Falling Iron Ore Prices: Analysis Of China's Steel Production Curbs

Table of Contents

China's Steel Production Curbs: The Driving Force

China's push to curb steel production stems from a confluence of factors: growing environmental concerns, the need to address overcapacity in the steel sector, and the country's ambitious carbon neutrality goals. These interconnected issues are significantly impacting global iron ore demand and, consequently, prices.

Environmental Regulations and Their Impact

The Chinese government has implemented a series of stringent environmental regulations targeting the steel industry. These regulations aim to reduce air and water pollution associated with steel production.

- Emission Limits: Stricter limits on emissions of pollutants like sulfur dioxide, nitrogen oxides, and particulate matter.

- Production Quotas: Implementation of production quotas for steel mills, particularly in regions with severe pollution problems.

- Energy Consumption Standards: New regulations enforcing stricter energy efficiency standards for steel production processes.

These regulations have directly reduced steel output, leading to decreased demand for iron ore, a key raw material in steelmaking. This reduced demand is a major contributor to the current falling iron ore prices.

Addressing Overcapacity in the Steel Industry

China's steel industry has historically suffered from significant overcapacity. This excess production capacity has led to price wars and unsustainable environmental practices. The government is actively working to consolidate and restructure the industry.

- Factory Closures: Closure of inefficient and polluting steel mills.

- Mergers and Acquisitions: Encouragement of mergers and acquisitions to create larger, more efficient steel companies.

- Production Consolidation: Shifting steel production to more technologically advanced and environmentally friendly facilities.

These strategies, while aimed at improving efficiency and sustainability, have resulted in a contraction of steel production and consequently, a decline in iron ore demand.

China's Carbon Neutrality Goals and Their Influence

China's commitment to achieving carbon neutrality by 2060 is significantly reshaping its steel industry. The steel sector is a major contributor to carbon emissions, and the government is implementing policies to decarbonize steel production.

- Renewable Energy Integration: Promoting the use of renewable energy sources in steel mills.

- Carbon Capture and Storage (CCS) Technologies: Investment in research and development of CCS technologies to capture carbon emissions.

- Green Steel Production: Support for the development and adoption of green steel production technologies.

The transition to a lower-carbon steel industry will likely involve further reductions in steel production in the short to medium term, exacerbating the pressure on iron ore prices.

Impact on Global Iron Ore Prices and Markets

The reduction in Chinese steel production has created a ripple effect across the global iron ore market. The decreased demand from China, the world's largest steel producer, has significantly impacted global iron ore prices.

Supply and Demand Dynamics

The reduced Chinese demand has created a surplus in the global iron ore market, putting downward pressure on prices.

- Impact on Major Producers: Australian and Brazilian iron ore producers, major suppliers to China, have been heavily impacted by the price decline.

- Price Volatility: The market is experiencing increased price volatility due to fluctuating demand and geopolitical uncertainties.

- Forecasting Challenges: Predicting future iron ore prices has become significantly more challenging due to the complexity of the interplay between Chinese policies and global economic conditions.

Implications for Iron Ore Producers and Traders

Falling iron ore prices have severe financial implications for iron ore companies and traders.

- Reduced Profits and Job Losses: Many companies are experiencing reduced profits and have had to implement job cuts.

- Cost-Cutting Measures: Companies are implementing various cost-cutting measures to maintain profitability in the face of lower prices.

- Diversification Strategies: Some companies are diversifying their operations to reduce their dependence on the iron ore market.

- Mergers and Acquisitions: The industry is likely to see further consolidation through mergers and acquisitions as weaker companies struggle to survive.

Future Outlook for Iron Ore Prices and Steel Production in China

Predicting the long-term trajectory of iron ore prices requires considering several factors, including the pace of China's policy implementation and the global economic outlook.

Potential for Price Recovery

Several factors could potentially lead to a recovery in iron ore prices:

- Increased Infrastructure Spending: Increased government investment in infrastructure projects globally could boost steel demand.

- Global Economic Recovery: A robust global economic recovery would likely increase demand for steel and iron ore.

- Technological Advancements: New technologies that reduce the carbon footprint of steel production could stimulate demand.

However, a price rebound would depend on these factors overcoming the persistent effects of China's production curbs.

Long-Term Implications for the Steel Industry

China's policies will have long-term implications for the global steel industry. We can expect to see:

- Shift in Production Capacity: A gradual shift in steel production capacity from China to other countries with less stringent environmental regulations.

- Technology Adoption: Increased adoption of cleaner and more efficient steel production technologies globally.

- Restructuring of Global Supply Chains: Changes in global supply chains as companies adapt to the new market dynamics.

Conclusion

This analysis demonstrates the significant impact of China's steel production curbs on falling iron ore prices. The intricate interplay between environmental regulations, overcapacity reduction, and carbon neutrality goals has created a complex and volatile market. Understanding these dynamics is crucial for all stakeholders in the iron ore and steel industries. To stay informed about the future of falling iron ore prices and their implications, continue to monitor China's policy changes and global economic trends. Further research into the long-term effects of these policies on global supply chains is recommended.

Featured Posts

-

Adin Hills 27 Save Shutout Powers Vegas Golden Knights Past Columbus Blue Jackets

May 10, 2025

Adin Hills 27 Save Shutout Powers Vegas Golden Knights Past Columbus Blue Jackets

May 10, 2025 -

9 Maya Makron I Tusk Podpisali Oboronnoe Soglashenie Podrobnosti I Znachenie Dlya Ukrainy

May 10, 2025

9 Maya Makron I Tusk Podpisali Oboronnoe Soglashenie Podrobnosti I Znachenie Dlya Ukrainy

May 10, 2025 -

Leon Draisaitl Reaches 100 Points Oilers Defeat Islanders In Overtime

May 10, 2025

Leon Draisaitl Reaches 100 Points Oilers Defeat Islanders In Overtime

May 10, 2025 -

The Us Attorney General And Fox News Understanding The Daily Appearances

May 10, 2025

The Us Attorney General And Fox News Understanding The Daily Appearances

May 10, 2025 -

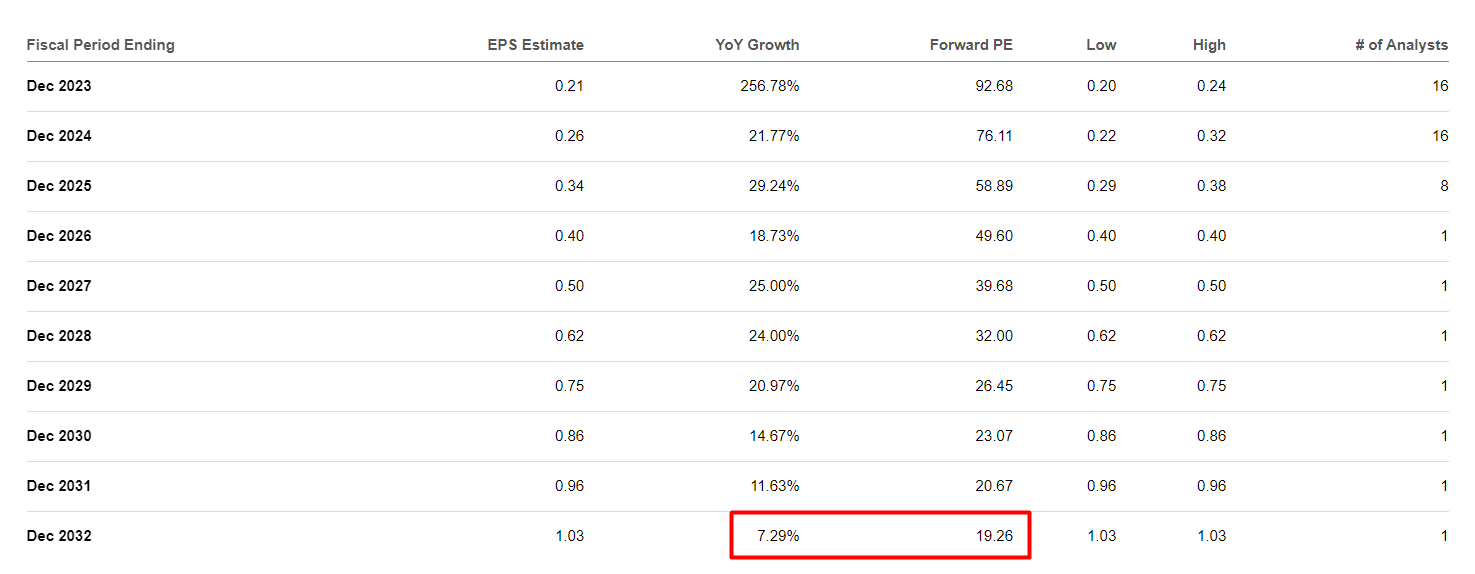

Is Palantir Stock A Good Investment Before May 5th Analyst Opinions

May 10, 2025

Is Palantir Stock A Good Investment Before May 5th Analyst Opinions

May 10, 2025