Significant Drop In Amsterdam Stock Exchange: AEX Index Down Over 4%

Table of Contents

Potential Causes of the AEX Index Decline

Several factors likely contributed to the substantial fall in the AEX Index. Understanding these contributing elements is crucial for interpreting the current market situation and predicting future trends for the AEX.

Global Market Volatility

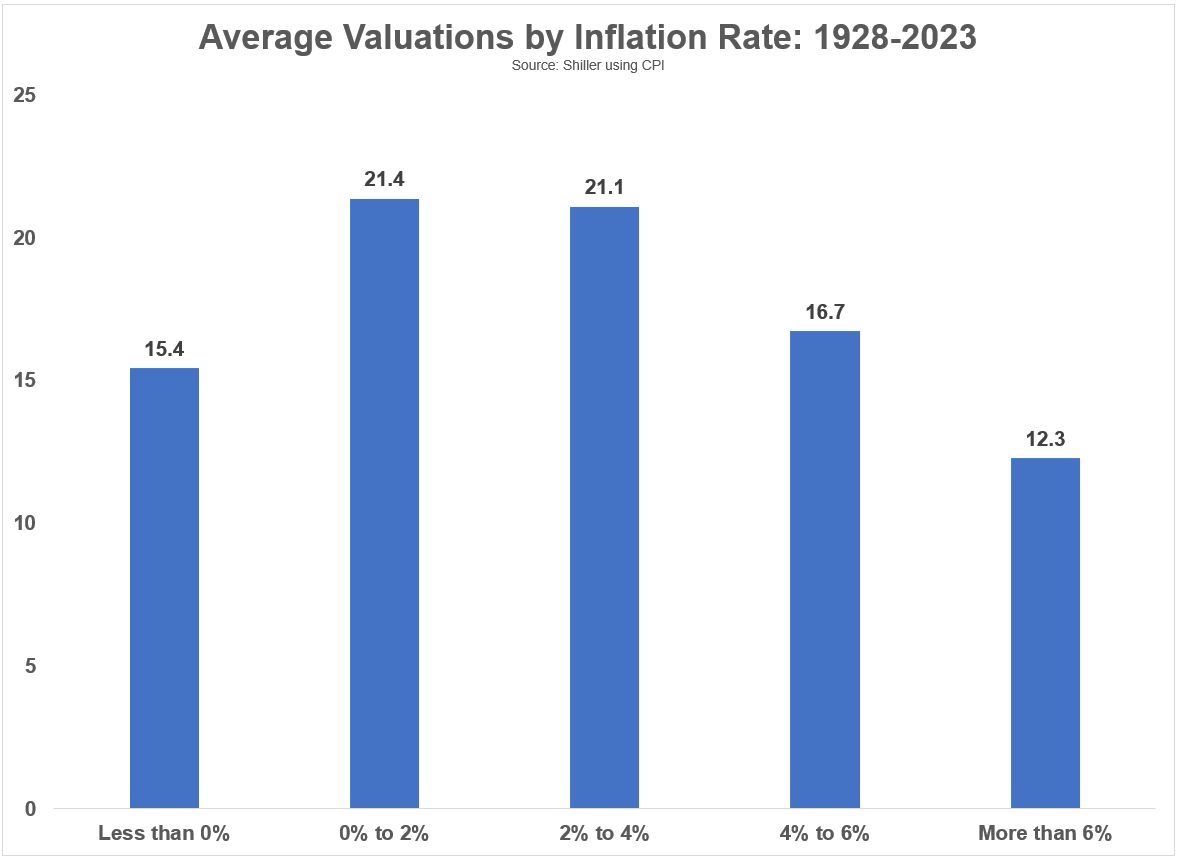

Global market volatility played a significant role in the AEX Index's decline. Rising inflation rates worldwide, aggressive interest rate hikes by central banks (like the Federal Reserve in the US and the European Central Bank), and persistent geopolitical tensions all contributed to a risk-off sentiment among investors. This uncertainty led to a sell-off across many global markets.

- Examples of impacting global events: The ongoing war in Ukraine, persistent supply chain disruptions, and escalating energy prices all exerted downward pressure on global markets.

- Performance of other major indices: The Dow Jones Industrial Average and the Nasdaq Composite also experienced significant declines, reflecting the global nature of this market downturn. The interconnectedness of global financial markets means that events in one region can quickly impact others, creating a domino effect.

- Interconnectedness of global markets: The AEX Index, like most national indices, is highly sensitive to global economic conditions. Negative news or trends in larger markets, such as the US or China, often trigger sell-offs in smaller, more regional markets like the Amsterdam Stock Exchange.

Sector-Specific Performance

The AEX decline wasn't uniform across all sectors. Some sectors were hit harder than others, revealing specific vulnerabilities within the Dutch economy.

- Top 3 worst-performing sectors: Preliminary data suggests that the technology, energy, and financial sectors experienced the most significant drops, with declines ranging from 5% to 8% in some cases.

- Reasons for sector-specific declines: The tech sector's fall can be attributed to continued concerns about high valuations and potential interest rate impacts on growth stocks. Energy sector declines reflect fluctuating oil and gas prices and anxieties about future energy security. The financial sector was likely affected by rising interest rates and concerns about potential loan defaults.

- Percentage drops: Specific percentage drops for individual companies within these sectors require further analysis of individual stock performance data.

Impact of Specific Company News

While global factors played a dominant role, specific company news also likely contributed to the AEX Index's decline.

- Specific companies and news: [Insert examples of specific companies and relevant news. For example: "Company X announced disappointing quarterly earnings, leading to a sharp drop in its share price." Link to news source if available].

- Impact on the AEX index: Negative news from large-cap companies listed on the AEX can have a significant ripple effect, impacting investor sentiment and contributing to the overall index's decline. This demonstrates the importance of monitoring individual company performance within the broader market context.

Implications of the AEX Index Drop

The significant drop in the AEX Index has several far-reaching implications for both investors and the Dutch economy.

Investor Sentiment and Confidence

The AEX Index decline negatively impacted investor sentiment and confidence.

- Potential investor reactions: Many investors may respond by selling off assets to limit potential losses, leading to a further downward spiral. Others may adopt a wait-and-see approach, delaying investment decisions until market stability is restored.

- Impact on future investment decisions: The current volatility could lead to increased caution and risk aversion among investors, potentially hindering future investment in the Dutch market.

- Expert opinions: [Include expert quotes or analyses about investor sentiment from reputable financial sources if available].

Economic Impact on the Netherlands

The AEX Index drop could have significant short-term and long-term consequences for the Dutch economy.

- Potential impacts: A decline in the stock market can reduce consumer confidence and spending, negatively impacting economic growth. It can also lead to job losses in affected sectors and potentially strain government finances.

- Relationship to economic indicators: The AEX Index serves as a key indicator of the health of the Dutch economy. Its decline suggests underlying economic vulnerabilities requiring further investigation and policy responses.

- Data points: [Include any available data points linking AEX performance to GDP growth or other key economic indicators].

Future Outlook and Predictions for the AEX Index

Predicting the future direction of the AEX Index is challenging, but analysis of analyst predictions and investor strategies can offer some insights.

Analyst Predictions and Forecasts

Financial analysts offer varying predictions regarding the AEX Index’s future trajectory.

- Specific predictions: [Include specific predictions and their sources from various financial institutions, news outlets, and analysts]. Note that these are just predictions, not guarantees.

- Optimistic vs. pessimistic views: Some analysts remain optimistic about a potential recovery, citing the resilience of the Dutch economy and opportunities for long-term growth. Others express concerns about sustained volatility and potential for further declines, pointing to lingering global uncertainties.

Strategies for Investors

Navigating the current market volatility requires careful consideration of several investment strategies.

- Diversification: Diversifying investments across different asset classes and sectors can help mitigate risk.

- Risk management: Investors should carefully assess their risk tolerance and adjust their portfolios accordingly.

- Long-term investment: A long-term investment strategy, focusing on sustained growth rather than short-term gains, is often recommended during periods of market instability.

Disclaimer: This article is for informational purposes only and does not constitute financial advice.

Conclusion

The significant drop in the AEX Index reflects a confluence of global and regional factors impacting the Dutch economy. Understanding the potential causes, implications, and predictions surrounding the AEX Index is crucial for informed decision-making. While the current market volatility presents challenges, careful analysis and strategic planning can help investors navigate these uncertain times. Stay informed about fluctuations in the AEX Index by regularly checking reputable financial news sources. Monitoring the AEX Index closely is crucial for making informed investment choices in the Dutch market.

Featured Posts

-

Bbc Radio 1 Big Weekend 2024 Lineup Jorja Smith Biffy Clyro Blossoms And More

May 24, 2025

Bbc Radio 1 Big Weekend 2024 Lineup Jorja Smith Biffy Clyro Blossoms And More

May 24, 2025 -

Zhizn I Tvorchestvo Innokentiya Smoktunovskogo Yubileyniy Dokumentalniy Film

May 24, 2025

Zhizn I Tvorchestvo Innokentiya Smoktunovskogo Yubileyniy Dokumentalniy Film

May 24, 2025 -

Amsterdam City Faces Lawsuit Residents Cite Tik Tok Induced Overcrowding At Local Business

May 24, 2025

Amsterdam City Faces Lawsuit Residents Cite Tik Tok Induced Overcrowding At Local Business

May 24, 2025 -

Porsche Cayenne Ev 2026 Leaked Spy Shots Offer Early Insights

May 24, 2025

Porsche Cayenne Ev 2026 Leaked Spy Shots Offer Early Insights

May 24, 2025 -

Nemecke Hospodarstvo Prepustanie V Tisicoch Zasahuje Velke Spolocnosti

May 24, 2025

Nemecke Hospodarstvo Prepustanie V Tisicoch Zasahuje Velke Spolocnosti

May 24, 2025

Latest Posts

-

Understanding The Controversy Surrounding Thames Waters Executive Bonuses

May 24, 2025

Understanding The Controversy Surrounding Thames Waters Executive Bonuses

May 24, 2025 -

Are Elevated Stock Market Valuations Justified Bof As Take

May 24, 2025

Are Elevated Stock Market Valuations Justified Bof As Take

May 24, 2025 -

Thames Waters Executive Bonuses A Look At The Financial Implications

May 24, 2025

Thames Waters Executive Bonuses A Look At The Financial Implications

May 24, 2025 -

Bof A Reassures Investors Understanding Current Stock Market Valuations

May 24, 2025

Bof A Reassures Investors Understanding Current Stock Market Valuations

May 24, 2025 -

Addressing Investor Concerns Bof A On Stretched Stock Market Valuations

May 24, 2025

Addressing Investor Concerns Bof A On Stretched Stock Market Valuations

May 24, 2025