Amsterdam Stock Market Crash: 7% Plunge Amidst Trade War Fears

Table of Contents

The 7% Plunge: A Detailed Analysis of the Amsterdam Stock Market Crash

The Amsterdam stock market crash, marked by a sharp 7% decline in the AEX index, represented a substantial loss in market capitalization. This wasn't a gradual decline; instead, the majority of the drop occurred within a single trading day, creating significant panic and uncertainty. [Insert a graph or chart here visually representing the AEX index's drop]. This dramatic fall translates to a loss of [insert precise number] points on the AEX, a significant event even compared to previous market fluctuations.

- Specific losses in key sectors: The technology sector suffered the most significant losses, followed by financial institutions and energy companies, all highly sensitive to global trade dynamics.

- Record lows reached: Several blue-chip stocks within the AEX index reached record lows during this period, further amplifying the severity of the crash.

- Comparison to previous downturns: While the Amsterdam stock market has experienced downturns before, the speed and magnitude of this crash are noteworthy, surpassing several previous market corrections in recent history.

Trade War Fears: The Primary Catalyst for the Amsterdam Stock Market Crash

The primary driver behind the Amsterdam stock market crash was the escalating global trade war. Concerns over new tariffs imposed by [mention specific countries/blocs] and retaliatory measures created a climate of uncertainty and fear among investors. This led to a significant drop in investor confidence, triggering widespread sell-offs. The interconnectedness of the global market means events in one region can quickly impact others; the Amsterdam market is no exception.

- Specific examples of trade policies impacting Dutch businesses: [Cite specific examples, e.g., impact on Dutch agricultural exports due to tariffs, difficulties for Dutch tech companies exporting to key markets].

- Analysis of investor sentiment: Before the crash, investor sentiment was relatively positive; however, the news of escalating trade tensions rapidly shifted this sentiment to fear and uncertainty.

- Statements from government officials/market analysts: [Include quotes or summaries of statements from relevant sources acknowledging the impact of trade war fears on the Amsterdam market].

Impact on Key Sectors: Assessing the Damage

The Amsterdam Stock Exchange crash disproportionately affected export-oriented sectors, highlighting their vulnerability to global trade uncertainties. Companies heavily reliant on international trade experienced the most significant losses. The long-term consequences could include reduced investment, job losses, and slower economic growth.

- Individual stock performance: [Provide examples of specific stock performances within different sectors, illustrating the varying degrees of impact].

- Impact on employment and economic growth: The crash's impact on employment remains to be seen, but certain sectors may experience layoffs and reduced hiring. Economic growth projections for the Netherlands will likely be revised downwards.

- Government interventions/support packages: The Dutch government may implement measures to mitigate the negative impact on affected industries, such as financial support or tax breaks.

Investor Reactions and Market Sentiment Following the Amsterdam Stock Market Crash

The immediate reaction to the crash was widespread panic selling, as investors sought to limit their losses. There was a clear "flight to safety," with investors moving funds into safer assets like government bonds. Following the crash, market sentiment was characterized by pessimism and uncertainty, although cautious optimism emerged as the market began to stabilize.

- Changes in trading volume: Trading volume surged during the crash, indicating heightened investor activity and panic selling. Post-crash, volume decreased, suggesting a period of consolidation.

- Analysis of investor behaviour: Investors employed various strategies, such as short selling and hedging, to manage risk and potentially profit from the volatility.

- Quotes from financial experts: [Include quotes summarizing expert opinions on investor behavior and the overall market sentiment].

Potential Future Consequences and Recovery Outlook for the Amsterdam Stock Market

The long-term implications of this crash remain uncertain. The speed of recovery depends on several factors, including the resolution of trade disputes, the overall global economic climate, and government policy responses. Future market volatility is expected, especially if trade tensions persist.

- Possible scenarios for market recovery: A swift recovery is possible if trade tensions ease and global economic indicators remain positive. Conversely, prolonged uncertainty could lead to a slower, more protracted recovery.

- Impact on foreign investment: The crash might deter foreign investment in the Netherlands in the short term, but the long-term impact depends on the market's ability to recover and demonstrate stability.

- Government policies to stabilize the market: Government intervention, through fiscal or monetary policy, could play a significant role in stabilizing the market and promoting recovery.

Conclusion: Understanding and Navigating the Amsterdam Stock Market Crash

The 7% plunge in the Amsterdam stock market, driven largely by trade war fears, serves as a stark reminder of the interconnectedness of global markets and the potential for significant volatility. The crash's impact on various sectors, particularly those heavily reliant on exports, was significant, affecting investor confidence and creating uncertainty. Understanding these factors is crucial for navigating future market volatility. Stay updated on the Amsterdam stock market, monitor the impact of trade wars on Dutch businesses, and understand the risks of market volatility to effectively manage your investments.

Featured Posts

-

Konchita Vurst Dnes Preobrazyavaneto Na Pevitsata Sled Pobedata

May 24, 2025

Konchita Vurst Dnes Preobrazyavaneto Na Pevitsata Sled Pobedata

May 24, 2025 -

Jejak Porsche 356 Dari Zuffenhausen Jerman Menuju Legenda

May 24, 2025

Jejak Porsche 356 Dari Zuffenhausen Jerman Menuju Legenda

May 24, 2025 -

Avrupa Borsalari Karisik Bir Guenuen Ardindan Kapandi

May 24, 2025

Avrupa Borsalari Karisik Bir Guenuen Ardindan Kapandi

May 24, 2025 -

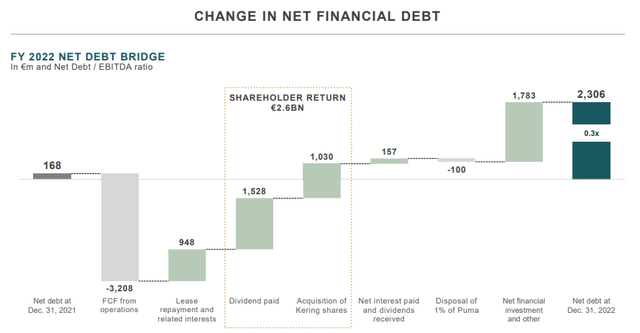

Weak Q1 Figures Trigger 6 Drop In Kering Share Price

May 24, 2025

Weak Q1 Figures Trigger 6 Drop In Kering Share Price

May 24, 2025 -

How To Get Bbc Radio 1 Big Weekend 2025 Tickets Full Line Up And Purchase Guide

May 24, 2025

How To Get Bbc Radio 1 Big Weekend 2025 Tickets Full Line Up And Purchase Guide

May 24, 2025

Latest Posts

-

Malaysia Ex Pm Najibs Alleged Role In 2002 French Submarine Bribery Scandal

May 24, 2025

Malaysia Ex Pm Najibs Alleged Role In 2002 French Submarine Bribery Scandal

May 24, 2025 -

Luxury Carmakers Struggle In China More Than Just Bmw And Porsche

May 24, 2025

Luxury Carmakers Struggle In China More Than Just Bmw And Porsche

May 24, 2025 -

The Ftc Investigates Open Ai Examining Chat Gpts Data Practices

May 24, 2025

The Ftc Investigates Open Ai Examining Chat Gpts Data Practices

May 24, 2025 -

Marks And Spencers 300 Million Cyberattack A Detailed Analysis

May 24, 2025

Marks And Spencers 300 Million Cyberattack A Detailed Analysis

May 24, 2025 -

Delayed But Delivered Accentures 50 000 Promotions

May 24, 2025

Delayed But Delivered Accentures 50 000 Promotions

May 24, 2025