G-7 Nations Debate Lowering Tariffs On Chinese Goods

Table of Contents

Arguments for Lowering Tariffs on Chinese Goods

Boosting Global Economic Growth

Lowering tariffs on Chinese goods could inject a significant dose of vitality into the global economy. Reduced import tariffs translate directly into lower prices for consumers in G7 nations. This increased affordability stimulates demand, boosting consumption and driving economic growth. Businesses also benefit significantly:

- Reduced production costs for businesses: Access to cheaper raw materials and intermediate goods from China reduces the overall cost of production, increasing profitability and competitiveness.

- Lower consumer prices on a wide range of goods: Consumers enjoy lower prices on everyday items, freeing up disposable income for other purchases, further stimulating economic activity.

- Increased competition leading to innovation: The influx of cheaper Chinese goods forces domestic industries to innovate and become more efficient to maintain market share, leading to technological advancements and improved products.

The potential for a substantial boost in global GDP through increased trade volume makes this a compelling argument for tariff reduction.

Addressing Supply Chain Issues

The COVID-19 pandemic exposed vulnerabilities in global supply chains, highlighting the risks of over-reliance on a single supplier, particularly China. However, a complete decoupling from China is unrealistic and potentially harmful. Strategically lowering tariffs could offer a more nuanced approach:

- Mitigation of supply chain vulnerabilities: Diversifying sourcing by making Chinese goods more accessible can reduce dependence on any single nation, enhancing resilience to future disruptions.

- Reduced dependence on a single source for crucial goods: Easing tariffs on specific critical goods from China can ensure a more stable supply, mitigating potential shortages.

- Enhanced global supply chain stability: A more balanced and diversified global trade network promotes stability, reducing the risk of shocks propagating through the system.

Tariff reduction is not about abandoning supply chain diversification but rather about managing it more effectively.

Arguments Against Lowering Tariffs on Chinese Goods

Protecting Domestic Industries

Lowering tariffs on Chinese goods presents significant risks for domestic industries in G7 nations. Many G7 manufacturers compete directly with their Chinese counterparts, and a sudden influx of cheaper imports could lead to:

- Potential job losses in domestic industries: Domestic businesses struggling to compete with subsidized Chinese goods may be forced to downsize or close, resulting in job losses.

- Risk of increased competition from subsidized Chinese goods: Concerns remain about unfair trade practices, such as government subsidies and dumping, which distort the market and unfairly disadvantage G7 businesses.

- Concerns over intellectual property theft: The persistent issue of intellectual property theft by Chinese companies necessitates caution in lowering tariffs, as it could further incentivize such practices.

These concerns highlight the need for careful consideration and potentially targeted tariff reductions, rather than a blanket approach.

Geopolitical Considerations

The geopolitical implications of lowering tariffs on Chinese goods are substantial. Some argue that such a move could be interpreted as rewarding China's aggressive trade practices and human rights record. This perspective highlights the importance of:

- Potential weakening of leverage against China on human rights issues: Easing tariffs might reduce the G7's leverage in addressing China's human rights record.

- Risk of emboldening China’s assertive foreign policy: Perceived concessions could embolden China's assertive foreign policy in other areas.

- Importance of maintaining a strong negotiating position: Maintaining a strong negotiating position on trade and other issues with China requires a careful assessment of the potential impacts of tariff reductions.

Potential Economic Consequences of Tariff Reduction

Impact on Inflation

Lower import prices from China could exert downward pressure on inflation in G7 nations. However, the impact is complex:

- Lower import prices could help to control inflation: Increased supply of cheaper goods can offset inflationary pressures from other sources.

- Conversely, increased competition could lead to price wars and decreased profit margins: Intense competition could lead to price wars, impacting profitability for some G7 businesses.

The net effect on inflation is highly dependent on the specific goods affected and the overall macroeconomic environment.

Impact on Employment

The impact on employment is another critical area of uncertainty.

- Potential job losses in some sectors but job creation in others (e.g., retail): While some sectors may experience job losses due to increased competition, others, such as retail and logistics, might see job creation.

- The overall net effect on employment is uncertain and requires careful analysis: A comprehensive assessment is required to understand the overall impact on employment across all sectors.

Impact on Trade Balances

Increased imports from China could widen the trade deficit for some G7 countries. This is a concern for countries already running large trade deficits with China.

Conclusion

The G7's debate on reducing tariffs on Chinese goods is a complex issue with no easy answers. While lowering tariffs presents the potential for boosting global economic growth and addressing supply chain vulnerabilities, it also carries substantial risks to domestic industries and poses significant geopolitical challenges. A thorough cost-benefit analysis, considering all the intricate economic and geopolitical ramifications, is imperative before any decisions are made. The ongoing discussions within the G7 underscore the delicate balance between fostering free trade and safeguarding national interests. Understanding the nuances of this complex issue is crucial for navigating the future of G7-China trade relations and mitigating potential risks associated with tariff reductions on Chinese goods. Further research and open, transparent dialogue are vital to inform sound policy decisions and achieve a sustainable outcome for all parties involved.

Featured Posts

-

Dax Soars Frankfurt Equities Open Higher Record High In Sight

May 24, 2025

Dax Soars Frankfurt Equities Open Higher Record High In Sight

May 24, 2025 -

The Growing Trend Of Betting On California Wildfires Los Angeles And Beyond

May 24, 2025

The Growing Trend Of Betting On California Wildfires Los Angeles And Beyond

May 24, 2025 -

Your Ticket To Bbc Radio 1 Big Weekend 2025 How To Buy

May 24, 2025

Your Ticket To Bbc Radio 1 Big Weekend 2025 How To Buy

May 24, 2025 -

2025 Philips Annual General Meeting Shareholder Information And Updates

May 24, 2025

2025 Philips Annual General Meeting Shareholder Information And Updates

May 24, 2025 -

Trump Tax Bill Passes House After Late Night Negotiations

May 24, 2025

Trump Tax Bill Passes House After Late Night Negotiations

May 24, 2025

Latest Posts

-

Savannah Guthries Mid Week Today Show Co Host Swap

May 24, 2025

Savannah Guthries Mid Week Today Show Co Host Swap

May 24, 2025 -

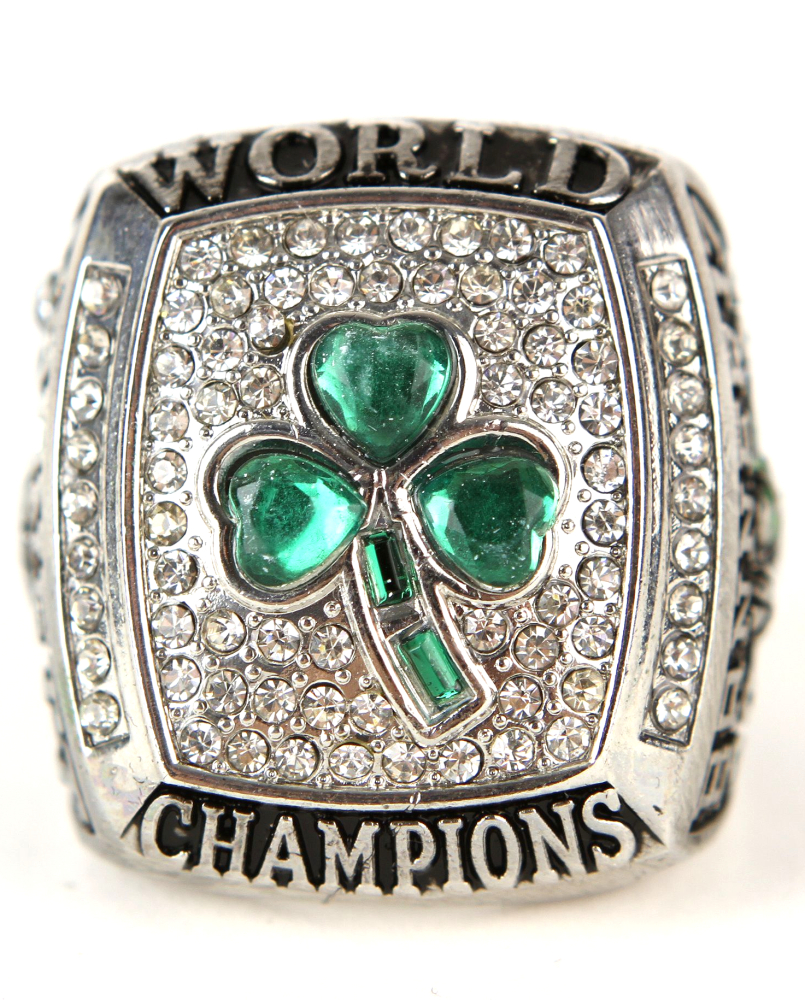

Walt Fraziers Ring Flash A Celtics Fans Reaction On Today

May 24, 2025

Walt Fraziers Ring Flash A Celtics Fans Reaction On Today

May 24, 2025 -

Behind The Scenes Drama Al Rokers Off The Record Comments Create Today Show Tension

May 24, 2025

Behind The Scenes Drama Al Rokers Off The Record Comments Create Today Show Tension

May 24, 2025 -

Dylan Dreyers Latest Post With Brian Fichera A Look At The Fan Response

May 24, 2025

Dylan Dreyers Latest Post With Brian Fichera A Look At The Fan Response

May 24, 2025 -

Walt Frazier Teases Today Show Host Dylan Dreyer With Championship Rings

May 24, 2025

Walt Frazier Teases Today Show Host Dylan Dreyer With Championship Rings

May 24, 2025