Amsterdam Stock Market Slump: AEX Index Down Over 4%

Table of Contents

Factors Contributing to the AEX Index Decline

Several interconnected factors contributed to the dramatic decline in the AEX Index, highlighting the complex interplay between global and domestic economic forces.

Global Economic Uncertainty

The current global economic climate is characterized by significant uncertainty, impacting investor sentiment worldwide and consequently affecting the Amsterdam Stock Market.

-

Increased inflation and rising interest rates: Globally rising inflation forces central banks to increase interest rates, impacting borrowing costs for businesses and dampening economic growth. This directly affects investor confidence and leads to selling pressure in stock markets, including the AEX.

-

Geopolitical tensions: Ongoing geopolitical tensions, such as the war in Ukraine and escalating trade disputes, create instability and uncertainty, prompting investors to seek safer havens for their investments, further contributing to the AEX Index slump.

-

Supply chain disruptions: Lingering supply chain disruptions continue to impact businesses, increasing production costs and limiting growth potential. This uncertainty makes investors hesitant, leading to reduced investment in the Amsterdam Stock Market.

-

Analysis of the correlation between global market trends and the AEX index: The AEX Index's performance closely mirrors global market trends, indicating a high degree of interconnectedness and sensitivity to international economic events.

-

Comparison to other major European stock market indices: A comparison with other major European stock market indices reveals a similar downward trend, suggesting that the AEX decline is part of a broader European market correction rather than an isolated incident.

Specific Sectoral Weaknesses

The decline wasn't uniform across all sectors. Specific sectors within the AEX experienced disproportionately large drops.

-

Identification of sectors most impacted by the decline: The technology and energy sectors, for example, were particularly hard hit, reflecting both global economic headwinds and sector-specific challenges.

-

Analysis of individual company performance within those sectors: Individual companies within these weakened sectors experienced significant drops in their stock prices, reflecting a combination of poor earnings reports and negative investor sentiment.

-

Discussion of company-specific news impacting stock prices: Negative news related to specific companies, such as disappointing earnings reports or regulatory setbacks, amplified the overall market downturn.

-

Mention of any significant corporate announcements or earnings reports: Several major Dutch companies released disappointing earnings reports in recent days, further contributing to the negative investor sentiment and the AEX Index decline.

Investor Sentiment and Market Psychology

Market psychology played a significant role in the severity of the AEX Index slump.

-

The role of fear and uncertainty in driving selling pressure: Fear and uncertainty are powerful drivers of market behavior. As investor confidence waned, a wave of selling pressure intensified the decline.

-

Impact of recent news and media coverage on investor confidence: Negative news coverage and media narratives further fueled investor anxiety, exacerbating the sell-off.

-

Examination of trading volume and market liquidity: High trading volumes indicated a significant level of investor activity, reflecting the heightened anxiety and the desire to liquidate assets.

-

Analysis of short-selling activity: Increased short-selling activity suggests that some investors are betting against further gains in the Amsterdam Stock Market, indicating a pessimistic outlook.

Implications of the AEX Index Slump

The AEX Index slump has wide-ranging implications, affecting both the Dutch economy and investor strategies.

Impact on the Dutch Economy

The decline in the AEX Index has significant consequences for the Dutch economy.

-

Potential effects on economic growth and employment: Reduced investor confidence can lead to decreased investment, potentially slowing economic growth and affecting employment levels.

-

Consequences for Dutch businesses and consumers: Lower stock prices can impact the value of company assets and potentially lead to reduced consumer spending, creating a negative feedback loop.

-

Discussion of the relationship between stock market performance and broader economic indicators (GDP, inflation): A correlation exists between stock market performance and broader economic indicators; a slump in the AEX could be a leading indicator of broader economic slowdown.

-

Analysis of potential government intervention or policy responses: The Dutch government might consider implementing economic stimulus measures to counteract the negative effects of the AEX decline.

Investment Strategies in a Volatile Market

Navigating a volatile market like the current Amsterdam Stock Market requires a carefully considered investment strategy.

-

Advice for investors on managing risk and navigating market uncertainty: Investors should focus on risk management and diversification, spreading their investments across different asset classes to minimize exposure to any single sector or market.

-

Strategies for diversification and portfolio protection: Diversification across geographic regions, asset classes, and sectors is crucial to mitigate risk.

-

Discussion of different asset classes and their relative performance: Some asset classes, such as government bonds, may perform better than others during periods of market uncertainty.

-

Recommendations for long-term vs. short-term investment strategies: A long-term investment strategy focused on fundamental analysis and value investing can help investors weather short-term market fluctuations.

Conclusion

The significant drop in the AEX index underscores the inherent volatility in the Amsterdam Stock Market and reflects broader global economic concerns. Understanding the contributing factors, including global uncertainty and sector-specific weaknesses, is crucial for investors. The interconnectedness of the Amsterdam Stock Market with global trends demands vigilant monitoring of global economic indicators.

Call to Action: Stay informed about developments in the Amsterdam Stock Market and the AEX Index to make informed investment decisions. Monitor global economic indicators and adjust your investment strategy accordingly to mitigate risk in this volatile environment. Learn more about navigating stock market slumps and protecting your investments. Understanding the intricacies of the AEX Index and its relationship to the broader Dutch economy and global markets is crucial for navigating the current volatility.

Featured Posts

-

Southamptons Walker Peters Leeds United Interest Confirmed

May 24, 2025

Southamptons Walker Peters Leeds United Interest Confirmed

May 24, 2025 -

Investing In Aapl Identifying Crucial Price Levels For Apple Stock

May 24, 2025

Investing In Aapl Identifying Crucial Price Levels For Apple Stock

May 24, 2025 -

Profun A Fyrstu 100 Rafutgafu Porsche Macan

May 24, 2025

Profun A Fyrstu 100 Rafutgafu Porsche Macan

May 24, 2025 -

Ferrari 296 Speciale Experiencia De Conducao Com Motor Hibrido De 880 Cv

May 24, 2025

Ferrari 296 Speciale Experiencia De Conducao Com Motor Hibrido De 880 Cv

May 24, 2025 -

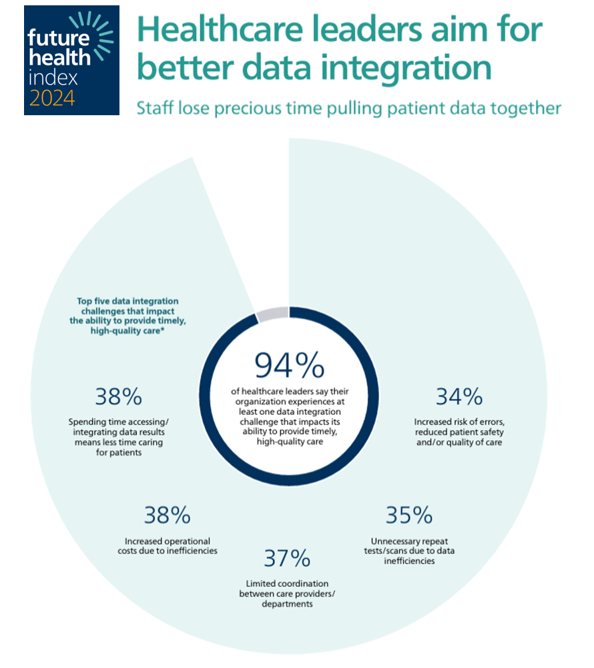

Global Healthcare Transformation Insights From The Philips Future Health Index 2025 On Ais Role

May 24, 2025

Global Healthcare Transformation Insights From The Philips Future Health Index 2025 On Ais Role

May 24, 2025

Latest Posts

-

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Controversy

May 24, 2025

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Controversy

May 24, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025 -

Farrow Seeks Trumps Incarceration Focus On Venezuelan Deportations

May 24, 2025

Farrow Seeks Trumps Incarceration Focus On Venezuelan Deportations

May 24, 2025