Stock Market Gains: Nasdaq, S&P 500, And Dow's 1000-Point Surge

Table of Contents

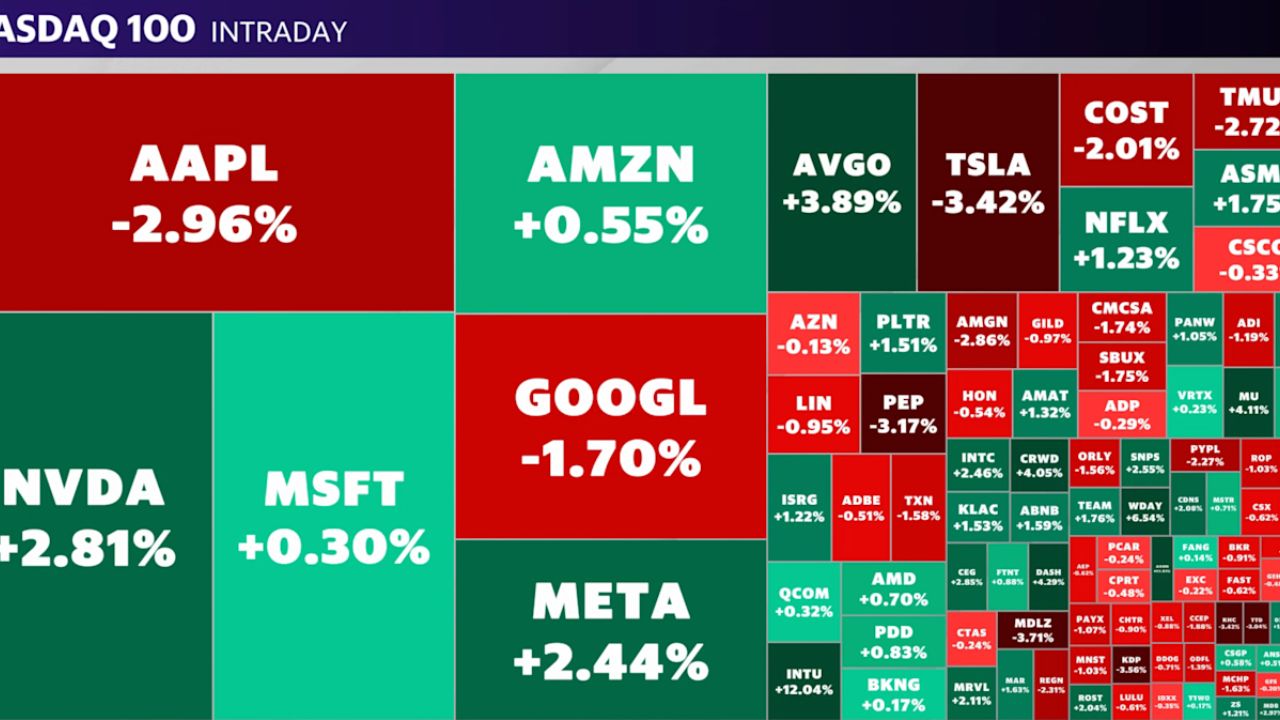

Analyzing the Nasdaq's Performance in the Recent Surge

The Nasdaq Composite, heavily weighted towards technology stocks, played a significant role in the recent 1000-point market surge. Its performance reflects the overall health and investor sentiment within the tech sector.

Factors Contributing to Nasdaq's Growth:

- Strong Tech Sector Performance: The tech sector's robust performance was the primary driver of the Nasdaq's growth. Companies like Apple, Microsoft, and Nvidia, among others, saw substantial increases in their stock prices, directly contributing to the overall index gains. This indicates strong investor confidence in the future of technological innovation.

- Positive Investor Sentiment: Positive investor sentiment towards tech stocks fueled significant buying activity, pushing prices higher. Announcements of strong earnings reports, promising product launches, and advancements in artificial intelligence (AI) all contributed to this optimism.

- Technological Advancements: Breakthroughs in AI, cloud computing, and other emerging technologies have fueled significant growth and investment in the tech sector. These advancements promise future profitability, attracting further investment and driving stock prices up. This positive feedback loop contributes to the Nasdaq's impressive gains.

Nasdaq Volatility and Future Predictions:

Despite the significant surge, the Nasdaq remains subject to volatility. Several factors could impact its future performance:

- Interest Rate Hikes: Rising interest rates can impact the valuation of growth stocks, potentially dampening the enthusiasm surrounding the tech sector.

- Geopolitical Uncertainty: Global events and geopolitical instability can create uncertainty and influence investor behavior, potentially leading to market corrections.

- Inflation Concerns: Persistent inflationary pressures could negatively influence consumer spending and corporate profits, impacting the overall performance of tech companies.

Experts offer varied predictions. Some anticipate continued growth driven by technological innovation, while others warn of potential corrections due to the factors mentioned above. Careful monitoring of these factors is crucial for making sound investment decisions.

Deciphering the S&P 500's Contribution to the 1000-Point Surge

The S&P 500, a broad market index representing 500 large-cap US companies across various sectors, provides a broader picture of the overall US economy's health. Its contribution to the 1000-point surge underscores the strength and resilience of the US market.

Broad Market Strength and the S&P 500:

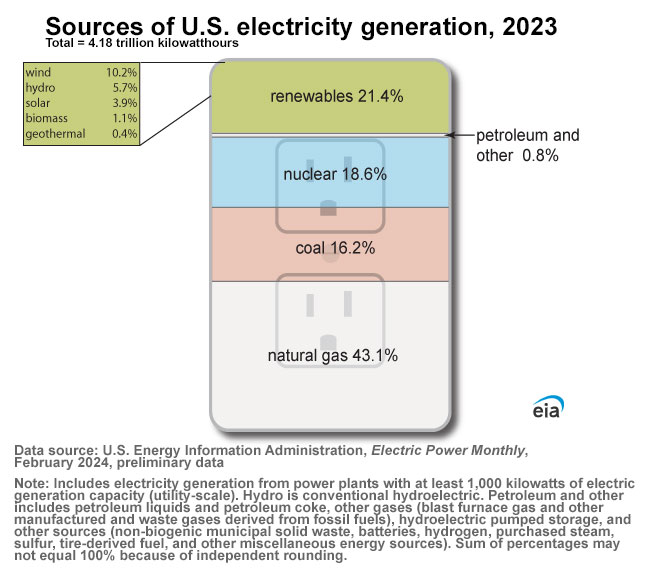

- Overall Economic Health: The S&P 500's performance reflects a generally positive outlook for the US economy, indicating strong corporate profitability and consumer confidence.

- Diverse Sector Performance: While the tech sector's growth contributed significantly, gains across multiple sectors within the S&P 500 demonstrate broad-based strength. This suggests a healthy and diverse economy.

- Strong Corporate Earnings: Strong corporate earnings reports across various sectors boosted investor confidence and contributed directly to the S&P 500's rise. These positive results fueled buying pressure, driving up stock prices.

S&P 500: Long-Term Growth Potential and Risks:

The S&P 500's long-term growth potential remains significant, but investors must consider several potential risks:

- Inflationary Pressures: High inflation can erode corporate profits and consumer purchasing power, potentially limiting future growth.

- Interest Rate Increases: Increased interest rates can impact borrowing costs for businesses and influence investor behavior, leading to market corrections.

- Geopolitical Instability: Global uncertainties and geopolitical events can significantly impact market sentiment and investor confidence, influencing the S&P 500's performance.

Understanding the Dow Jones's Role in the 1000-Point Market Rally

The Dow Jones Industrial Average, comprised of 30 large, established companies, offers a different perspective on the market surge. Its performance highlights the resilience of blue-chip stocks.

Dow Jones's Resilience and its Blue-Chip Companies:

- Blue-Chip Strength: The Dow Jones's resilience demonstrates the stability of large, established companies, often considered safer investments during periods of market uncertainty.

- Key Company Performance: Strong performance from key blue-chip companies, such as those in the industrial, financial, and consumer goods sectors, significantly contributed to the index's gains.

- Stable Investment Option: Blue-chip stocks, represented in the Dow Jones, often serve as a stable foundation for investment portfolios, offering a degree of protection against market volatility.

Dow Jones: Future Projections and Investment Strategies:

Future projections for the Dow Jones are positive, but cautious optimism is warranted:

- Market Trends: Analyzing current market trends, including economic growth, inflation rates, and geopolitical factors, is crucial for forecasting future performance.

- Investment Strategies: Diversification across various sectors and asset classes remains a crucial aspect of sound investment strategies.

- Risk Management: Implementing effective risk management strategies is crucial for mitigating potential losses and safeguarding investments during periods of market volatility.

Conclusion: Navigating the Stock Market After a 1000-Point Surge

The recent 1000-point stock market surge, impacting the Nasdaq, S&P 500, and Dow Jones, resulted from a confluence of factors, including strong corporate earnings, positive investor sentiment, and technological advancements. However, it's crucial to remember that market dynamics are complex and influenced by numerous variables. Understanding these dynamics and performing thorough research is essential for informed investment decisions. Careful analysis, risk assessment, and diversification are vital for navigating the complexities of the market and capitalizing on future opportunities. Continue your research and make informed decisions regarding your investment strategies based on this analysis of the recent stock market gains.

Featured Posts

-

Trumps Immigration Enforcement New Legal Setbacks

Apr 24, 2025

Trumps Immigration Enforcement New Legal Setbacks

Apr 24, 2025 -

Country Name S Rising Business Stars Locational Analysis And Trends

Apr 24, 2025

Country Name S Rising Business Stars Locational Analysis And Trends

Apr 24, 2025 -

Elon Musk Doge And The Epa A Turning Point For Tesla And Space X

Apr 24, 2025

Elon Musk Doge And The Epa A Turning Point For Tesla And Space X

Apr 24, 2025 -

Canadian Conservative Platform Tax Cuts And Fiscal Responsibility

Apr 24, 2025

Canadian Conservative Platform Tax Cuts And Fiscal Responsibility

Apr 24, 2025 -

Cassidy Hutchinsons Memoir A Look Inside The January 6th Hearings

Apr 24, 2025

Cassidy Hutchinsons Memoir A Look Inside The January 6th Hearings

Apr 24, 2025

Latest Posts

-

Elon Musks Fortune Examining The Influence Of Us Economic Factors

May 10, 2025

Elon Musks Fortune Examining The Influence Of Us Economic Factors

May 10, 2025 -

The Correlation Between Us Economic Power And Elon Musks Wealth

May 10, 2025

The Correlation Between Us Economic Power And Elon Musks Wealth

May 10, 2025 -

Did Us Economic Conditions Affect Elon Musks Net Worth And Tesla

May 10, 2025

Did Us Economic Conditions Affect Elon Musks Net Worth And Tesla

May 10, 2025 -

Elon Musk Net Worth 2024 Analyzing The Impact Of Us Economic Shifts

May 10, 2025

Elon Musk Net Worth 2024 Analyzing The Impact Of Us Economic Shifts

May 10, 2025 -

100 Days Of Trump How Did It Affect Elon Musks Net Worth

May 10, 2025

100 Days Of Trump How Did It Affect Elon Musks Net Worth

May 10, 2025