Amundi Dow Jones Industrial Average UCITS ETF (Dist): NAV Explained

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the value of an ETF's underlying assets per share. It's a critical metric for valuing ETFs, providing a snapshot of the fund's worth. For the Amundi Dow Jones Industrial Average UCITS ETF (Dist), the NAV calculation involves determining the market value of all the holdings that track the Dow Jones Industrial Average (DJIA). This includes the 30 constituent companies of the DJIA. The fund manager diligently tracks the prices of these companies, ensuring an accurate reflection of the portfolio's value. The calculation is typically performed daily, usually at the market close.

- NAV represents the value of the ETF's holdings per share. This means it reflects the net asset value of the underlying investments.

- Calculated daily, typically at market close. The closing prices of the DJIA components are used in this daily calculation.

- Reflects the market value of all the underlying assets. This ensures a fair representation of the ETF’s current worth.

- Differences between bid and ask price explained. While the NAV is the theoretical value, the market price you see may slightly differ due to supply and demand (bid and ask prices). These differences are typically minimal for actively traded ETFs like the Amundi DJIA ETF.

Understanding the Amundi DJIA ETF's NAV and its Components

The Amundi DJIA ETF's NAV is directly linked to the performance of the Dow Jones Industrial Average. Since the ETF aims to replicate the DJIA, its NAV fluctuates in line with the index's movements. This means that if the DJIA rises, the NAV of the Amundi DJIA ETF generally increases, and vice versa. The ETF's holdings comprise the 30 major companies that make up the DJIA, offering a diversified portfolio within a single investment. The performance of each individual stock within the DJIA impacts the overall NAV; a strong performance by a significant component will positively influence the NAV, while underperformance will have the opposite effect.

- The ETF aims to track the DJIA. This is the core objective of the Amundi DJIA ETF.

- NAV fluctuations reflect DJIA movements. This strong correlation is a key feature for investors.

- Diversification within the ETF (30 companies). This reduces overall portfolio risk compared to investing in individual stocks.

- Impact of individual stock performance on overall NAV. The weighting of each component in the DJIA influences its effect on the overall NAV.

NAV and Dividend Distributions

The Amundi Dow Jones Industrial Average UCITS ETF (Dist) distributes dividends to its shareholders. These dividends, derived from the dividend payments of the underlying DJIA companies, affect the ETF's NAV. On the ex-dividend date – the date after which a buyer of the ETF will not receive the upcoming dividend payment – the NAV is typically reduced by the amount of the dividend distributed. This is because the fund's assets are decreased by the payout. Investors can choose to reinvest these dividends, leading to an accumulation of more ETF shares, thereby potentially offsetting the NAV reduction over time. However, dividend payments are also subject to tax implications, a factor investors should consider.

- Dividends reduce the NAV on the ex-dividend date. This is a normal occurrence and reflects the distribution of earnings.

- Impact of dividend reinvestment on share accumulation. Reinvesting dividends can lead to increased long-term holdings.

- Understanding the distribution schedule. Familiarize yourself with the ETF's dividend payment schedule to effectively manage your investments.

- Tax implications of dividend distributions. Dividend income is typically subject to taxation.

How to Use NAV Information to Make Informed Investment Decisions

Monitoring the Amundi DJIA ETF's NAV is key to effective investment management. By tracking NAV changes over time, investors can assess the ETF's performance. Comparing the NAV to the market price of the ETF can highlight potential arbitrage opportunities, though these are usually minimal with well-established ETFs like the Amundi DJIA ETF. This information is also essential for portfolio performance analysis and long-term investment strategy development. Understanding NAV trends helps in making informed decisions regarding buying, selling, or holding the ETF.

- Tracking NAV changes over time. Observe trends to understand long-term performance.

- Comparing NAV with market price. Identify any significant discrepancies that might signal opportunities (though often minor with this ETF).

- Using NAV for portfolio performance analysis. Assess your investment's contribution to your overall portfolio.

- Significance of NAV in long-term investment strategies. Incorporate NAV into your broader investment planning.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF (Dist) is essential for making informed investment decisions. We've explored how the NAV is calculated, its relationship with the DJIA, the impact of dividend distributions, and how investors can utilize NAV information for effective portfolio management. Mastering the intricacies of the Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV allows for more informed investment strategies. Learn more and start building your portfolio today!

Featured Posts

-

Essen Uniklinikum Beruehrende Ereignisse In Der Naehe

May 24, 2025

Essen Uniklinikum Beruehrende Ereignisse In Der Naehe

May 24, 2025 -

Frankfurt Stock Exchange Opens Dax Maintains Stability Post Record

May 24, 2025

Frankfurt Stock Exchange Opens Dax Maintains Stability Post Record

May 24, 2025 -

Intimacy Growth And The New Album Her In Deep An Interview With Matt Maltese

May 24, 2025

Intimacy Growth And The New Album Her In Deep An Interview With Matt Maltese

May 24, 2025 -

Princess Road Closed Live Updates On Pedestrian Accident And Emergency Response

May 24, 2025

Princess Road Closed Live Updates On Pedestrian Accident And Emergency Response

May 24, 2025 -

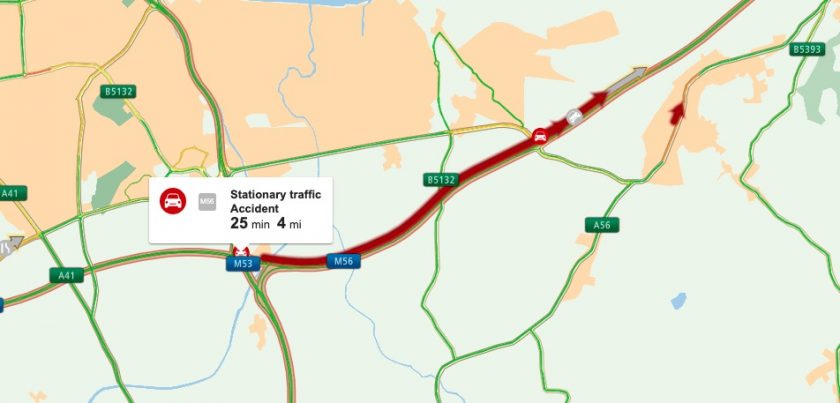

Significant M56 Congestion Cheshire Deeside Border Collision Impact

May 24, 2025

Significant M56 Congestion Cheshire Deeside Border Collision Impact

May 24, 2025

Latest Posts

-

Amsterdam Accueille Le Ces Unveiled Europe Les Technologies De Demain

May 24, 2025

Amsterdam Accueille Le Ces Unveiled Europe Les Technologies De Demain

May 24, 2025 -

Ces Unveiled Europe Nouveautes Technologiques A Amsterdam

May 24, 2025

Ces Unveiled Europe Nouveautes Technologiques A Amsterdam

May 24, 2025 -

Ces Unveiled Europe A Amsterdam Un Apercu Des Innovations Technologiques

May 24, 2025

Ces Unveiled Europe A Amsterdam Un Apercu Des Innovations Technologiques

May 24, 2025 -

Mathieu Avanzi Depasser Les Cliches Le Francais Aujourd Hui

May 24, 2025

Mathieu Avanzi Depasser Les Cliches Le Francais Aujourd Hui

May 24, 2025 -

Mathieu Avanzi Le Francais Plus Qu Une Matiere Scolaire

May 24, 2025

Mathieu Avanzi Le Francais Plus Qu Une Matiere Scolaire

May 24, 2025