Trump Tariffs And Apple: Assessing The Risk To Buffett's Investment

Table of Contents

The Impact of Trump Tariffs on Apple's Supply Chain

The Trump administration's imposition of tariffs on various imported goods significantly impacted Apple's intricate global supply chain. The increased costs associated with these tariffs presented a complex challenge to the tech giant's profitability and strategic planning.

Increased Production Costs

Tariffs levied on imported components, crucial for Apple's manufacturing process, directly increased production costs. These tariffs primarily affected components sourced from China and other countries targeted by the trade war.

- Examples of affected components: Displays (primarily sourced from South Korea and China), memory chips (significant reliance on Taiwanese manufacturers), and various other electronic components.

- Percentage increase in costs: Estimates vary, but industry analysts suggest tariff-related cost increases ranged from a few percentage points to potentially double-digit figures depending on the specific component and the tariff rate applied.

- Geographical origins of affected components: A significant portion of Apple's supply chain relied heavily on components from China, Taiwan, South Korea, and other Asian countries, making them particularly susceptible to the tariffs.

Data from Apple's financial reports during this period, while not explicitly detailing tariff-related costs, showed a squeeze on profit margins, suggesting that the increased costs of imported components undoubtedly played a role.

Diversification Strategies

Faced with escalating tariffs, Apple implemented diversification strategies to mitigate the risks to its supply chain. This involved shifting production to other countries and exploring alternative suppliers.

- Countries where production shifted: Apple increased its manufacturing footprint in countries like India and Vietnam, aiming to reduce its reliance on China.

- Success or challenges faced in diversification: While these efforts demonstrated a commitment to diversification, shifting a complex manufacturing process across borders is a challenging and time-consuming endeavor. This process faced logistical hurdles, including establishing new manufacturing facilities, training workforces, and navigating different regulatory environments.

The effectiveness of these strategies in completely offsetting the impact of tariffs remains a subject of ongoing debate. While some diversification helped, the complexities of global manufacturing mean complete insulation from trade tensions is almost impossible.

Consumer Impact and Price Adjustments

A critical question is whether Apple absorbed the increased costs or passed them onto consumers through price hikes.

- Evidence of price changes: While Apple didn't explicitly attribute price increases solely to tariffs, some analysts believe that the price increases seen in certain Apple products during this period partially reflected the increased production costs.

- Impact on sales volume: The extent to which price increases affected sales volume is difficult to isolate, as other market factors played a role. However, the elasticity of demand for Apple products suggests that some price sensitivity exists amongst consumers.

- Consumer reactions: Consumer reactions to price changes were mixed. Some consumers remained loyal, while others may have delayed purchases or switched to alternative brands, showcasing varying levels of price sensitivity.

Financial Performance of Apple During the Tariff Period

Analyzing Apple's financial reports during the period of significant tariffs reveals the impact of these trade policies on the company’s performance.

Profitability Analysis

Examining key financial metrics provides insights into the profitability of Apple during the tariff period.

- Key financial metrics (e.g., profit margins, revenue growth, return on investment): While Apple's overall financial performance remained strong, a closer analysis shows that profit margins were impacted by the increased production costs, though the impact wasn't catastrophic due to Apple's strong brand and pricing power. Revenue growth continued, albeit at a slightly slower pace than in previous years, according to available financial reports.

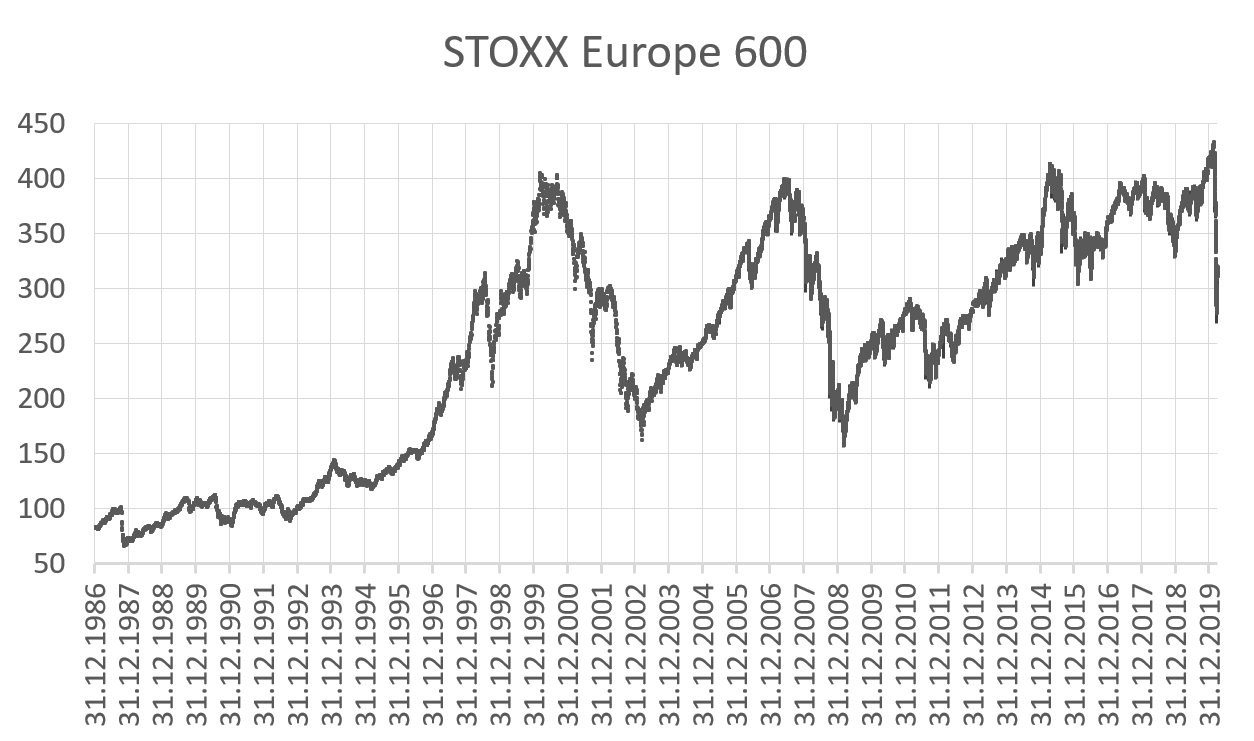

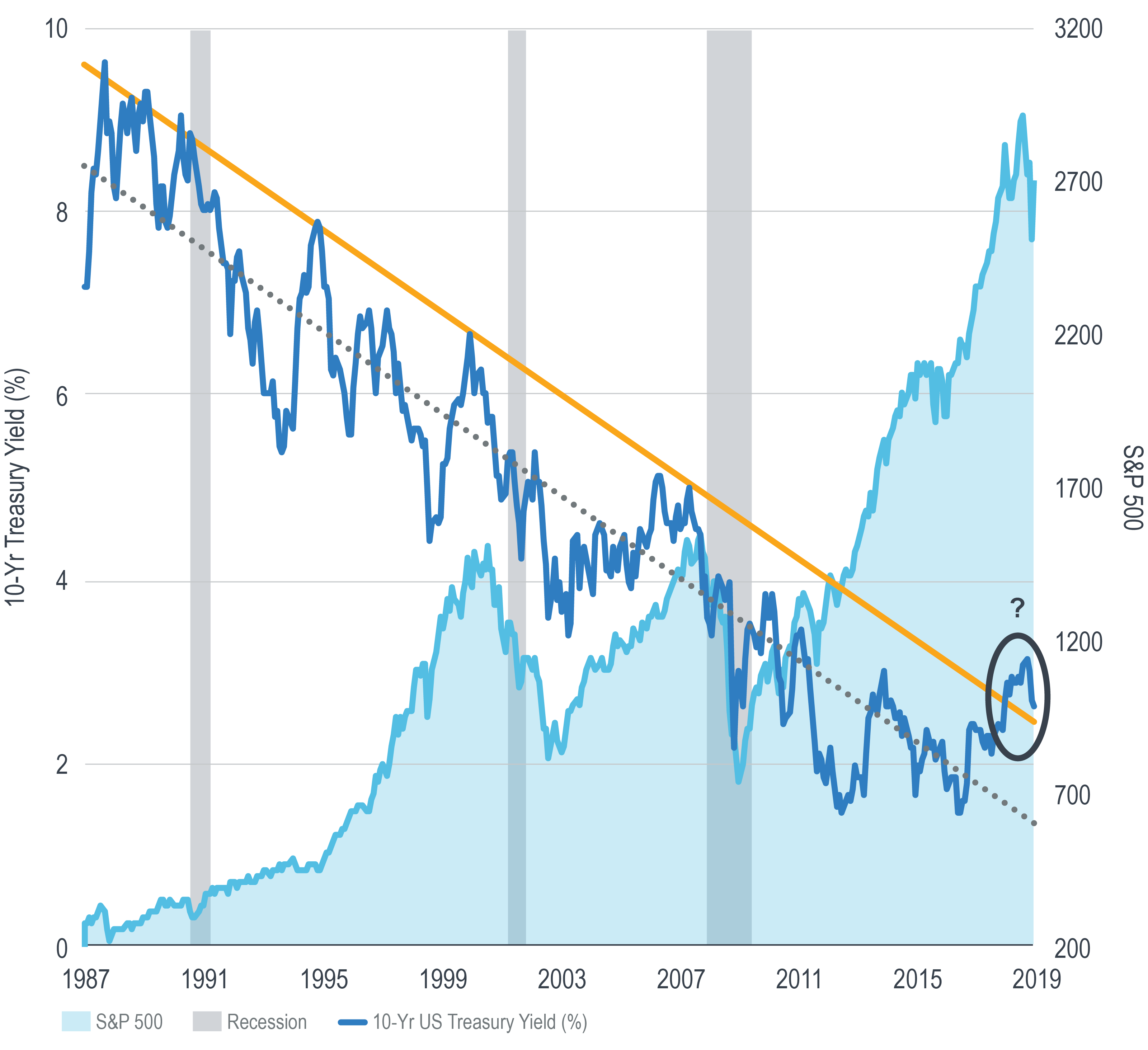

- Comparison to pre-tariff periods: Comparing financial metrics to the pre-tariff era reveals a noticeable shift, with profit margins being slightly compressed during the tariff period. Visual representations using charts and graphs would further highlight these changes.

Stock Market Reaction

The imposition of tariffs and subsequent developments significantly impacted Apple's stock price.

- Stock price fluctuations during tariff announcements and implementations: Announcements and implementation of tariffs often resulted in short-term fluctuations in Apple's stock price, reflecting investor uncertainty and concern over the potential impact on profitability.

- Investor sentiment analysis: Investor sentiment regarding Apple during the tariff period was largely cautious. The uncertainty surrounding the long-term implications of the trade war weighed on investor confidence.

- Correlation between tariff news and Apple's stock performance: A clear correlation existed between negative tariff-related news and short-term declines in Apple's stock price. However, Apple's fundamental strength and long-term growth prospects prevented any major long-term damage.

Buffett's Investment Strategy and Risk Tolerance

Understanding Buffett's investment philosophy is crucial to evaluating his risk tolerance in the face of these tariff-related challenges.

- Relevant aspects of Buffett's investment strategy: Buffett's long-term value investing approach prioritizes companies with strong fundamentals and competitive advantages. He generally shows patience and a long-term perspective.

- His past experiences with similar situations: Buffett has navigated various economic and geopolitical challenges throughout his career. His experience likely informed his decision-making regarding Apple during the tariff period.

- Whether tariffs influenced his investment decisions regarding Apple: It's unlikely that the tariffs alone would have drastically altered Buffett's long-term view of Apple. His investment likely reflects his confidence in Apple's enduring brand strength and adaptability.

Long-Term Implications and Future Risks

The impact of the Trump tariffs offers valuable lessons about the vulnerability of global supply chains and the ongoing need for strategic adaptability.

Geopolitical Uncertainty and Trade Wars

Global trade relations remain volatile, posing ongoing risks to Apple's business model.

- Potential future risks related to trade policies: Future trade disputes and protectionist policies could again disrupt Apple's supply chain and impact its profitability.

- Ongoing tensions between major economies: Tensions between the US and China, as well as other global power dynamics, will continue to create uncertainty in the international trade landscape.

- Vulnerability of Apple's supply chain to future disruptions: Apple's highly globalized supply chain remains vulnerable to future disruptions stemming from geopolitical instability and trade disputes.

Sustainable Sourcing and Ethical Considerations

Apple's commitment to sustainable and ethical sourcing is increasingly intertwined with its ability to navigate global trade dynamics.

- Initiatives aimed at mitigating risks and promoting ethical manufacturing: Apple has implemented various initiatives to promote responsible sourcing and mitigate risks associated with its supply chain, such as greater transparency in its sourcing practices.

- How these practices might influence Apple's future resilience to trade policy changes: These practices, while not directly mitigating trade risks, enhance Apple's long-term resilience by building stronger and more diversified relationships with suppliers, potentially reducing reliance on any single region or supplier.

Conclusion

The Trump-era tariffs presented a significant, albeit surmountable, challenge to Apple's business operations and, by extension, Buffett's investment. While Apple demonstrated resilience through diversification and strategic adaptation, the vulnerabilities of its globally integrated supply chain remain. The experience highlights the ongoing risks associated with geopolitical uncertainty and the need for agile responses to fluctuating trade policies. While Apple’s fundamental strength and brand loyalty mitigated the worst effects, the long-term impact of such events remains a consideration. Future trade disputes and protectionist policies pose a persistent threat, underscoring the complexity of operating in a globalized market.

Call to action: Continue the discussion by leaving a comment below sharing your thoughts on the Trump Tariffs and Apple's future. How do you assess the ongoing risk to Buffett's investment? What are your predictions for the impact of future trade policies on Apple's profitability?

Featured Posts

-

The Busiest Days To Fly Around Memorial Day 2025 A Travelers Guide

May 24, 2025

The Busiest Days To Fly Around Memorial Day 2025 A Travelers Guide

May 24, 2025 -

Stocks Surge 8 On Euronext Amsterdam Trumps Tariff Pause Fuels Rally

May 24, 2025

Stocks Surge 8 On Euronext Amsterdam Trumps Tariff Pause Fuels Rally

May 24, 2025 -

Konchita Vurst Ot Evrovideniya 2014 Do Mechty Stat Devushkoy Bonda

May 24, 2025

Konchita Vurst Ot Evrovideniya 2014 Do Mechty Stat Devushkoy Bonda

May 24, 2025 -

Avrupa Borsalari Duesueste Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme 16 Nisan 2025

May 24, 2025

Avrupa Borsalari Duesueste Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme 16 Nisan 2025

May 24, 2025 -

Drapers Maiden Atp Masters 1000 Triumph In Indian Wells

May 24, 2025

Drapers Maiden Atp Masters 1000 Triumph In Indian Wells

May 24, 2025

Latest Posts

-

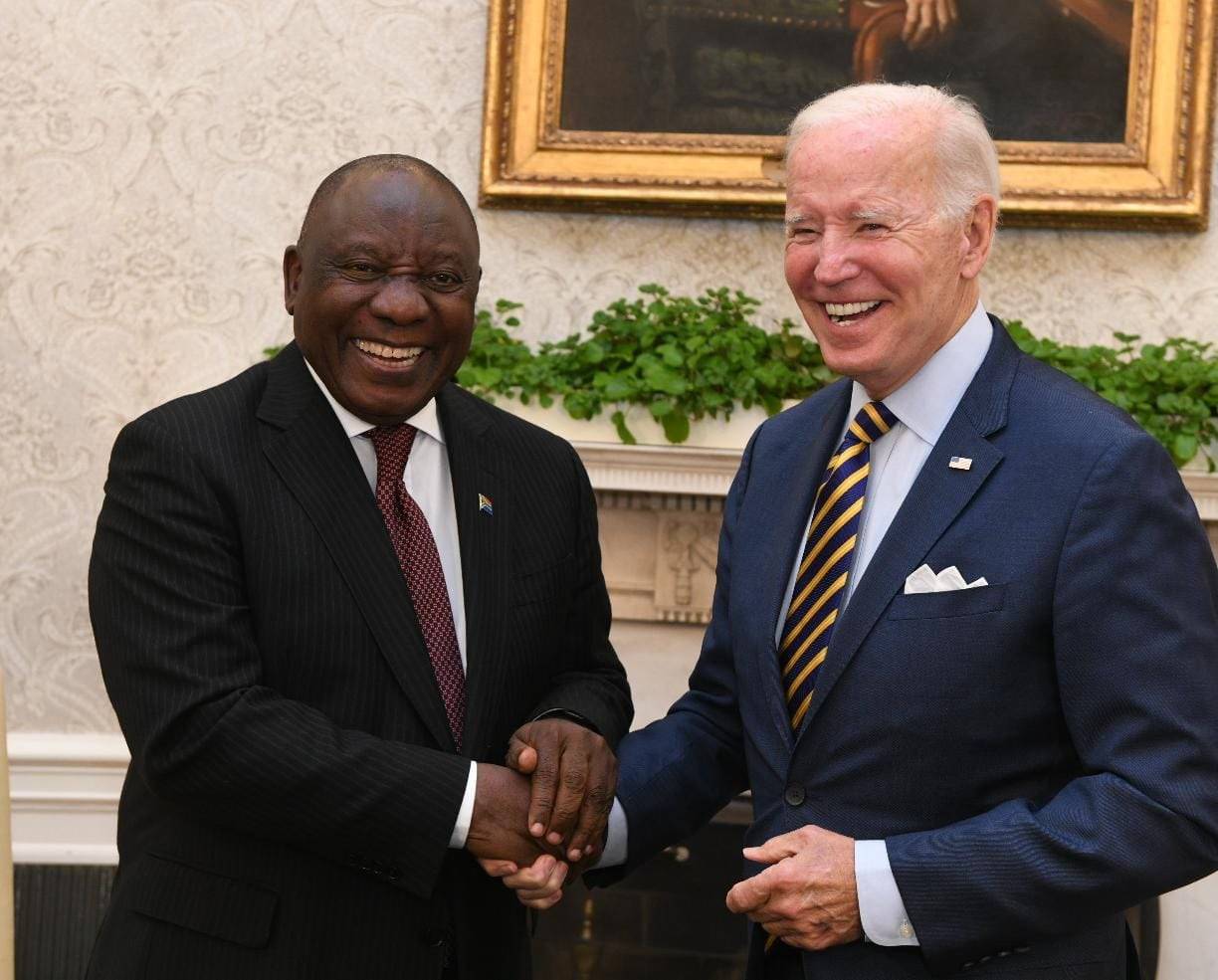

South Africa Reacts Exploring Other Options For Cyril Ramaphosa At The White House

May 24, 2025

South Africa Reacts Exploring Other Options For Cyril Ramaphosa At The White House

May 24, 2025 -

Ramaphosas Calm Response Alternative Actions In The White House Ambush

May 24, 2025

Ramaphosas Calm Response Alternative Actions In The White House Ambush

May 24, 2025 -

Newark Airport Chaos Trump Era Air Traffic Control Plan Blamed

May 24, 2025

Newark Airport Chaos Trump Era Air Traffic Control Plan Blamed

May 24, 2025 -

Market Movers Today Bonds Dow Futures And Bitcoin Real Time Updates

May 24, 2025

Market Movers Today Bonds Dow Futures And Bitcoin Real Time Updates

May 24, 2025 -

Stock Market News Analysis Of Todays Bond Market Decline And Bitcoin Surge

May 24, 2025

Stock Market News Analysis Of Todays Bond Market Decline And Bitcoin Surge

May 24, 2025