Amundi Dow Jones Industrial Average UCITS ETF: A Guide To Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV) and Why is it Important?

Net Asset Value (NAV) represents the value of an ETF's underlying assets per share. It's calculated by taking the total market value of all assets held within the fund, subtracting liabilities, and then dividing by the number of outstanding shares. Essentially, it reflects the intrinsic worth of a single ETF share. This is distinct from the market price, which is the price at which the ETF is currently trading on the exchange.

The importance of NAV for investors cannot be overstated:

- NAV is calculated daily, typically at the close of the market, providing a snapshot of the ETF's value.

- It reflects the market value of all assets held within the ETF, giving you a clear picture of the fund's holdings.

- Understanding NAV helps investors assess the fund's performance against its benchmark (in this case, the DJIA). A consistent NAV increase, reflecting DJIA growth, signifies successful tracking.

- Differences between NAV and market price can indicate trading opportunities. A significant discount (market price below NAV) might present a buying opportunity, while a premium (market price above NAV) might suggest a selling opportunity. However, always consider market conditions and other factors before making investment decisions.

How is the NAV of the Amundi Dow Jones Industrial Average UCITS ETF Calculated?

Calculating the NAV of the Amundi Dow Jones Industrial Average UCITS ETF involves a multi-step process:

- The NAV reflects the weighted average market price of the 30 DJIA companies. Each company's weighting in the DJIA index determines its contribution to the overall NAV.

- Currency conversion may be involved if the ETF holds assets denominated in currencies other than the base currency of the ETF.

- Expenses and management fees are deducted from the total asset value before the final NAV is calculated. These are essential costs to consider for any investment.

- Regular portfolio rebalancing impacts the NAV calculation. Amundi, as the fund manager, will rebalance the ETF's holdings to maintain alignment with the DJIA's composition. This rebalancing can cause minor fluctuations in the NAV.

Accessing the Amundi Dow Jones Industrial Average UCITS ETF NAV

Staying informed about the Amundi Dow Jones Industrial Average UCITS ETF's NAV is straightforward:

- Check Amundi's official website: The fund manager usually provides daily NAV updates on their investor relations page.

- Major financial news sources (Bloomberg, Yahoo Finance, Google Finance, etc.) often display real-time and historical NAV data for ETFs.

- Your brokerage account: Reputable brokerage platforms will display the NAV alongside the market price of the ETF, simplifying your monitoring.

- Dedicated financial data providers: Companies specializing in financial data provide comprehensive historical NAV data, useful for in-depth analysis and charting.

Using NAV to Make Informed Investment Decisions

Understanding the NAV of the Amundi Dow Jones Industrial Average UCITS ETF is not merely academic; it's crucial for effective investment decision-making.

- Compare the ETF's market price to its NAV: Identify potential premiums or discounts. A consistent premium might indicate high investor demand, while a persistent discount might signal a potential bargain.

- Monitor the NAV's trend over time: This reveals the ETF's long-term performance, offering insights into whether it's tracking the DJIA effectively.

- Use NAV data in conjunction with other financial metrics: Consider factors like expense ratios, trading volume, and the DJIA's overall market trend for a holistic perspective.

- Consider NAV changes when rebalancing your investment portfolio: Use NAV data to adjust your holdings and maintain your desired asset allocation strategy.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is vital for any investor seeking to optimize their portfolio. By consistently monitoring the NAV alongside the market price, you can make informed buying and selling decisions, assess the fund's performance against the DJIA, and effectively manage your investment in this prominent index-tracking ETF. Learn more about the Amundi Dow Jones Industrial Average UCITS ETF and how to effectively utilize its Net Asset Value (NAV) for your investment strategy. Regularly check the NAV to optimize your investment in this prominent index-tracking ETF.

Featured Posts

-

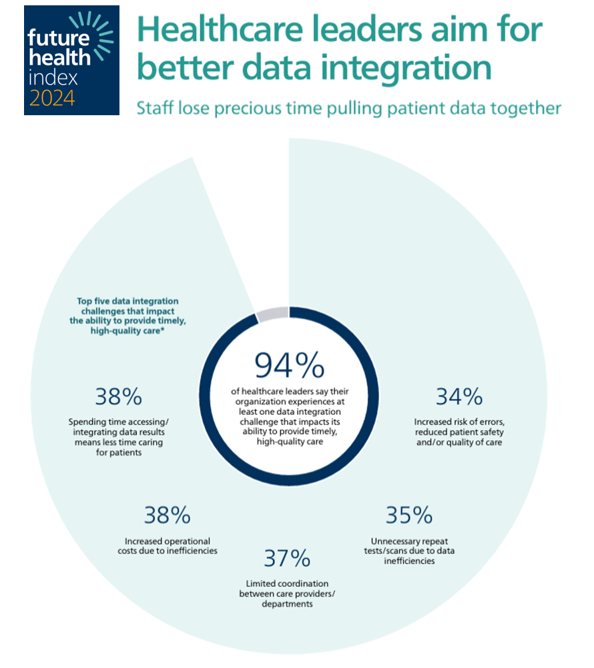

Global Healthcare Transformation Insights From The Philips Future Health Index 2025 On Ais Role

May 24, 2025

Global Healthcare Transformation Insights From The Philips Future Health Index 2025 On Ais Role

May 24, 2025 -

The Joys Of An Escape To The Country Lifestyle And Benefits

May 24, 2025

The Joys Of An Escape To The Country Lifestyle And Benefits

May 24, 2025 -

Analyzing The Glastonbury 2025 Lineup Charli Xcx Neil Young And Beyond

May 24, 2025

Analyzing The Glastonbury 2025 Lineup Charli Xcx Neil Young And Beyond

May 24, 2025 -

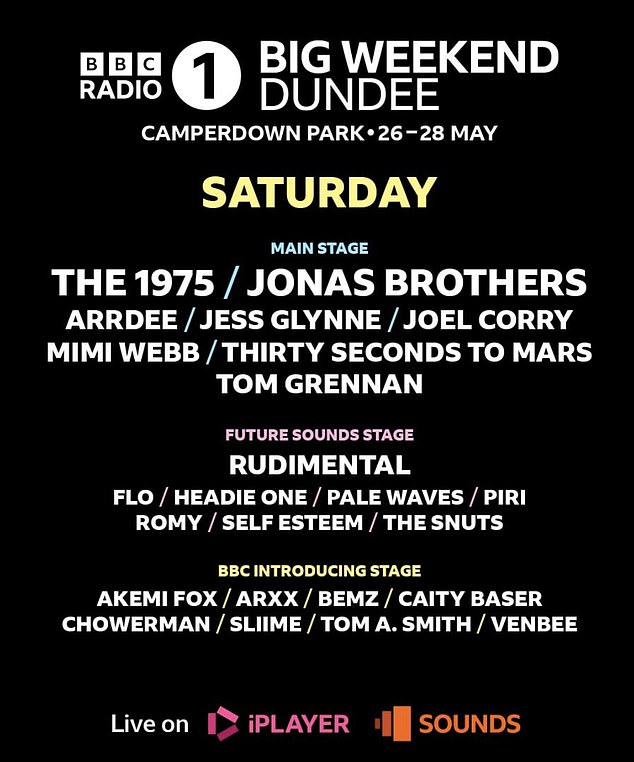

Secure Your Bbc Radio 1 Big Weekend 2025 Tickets Complete Guide

May 24, 2025

Secure Your Bbc Radio 1 Big Weekend 2025 Tickets Complete Guide

May 24, 2025 -

Securing Bbc Radio 1 Big Weekend Tickets A Step By Step Guide

May 24, 2025

Securing Bbc Radio 1 Big Weekend Tickets A Step By Step Guide

May 24, 2025

Latest Posts

-

Amsterdam Stock Market Three Days Of Significant Losses Totaling 11

May 24, 2025

Amsterdam Stock Market Three Days Of Significant Losses Totaling 11

May 24, 2025 -

Dazi E Mercati L Unione Europea Pronta A Reagire Alla Crisi

May 24, 2025

Dazi E Mercati L Unione Europea Pronta A Reagire Alla Crisi

May 24, 2025 -

Dutch Stocks Continue Downturn As Trade War With Us Heats Up

May 24, 2025

Dutch Stocks Continue Downturn As Trade War With Us Heats Up

May 24, 2025 -

Le Borse Crollano A Causa Dei Dazi La Risposta Decisa Della Ue

May 24, 2025

Le Borse Crollano A Causa Dei Dazi La Risposta Decisa Della Ue

May 24, 2025 -

Guerra Dei Dazi Impatto Sulle Borse Europee E Reazioni Ue

May 24, 2025

Guerra Dei Dazi Impatto Sulle Borse Europee E Reazioni Ue

May 24, 2025