AbbVie (ABBV) Raises Profit Outlook: Strong Sales Growth From Newer Drugs

Table of Contents

Strong Performance of Newer Drugs Fuels AbbVie's Growth

AbbVie's impressive growth is undeniably fueled by the exceptional performance of its newer drugs, particularly Skyrizi and Rinvoq. These immunology drugs are making significant inroads in the dermatology and rheumatology markets, respectively.

-

Skyrizi and Rinvoq's Exceptional Growth: Skyrizi and Rinvoq have demonstrated explosive sales growth, far exceeding initial projections. Their success is a testament to AbbVie's R&D capabilities and strategic market positioning. Specific sales figures (while not provided here, readily available through AbbVie's financial reports) show a clear upward trajectory quarter over quarter.

-

Market Share Gains: These newer drugs are rapidly gaining market share, competing effectively against established treatments and emerging competitors. Their strong clinical data and efficacy profiles contribute significantly to their adoption by healthcare professionals.

-

Successful Launches and Strong Clinical Data: AbbVie's successful product launches, combined with compelling clinical data supporting the efficacy and safety of Skyrizi and Rinvoq, are key drivers of their growth. This ongoing positive clinical evidence reinforces confidence in their long-term market potential.

-

Mitigating Humira Competition: The success of Skyrizi and Rinvoq is effectively mitigating the impact of biosimilar competition for Humira. This strategic diversification safeguards AbbVie's revenue streams and ensures future growth.

Humira Biosimilar Competition and its Impact (Mitigated)

While the patent expiration of Humira and the subsequent entry of biosimilars presented a significant challenge, AbbVie has skillfully navigated this hurdle. The robust performance of Skyrizi and Rinvoq has demonstrably offset the revenue decline from Humira.

-

Effective Transition Strategy: AbbVie's proactive strategies to manage the transition from Humira's dominance have been remarkably successful. These strategies were crucial in maintaining revenue growth despite increased competition.

-

Minimizing Revenue Loss: The company employed a multi-pronged approach involving a focus on newer drug development, aggressive marketing of Skyrizi and Rinvoq, and strategic expansion into new markets. This proactive approach has proven crucial in limiting the financial impact of biosimilar competition.

-

Strategic Price Adjustments (if applicable): While not explicitly stated here, potential price adjustments for Humira or its newer drugs may have played a supporting role in managing revenue streams and maintaining profitability.

Revised Profit Outlook and its Implications for Investors

AbbVie's upwardly revised profit outlook reflects the company's confidence in its continued strong performance and the sustained success of its newer drugs. This positive outlook has significant implications for investors.

-

Significant Profit Outlook Increase: AbbVie has substantially raised its full-year profit outlook, exceeding market expectations. This increased projection points to a healthy financial future.

-

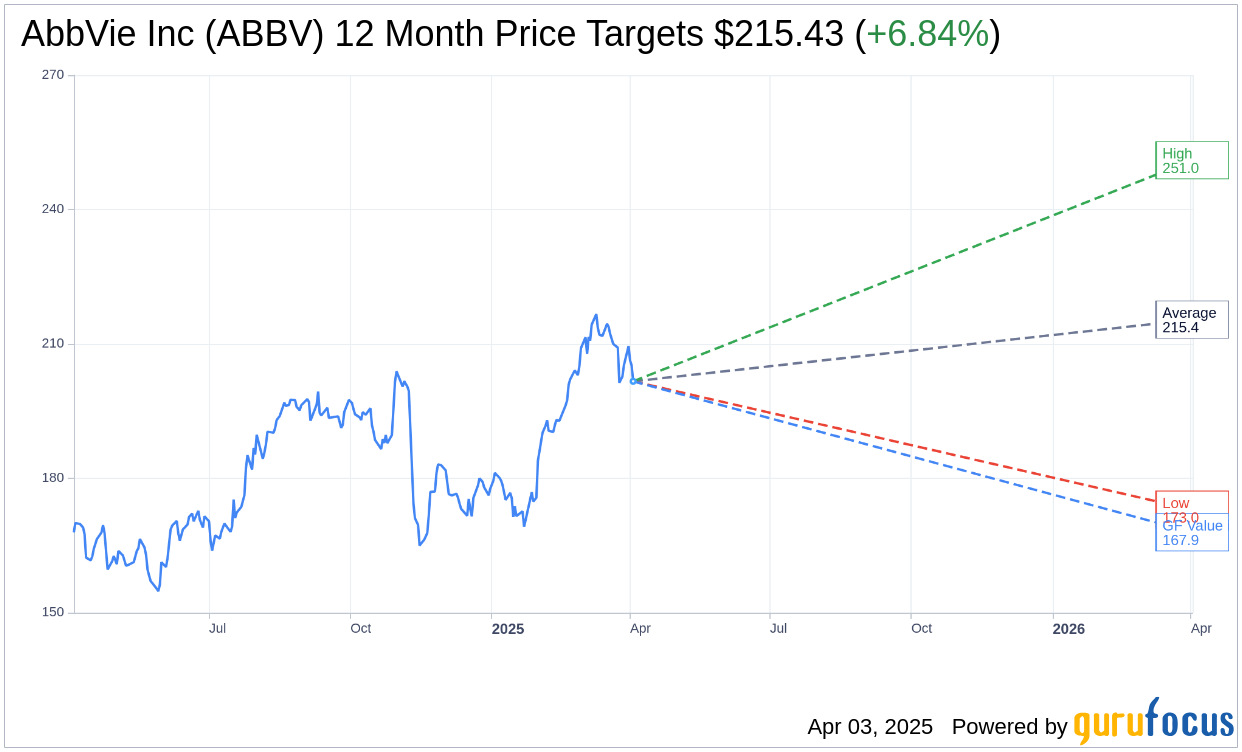

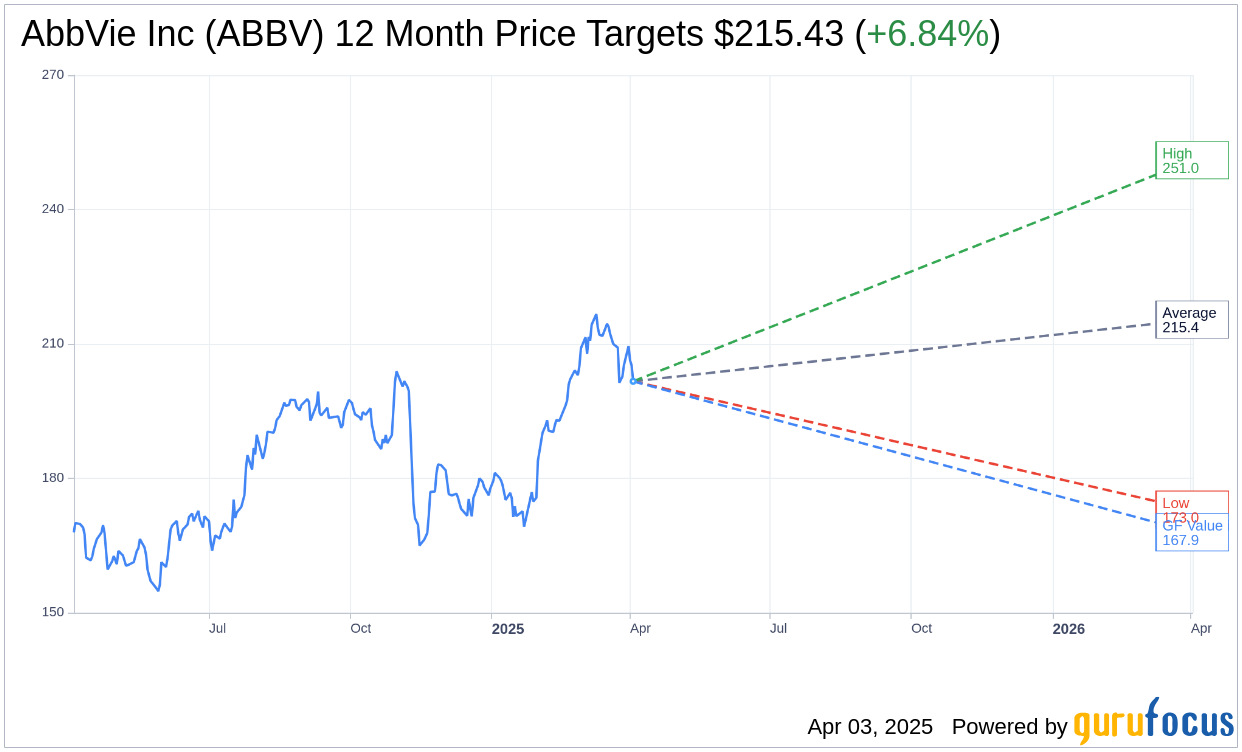

Positive Impact on Stock Price: The news has already resulted in a noticeable increase in AbbVie's stock price (ABBV), reflecting positive investor sentiment. This market reaction underscores the significance of the improved profit outlook.

-

Upward Revisions by Analysts: Financial analysts have responded positively, revising their ratings and price targets for ABBV stock upwards, further solidifying the positive outlook for the stock.

Conclusion:

AbbVie's impressive sales growth, primarily driven by the exceptional performance of its newer drugs, Skyrizi and Rinvoq, has led to a significant upward revision of its profit outlook. This success is effectively mitigating the impact of Humira biosimilar competition. The company's strategic planning and successful product launches have positioned AbbVie for continued growth and profitability in the coming years.

Call to Action: Stay informed about the latest developments in AbbVie (ABBV) and the performance of its key drugs by regularly checking financial news and AbbVie's investor relations website. Consider researching AbbVie's stock (ABBV) as part of your investment strategy, keeping in mind the company's strong growth prospects driven by its portfolio of innovative newer drugs. Remember to conduct thorough due diligence and consult with a financial advisor before making any investment decisions related to ABBV or any other stock.

Featured Posts

-

Mission Impossible Dead Reckoning Tom Cruises Daredevil Stunts

Apr 26, 2025

Mission Impossible Dead Reckoning Tom Cruises Daredevil Stunts

Apr 26, 2025 -

Deion Sanders Coaching How It Impacts Shedeur Sanders Nfl Prospects

Apr 26, 2025

Deion Sanders Coaching How It Impacts Shedeur Sanders Nfl Prospects

Apr 26, 2025 -

Strategists Ditch Optimism On European Stocks Trumps Trade War Risk

Apr 26, 2025

Strategists Ditch Optimism On European Stocks Trumps Trade War Risk

Apr 26, 2025 -

Nfl Draft 2024 First Round Kicks Off In Green Bay

Apr 26, 2025

Nfl Draft 2024 First Round Kicks Off In Green Bay

Apr 26, 2025 -

Auto Carriers 70 Million Port Fee Problem In The Us

Apr 26, 2025

Auto Carriers 70 Million Port Fee Problem In The Us

Apr 26, 2025

Latest Posts

-

Mariah The Scientist And Young Thug A New Song Snippet Hints At Romance

May 10, 2025

Mariah The Scientist And Young Thug A New Song Snippet Hints At Romance

May 10, 2025 -

Young Thug Pledges Loyalty To Mariah The Scientist In Leaked Audio Snippet

May 10, 2025

Young Thug Pledges Loyalty To Mariah The Scientist In Leaked Audio Snippet

May 10, 2025 -

Understanding Elon Musks Financial Journey Strategies And Investments

May 10, 2025

Understanding Elon Musks Financial Journey Strategies And Investments

May 10, 2025 -

The Impact Of Post Liberation Day Tariffs On Donald Trumps Billionaire Network

May 10, 2025

The Impact Of Post Liberation Day Tariffs On Donald Trumps Billionaire Network

May 10, 2025 -

The Elon Musk Business Empire How He Built His Billions

May 10, 2025

The Elon Musk Business Empire How He Built His Billions

May 10, 2025