Amsterdam Exchange Suffers 7% Plunge: Trade War Impact

Table of Contents

The Immediate Impact of the Trade War on the Amsterdam Exchange

The escalating trade war has a direct and immediate correlation with the Amsterdam Exchange's sharp 7% drop. The uncertainty surrounding global trade policies has created a climate of fear and risk aversion among investors, leading to widespread selling. This impact is not uniform, however, with certain sectors feeling the brunt of the crisis more acutely than others.

- Specific examples of affected sectors: The technology and manufacturing sectors have been particularly hard hit. Companies heavily reliant on international supply chains and export markets are experiencing significant challenges.

- Specific companies significantly impacted by the plunge: While specific company data may be subject to market fluctuations and requires further detailed research, preliminary reports suggest that several large-cap companies within the technology and export-oriented manufacturing sectors experienced substantial losses. Further investigation from reliable financial news sources is needed to provide precise details on individual companies.

- Quantify the losses in terms of market capitalization: The 7% drop translates to a significant loss in overall market capitalization for the Amsterdam Exchange, representing billions of euros wiped off the value of listed companies. Precise figures will become available as market data is consolidated and reported by financial institutions.

- Data from reliable financial news sources: Sources such as the Financial Times, Reuters, and Bloomberg are continuously reporting on the situation and providing updates on the economic impact of this market event.

Analysis of Vulnerable Sectors within the Amsterdam Exchange

Several sectors within the Amsterdam Exchange are demonstrably more vulnerable to the uncertainties created by the trade war. These vulnerabilities highlight the interconnected nature of global trade and the ripple effects of protectionist policies.

- Export-oriented businesses disproportionately affected: Companies heavily dependent on exporting goods and services are experiencing significant challenges due to increased tariffs and trade restrictions. The resulting decrease in demand from international markets is directly impacting their profitability and stock prices.

- Impact on import-dependent industries: Industries that rely on imported raw materials or components are also facing increased costs, leading to reduced competitiveness and profit margins. This effect further compounds the existing economic pressure caused by the trade war.

- Specific regulations or tariffs impacting specific sectors: The introduction of specific tariffs or trade restrictions on certain goods is directly impacting the performance of companies involved in the production, import, or export of those goods. This creates significant uncertainty and risk for businesses operating in affected sectors.

- Examples of companies in vulnerable sectors and their performance: While pinpointing specific companies early after such an event may be unreliable without dedicated financial research, it is reasonable to assume that companies within the agricultural sector, high-tech manufacturing, and companies heavily involved in international shipping are particularly vulnerable.

Investor Sentiment and Market Volatility Following the Plunge

The 7% drop in the Amsterdam Exchange has triggered a significant shift in investor sentiment, marked by increased uncertainty and risk aversion. This has contributed to heightened market volatility.

- Increase in market volatility: Trading volumes have increased significantly, reflecting the heightened uncertainty and the increased frequency of price fluctuations. This volatility creates challenges for investors trying to assess the market’s direction and make informed decisions.

- Investor reactions and trading patterns: Many investors are adopting a wait-and-see approach, while others are moving their investments into safer assets, such as government bonds. This "flight to safety" is a common response to market uncertainty.

- Predictions and analyses from financial experts: Financial analysts are closely monitoring the situation, offering diverse predictions and analyses depending on their economic perspectives. Some suggest the current downturn is temporary and the market will recover, others warn of potential further corrections.

- Potential flight to safety: The observed increase in demand for safer assets, like government bonds, illustrates the flight to safety response and reflects growing anxiety about the ongoing trade war impact.

Potential Long-Term Consequences of the Trade War on the Amsterdam Exchange

The ongoing trade war could have profound long-term consequences for the Amsterdam Exchange and the Netherlands' economy. The implications extend beyond immediate market fluctuations and touch upon long-term growth and foreign investment.

- Potential for further market corrections: Depending on the trajectory of trade negotiations and global economic conditions, further market corrections cannot be ruled out. The current volatility underscores the sensitivity of the Amsterdam Exchange to trade war developments.

- Impact on long-term growth projections: Continued trade tensions could negatively impact long-term growth projections for the Netherlands, hindering economic expansion and job creation.

- Potential government interventions or policy changes: The Dutch government might introduce policy measures to mitigate the negative effects of the trade war on the economy, potentially including stimulus packages or industry-specific support programs.

- Implications for foreign investment in the Netherlands: The uncertainty created by the trade war could deter foreign investment in the Netherlands, impacting long-term economic prospects.

Conclusion

The 7% plunge suffered by the Amsterdam Exchange is a stark reminder of the significant and far-reaching impact of the ongoing trade war. The immediate and potential long-term consequences are substantial, affecting various sectors and impacting investor confidence. Understanding the vulnerabilities within the Amsterdam Exchange is crucial for navigating this turbulent period. The interplay between global trade policies and the performance of the Amsterdam Exchange underlines the need for continuous monitoring and informed decision-making.

Call to Action: Stay informed about the evolving situation and its impact on the Amsterdam Exchange. Regularly monitor the news and analysis surrounding the trade war and its consequences for your investments in the Amsterdam Exchange and related markets. Learn more about mitigating risks associated with trade war uncertainty and develop a robust investment strategy to navigate this complex environment.

Featured Posts

-

Escape To The Country Overcoming The Challenges Of Rural Living

May 24, 2025

Escape To The Country Overcoming The Challenges Of Rural Living

May 24, 2025 -

Is News Corp An Undervalued Asset A Deep Dive Into Its Business Units

May 24, 2025

Is News Corp An Undervalued Asset A Deep Dive Into Its Business Units

May 24, 2025 -

Yevrobachennya Peremozhtsi Ostannogo Desyatilittya Ta Yikhni Dosyagnennya

May 24, 2025

Yevrobachennya Peremozhtsi Ostannogo Desyatilittya Ta Yikhni Dosyagnennya

May 24, 2025 -

Konchita Vurst Evrovidenie 2014 Zhizn Kaming Aut I Plany Na Buduschee

May 24, 2025

Konchita Vurst Evrovidenie 2014 Zhizn Kaming Aut I Plany Na Buduschee

May 24, 2025 -

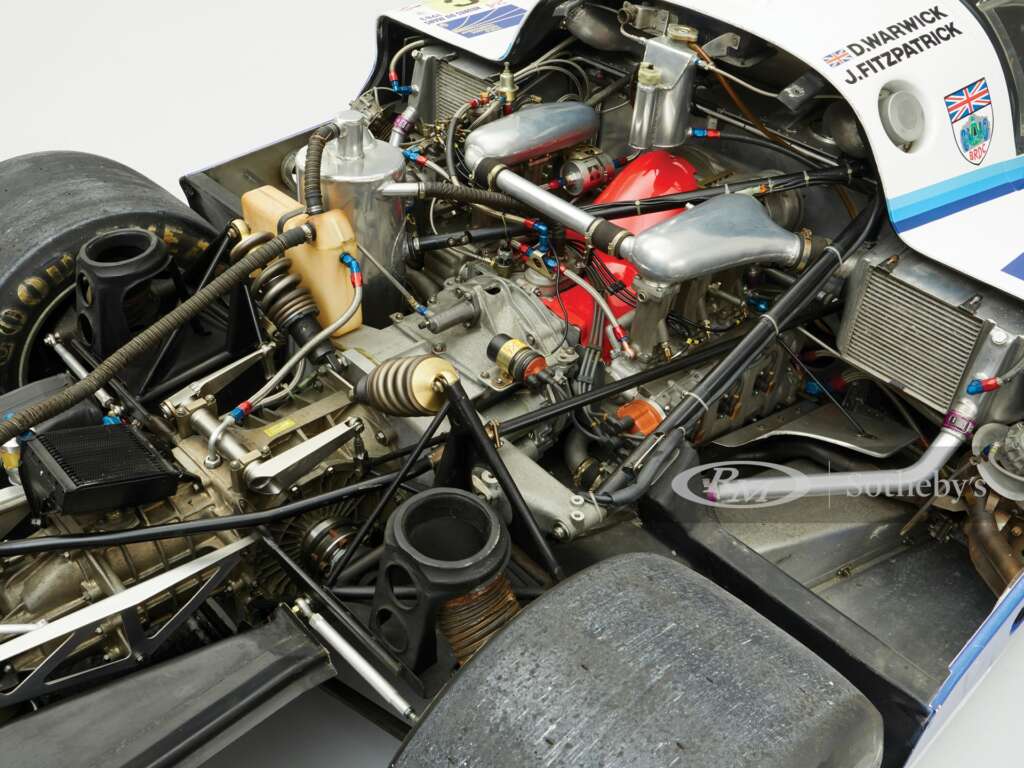

Porsche 956 Nin Tavanindan Asili Sergilenmesinin Teknik Sebepleri

May 24, 2025

Porsche 956 Nin Tavanindan Asili Sergilenmesinin Teknik Sebepleri

May 24, 2025

Latest Posts

-

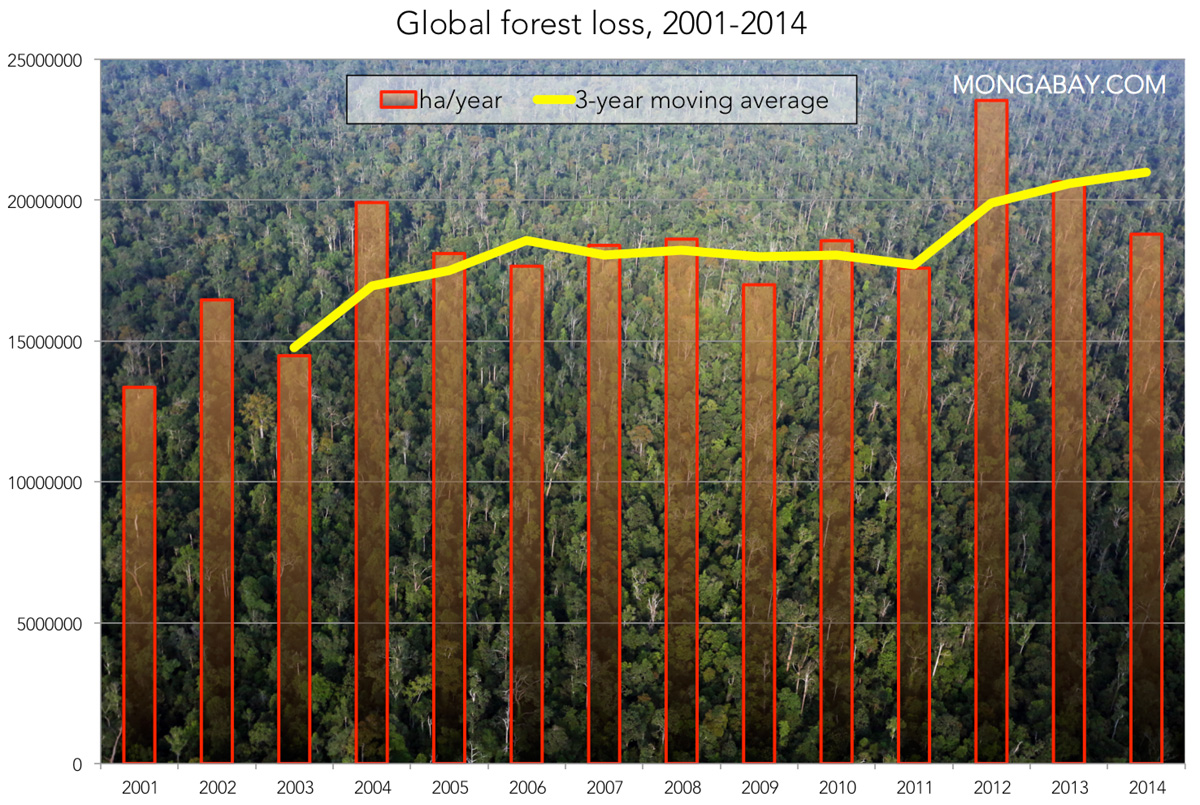

The Devastating Impact Of Wildfires Record High In Global Forest Loss

May 24, 2025

The Devastating Impact Of Wildfires Record High In Global Forest Loss

May 24, 2025 -

Wildfires Drive Record Breaking Global Forest Loss

May 24, 2025

Wildfires Drive Record Breaking Global Forest Loss

May 24, 2025 -

Navigating The Complexities Of The Chinese Auto Market Case Studies Of Bmw And Porsche

May 24, 2025

Navigating The Complexities Of The Chinese Auto Market Case Studies Of Bmw And Porsche

May 24, 2025 -

The China Market Slowdown Impact On Bmw Porsche And The Automotive Industry

May 24, 2025

The China Market Slowdown Impact On Bmw Porsche And The Automotive Industry

May 24, 2025 -

The Growing Trend Of Betting On California Wildfires Los Angeles And Beyond

May 24, 2025

The Growing Trend Of Betting On California Wildfires Los Angeles And Beyond

May 24, 2025