Amsterdam Stock Market Plunges: 7% Drop Amidst Trade War Fears

Table of Contents

Trade War Fears as the Primary Catalyst

The escalating trade tensions between major global economies, particularly the ongoing US-China trade war, are the primary catalysts for today's Amsterdam stock market plunge. These tensions have created a climate of uncertainty, significantly impacting global investor confidence. The fear of prolonged trade disputes and unpredictable tariff changes is causing investors to reassess their portfolios and seek safer investment options. This uncertainty directly affects the Amsterdam stock exchange, given its interconnectedness with the global economy.

- Increased tariffs: Higher import costs for Dutch businesses, resulting from increased tariffs imposed by trading partners, are squeezing profit margins and hindering economic growth.

- Uncertainty surrounding future trade agreements: The lack of clarity regarding future trade deals creates significant uncertainty for businesses, making investment planning difficult and discouraging further capital investments.

- Decline in global demand: The trade war is leading to a slowdown in global demand, negatively impacting Dutch export-oriented companies that rely heavily on international trade for their revenue. This decline in demand translates directly into lower stock valuations.

Impact on Key Sectors of the Amsterdam Stock Exchange

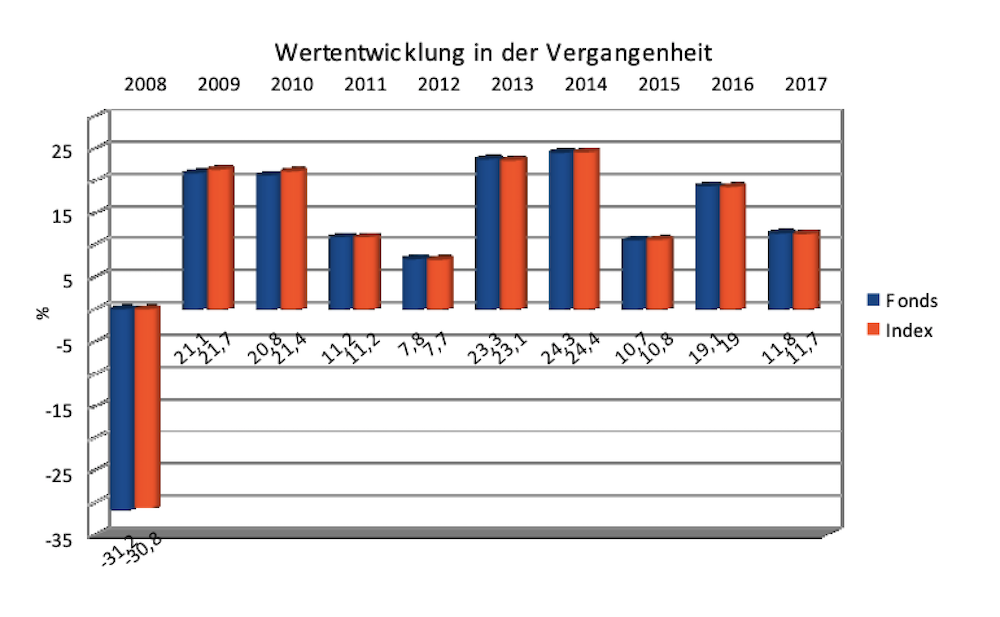

The Amsterdam stock market plunge has not affected all sectors equally. The technology, finance, and energy sectors have been particularly hard hit, experiencing some of the most significant stock price drops. This is largely due to their dependence on global trade and their sensitivity to shifts in investor sentiment. The AEX index, a benchmark for the Amsterdam Stock Exchange, reflects this widespread decline.

- AEX Index Performance: The AEX index experienced a significant drop, mirroring the broader market decline and highlighting the widespread impact of the trade war fears.

- Specific Examples: Several prominent companies within these sectors have seen double-digit percentage drops in their share prices. Analyzing the performance of these individual companies provides a clearer picture of the sector-specific impact of the Amsterdam stock market plunge.

- Correlation with Global Market Trends: The Amsterdam Exchange is tightly coupled with global market trends. The current decline reflects a broader global trend of uncertainty and risk aversion, showcasing the interconnected nature of international financial markets.

Investor Sentiment and Market Volatility

The Amsterdam stock market plunge reflects a significant shift in investor sentiment, moving from bullish to bearish. This shift is evident in the increased market volatility and heightened trading volume observed today. Investors are reacting to the escalating trade war fears by reassessing their risk profiles and seeking more stable investments.

- Increased Trading Volume: The significant increase in trading volume indicates heightened investor activity as investors react to the unfolding situation and try to adjust their portfolios accordingly.

- Shift in Investor Sentiment: The market's sharp decline clearly shows a shift in investor sentiment, with many opting for risk aversion strategies.

- Market Indices and Volatility Indicators: Volatility indices, which measure market uncertainty, have spiked sharply, reflecting the heightened anxiety and uncertainty in the Amsterdam stock market.

Safe Haven Assets and Investor Behavior

The flight to safety is evident in the rising prices of gold and other safe-haven assets. Investors are seeking stability in uncertain times, leading to increased demand for assets perceived as less risky.

- Gold Prices: The price of gold has risen as investors move away from riskier assets like stocks, seeking the security of precious metals.

- Investor Behavior: This behavior is classic risk aversion, a common response to heightened economic uncertainty and geopolitical instability.

- Impact on the Euro: The uncertainty surrounding the Amsterdam stock market plunge and its implications for the European economy is likely to impact the Euro's exchange rate as well.

Government Response and Potential Mitigation Strategies

The Dutch government is likely to closely monitor the situation and may consider various measures to mitigate the impact of the Amsterdam stock market plunge and the underlying trade war fears. While immediate solutions are limited, longer-term strategies for building economic resilience will be crucial.

- Potential Government Interventions: The government might consider fiscal stimulus measures or other interventions to support the market and boost investor confidence.

- Fiscal and Monetary Policy Options: Adjustments to fiscal and monetary policy could be explored to address the economic fallout.

- Long-term Strategies for Economic Resilience: Diversifying the Dutch economy and reducing reliance on specific sectors vulnerable to global trade tensions are crucial long-term strategies.

Conclusion

The Amsterdam stock market plunge, a significant 7% drop, underscores the considerable impact of escalating trade war fears on global markets and the Dutch economy. The decline significantly affected key sectors, fueled investor uncertainty, and highlighted the need for proactive government strategies. Understanding the dynamics of these events is crucial for navigating future market volatility.

Call to Action: Stay informed on the evolving situation of the Amsterdam stock market and global trade tensions. Continuous monitoring of the Amsterdam Stock Market Plunge and related news is vital for making informed investment decisions in these uncertain times. Understanding the underlying causes of this plunge will help investors adapt their strategies and mitigate potential risks.

Featured Posts

-

Urban Oasis How A Seattle Park Became A Refuge During Covid 19

May 24, 2025

Urban Oasis How A Seattle Park Became A Refuge During Covid 19

May 24, 2025 -

Marks And Spencer Cyber Attack 300 Million Loss Revealed

May 24, 2025

Marks And Spencer Cyber Attack 300 Million Loss Revealed

May 24, 2025 -

Garazh Ryazanova Plenum Tsenzura I Neozhidannaya Pomosch Brezhneva

May 24, 2025

Garazh Ryazanova Plenum Tsenzura I Neozhidannaya Pomosch Brezhneva

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Understanding Net Asset Value Nav

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Understanding Net Asset Value Nav

May 24, 2025 -

Amsterdam Stock Index Plunges Over 4 Drop To Year Low

May 24, 2025

Amsterdam Stock Index Plunges Over 4 Drop To Year Low

May 24, 2025

Latest Posts

-

Jan 6th And The Epps Fox News Defamation Case A Deeper Dive Into The Allegations

May 24, 2025

Jan 6th And The Epps Fox News Defamation Case A Deeper Dive Into The Allegations

May 24, 2025 -

Marks And Spencer Cyber Attack 300 Million Loss Revealed

May 24, 2025

Marks And Spencer Cyber Attack 300 Million Loss Revealed

May 24, 2025 -

G 7 Nations Debate Lowering Tariffs On Chinese Goods

May 24, 2025

G 7 Nations Debate Lowering Tariffs On Chinese Goods

May 24, 2025 -

Ftc To Challenge Ruling On Microsoft Activision Blizzard Deal

May 24, 2025

Ftc To Challenge Ruling On Microsoft Activision Blizzard Deal

May 24, 2025 -

Accenture To Promote 50 000 Employees After Six Month Delay

May 24, 2025

Accenture To Promote 50 000 Employees After Six Month Delay

May 24, 2025