Strong Frankfurt Opening: DAX Index Pushes Towards New Record

Table of Contents

Key Factors Driving the DAX's Rise

Several interconnected factors contribute to the DAX index's impressive rise, painting a picture of a thriving German economy and attracting global investment.

Positive Economic Data

Recent economic reports from Germany paint a rosy picture, bolstering investor confidence and fueling demand for DAX stocks.

- GDP Growth: Germany's GDP growth exceeded expectations in the last quarter, posting a robust X% increase (replace X with actual data). This signifies strong economic momentum and underpins the positive sentiment surrounding the DAX.

- Unemployment Rate: The unemployment rate remains low at Y% (replace Y with actual data), indicating a healthy labor market and strong consumer spending power, further contributing to economic growth.

- Industrial Production: Industrial production figures show a Z% increase (replace Z with actual data), particularly strong in the automotive and technology sectors, signaling a healthy manufacturing base and driving the DAX's upward trajectory. These sectors are key drivers of the German economy and their performance directly impacts the DAX.

These positive indicators collectively boost investor confidence, leading to increased demand for DAX-listed stocks and pushing the index to new heights.

Global Economic Optimism

The positive trajectory of the DAX is not isolated; it reflects broader global economic optimism that spills over into the German market.

- US Economic Growth: Sustained growth in the US economy provides a positive external influence on the DAX, as it is a major trading partner for Germany.

- Easing Global Uncertainty: A reduction in geopolitical uncertainties and trade tensions creates a more stable and predictable global economic environment, encouraging foreign investment in the DAX.

- Positive Sentiment in China: Positive economic signals emerging from China, a significant trading partner, also contribute to overall investor confidence and influence the DAX's performance.

Improved global conditions create a favorable environment for investment in the German market, making the DAX an attractive option for international investors.

Strong Corporate Earnings

Robust financial reports from major DAX-listed companies significantly contribute to the index's rise.

- Exceeding Expectations: Several prominent companies have recently exceeded earnings expectations, demonstrating strong financial performance and boosting investor confidence. Examples include [insert company names and brief descriptions of their performance].

- Strong Sectors: Sectors like luxury goods and pharmaceuticals are showing particularly robust earnings growth, further driving the DAX's upward momentum. This diversification of strength across various sectors signals a robust and resilient German economy.

These positive earnings reports reinforce the perception of a healthy and growing German economy, directly impacting stock prices and driving the DAX index higher.

Implications for Investors

The DAX's rise presents both exciting opportunities and potential risks for investors.

Investment Opportunities

The upward trend creates various investment opportunities for those interested in the German market.

- Sector-Specific Investments: Investors can focus on specific sectors exhibiting robust growth, such as the automotive or technology sectors, for targeted returns.

- Individual Stock Selection: Careful analysis of individual companies within the DAX can reveal promising investment opportunities.

- Long-Term vs. Short-Term Strategies: Investors can choose between long-term holding strategies for steady growth or short-term trading to capitalize on market fluctuations.

However, it's crucial to understand that past performance does not guarantee future results.

Potential Risks and Challenges

While the outlook is positive, investors should acknowledge potential risks that could hinder continued growth.

- Inflationary Pressures: Rising inflation could erode corporate profits and dampen investor sentiment, potentially leading to a market correction.

- Geopolitical Uncertainty: Unforeseen geopolitical events could negatively impact market confidence and trigger volatility in the DAX.

- Interest Rate Changes: Changes in interest rates by the European Central Bank could influence borrowing costs and impact investor behavior, potentially affecting the DAX's performance.

A balanced perspective acknowledging these potential downsides is crucial for making informed investment decisions.

Technical Analysis of the DAX

Technical analysis provides valuable insights into the DAX's short-term and long-term outlook.

Chart Patterns and Indicators

Analyzing chart patterns and key technical indicators offers a clearer understanding of the market's trajectory.

- Moving Averages: The behavior of moving averages (e.g., 50-day, 200-day) indicates the overall trend direction.

- RSI (Relative Strength Index): The RSI helps assess whether the DAX is overbought or oversold, indicating potential short-term reversals.

- MACD (Moving Average Convergence Divergence): The MACD identifies momentum changes and potential shifts in trend.

- Support and Resistance Levels: Identifying support and resistance levels helps predict potential price movements and potential areas of consolidation or breakout.

Careful interpretation of these indicators can aid in formulating effective trading strategies.

Conclusion

The DAX index's strong opening reflects a confluence of positive factors, including robust economic data, global economic optimism, and strong corporate earnings. This upward trend presents attractive opportunities for investors seeking exposure to the German market. However, investors should remain vigilant and aware of the potential risks associated with market volatility. While the current trajectory is promising, a balanced approach considering both opportunities and risks is crucial.

Call to Action: Stay informed about the latest developments in the DAX index and the German stock market to make informed investment decisions. Track the DAX's performance closely, and adjust your investment strategy accordingly. Consider consulting a financial advisor before making significant investment choices in the DAX Index or German stocks. Remember that investing always involves risk, and past performance is not indicative of future results.

Featured Posts

-

Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc Explained

May 24, 2025

Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc Explained

May 24, 2025 -

Financing Your Escape To The Country Practical Tips

May 24, 2025

Financing Your Escape To The Country Practical Tips

May 24, 2025 -

Annie Kilners Solo Outing After Kyle Walkers Night Out

May 24, 2025

Annie Kilners Solo Outing After Kyle Walkers Night Out

May 24, 2025 -

Your Dream Country Escape Location Lifestyle And Logistics

May 24, 2025

Your Dream Country Escape Location Lifestyle And Logistics

May 24, 2025 -

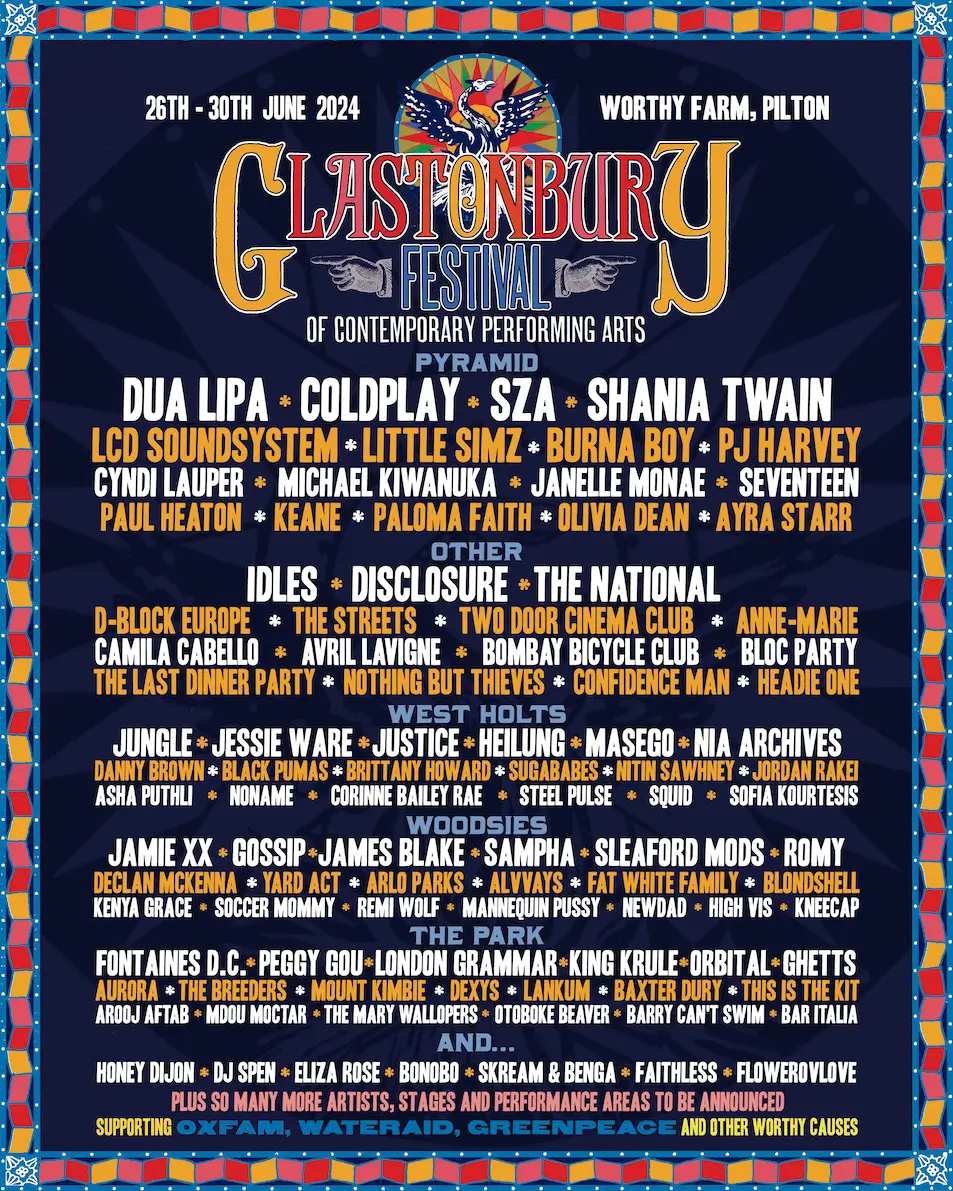

Glastonbury 2025 Announced Lineup Sparks Outrage Among Fans

May 24, 2025

Glastonbury 2025 Announced Lineup Sparks Outrage Among Fans

May 24, 2025

Latest Posts

-

Dreyfus Affair Proposed Posthumous Promotion Highlights Frances Ongoing Reconciliation

May 24, 2025

Dreyfus Affair Proposed Posthumous Promotion Highlights Frances Ongoing Reconciliation

May 24, 2025 -

Seeking Change Facing Punishment Navigating Reprisals For Dissent

May 24, 2025

Seeking Change Facing Punishment Navigating Reprisals For Dissent

May 24, 2025 -

Facing Retribution The High Cost Of Challenging The Status Quo

May 24, 2025

Facing Retribution The High Cost Of Challenging The Status Quo

May 24, 2025 -

The Perils Of Change When Seeking Improvement Leads To Punishment

May 24, 2025

The Perils Of Change When Seeking Improvement Leads To Punishment

May 24, 2025 -

Punished For Seeking Change Understanding The Consequences Of Dissent

May 24, 2025

Punished For Seeking Change Understanding The Consequences Of Dissent

May 24, 2025