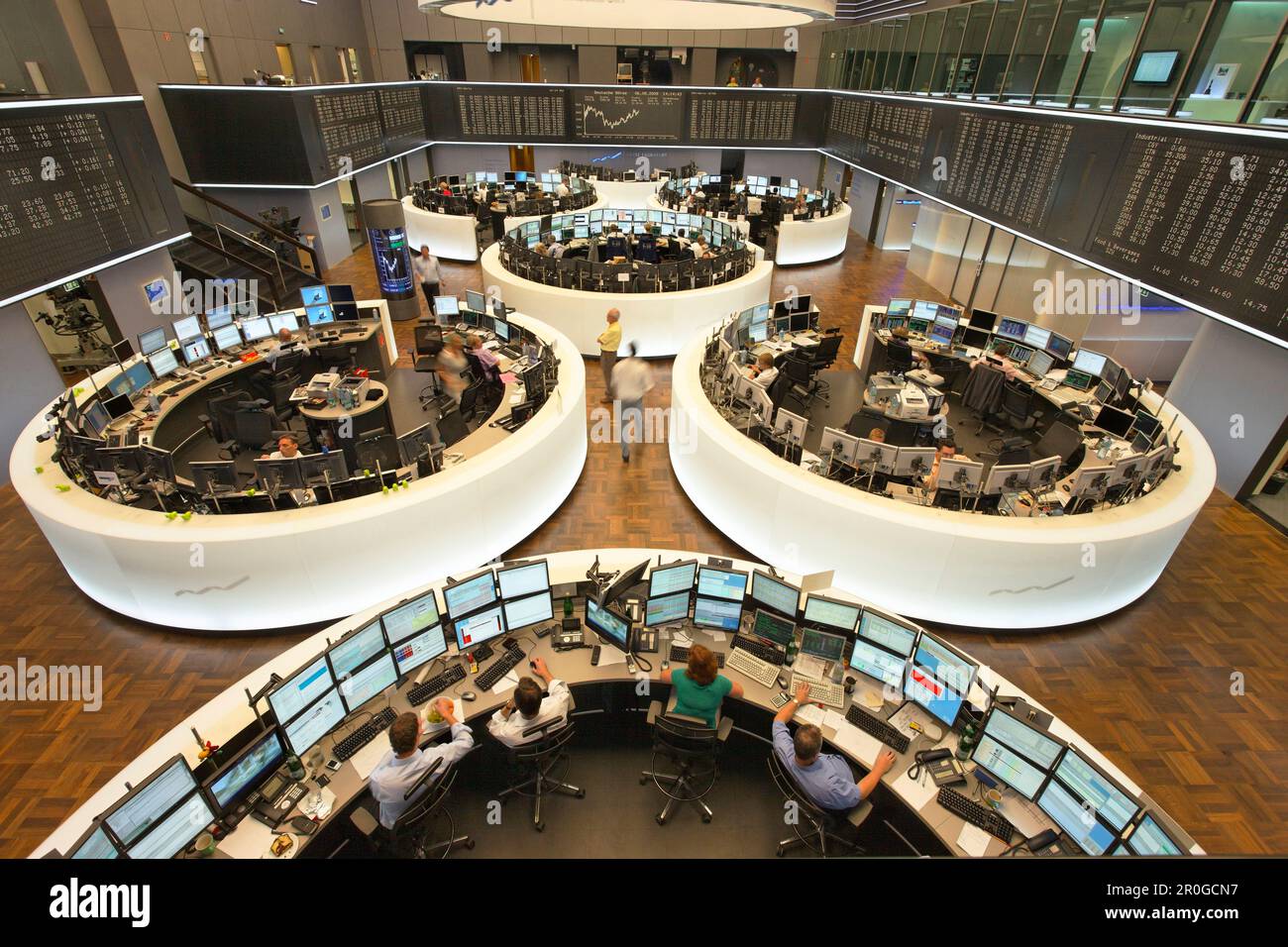

Frankfurt Stock Exchange Opens: DAX Maintains Stability Post-Record

Table of Contents

DAX Index Performance at Opening

Opening Value and Comparison to Previous Day's Close

The DAX opened today at 16,250.33 points, a slight increase of 0.12% compared to yesterday's closing value of 16,233.07. While a modest gain, this stability is significant considering the recent record high of 16,300 points reached last week. The minimal volatility during the opening hours further underscores the market's current cautious optimism.

- Opening Value: 16,250.33 points

- Percentage Change from Previous Day's Close: +0.12%

- Comparison to Recent Record High: -0.30%

- Opening Volatility: Minimal fluctuations observed during the first hour of trading.

Factors Contributing to DAX Stability

Global Economic Factors

The current global economic climate remains a complex mix of challenges and opportunities. While inflation continues to be a concern, the pace of increase seems to be slowing in some key economies, potentially easing pressure on the European Central Bank (ECB). Geopolitical events, particularly the ongoing conflict in Ukraine and its impact on energy prices, continue to be significant factors influencing investor sentiment. However, the DAX's stability suggests a degree of resilience in the German economy.

- Impact of Inflation: While inflation remains above target, its decelerating trend has fostered some confidence among investors.

- Effect of ECB Interest Rates: The ECB's recent interest rate decisions are being closely watched, with their impact on borrowing costs and economic growth yet to be fully realised.

- Influence of Global Events: The energy crisis stemming from the war in Ukraine remains a significant concern, but proactive measures by the German government are attempting to mitigate its effects.

Performance of Key DAX Companies

The relatively stable DAX performance reflects a mixed bag of results from its constituent companies. While some sectors, such as technology, are showing signs of strength, others like automotive are facing headwinds. Volkswagen, a DAX heavyweight, experienced a slight dip today, while Siemens saw a modest gain. The chemicals sector, represented by BASF, showed relatively flat performance. This balanced performance across sectors suggests a degree of internal resilience within the DAX.

- Volkswagen: Slight decrease in share price.

- Siemens: Modest increase in share price.

- BASF: Relatively flat performance.

- Sector Performance: Technology showing strength; automotive facing some challenges.

Investor Sentiment and Market Outlook

Analyst Predictions and Market Forecasts

Financial analysts remain largely optimistic about the DAX's long-term prospects, despite the ongoing global uncertainty. Many believe that the current stability reflects a cautious optimism in anticipation of upcoming economic data releases. Predictions for future interest rate changes vary, with some anticipating further increases from the ECB while others foresee a pause or even a potential rate cut later in the year.

- Analyst Quotes: "The DAX is showing remarkable resilience," said one analyst, highlighting the strength of the German economy.

- Interest Rate Predictions: Forecasts vary, with some expecting further rate hikes and others predicting a pause or potential decrease.

- Upcoming Economic Indicators: GDP growth figures and inflation reports for the next quarter will be closely scrutinised for their impact on the DAX.

Trading Volume and Investor Behavior

Trading volume on the Frankfurt Stock Exchange today was slightly below average, suggesting a degree of caution among investors. However, this relatively low volume, combined with the positive, albeit modest, movement of the DAX, could indicate a consolidating market, rather than a signal of significant concern.

- Trading Volume: Slightly below average.

- Interpretation: Suggests a cautious, consolidating market rather than overt pessimism.

- Investor Sentiment: Mixed, but leaning towards cautious optimism.

Conclusion

The Frankfurt Stock Exchange opened today with the DAX showing remarkable stability, holding steady after its recent record high. This performance is significant considering the current global economic uncertainties. The DAX's resilience is attributable to a combination of factors: a somewhat easing inflation trend, the performance of key DAX companies, and a cautiously optimistic investor sentiment. While the market outlook remains subject to global events and upcoming economic data, the DAX’s current stability offers a degree of reassurance for investors in the German stock market.

Call to Action: Stay informed about the daily performance of the Frankfurt Stock Exchange and the DAX index for up-to-date insights into the German and European markets. Follow our website/blog for continuous coverage of the Frankfurt Stock Exchange and DAX market analysis. For in-depth analyses and investment strategies related to the DAX and the Frankfurt Stock Exchange, subscribe to our premium service.

Featured Posts

-

Legendas F1 Motorral Felszerelt Porsche Reszletes Bemutatas

May 24, 2025

Legendas F1 Motorral Felszerelt Porsche Reszletes Bemutatas

May 24, 2025 -

Fedor Lavrov O Pavle I Pochemu Lyudi Lyubyat Schekotat Nervy

May 24, 2025

Fedor Lavrov O Pavle I Pochemu Lyudi Lyubyat Schekotat Nervy

May 24, 2025 -

Strong Frankfurt Opening Dax Index Pushes Towards New Record

May 24, 2025

Strong Frankfurt Opening Dax Index Pushes Towards New Record

May 24, 2025 -

Realizing Your Dream An Escape To The Country

May 24, 2025

Realizing Your Dream An Escape To The Country

May 24, 2025 -

Apple Stock Price Key Levels Breached Ahead Of Q2 Earnings

May 24, 2025

Apple Stock Price Key Levels Breached Ahead Of Q2 Earnings

May 24, 2025

Latest Posts

-

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Controversy

May 24, 2025

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Controversy

May 24, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025 -

Farrow Seeks Trumps Incarceration Focus On Venezuelan Deportations

May 24, 2025

Farrow Seeks Trumps Incarceration Focus On Venezuelan Deportations

May 24, 2025