Market Movers Today: Bonds, Dow Futures, And Bitcoin — Real-Time Updates

Table of Contents

Bond Market Analysis: Interest Rates and Yields

Treasury Yields and their Impact

Treasury yields are a key indicator of the overall bond market health and investor sentiment. Currently, the 10-year Treasury yield stands at [Insert Current 10-Year Treasury Yield], while the 30-year yield is at [Insert Current 30-Year Treasury Yield]. These yields are closely tied to interest rates set by central banks.

- Yield Changes: The recent increase/decrease (choose appropriate descriptor based on current market conditions) in Treasury yields can be attributed to [Explain reason, e.g., rising inflation expectations, anticipated Federal Reserve policy changes, etc.].

- Impact on Fixed-Income Investments: Higher yields generally mean lower bond prices, impacting the returns on fixed-income investments. Conversely, lower yields can boost bond prices. Investors need to carefully consider their risk tolerance and investment horizon when navigating these fluctuating yields.

- Inflation's Role: Inflation significantly influences Treasury yields. High inflation typically pushes yields higher as investors demand greater returns to compensate for the erosion of purchasing power.

Corporate Bond Performance

The performance of corporate bonds is equally important for understanding the broader market. Credit spreads, which measure the difference between corporate bond yields and Treasury yields, are currently at [Insert Current Credit Spread Data].

- Sector Performance: [Discuss specific sectors performing well and those underperforming, e.g., "The technology sector is showing strong performance, while energy sector bonds are lagging."].

- Issuances and Defaults: [Mention any significant recent corporate bond issuances or defaults and their market impact].

- Economic Outlook: The performance of corporate bonds is intrinsically linked to the overall economic outlook. A positive economic forecast usually supports higher corporate bond prices, while negative forecasts can lead to lower prices and increased credit spreads.

Dow Futures: Gauging Pre-Market Sentiment

Current Dow Futures Prices and Trends

The Dow Jones Industrial Average futures are currently trading at [Insert Current Dow Futures Price]. Over the past hour, the futures have [Describe recent trend, e.g., "seen a slight increase," "experienced a modest dip," etc.]. Looking at the broader trend, the Dow futures have [Describe longer-term trend, e.g., "shown a generally upward trajectory over the past week," "experienced increased volatility in recent days," etc.].

- Influencing Factors: Key factors impacting the Dow futures include recent earnings reports from major companies, upcoming economic data releases (e.g., GDP growth, inflation figures), and geopolitical events.

- Significant News Events: [Mention any significant news impacting the Dow, e.g., policy announcements, international conflicts, etc.].

Interpreting Futures Data for Stock Market Predictions

Dow futures provide a valuable insight into pre-market sentiment, offering a glimpse into the potential direction of the stock market. However, they are not a foolproof predictor.

- Limitations: It's crucial to remember that futures prices can fluctuate significantly and are subject to various factors beyond the overall market outlook.

- Other Indicators: Relying solely on futures data for investment decisions is risky. Investors should always consider other market indicators, such as economic data, company fundamentals, and technical analysis, before making any investment choices.

Bitcoin and Cryptocurrency Market Update

Bitcoin Price and Volatility

Bitcoin (BTC) is currently trading at [Insert Current Bitcoin Price]. In the last 24 hours, the price has [Describe recent price movement]. Over the past week, Bitcoin has experienced [Describe the weekly price trend, e.g., "increased volatility," "a period of consolidation," etc.].

- Influencing Factors: Several factors influence Bitcoin's price, including regulatory announcements, institutional adoption by large financial firms, technological developments within the blockchain space, and overall market sentiment.

Altcoin Performance

The performance of altcoins (alternative cryptocurrencies) varies considerably. [Mention specific altcoins and their performance, e.g., "Ethereum (ETH) is currently trading at [price] showing [trend], while Solana (SOL) has experienced [trend]."]

- Risks and Rewards: Altcoins often present higher risk and potential reward compared to Bitcoin. Their prices can be significantly more volatile, influenced by both broader market trends and project-specific news.

Overall Cryptocurrency Market Capitalization

The total market capitalization of the cryptocurrency market is currently at [Insert Current Market Cap]. [Describe the overall trend, e.g., "This represents a decrease from last week's high," "The market cap shows a general upward trend despite recent volatility," etc.].

- Market Implications: Changes in the overall market cap indicate the general health and sentiment within the broader cryptocurrency market.

Conclusion

Today's market witnessed notable movements across various asset classes. The bond market showed [Summarize bond market trend], reflecting [mention influencing factors]. Dow futures indicated [Summarize Dow futures trend], suggesting [potential market direction]. Finally, the cryptocurrency market, with Bitcoin leading the way at [Bitcoin price], exhibited [Summarize crypto market trend]. These movements highlight the dynamic nature of the financial landscape and the importance of staying informed.

For continuous updates on the key Market Movers Today, including real-time analysis of bonds, Dow futures, and Bitcoin, bookmark this page and check back regularly for the latest insights. Understanding these market movers is crucial for informed decision-making. Remember that this information is for educational purposes only and is not financial advice. Consult a financial professional before making any investment decisions.

Featured Posts

-

Significant Drop In Amsterdam Stock Exchange Aex Index Down Over 4

May 24, 2025

Significant Drop In Amsterdam Stock Exchange Aex Index Down Over 4

May 24, 2025 -

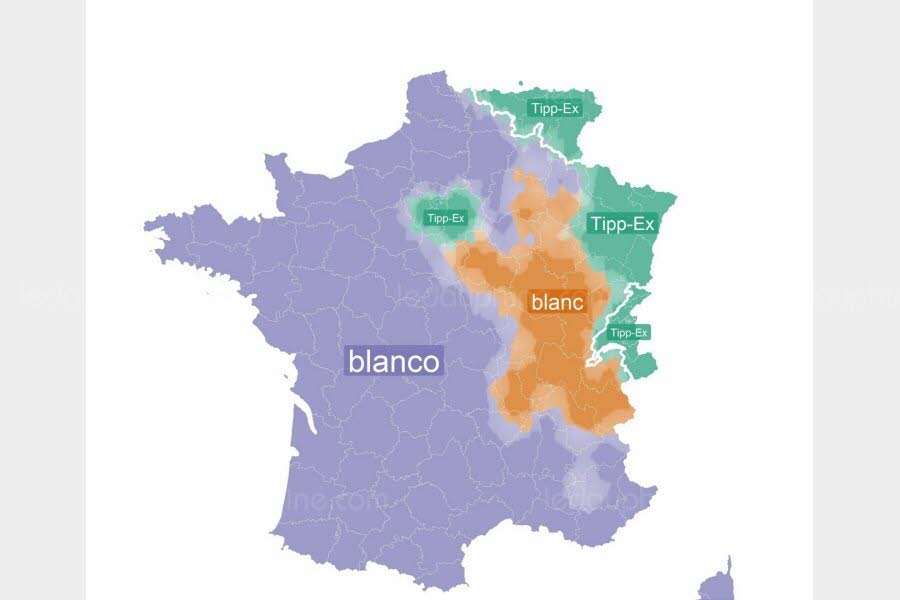

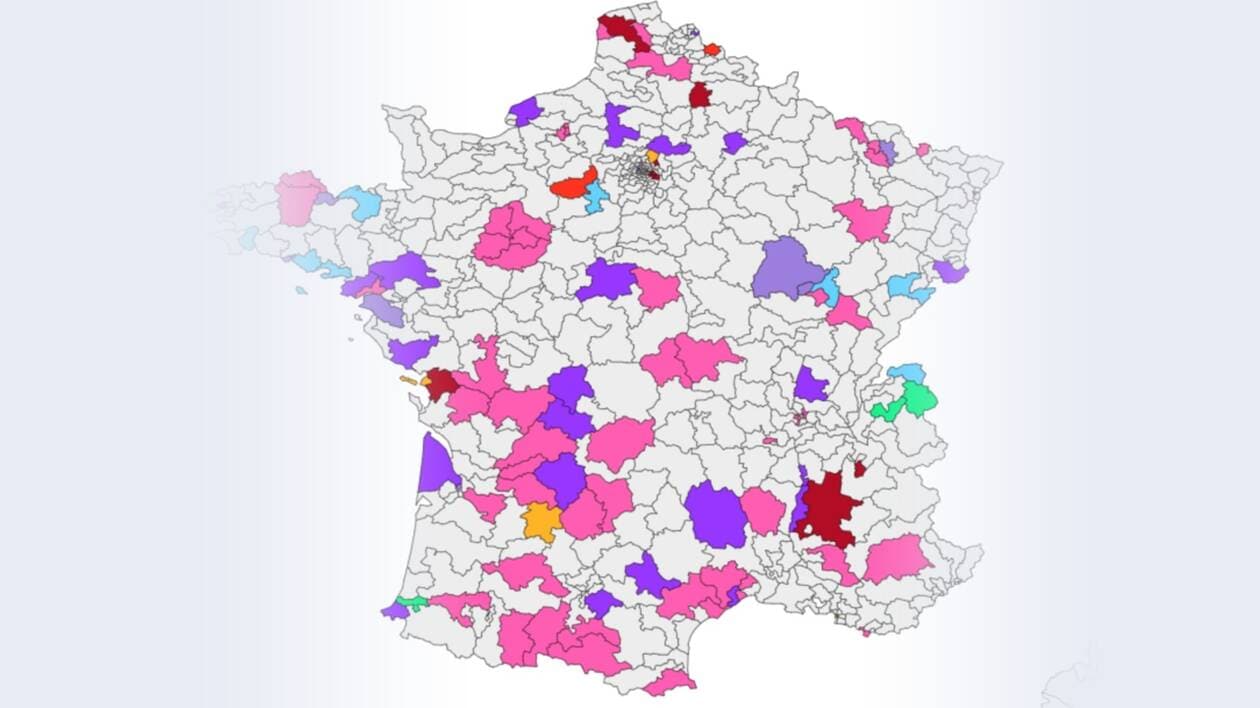

Mathieu Avanzi L Evolution Du Francais Et Son Usage Moderne

May 24, 2025

Mathieu Avanzi L Evolution Du Francais Et Son Usage Moderne

May 24, 2025 -

G 7 Nations Debate Lowering Tariffs On Chinese Goods

May 24, 2025

G 7 Nations Debate Lowering Tariffs On Chinese Goods

May 24, 2025 -

La Repression Chinoise Des Dissidents En France Une Analyse

May 24, 2025

La Repression Chinoise Des Dissidents En France Une Analyse

May 24, 2025 -

Delayed But Delivered Accentures 50 000 Promotions

May 24, 2025

Delayed But Delivered Accentures 50 000 Promotions

May 24, 2025

Latest Posts

-

Memorial Day Gas Prices A Decade Low

May 24, 2025

Memorial Day Gas Prices A Decade Low

May 24, 2025 -

Your Ultimate Guide To Memorial Day 2025 Sales

May 24, 2025

Your Ultimate Guide To Memorial Day 2025 Sales

May 24, 2025 -

Memorial Day 2025 Sales Event Deals On Laptops Beauty And More

May 24, 2025

Memorial Day 2025 Sales Event Deals On Laptops Beauty And More

May 24, 2025 -

New York City Memorial Day Weekend Weather Forecast And Rain Probability

May 24, 2025

New York City Memorial Day Weekend Weather Forecast And Rain Probability

May 24, 2025 -

Is It Going To Rain In Nyc During Memorial Day Weekend Forecast

May 24, 2025

Is It Going To Rain In Nyc During Memorial Day Weekend Forecast

May 24, 2025