House Approves Amended Trump Tax Bill: What You Need To Know

Table of Contents

Key Changes in the Amended Trump Tax Bill

The amended Trump Tax Bill includes several noteworthy alterations to the original legislation. These changes affect both individual taxpayers and corporations, potentially reshaping the American tax landscape.

Individual Tax Rate Adjustments

The revised bill features adjustments to individual income tax brackets, the standard deduction, and several tax credits. These changes aim to provide tax relief in certain areas while potentially increasing the tax burden in others.

- Increased Standard Deduction: The standard deduction amount has been increased, potentially benefiting many taxpayers who previously itemized. This simplification could lead to quicker tax filing for many.

- Altered Tax Brackets: The income thresholds for various tax brackets have been modified, leading to potential changes in the effective tax rate for different income levels. Some brackets may see slight reductions, while others might experience minor increases.

- Changes to Child Tax Credit: Modifications to the child tax credit might alter the amount of tax relief families receive, potentially influencing household budgets. The exact details of these changes should be examined carefully.

These changes impact different income levels differently. For example, a lower-income family might see a minor increase in their tax refund due to the increased standard deduction, while a higher-income family might experience a less significant impact due to the altered tax brackets. It's crucial to understand your specific circumstances to determine your personal tax liability.

Corporate Tax Rate Modifications

While the corporate tax rate remains largely unchanged from the original Trump Tax Bill, the amended version introduces subtle modifications to certain deductions and credits available to corporations. These changes could affect business investment, job creation, and overall economic growth.

- Changes to Depreciation Schedules: Alterations to depreciation schedules could influence how businesses deduct the cost of assets over time, potentially impacting their short-term profitability.

- Modified Research and Development Credits: Adjustments to R&D tax credits could impact the amount of investment businesses are willing to make in innovation and new technologies.

- Impact on International Business: Changes to international tax provisions could affect multinational corporations and their investment strategies.

The net effect of these corporate tax modifications remains a subject of ongoing analysis and debate among economists and financial experts.

Changes to Itemized Deductions

The amended bill also includes adjustments to several itemized deductions, significantly affecting taxpayers who choose to itemize rather than use the standard deduction.

- Mortgage Interest Deduction: While largely untouched, certain aspects of the mortgage interest deduction might be subject to new limitations.

- State and Local Taxes (SALT): The limitations on the deduction for state and local taxes (SALT) introduced in the original bill remain in place, continuing to impact high-tax states disproportionately.

- Charitable Contributions: Deductions for charitable contributions may see minor changes, affecting taxpayers' ability to deduct charitable donations.

Taxpayers will need to carefully analyze whether itemizing or taking the standard deduction will be more beneficial given the revised limits on deductions.

Impact on Different Income Groups

The amended Trump Tax Bill's impact varies widely across different income groups.

High-Income Earners

High-income earners might see a net decrease in their tax burden due to lower tax rates in certain brackets, although the impact of the changes to itemized deductions must be considered. Potential changes to capital gains taxes and estate taxes could also significantly affect this demographic.

Middle-Income Families

Middle-income families will likely experience a more moderate impact, with some benefits from increased standard deductions potentially offset by changes to tax credits like the child tax credit. The overall effect will depend significantly on individual circumstances.

Low-Income Individuals

The effects on low-income individuals depend heavily on adjustments to credits such as the Earned Income Tax Credit (EITC). Any alterations to this credit could significantly influence the tax burden and overall financial well-being of this population segment.

The Political Landscape and Future of the Amended Trump Tax Bill

The passage of the amended Trump Tax Bill through the House faces an uncertain future in the Senate. Potential amendments, political gridlock, and lobbying efforts could significantly alter the final version of the legislation. The long-term economic and social implications will depend heavily on the final form and implementation of this amended bill. The likelihood of future tax legislation will also be influenced by the overall success or failure of this revised bill.

Conclusion

The amended Trump Tax Bill introduces significant changes to the individual and corporate tax systems. The impact varies considerably depending on income level, with different groups potentially experiencing different benefits and drawbacks. Understanding these changes requires a careful analysis of individual circumstances and potential implications. The future of this amended tax bill remains uncertain, depending on the outcome of Senate proceedings and potential amendments.

Call to Action: Stay informed about the evolving implications of this amended Trump Tax Bill. Consult with a qualified tax professional to understand how these changes may specifically affect your individual tax situation. Understanding the amended Trump Tax Bill is crucial for effective financial planning. Learn more about the implications of the amended Trump Tax Bill today!

Featured Posts

-

Crystal Palace Target Free Transfer For Kyle Walker Peters

May 24, 2025

Crystal Palace Target Free Transfer For Kyle Walker Peters

May 24, 2025 -

Teatr Mossoveta Vecher Pamyati Sergeya Yurskogo

May 24, 2025

Teatr Mossoveta Vecher Pamyati Sergeya Yurskogo

May 24, 2025 -

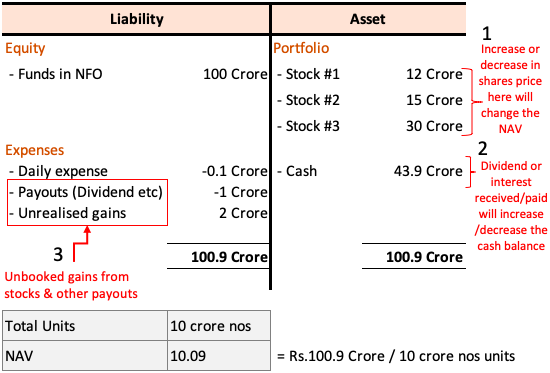

How To Interpret The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

How To Interpret The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

The Last Rodeo Exploring Neal Mc Donoughs Character

May 24, 2025

The Last Rodeo Exploring Neal Mc Donoughs Character

May 24, 2025 -

Sean Penns Shocking Transformation Fans React To Bombshell Claims

May 24, 2025

Sean Penns Shocking Transformation Fans React To Bombshell Claims

May 24, 2025

Latest Posts

-

How Joe Jonas Handled A Couples Argument About Him

May 24, 2025

How Joe Jonas Handled A Couples Argument About Him

May 24, 2025 -

Joe Jonas And The Unexpected Fan Fight His Reaction

May 24, 2025

Joe Jonas And The Unexpected Fan Fight His Reaction

May 24, 2025 -

The Jonas Brothers Drama A Married Couples Unexpected Feud

May 24, 2025

The Jonas Brothers Drama A Married Couples Unexpected Feud

May 24, 2025 -

Joe Jonas Responds To Married Couples Dispute

May 24, 2025

Joe Jonas Responds To Married Couples Dispute

May 24, 2025 -

Joe Jonas Perfect Response To A Couples Fight Over Him

May 24, 2025

Joe Jonas Perfect Response To A Couples Fight Over Him

May 24, 2025