Investing In AAPL: Identifying Crucial Price Levels For Apple Stock

Table of Contents

Identifying Support Levels for AAPL Stock

What are Support Levels?

Support levels in technical analysis represent price points where buying pressure is strong enough to prevent a further price decline. They act as a floor, often leading to price reversals or bounces. Think of them as a safety net for the stock price.

- Definition of Support: A price level where the price of an asset has historically found buying pressure, preventing further downward movement.

- How They Form: Support levels are typically formed at previous lows, psychological levels (round numbers like $150, $175), or significant trendline support.

- Psychological Significance of Round Numbers as Support: Round numbers often act as strong psychological support levels, as traders tend to view them as significant price points. For example, a break below $150 in AAPL might trigger further selling.

Consider AAPL's historical chart. You'll often see instances where the price dropped, touched a specific level, and then bounced back up – this is a classic demonstration of a support level. For example, the $130 level in late 2022 acted as significant support for AAPL.

Key Support Levels for AAPL

Identifying key support levels for AAPL requires analyzing its historical price action. Here are a few examples:

- $130: This level acted as strong support in late 2022 and early 2023, demonstrating significant buyer interest at this price point.

- $150: This round number often serves as a psychological support level, where we can expect buying pressure to increase.

- $170: This level has historically been a significant support point, offering a strong potential base for future price increases.

[Insert Chart/Graph illustrating these support levels on the AAPL stock chart]

Assessing the Strength of Support

The strength of a support level is crucial in predicting future price movements. Several factors influence this strength:

- High Volume Confirmation: A significant increase in trading volume at a support level confirms its strength. High volume indicates strong buyer conviction.

- Duration of Support: Support levels that hold for an extended period are generally stronger than those that break quickly.

- Breakouts and Retests: A successful breakout below a support level can signal weakness. However, a subsequent retest of that broken level (now acting as resistance) could offer a new entry point.

Identifying Resistance Levels for AAPL Stock

What are Resistance Levels?

Resistance levels are price points where selling pressure is strong enough to prevent further price increases. They act as a ceiling, often leading to price reversals or pullbacks.

- Definition of Resistance: A price level where the price of an asset has historically faced strong selling pressure, preventing further upward movement.

- How They Form: Resistance levels are typically formed at previous highs, psychological levels, or significant trendline resistance.

- Psychological Significance of Round Numbers as Resistance: Round numbers also hold psychological significance as resistance levels. For AAPL, a price around $200 could face significant selling pressure.

Looking at AAPL's historical chart, you'll see instances where the price rallied, approached a specific level, and then encountered selling pressure – this defines resistance.

Key Resistance Levels for AAPL

Based on historical data, here are some notable resistance levels for AAPL:

- $175: This level has frequently capped AAPL's upward price movements in the past.

- $190: This represents a crucial resistance level that often marks a significant hurdle for the stock price.

- $200: This round number often acts as a strong psychological resistance level, potentially triggering profit-taking.

[Insert Chart/Graph illustrating these resistance levels on the AAPL stock chart]

Assessing the Strength of Resistance

Similar to support levels, the strength of resistance is crucial for accurate predictions. Key factors influencing resistance strength include:

- High Volume Rejection: A significant increase in trading volume at a resistance level, accompanied by a price rejection (failure to break through), confirms its strength.

- Duration of Resistance: Resistance levels that hold for a longer period are typically stronger.

- Breakouts and Retests: A successful breakout above a resistance level can signal strength. A retest of the now-broken level (acting as support) could be a good confirmation.

Using Technical Indicators to Confirm Price Levels

Technical indicators can help confirm support and resistance levels and predict potential price movements.

Moving Averages

Moving averages, such as the 50-day and 200-day moving averages, smooth out price fluctuations and provide insights into trends.

- How Moving Averages Work: They calculate the average price over a specified period.

- Interpretation of Crossovers: A 50-day moving average crossing above the 200-day moving average is often considered a bullish signal, while the opposite is bearish.

- Confirmation of Support/Resistance Levels: Moving averages can confirm support and resistance levels by acting as dynamic support or resistance themselves.

Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements.

- RSI Interpretation (Overbought/Oversold): An RSI above 70 is generally considered overbought, suggesting potential price reversals. An RSI below 30 is often considered oversold, indicating potential price rebounds.

- Confirmation of Support/Resistance based on RSI Levels: Divergence between price and RSI can also help confirm support and resistance levels.

MACD

The Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator.

- How MACD Works: It compares two moving averages to identify momentum shifts.

- Identifying Potential Buy/Sell Signals using MACD in conjunction with price levels: MACD crossovers combined with support and resistance level analysis can provide strong buy or sell signals.

Analyzing AAPL's Future Price Movement based on identified levels

Scenario Planning

Based on the identified support and resistance levels, several scenarios are possible for AAPL's future price movement:

- Scenario 1 (Bullish): If AAPL breaks above the $190 resistance level with strong volume, it could signal a move toward $200 and beyond.

- Scenario 2 (Bearish): A break below the $150 support level could trigger further selling pressure, potentially leading to lower prices.

- Scenario 3 (Consolidation): AAPL might consolidate between the $150 and $175 levels before a significant breakout in either direction.

Risk Management Considerations

Successful investing in AAPL, or any stock, requires robust risk management:

- Stop-Loss Orders: Always use stop-loss orders to limit potential losses. This helps protect your capital if the price moves against your position.

- Position Sizing: Never invest more than you can afford to lose. Diversify your portfolio to mitigate risks.

Conclusion

Investing in AAPL effectively involves understanding its crucial price levels. We've identified key support levels (around $130, $150, and $170) and resistance levels (around $175, $190, and $200). Utilizing technical indicators like moving averages, RSI, and MACD can help confirm these levels and predict potential price movements. Remember that careful scenario planning and rigorous risk management strategies are paramount. By incorporating these techniques into your Apple stock analysis, you can make more informed investment decisions regarding AAPL stock. Start your own AAPL stock analysis today using the techniques discussed here!

Featured Posts

-

Exclusive Listing Pts Riviera Blue Porsche 911 S T For Sale

May 24, 2025

Exclusive Listing Pts Riviera Blue Porsche 911 S T For Sale

May 24, 2025 -

Amsterdam Exchange Suffers 7 Plunge Trade War Impact

May 24, 2025

Amsterdam Exchange Suffers 7 Plunge Trade War Impact

May 24, 2025 -

Trump Tariffs And Apple Assessing The Risk To Buffetts Investment

May 24, 2025

Trump Tariffs And Apple Assessing The Risk To Buffetts Investment

May 24, 2025 -

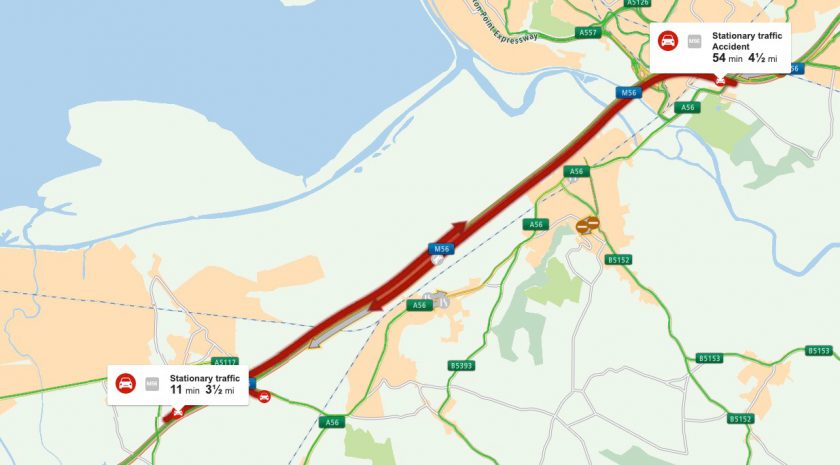

Travel Alert M56 Delays Collision On Cheshire Deeside Border

May 24, 2025

Travel Alert M56 Delays Collision On Cheshire Deeside Border

May 24, 2025 -

New Music Joy Crookes Shares New Single Carmen

May 24, 2025

New Music Joy Crookes Shares New Single Carmen

May 24, 2025

Latest Posts

-

House Approves Amended Trump Tax Bill What You Need To Know

May 24, 2025

House Approves Amended Trump Tax Bill What You Need To Know

May 24, 2025 -

Orbital Space Crystals And Pharmaceutical Advancement Exploring The Possibilities

May 24, 2025

Orbital Space Crystals And Pharmaceutical Advancement Exploring The Possibilities

May 24, 2025 -

Tik Tokers Viral Pope Leo Video A Resurfaced Story

May 24, 2025

Tik Tokers Viral Pope Leo Video A Resurfaced Story

May 24, 2025 -

Dr Beachs 2025 Best Beaches In The Us Top 10 List

May 24, 2025

Dr Beachs 2025 Best Beaches In The Us Top 10 List

May 24, 2025 -

Important Update Southwest Airlines Policy On Portable Chargers In Carry On Luggage

May 24, 2025

Important Update Southwest Airlines Policy On Portable Chargers In Carry On Luggage

May 24, 2025