AbbVie's Upbeat Q[Quarter Number] Earnings: New Drugs Fuel Sales Surge And Revised Guidance

![AbbVie's Upbeat Q[Quarter Number] Earnings: New Drugs Fuel Sales Surge And Revised Guidance AbbVie's Upbeat Q[Quarter Number] Earnings: New Drugs Fuel Sales Surge And Revised Guidance](https://manfred-groh.de/image/abb-vies-upbeat-q-quarter-number-earnings-new-drugs-fuel-sales-surge-and-revised-guidance.jpeg)

Table of Contents

Strong Sales Performance Driven by New Drug Launches

AbbVie's Q3 success story is largely attributed to the outstanding performance of its newly launched drugs and the sustained strength of its established products.

Rinvoq Exceeds Expectations

Rinvoq, AbbVie's blockbuster treatment for various inflammatory conditions, significantly exceeded expectations in Q3. Sales figures surpassed analyst predictions, demonstrating strong market penetration and acceptance amongst patients and healthcare professionals.

- Sales Figures: [Insert actual sales figures here – e.g., $X billion, exceeding projected $Y billion].

- Market Share: Rinvoq gained [Insert percentage]% market share in its key therapeutic areas, showcasing its competitive edge.

- Clinical Trial Data: Positive data from ongoing clinical trials continues to support Rinvoq's efficacy and safety profile, further boosting investor confidence.

- Target Market: Rinvoq’s broad target market, encompassing patients with rheumatoid arthritis, psoriatic arthritis, and other inflammatory conditions, contributes to its substantial sales potential.

Skyrizi Contributes to Revenue Growth

Skyrizi, another key addition to AbbVie's portfolio, also played a crucial role in the Q3 revenue surge. This drug, targeting similar inflammatory conditions as Rinvoq, complements AbbVie's existing lineup and shows great promise.

- Sales Figures: [Insert actual sales figures here – e.g., $Z billion].

- Market Share: Skyrizi’s market share growth is [Insert percentage]%, demonstrating strong competition within the market.

- Comparison to Rinvoq: While both drugs target similar patient populations, Skyrizi’s [mention a key differentiating factor, e.g., specific formulation or route of administration] sets it apart and contributes to the overall portfolio strength.

- Regulatory Approvals: Continued approvals in new regions further expand Skyrizi's reach and contribute to revenue growth.

Existing Blockbuster Drugs Maintain Strong Performance

AbbVie's existing blockbuster drugs, such as Humira (though facing biosimilar competition), continued to perform well, contributing significantly to the overall revenue growth.

- Humira Sales: While facing biosimilar competition, Humira continues to maintain a strong market presence, demonstrating the enduring strength of the brand and AbbVie's strategic approach to managing the competitive landscape. [Insert actual sales figures].

- Market Dominance: AbbVie strategically maintains its market dominance through [mention strategies, e.g., continuous innovation, strong marketing, robust distribution networks].

- Sales Strategies: The company’s focus on [mention sales strategies, e.g., patient support programs, physician engagement initiatives] ensures continued success in a dynamic market.

Upward Revision of Guidance Reflects Positive Outlook

The exceptional Q3 performance prompted AbbVie to revise its full-year guidance upwards, signaling a highly positive outlook for the remainder of 2023.

Increased Revenue Projections

AbbVie increased its full-year revenue projection from [Previous Projection] to [Revised Projection], reflecting substantial confidence in the company's continued growth trajectory. This significant increase underscores the strength of the company's product portfolio and market position.

Positive Impact on Earnings Per Share (EPS)

The upward revision in revenue projections is expected to positively impact the company's earnings per share (EPS), further bolstering investor sentiment. The projected EPS increase is [Insert projected percentage increase].

Factors Contributing to Upward Revision

Several key factors contributed to this positive guidance revision:

- Successful New Drug Launches: The impressive performance of Rinvoq and Skyrizi played a pivotal role in driving revenue growth beyond initial projections.

- Strong Sales of Existing Products: The continued success of established products, despite competitive pressures, significantly bolstered the overall financial performance.

- Positive Market Trends: Favorable market conditions and the increasing demand for AbbVie's therapeutic areas further fueled the positive outlook.

Investor Reactions and Market Analysis

The positive Q3 earnings announcement had a significant impact on AbbVie's stock price and overall market perception.

Stock Price Movement

Following the earnings release, AbbVie's stock price experienced a [Describe the movement, e.g., significant increase, modest rise]. This positive market reaction reflects investor confidence in the company's future prospects.

Analyst Comments and Ratings

Financial analysts largely responded positively to the Q3 results, with many upgrading their ratings and price targets for AbbVie's stock. [Include specific examples of analyst comments if available].

Competitive Landscape

AbbVie maintains a strong position within the competitive pharmaceutical landscape. The company's ongoing innovation and robust product pipeline provide a solid foundation for sustained growth and market leadership.

Conclusion: AbbVie's Q3 Earnings Signal Strong Growth and Future Potential

AbbVie's Q3 2023 earnings report showcases a remarkable period of growth, driven by the successful launch of new drugs and the consistent performance of its established portfolio. The upward revision of full-year guidance solidifies a positive outlook for the company and strengthens investor confidence. This exceptional performance highlights AbbVie's strategic focus on innovation and its ability to navigate a dynamic pharmaceutical market. To stay informed about AbbVie's future performance and explore potential investment opportunities, keep an eye on future earnings announcements and consult reputable financial resources. Understanding AbbVie earnings and their implications for stock market performance is crucial for informed investment decisions.

![AbbVie's Upbeat Q[Quarter Number] Earnings: New Drugs Fuel Sales Surge And Revised Guidance AbbVie's Upbeat Q[Quarter Number] Earnings: New Drugs Fuel Sales Surge And Revised Guidance](https://manfred-groh.de/image/abb-vies-upbeat-q-quarter-number-earnings-new-drugs-fuel-sales-surge-and-revised-guidance.jpeg)

Featured Posts

-

A Geographic Analysis Of The Countrys Best New Business Locations

Apr 26, 2025

A Geographic Analysis Of The Countrys Best New Business Locations

Apr 26, 2025 -

Nfl Draft 2024 Will Ahmed Hassanein Break New Ground For Egypt

Apr 26, 2025

Nfl Draft 2024 Will Ahmed Hassanein Break New Ground For Egypt

Apr 26, 2025 -

Harvard University A Conservative View On Its Future

Apr 26, 2025

Harvard University A Conservative View On Its Future

Apr 26, 2025 -

Rural School 2700 Miles From Dc Feeling The Impact Of Trumps First 100 Days

Apr 26, 2025

Rural School 2700 Miles From Dc Feeling The Impact Of Trumps First 100 Days

Apr 26, 2025 -

Anchor Brewing Companys Closure Whats Next For San Francisco Beer

Apr 26, 2025

Anchor Brewing Companys Closure Whats Next For San Francisco Beer

Apr 26, 2025

Latest Posts

-

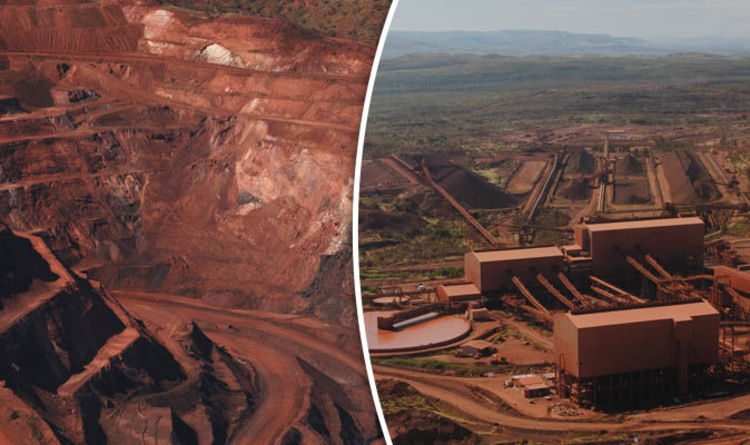

Falling Iron Ore Prices Analysis Of Chinas Steel Production Curbs

May 10, 2025

Falling Iron Ore Prices Analysis Of Chinas Steel Production Curbs

May 10, 2025 -

The China Factor Analyzing The Difficulties Faced By Premium Car Brands Like Bmw And Porsche

May 10, 2025

The China Factor Analyzing The Difficulties Faced By Premium Car Brands Like Bmw And Porsche

May 10, 2025 -

Middle Managers Their Crucial Role In Boosting Company Performance And Employee Satisfaction

May 10, 2025

Middle Managers Their Crucial Role In Boosting Company Performance And Employee Satisfaction

May 10, 2025 -

Iron Ore Price Drop Chinas Steel Output Restrictions And Market Response

May 10, 2025

Iron Ore Price Drop Chinas Steel Output Restrictions And Market Response

May 10, 2025 -

The Value Of Middle Managers Bridging The Gap Between Leadership And Employees

May 10, 2025

The Value Of Middle Managers Bridging The Gap Between Leadership And Employees

May 10, 2025