Amundi Dow Jones Industrial Average UCITS ETF: A Guide To Net Asset Value

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

Net Asset Value (NAV) represents the net worth of an ETF's underlying assets. For the Amundi Dow Jones Industrial Average UCITS ETF, this means the total value of its holdings, mirroring the composition of the Dow Jones Industrial Average. Understanding how NAV is calculated is fundamental to comprehending the ETF's performance.

The calculation involves subtracting liabilities (expenses and other obligations) from the total market value of the ETF's assets. A simplified formula is:

Assets – Liabilities = NAV

The "assets" component primarily consists of the market value of the 30 constituent companies of the Dow Jones Industrial Average, each weighted according to its representation in the index.

Several factors influence NAV fluctuations:

- Market movements of the Dow Jones Industrial Average: Changes in the prices of the Dow's constituent stocks directly impact the ETF's NAV. A rising Dow generally leads to a higher NAV, and vice versa.

- Currency fluctuations: If the ETF holds assets denominated in currencies other than the base currency of the ETF, exchange rate movements can affect the NAV.

- Dividend payments from underlying companies: Dividend payouts from the constituent companies increase the cash component of the ETF's assets, thereby influencing the NAV.

- ETF management fees: These fees are deducted from the ETF's assets, leading to a slight reduction in the NAV.

Accessing the Amundi Dow Jones Industrial Average UCITS ETF NAV

Finding the daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF is straightforward. Reliable sources include:

- Amundi's official website: The asset management company regularly publishes the NAV on its dedicated ETF pages.

- Financial news sources: Major financial news websites and data providers typically include real-time or end-of-day NAV data for ETFs.

- Brokerage platforms: If you hold the ETF through a brokerage account, the platform usually displays the current NAV alongside the market price.

It's important to note that the NAV is typically calculated and published at the end of the trading day, reflecting the closing prices of the underlying assets. You'll also notice a difference between the NAV and the market price at which the ETF trades. This difference, the bid-ask spread, reflects the cost of buying or selling the ETF shares.

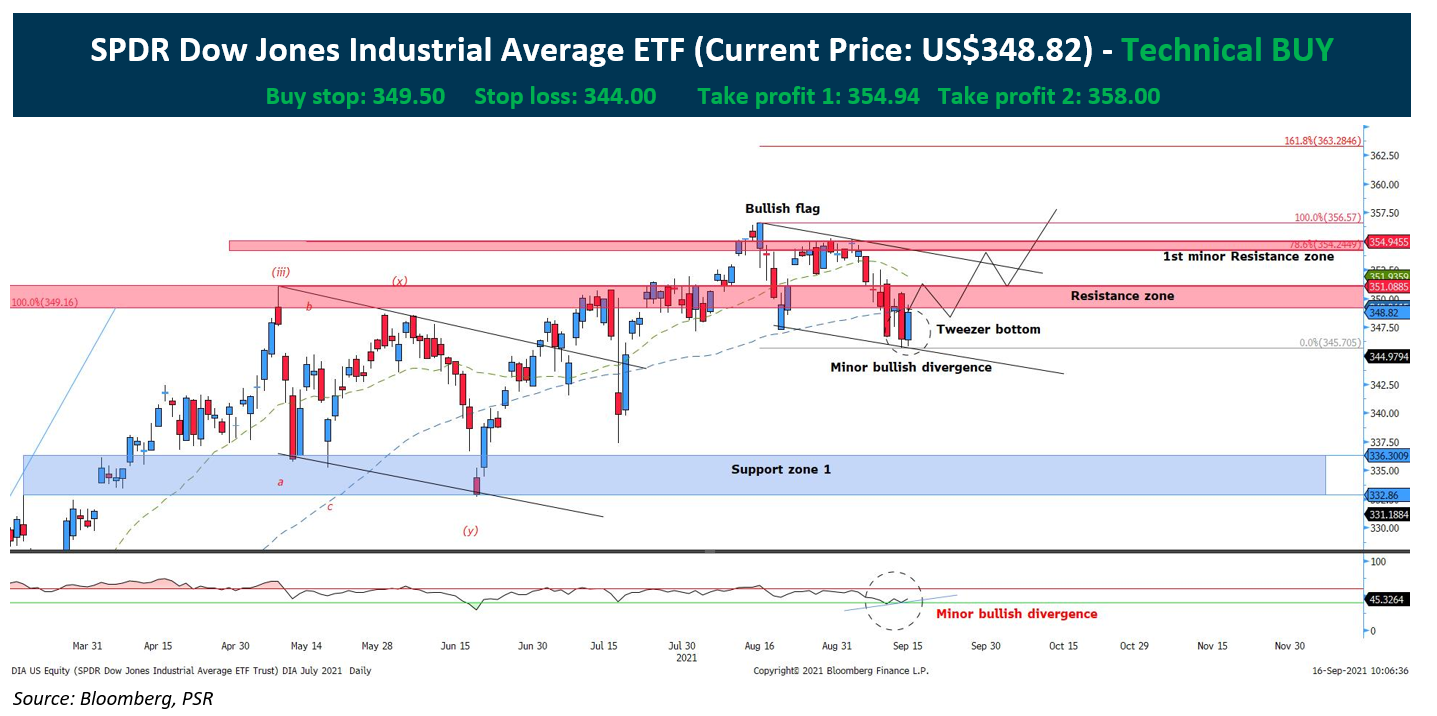

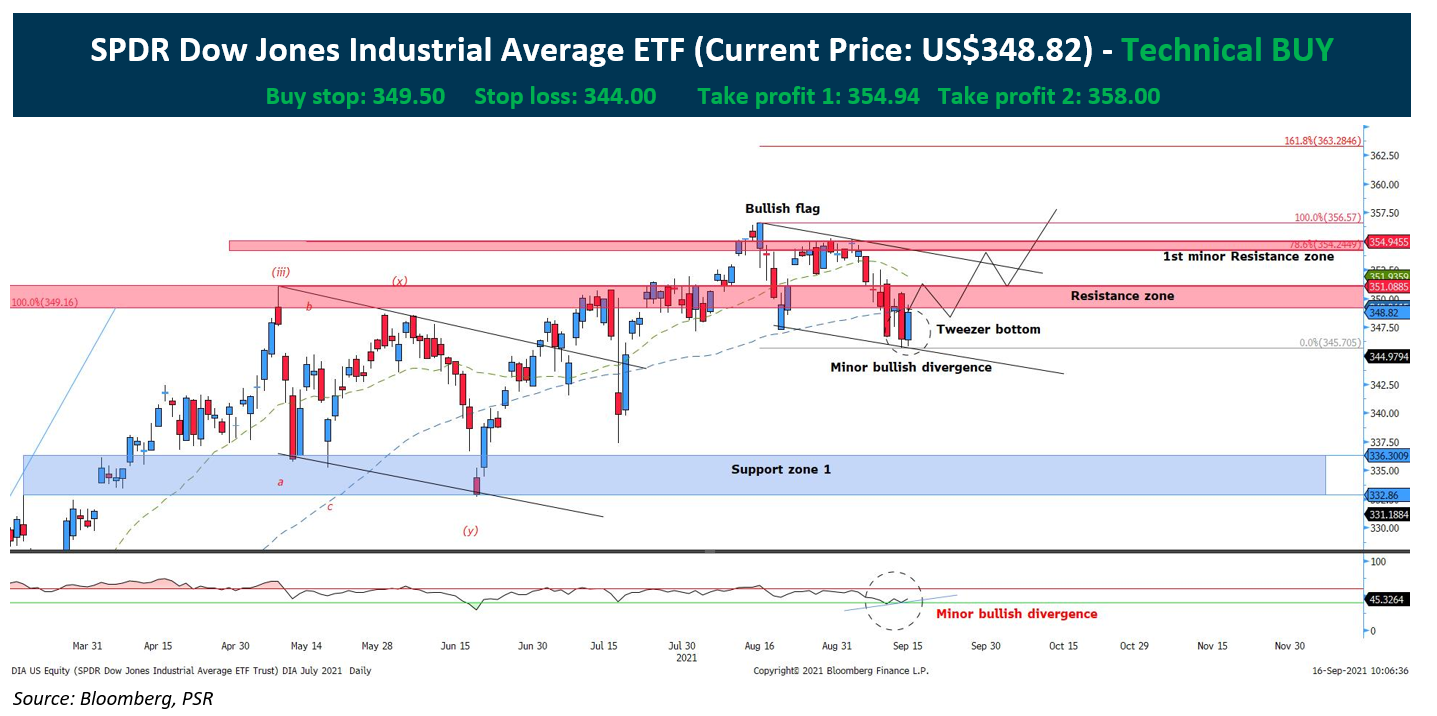

Using NAV to Analyze the Amundi Dow Jones Industrial Average UCITS ETF Performance

Monitoring the Amundi Dow Jones Industrial Average UCITS ETF NAV over time allows investors to track its performance. By comparing the NAV on different dates, you can calculate the percentage change, revealing the ETF's growth or decline. This is a valuable tool for assessing the ETF's performance against its benchmark, the Dow Jones Industrial Average itself.

- Performance Tracking: Comparing NAV over different periods (e.g., monthly, quarterly, annually) provides a clear picture of the ETF's performance.

- Benchmarking: Comparing the ETF's NAV performance against the Dow Jones Industrial Average helps assess the ETF's tracking efficiency.

- Percentage Change Calculation: A simple formula – [(New NAV – Old NAV) / Old NAV] x 100 – provides the percentage change in NAV over a specific period.

- Holistic Performance Metrics: While NAV is crucial, consider other metrics like total return (including dividends) for a comprehensive view of the ETF's performance.

Understanding NAV and Investment Decisions

The Amundi Dow Jones Industrial Average UCITS ETF NAV is a vital tool for making informed investment choices. A rising NAV generally suggests positive performance, potentially indicating a good time to hold or even consider buying more shares. Conversely, a consistently declining NAV might signal a need to re-evaluate the investment strategy.

However, relying solely on NAV can be misleading. Transaction costs, brokerage fees, and tax implications should also be factored into the investment decision-making process. NAV provides a crucial piece of the puzzle, but not the entire picture.

Conclusion: Making Informed Decisions with Amundi Dow Jones Industrial Average UCITS ETF NAV

Understanding Amundi Dow Jones Industrial Average UCITS ETF NAV is paramount for investors seeking to track performance and make informed decisions. Regularly monitoring the NAV, coupled with an analysis of other relevant performance indicators and careful consideration of fees and costs, allows for a comprehensive assessment of your investment. By leveraging the information presented in this guide and accessing readily available NAV data, you can effectively manage your investment in the Amundi Dow Jones Industrial Average UCITS ETF and make well-informed investment choices. To learn more about the Amundi Dow Jones Industrial Average UCITS ETF and other related investment strategies, explore the resources available on Amundi's website.

Featured Posts

-

Model Night Out Fallout Annie Kilners Poisoning Claims Against Kyle Walker

May 24, 2025

Model Night Out Fallout Annie Kilners Poisoning Claims Against Kyle Walker

May 24, 2025 -

Menya Vela Kakaya To Sila Dokumentalniy Film K 100 Letiyu Innokentiya Smoktunovskogo

May 24, 2025

Menya Vela Kakaya To Sila Dokumentalniy Film K 100 Letiyu Innokentiya Smoktunovskogo

May 24, 2025 -

Is Kyle Walker Peters Headed To West Ham Examining The Transfer Offer

May 24, 2025

Is Kyle Walker Peters Headed To West Ham Examining The Transfer Offer

May 24, 2025 -

Avrupa Borsalarinin Guenluek Performansi Karisik Islemler

May 24, 2025

Avrupa Borsalarinin Guenluek Performansi Karisik Islemler

May 24, 2025 -

Heineken Exceeds Revenue Expectations Maintains Forecast Despite Tariffs

May 24, 2025

Heineken Exceeds Revenue Expectations Maintains Forecast Despite Tariffs

May 24, 2025

Latest Posts

-

Amsterdam Stock Market Three Days Of Significant Losses Totaling 11

May 24, 2025

Amsterdam Stock Market Three Days Of Significant Losses Totaling 11

May 24, 2025 -

Dazi E Mercati L Unione Europea Pronta A Reagire Alla Crisi

May 24, 2025

Dazi E Mercati L Unione Europea Pronta A Reagire Alla Crisi

May 24, 2025 -

Dutch Stocks Continue Downturn As Trade War With Us Heats Up

May 24, 2025

Dutch Stocks Continue Downturn As Trade War With Us Heats Up

May 24, 2025 -

Le Borse Crollano A Causa Dei Dazi La Risposta Decisa Della Ue

May 24, 2025

Le Borse Crollano A Causa Dei Dazi La Risposta Decisa Della Ue

May 24, 2025 -

Guerra Dei Dazi Impatto Sulle Borse Europee E Reazioni Ue

May 24, 2025

Guerra Dei Dazi Impatto Sulle Borse Europee E Reazioni Ue

May 24, 2025