How To Interpret The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

Understanding the Components of the Amundi Dow Jones Industrial Average UCITS ETF NAV

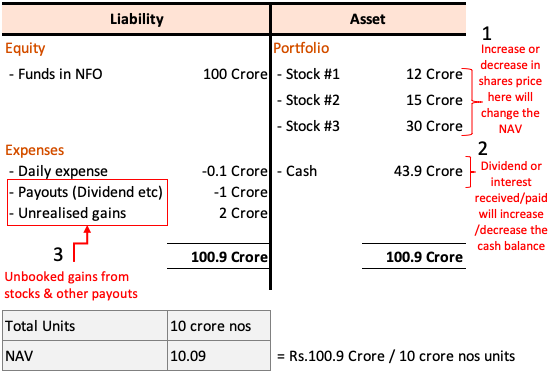

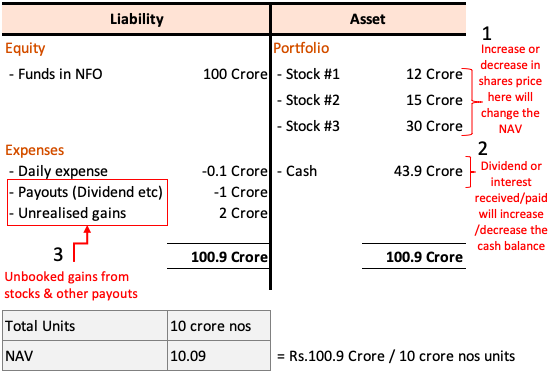

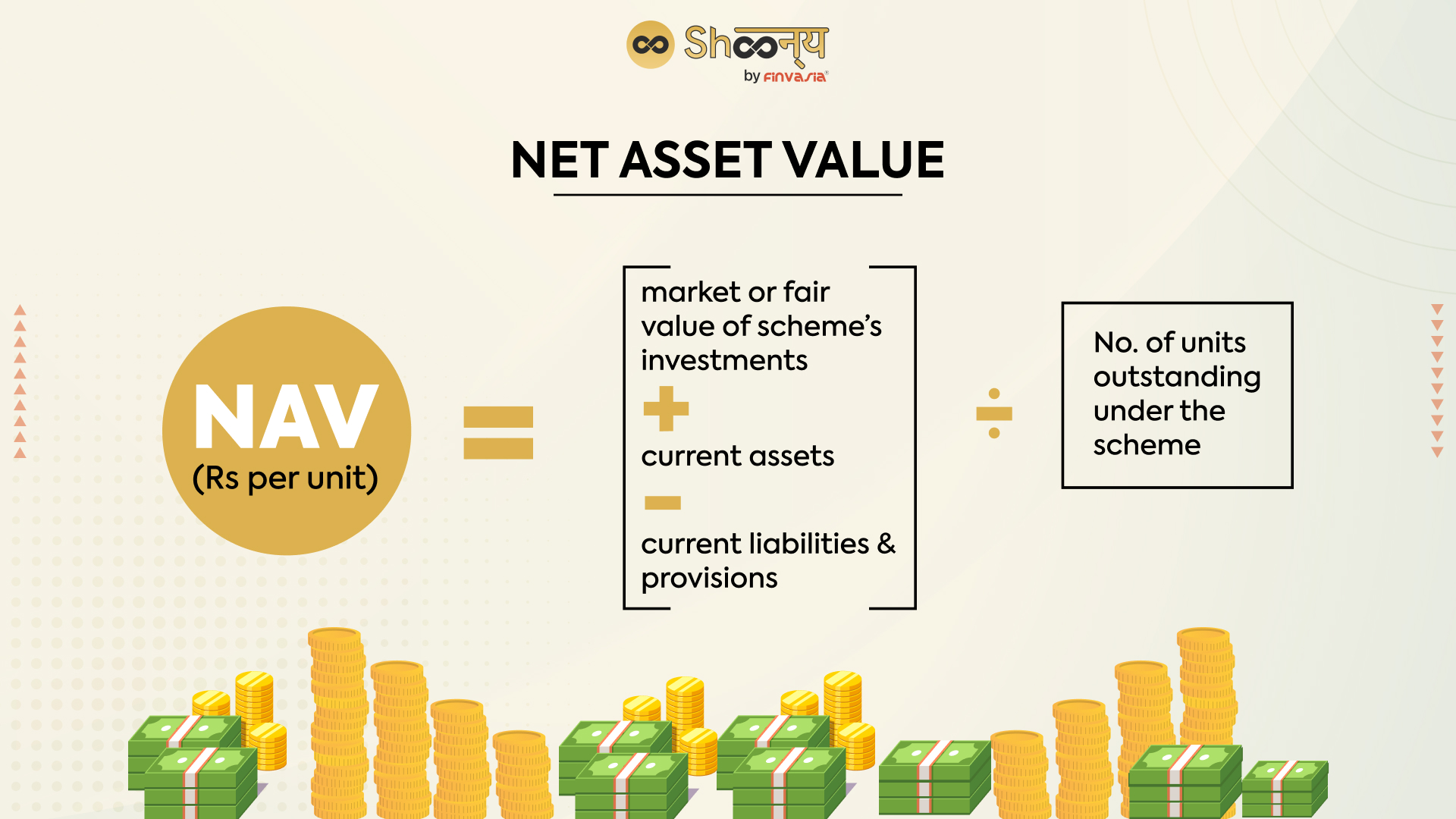

The Calculation of NAV

The Net Asset Value (NAV) represents the underlying value of an ETF's holdings. For the Amundi Dow Jones Industrial Average UCITS ETF, the NAV calculation is fairly straightforward: Assets – Liabilities = NAV.

- Assets: This primarily includes the market value of the ETF's holdings in the 30 companies that make up the Dow Jones Industrial Average. Each company's stock price is multiplied by the number of shares held by the ETF to determine its contribution to the total asset value.

- Liabilities: These encompass various expenses, including:

- Management fees charged by Amundi.

- Transaction costs associated with buying and selling securities.

- Other administrative expenses.

Understanding the breakdown of assets and liabilities provides a clear picture of the ETF's actual value, independent of its market price. This distinction is critical for evaluating the ETF's performance and identifying potential discrepancies. Keywords: NAV calculation, Amundi Dow Jones Industrial Average UCITS ETF assets, liabilities, ETF expenses.

Factors Influencing Daily NAV Fluctuations

The NAV of the Amundi Dow Jones Industrial Average UCITS ETF fluctuates daily due to several factors:

- Market Movements: Changes in the prices of the underlying Dow Jones Industrial Average stocks directly impact the ETF's NAV. A rise in the Dow generally leads to a higher NAV, and vice versa. Keywords: Dow Jones Industrial Average, market volatility, NAV fluctuation.

- Currency Exchange Rates: If the ETF holds assets denominated in currencies other than the base currency of the ETF, fluctuations in exchange rates can affect the NAV.

- Dividends and Corporate Actions: Dividend payouts from the underlying companies increase the cash component of the ETF's assets, impacting the NAV. Corporate actions like stock splits or mergers also affect the NAV. Keywords: dividend payouts, corporate actions, NAV fluctuation.

- ETF Trading Volume: While the NAV itself isn't directly influenced by trading volume, high trading volume can lead to price discrepancies between the market price and the NAV. Keywords: ETF trading volume.

Monitoring these factors provides context for understanding NAV fluctuations, helping you differentiate between normal market variations and potentially significant changes.

Accessing the Amundi Dow Jones Industrial Average UCITS ETF NAV Data

Real-time and historical NAV data for the Amundi Dow Jones Industrial Average UCITS ETF is readily available from various sources:

- Amundi's Website: The official Amundi website is the primary source for accurate and up-to-date NAV information.

- Financial News Sources: Major financial news websites and data providers (like Bloomberg, Yahoo Finance, Google Finance) typically publish the daily NAV.

- Brokerage Platforms: If you hold the ETF through a brokerage account, the platform usually displays the current NAV alongside other key metrics.

The NAV is typically updated daily, reflecting the closing prices of the underlying assets. Understanding where to access this data empowers you to actively monitor your investment. Keywords: Amundi website, NAV data, real-time NAV, historical NAV, financial data providers.

Interpreting the NAV and Making Informed Investment Decisions

NAV and Investment Strategy

The NAV is a crucial tool for developing and executing your investment strategy:

- Performance Tracking: By comparing the NAV over time, you can track the ETF's performance against its benchmark (the Dow Jones Industrial Average).

- Premium/Discount Analysis: The ETF's market price may sometimes trade at a premium or discount to its NAV. Understanding the reasons behind these discrepancies can inform your buy/sell decisions.

- Buy/Sell Signals: While not a standalone indicator, changes in the NAV, in conjunction with broader market analysis, can provide insights into potential buy or sell signals. Keywords: investment strategy, ETF performance, benchmark comparison, buy signals, sell signals, premium, discount.

NAV and Risk Management

Monitoring the NAV is vital for effective risk management:

- Risk Assessment: Significant and sudden drops in the NAV signal potential risks associated with your investment.

- Risk Tolerance: Your risk tolerance should guide your reaction to NAV fluctuations. A conservative investor might react differently to a NAV drop than a more aggressive investor.

- Portfolio Diversification: Using NAV data across different ETFs within your portfolio helps you assess the overall risk of your diversified holdings. Keywords: risk management, risk tolerance, portfolio diversification, NAV risk assessment.

Conclusion: Mastering the Amundi Dow Jones Industrial Average UCITS ETF NAV

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for informed investment decisions. By grasping the components of the NAV calculation, the factors influencing its fluctuations, and its role in investment strategy and risk management, you can effectively monitor your investment and make better choices for your portfolio. Regularly check the NAV of your Amundi Dow Jones Industrial Average UCITS ETF holdings and utilize the resources mentioned above to deepen your understanding of ETF investing. For further resources on ETF investing and the Amundi Dow Jones Industrial Average UCITS ETF, explore Amundi's investor education materials and reputable financial websites. Keywords: Amundi Dow Jones Industrial Average UCITS ETF NAV, ETF investing, investment decisions, financial literacy.

Featured Posts

-

Experience The Ferrari Bengaluru Service Centre A First Look

May 24, 2025

Experience The Ferrari Bengaluru Service Centre A First Look

May 24, 2025 -

Pandemic Reflection A Seattle Parks Role As A Refuge

May 24, 2025

Pandemic Reflection A Seattle Parks Role As A Refuge

May 24, 2025 -

Kyle Walkers Night Out Annie Kilner Spotted On Solo Errands

May 24, 2025

Kyle Walkers Night Out Annie Kilner Spotted On Solo Errands

May 24, 2025 -

Amundi Djia Ucits Etf Distributing A Guide To Net Asset Value

May 24, 2025

Amundi Djia Ucits Etf Distributing A Guide To Net Asset Value

May 24, 2025 -

Escape To The Country Top Locations For A Tranquil Lifestyle

May 24, 2025

Escape To The Country Top Locations For A Tranquil Lifestyle

May 24, 2025

Latest Posts

-

Amsterdam Stock Market Three Days Of Significant Losses Totaling 11

May 24, 2025

Amsterdam Stock Market Three Days Of Significant Losses Totaling 11

May 24, 2025 -

Dazi E Mercati L Unione Europea Pronta A Reagire Alla Crisi

May 24, 2025

Dazi E Mercati L Unione Europea Pronta A Reagire Alla Crisi

May 24, 2025 -

Dutch Stocks Continue Downturn As Trade War With Us Heats Up

May 24, 2025

Dutch Stocks Continue Downturn As Trade War With Us Heats Up

May 24, 2025 -

Le Borse Crollano A Causa Dei Dazi La Risposta Decisa Della Ue

May 24, 2025

Le Borse Crollano A Causa Dei Dazi La Risposta Decisa Della Ue

May 24, 2025 -

Guerra Dei Dazi Impatto Sulle Borse Europee E Reazioni Ue

May 24, 2025

Guerra Dei Dazi Impatto Sulle Borse Europee E Reazioni Ue

May 24, 2025