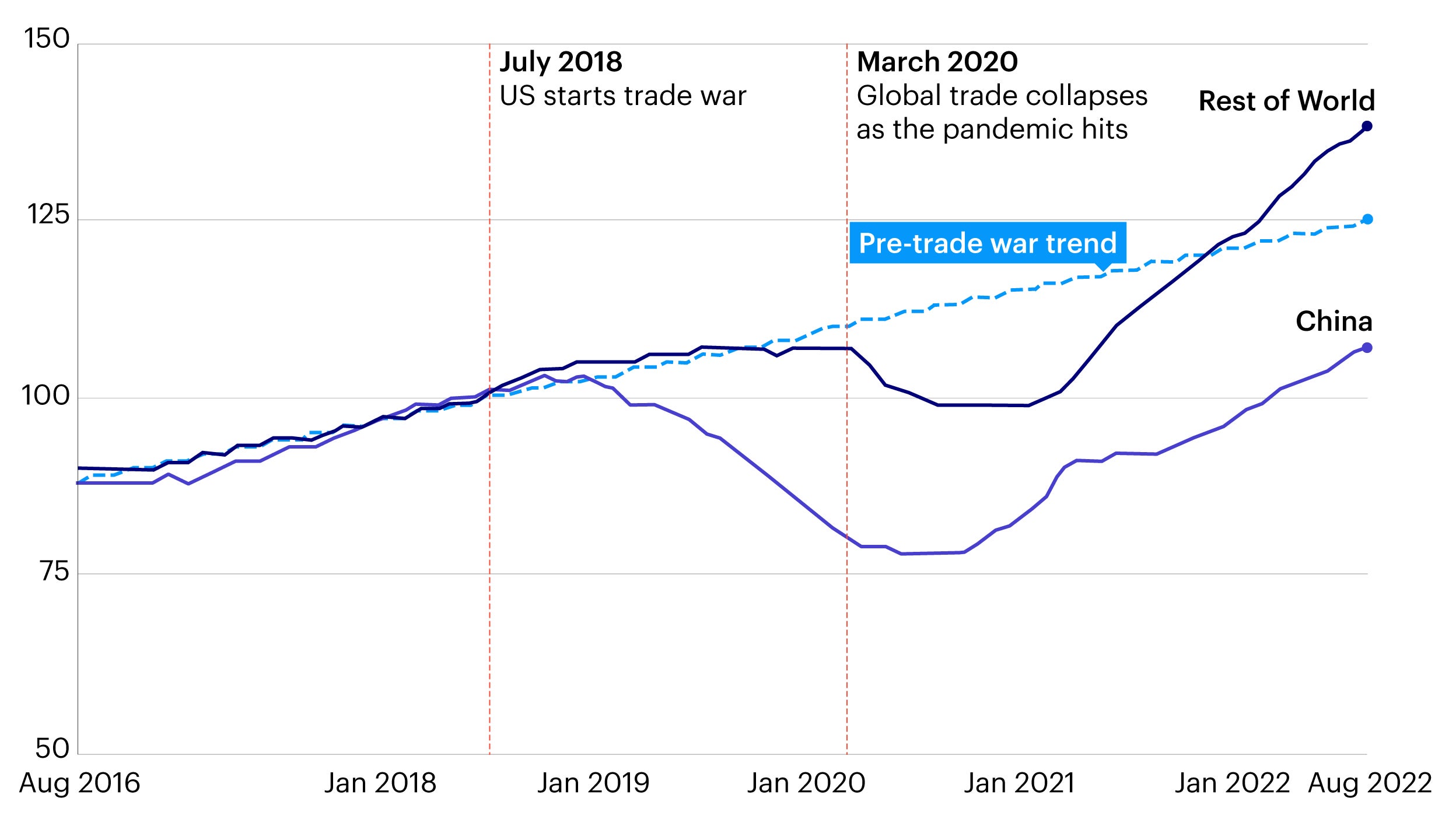

Blue Origin Rocket Launch Postponed Subsystem Issue Identified

May 23, 2025

Blue Origin Rocket Launch Postponed Subsystem Issue Identified

May 23, 2025 -

The Undervalued Asset How Middle Managers Drive Employee Engagement And Business Growth

May 23, 2025

The Undervalued Asset How Middle Managers Drive Employee Engagement And Business Growth

May 23, 2025