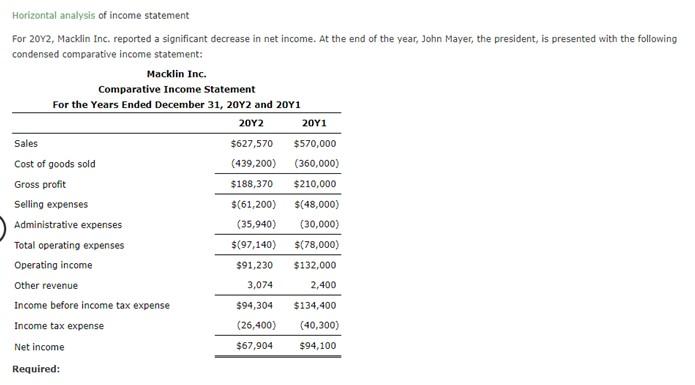

Analysis Of Tesla's Q1 Earnings: 71% Net Income Decrease Explained

Table of Contents

Price Wars and Reduced Profit Margins

The significant drop in Tesla's Q1 net income is largely attributed to aggressive price cuts and intensifying competition within the electric vehicle (EV) market.

The Impact of Price Cuts

Tesla implemented aggressive price cuts in Q1 2024, particularly in the crucial Chinese market, to stimulate sales volume. This strategy, while boosting deliveries, significantly impacted average selling prices (ASP).

- Effect on ASP: The price reductions led to a considerable decrease in Tesla's average selling price, directly impacting overall revenue generation. The impact was most keenly felt in China, a key market for Tesla's growth.

- Impact on Overall Revenue: While sales volume increased, the lower ASP meant that the overall revenue growth didn't match expectations, contributing to the lower net income. Financial reports show a clear correlation between the price cuts and reduced revenue per vehicle.

- Strategic Rationale: Tesla's price cuts were likely a strategic move to maintain market share amidst growing competition and to increase overall vehicle deliveries. The hope was that higher sales volume would offset the lower profit margins per unit.

- Competitor Responses: Competitors, such as BYD and other established automakers, quickly responded to Tesla’s price cuts, further intensifying the price war and compressing profit margins across the industry.

Increased Competition in the EV Market

The EV market is becoming increasingly crowded. Tesla is facing stiffer competition from established automakers launching their own EV models and rapidly growing Chinese EV manufacturers.

- Key Competitors: Competitors like BYD, Volkswagen, and Hyundai are aggressively expanding their EV portfolios, offering compelling alternatives to Tesla vehicles.

- Market Strategies: Competitors are employing various strategies, including aggressive pricing, innovative features, and expanded charging infrastructure, to capture market share.

- Pricing and Features: Many competitors are offering comparable features at lower price points, directly challenging Tesla's pricing strategy and market dominance.

- Market Share Shifts: The competitive landscape is shifting, with some analysis suggesting a small decrease in Tesla's overall market share in certain regions.

Supply Chain Challenges and Increased Costs

Tesla's Q1 earnings were also negatively impacted by persistent supply chain challenges and escalating input costs.

Raw Material Inflation

Rising prices for critical raw materials are a major factor influencing Tesla's profitability.

- Price Increases: The cost of lithium, nickel, and aluminum, essential components in EV batteries, has skyrocketed in recent months, putting significant pressure on Tesla's production costs. Specific data on these price increases can be found in Tesla's quarterly reports.

- Impact on Profit Margins: The increased cost of raw materials directly eats into Tesla's already compressed profit margins, further exacerbating the decline in net income.

- Mitigation Efforts: Tesla is actively pursuing strategies to mitigate these rising costs, including vertical integration (e.g., investing in its own lithium mining and refining operations) to secure its supply chain.

Logistics and Transportation Costs

Global supply chain disruptions and increased freight costs add further pressure to Tesla's bottom line.

- Supply Chain Bottlenecks: Ongoing challenges, such as port congestion and transportation delays, continue to disrupt Tesla's manufacturing and delivery processes.

- Consequences of Bottlenecks: These disruptions lead to increased inventory holding costs, production delays, and ultimately, reduced profitability.

- Strategies to Manage Challenges: Tesla is implementing various strategies to improve its supply chain resilience, including diversifying its supplier base and investing in more efficient logistics solutions.

Increased Operational Expenses and Investments

Tesla's substantial investments in R&D and expansion also played a role in the reduced net income.

R&D and Expansion Costs

Tesla continues to invest heavily in research and development (R&D), particularly in autonomous driving technology and new vehicle platforms.

- R&D Spending: A significant portion of Tesla's operating expenses is allocated to R&D, reflecting the company’s commitment to technological innovation.

- Key Projects: These investments include advancements in Full Self-Driving (FSD) capabilities, development of next-generation battery technology, and expansion into new vehicle segments.

- Long-Term Strategic Rationale: While these investments currently impact short-term profitability, they are crucial for Tesla's long-term strategic goals and future growth.

Sales and Marketing Expenditure

Tesla's sales and marketing strategies also contribute to its operational expenses.

- Marketing Approaches: Tesla's marketing strategy, which relies heavily on brand building and word-of-mouth marketing, has evolved.

- Effectiveness of Marketing: While less traditional than competitors, Tesla’s marketing appears effective in maintaining brand recognition and generating excitement around new models.

- Return on Investment (ROI): Analyzing the ROI of Tesla’s marketing campaigns requires further study, as the long-term value creation of brand-building is less easily measured than traditional advertising.

External Factors Affecting Tesla's Performance

Macroeconomic conditions and geopolitical uncertainty also affected Tesla’s Q1 performance.

Macroeconomic Conditions

Global macroeconomic factors significantly influence consumer spending and demand for EVs.

- Inflation and Interest Rate Hikes: High inflation and increased interest rates reduce consumer purchasing power, impacting demand for luxury goods, such as Tesla vehicles.

- Influence on Sales: This decreased consumer confidence is reflected in Tesla's sales figures for the quarter.

Geopolitical Uncertainty

Geopolitical events and trade tensions also affect Tesla's operations and supply chains.

- Geopolitical Events: Ongoing geopolitical instability and trade disputes can disrupt supply chains and impact production.

- Regions Significantly Impacted: Specific regions, where Tesla has production facilities or significant markets, may be particularly vulnerable to these disruptions.

Conclusion

Tesla's 71% decrease in Q1 net income is a complex issue stemming from a confluence of factors. Aggressive price wars leading to reduced profit margins, persistent supply chain challenges and increased costs, substantial investments in R&D and expansion, and external macroeconomic and geopolitical pressures all contributed to this significant downturn. While the immediate outlook may present challenges, Tesla's long-term strategy centered around technological leadership and expansion continues. The company's ability to navigate these challenges and maintain its market position will be crucial for its future success.

Call to Action: Stay informed about the evolving landscape of the electric vehicle market and Tesla's financial performance by regularly checking back for our in-depth analysis of future Tesla Q[Number] earnings reports. Continue to follow our updates on Tesla Q1 Earnings and related news for crucial insights into the future of electric vehicles.

Featured Posts

-

Examine The Liberal Platform Informed Voting In Year Election Cycle

Apr 24, 2025

Examine The Liberal Platform Informed Voting In Year Election Cycle

Apr 24, 2025 -

Voting Liberal A Critical Analysis Of Their Platform

Apr 24, 2025

Voting Liberal A Critical Analysis Of Their Platform

Apr 24, 2025 -

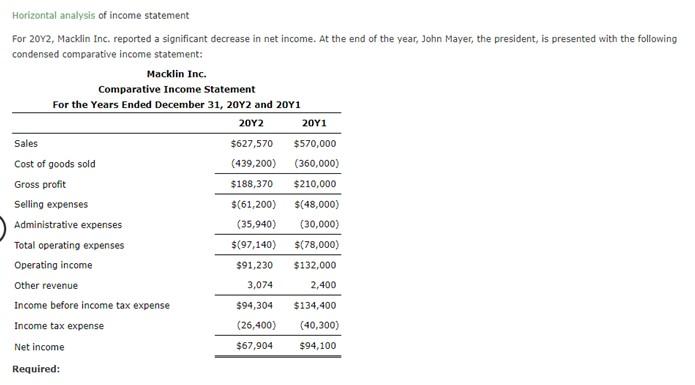

Stock Market Gains Nasdaq S And P 500 And Dows 1000 Point Surge

Apr 24, 2025

Stock Market Gains Nasdaq S And P 500 And Dows 1000 Point Surge

Apr 24, 2025 -

Understanding The Value Of Middle Managers In Todays Workplace

Apr 24, 2025

Understanding The Value Of Middle Managers In Todays Workplace

Apr 24, 2025 -

Ftc Investigates Open Ais Chat Gpt What This Means For Ai

Apr 24, 2025

Ftc Investigates Open Ais Chat Gpt What This Means For Ai

Apr 24, 2025

Latest Posts

-

Young Thug Teases Uy Scuti Album Release Date

May 10, 2025

Young Thug Teases Uy Scuti Album Release Date

May 10, 2025 -

Edmontons Nordic Spa Dreams Closer To Reality Council Approves Rezoning

May 10, 2025

Edmontons Nordic Spa Dreams Closer To Reality Council Approves Rezoning

May 10, 2025 -

Young Thugs Uy Scuti Release Date Hints And Album Expectations

May 10, 2025

Young Thugs Uy Scuti Release Date Hints And Album Expectations

May 10, 2025 -

Edmonton Nordic Spa Rezoning Approved Project Moves Forward

May 10, 2025

Edmonton Nordic Spa Rezoning Approved Project Moves Forward

May 10, 2025 -

Beyonces Cowboy Carter Double The Streams Post Tour Debut

May 10, 2025

Beyonces Cowboy Carter Double The Streams Post Tour Debut

May 10, 2025