Net Asset Value (NAV) Of Amundi MSCI All Country World UCITS ETF USD Acc: Explained

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the underlying value of each share in an investment fund, like the Amundi MSCI All Country World UCITS ETF USD Acc. It's a crucial metric for asset-backed investments, providing a snapshot of the fund's worth. Unlike share prices which can fluctuate throughout the trading day based on supply and demand, the NAV represents the actual value of the assets held within the fund. It's calculated by a simple formula:

- NAV = Total Assets - Total Liabilities

This means:

- Assets: Include the market value of all the securities (stocks, bonds, etc.) held within the Amundi MSCI All Country World UCITS ETF USD Acc portfolio. This is constantly changing based on market movements.

- Liabilities: Encompass all the expenses and debts associated with the fund's operation, such as management fees and other operational costs.

The NAV per share is then calculated by dividing the total NAV by the number of outstanding shares. This gives you the intrinsic value of a single share in the ETF.

How is the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc Calculated?

The daily NAV of the Amundi MSCI All Country World UCITS ETF USD Acc is meticulously calculated by Amundi. The process involves several key steps:

- Daily Market Value Assessment: The market value of each asset within the ETF's portfolio is determined using the closing prices of the respective securities on the relevant exchanges.

- Currency Conversion: Since this is a USD Acc (Accumulation) ETF, any holdings denominated in currencies other than USD are converted to USD using the prevailing exchange rates at the end of the trading day. This ensures the NAV accurately reflects the USD value of the portfolio.

- Expense Deduction: All expenses related to running the ETF, including management fees and operating costs, are deducted from the total asset value.

- NAV Per Share Calculation: The net asset value is then divided by the total number of outstanding shares to determine the NAV per share.

- Publication: The calculated NAV per share is then published daily, usually at the close of market hours.

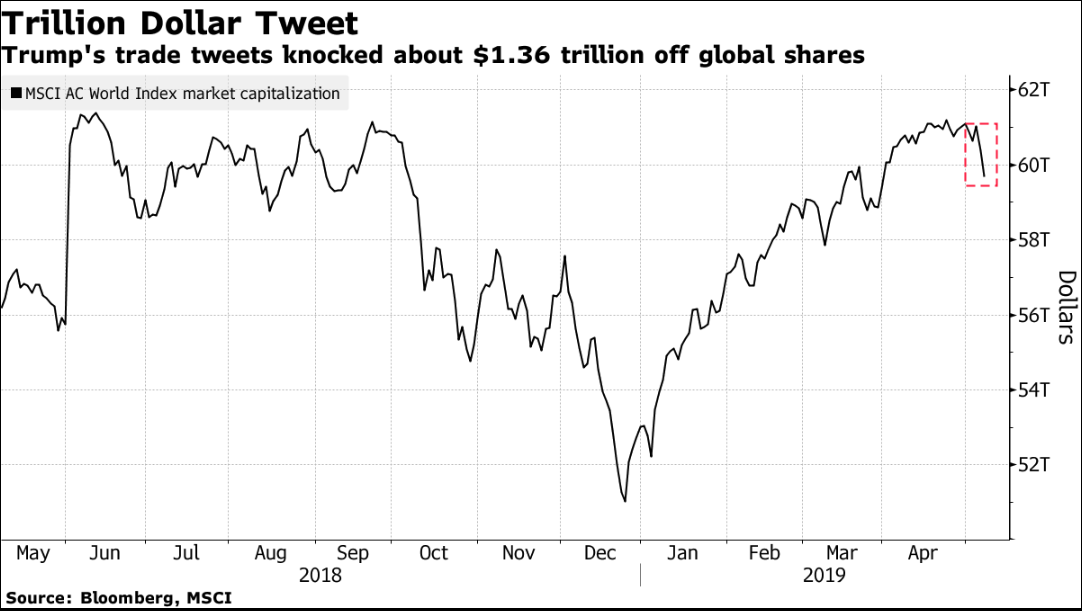

The Importance of the MSCI All Country World Index

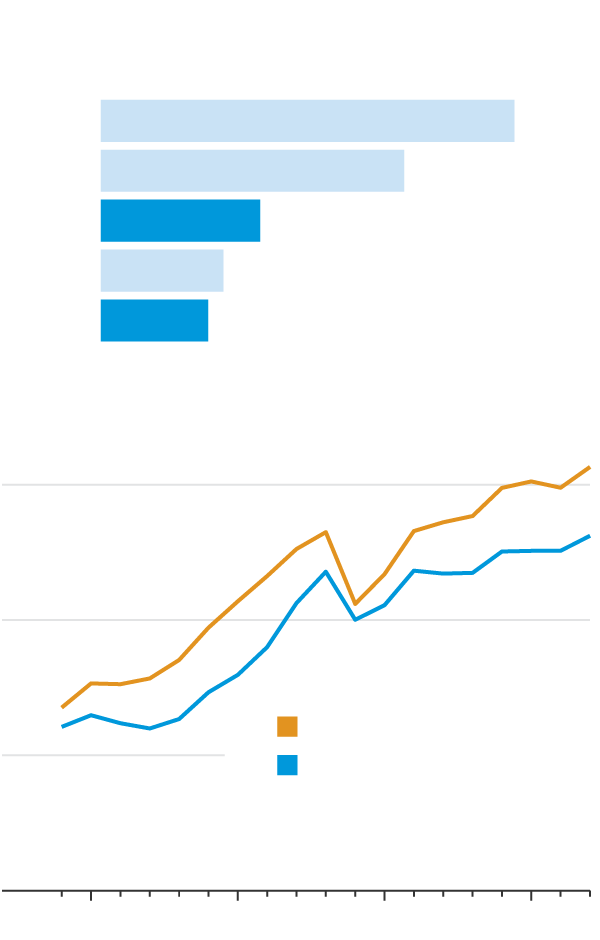

The Amundi MSCI All Country World UCITS ETF USD Acc aims to track the performance of the MSCI All Country World Index. This benchmark index serves as a representation of the global equity market. The ETF's holdings are carefully selected to mirror the composition of this index. Therefore, the MSCI All Country World Index plays a significant role in determining the ETF's NAV, providing investors with exposure to a broad range of global markets. The closer the ETF's performance tracks the index, the better it reflects the overall global market trends. This index tracking methodology is a key factor in understanding the ETF's NAV movements.

Why is Understanding the NAV Important for Investors?

Monitoring the NAV of your Amundi MSCI All Country World UCITS ETF USD Acc is vital for several reasons:

- Performance Monitoring: Tracking the NAV allows you to monitor your investment's performance over time. You can easily compare your returns to the benchmark MSCI All Country World Index.

- Risk Assessment: By observing NAV fluctuations, you can gain insight into the volatility of your investment and assess the associated risks.

- Informed Decision-Making: Understanding the NAV empowers you to make informed decisions about buying or selling your ETF shares. You can make these choices based on the underlying value of your investment, rather than solely on the market price.

- Portfolio Value: Knowing the NAV gives you a clear picture of the current value of your portfolio, which is crucial for long-term financial planning.

Where to Find the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc?

Several reliable sources provide the daily NAV for the Amundi MSCI All Country World UCITS ETF USD Acc:

- Amundi's Official Website: The most reliable source is usually the asset manager's website itself. Check Amundi's website for the latest NAV figures.

- Financial News Websites: Reputable financial news sources frequently publish ETF NAV data.

- Brokerage Platforms: Your brokerage account will display the NAV of your held ETFs, usually with a delay.

Conclusion:

Understanding the Net Asset Value (NAV) of your Amundi MSCI All Country World UCITS ETF USD Acc is crucial for effective investment management. By regularly checking the NAV, you gain a clear picture of your investment's performance, allowing you to make informed decisions and track its progress against the MSCI All Country World Index. Regularly check the NAV of your Amundi MSCI All Country World UCITS ETF USD Acc holdings to stay informed about your investment’s performance. Understanding the Net Asset Value is key to successful investing in this global ETF. Learn more about Amundi ETFs and their NAV calculations today!

Featured Posts

-

Hvad Er Nytt I Fyrstu Rafutgafu Porsche Macan

May 24, 2025

Hvad Er Nytt I Fyrstu Rafutgafu Porsche Macan

May 24, 2025 -

Escape To The Country Nicki Chapmans Chiswick Garden Revealed

May 24, 2025

Escape To The Country Nicki Chapmans Chiswick Garden Revealed

May 24, 2025 -

Dog Walker Drama Kyle And Teddis Fiery Exchange

May 24, 2025

Dog Walker Drama Kyle And Teddis Fiery Exchange

May 24, 2025 -

Kering Q1 Results Send Shares Down 6

May 24, 2025

Kering Q1 Results Send Shares Down 6

May 24, 2025 -

France Revisits Dreyfus Affair Legislators Advocate For Promotion

May 24, 2025

France Revisits Dreyfus Affair Legislators Advocate For Promotion

May 24, 2025

Latest Posts

-

Trumps Tariff Relief Hint Boosts European Stocks Lvmh Shares Fall

May 24, 2025

Trumps Tariff Relief Hint Boosts European Stocks Lvmh Shares Fall

May 24, 2025 -

European Shares Rise On Trump Tariff Hint Lvmh Dips

May 24, 2025

European Shares Rise On Trump Tariff Hint Lvmh Dips

May 24, 2025 -

Sundays Demonstration Assessing The National Rallys Show Of Support For Le Pen

May 24, 2025

Sundays Demonstration Assessing The National Rallys Show Of Support For Le Pen

May 24, 2025 -

Analysis Did Le Pens National Rally Demonstration Achieve Its Goals

May 24, 2025

Analysis Did Le Pens National Rally Demonstration Achieve Its Goals

May 24, 2025 -

Le Pens Support Base Questioned After Low Turnout At National Rally Demonstration

May 24, 2025

Le Pens Support Base Questioned After Low Turnout At National Rally Demonstration

May 24, 2025