Canadian Conservative Platform: Tax Cuts And Fiscal Responsibility

Table of Contents

Proposed Tax Cuts

The Canadian Conservative Party’s approach to economic policy typically centers around significant tax cuts designed to stimulate economic growth. These cuts are usually targeted at individuals, corporations, and specific sectors through targeted tax credits and deductions.

Individual Income Tax Reductions

Conservatives typically advocate for broad-based reductions in individual income tax rates across various brackets. The rationale is that lower taxes leave more disposable income in the hands of Canadians, boosting consumer spending and driving economic activity.

- Specific examples: Recent platforms have proposed percentage reductions varying by income bracket, aiming for a simplified tax system with fewer brackets. For example, a previous platform may have suggested a reduction of X% for the lowest bracket and Y% for the highest bracket. These numbers would need to be updated to reflect the most current platform.

- Claimed economic benefits: The party often projects increased consumer spending, leading to job creation and overall economic expansion as a result of these individual income tax reductions.

- Criticisms and counterarguments: Critics argue that such cuts disproportionately benefit higher-income earners, exacerbating income inequality. Furthermore, there are concerns about the potential impact on government revenue and the funding of crucial public services. The effectiveness of trickle-down economics remains a subject of ongoing debate.

Corporate Tax Rate Cuts

Lowering the corporate tax rate is another cornerstone of the Canadian Conservative platform. The aim is to enhance Canada's competitiveness, attract foreign investment, and foster business growth within the country.

- Specific proposed reductions: Proposals generally focus on reducing the corporate tax rate to a level deemed competitive internationally, potentially leading to a more business-friendly environment. The exact percentage proposed varies depending on the election cycle.

- Arguments for positive impact: Supporters argue that lower corporate taxes incentivize businesses to invest, expand operations, and create jobs, ultimately benefiting the entire economy. Increased investment would lead to greater economic activity, increased tax revenue in the long run.

- Counterarguments: Opponents argue that significant corporate tax cuts can lead to substantial revenue losses for the government, potentially impacting funding for essential public services like healthcare and education. There are also concerns that these benefits may not always trickle down to workers in the form of higher wages or job creation.

Targeted Tax Credits and Deductions

Beyond broad-based tax cuts, the Conservative platform often incorporates specific tax credits and deductions to support particular groups or sectors.

- Examples: These may include enhanced child tax benefits, tax credits for home renovations, or tax incentives for specific industries deemed crucial to the Canadian economy (e.g., resource extraction, manufacturing).

- Aim of the measures: The goal is to alleviate financial burdens for families and seniors while simultaneously stimulating growth in targeted sectors. These measures are often presented as ways to provide specific relief and boost specific sectors.

- Effectiveness and limitations: The effectiveness of targeted tax credits is a subject of debate. While proponents argue that these measures effectively achieve their goals, critics often question whether they are efficient and equitable ways of stimulating the economy or distributing resources.

Fiscal Responsibility Measures

Fiscal responsibility is a central theme in the Canadian Conservative platform, often presented as a key differentiator from other parties. This translates into a commitment to balanced budgets, government spending control, and regulatory reform.

Balanced Budget Commitment

Achieving a balanced federal budget is frequently a stated priority in the Conservative platform.

- Strategies proposed: Strategies usually involve a combination of spending cuts, increased efficiency in government operations, and potentially revenue-generating measures such as tax reforms (as previously discussed).

- Feasibility analysis: The feasibility of achieving a balanced budget depends heavily on prevailing economic conditions. Periods of economic growth make balancing the budget easier, while recessions present significant challenges.

- Consequences of failure: Failure to achieve a balanced budget could lead to increased national debt, potentially impacting Canada's credit rating and limiting the government's future financial flexibility.

Government Spending Control

Controlling government spending and reducing the national debt are key planks of the Conservative approach to fiscal management.

- Proposed spending cuts: Proposed cuts are often targeted at specific areas of government spending deemed less essential or inefficient. The specifics of these cuts are often debated during election campaigns.

- Impact of cuts: Cuts could potentially impact various government programs and services. This is where the debate on priorities often focuses – balancing debt reduction with the need for sufficient funding for key social services and infrastructure.

- Debt reduction vs. social spending: A central tension in the Conservative platform is balancing the priority of debt reduction with the need for adequate funding for social programs and infrastructure development.

Regulatory Reform

Streamlining regulations to foster economic activity and reduce burdens on businesses is frequently part of the Conservative platform.

- Proposed regulatory changes: Examples might include reducing red tape for businesses, simplifying environmental regulations, or reforming certain labor laws. Specific examples are often detailed in the party's platform documents.

- Potential benefits: The intended benefit is to make it easier for businesses to operate and invest in Canada, potentially leading to job creation and economic growth.

- Concerns: Critics often raise concerns about the potential negative impacts of deregulation on environmental protection, worker safety, and consumer rights.

Conclusion

The Canadian Conservative Platform's focus on tax cuts and fiscal responsibility offers a specific vision for Canada's economic future. Proponents argue that these policies will stimulate economic growth and create jobs. However, critics raise concerns about the potential impacts on social programs, income inequality, and environmental protection. Understanding the nuances of these proposals is crucial for voters to make informed decisions. To learn more about specific details and the latest updates, research the official Canadian Conservative Party platform and engage in informed discussions about the Canadian Conservative platform's approach to tax cuts and fiscal responsibility.

Featured Posts

-

Millions In Losses Federal Charges Filed In Major Office365 Data Breach

Apr 24, 2025

Millions In Losses Federal Charges Filed In Major Office365 Data Breach

Apr 24, 2025 -

Obituary Sophie Nyweide Mammoth And Noah Child Actor 1999 2023

Apr 24, 2025

Obituary Sophie Nyweide Mammoth And Noah Child Actor 1999 2023

Apr 24, 2025 -

Breast Cancer Awareness Tina Knowles Experience Highlights Mammogram Importance

Apr 24, 2025

Breast Cancer Awareness Tina Knowles Experience Highlights Mammogram Importance

Apr 24, 2025 -

Hisd Mariachi Groups Viral Whataburger Video Sends Them To Uil State

Apr 24, 2025

Hisd Mariachi Groups Viral Whataburger Video Sends Them To Uil State

Apr 24, 2025 -

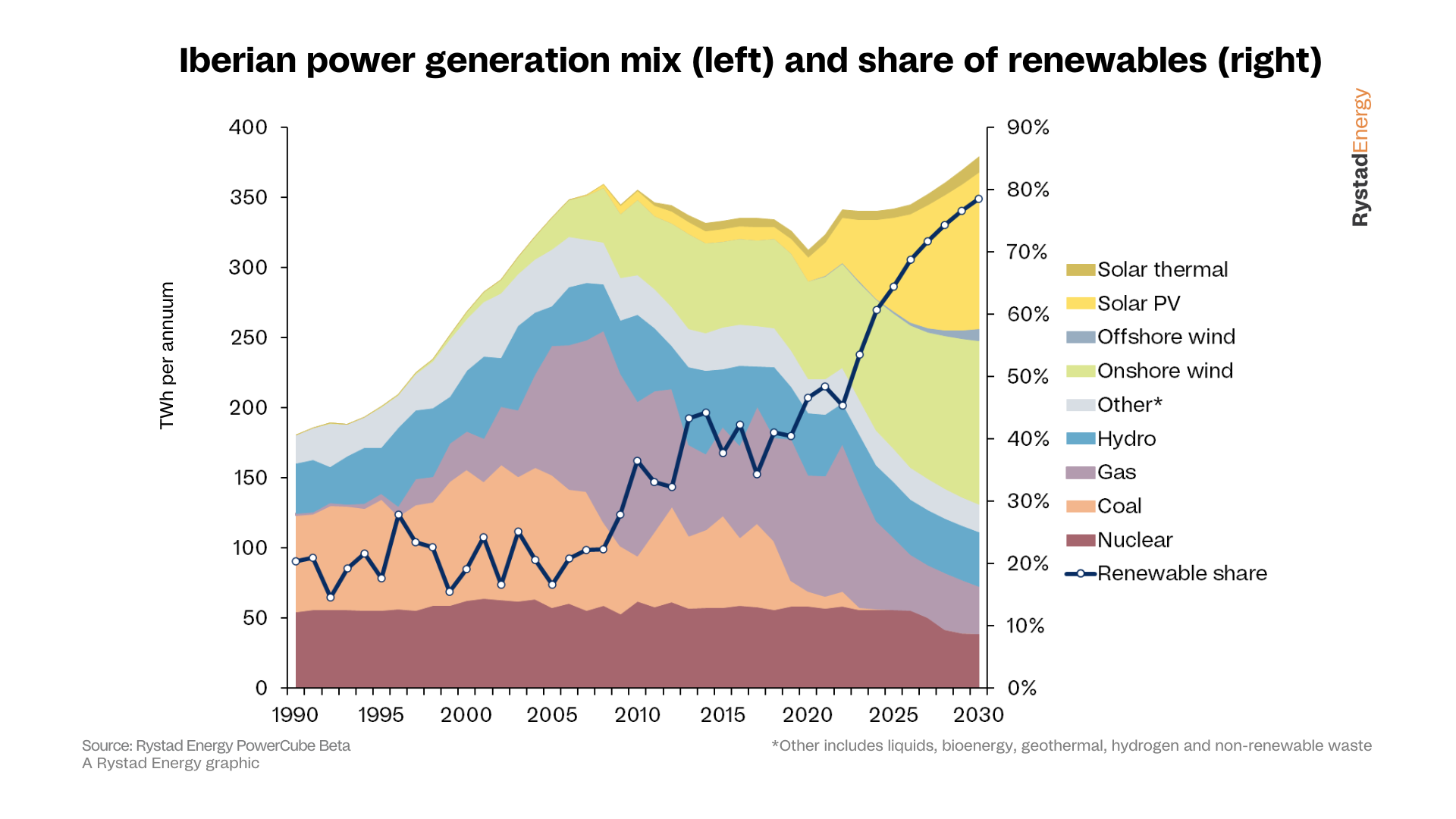

Russian Gas Phaseout Eu Discusses Spot Market Strategies

Apr 24, 2025

Russian Gas Phaseout Eu Discusses Spot Market Strategies

Apr 24, 2025

Latest Posts

-

Remembering Americas Pioneer Nonbinary Figure A Life Cut Short

May 10, 2025

Remembering Americas Pioneer Nonbinary Figure A Life Cut Short

May 10, 2025 -

Lynk Lee Chuyen Gioi Thanh Cong Tinh Yeu Dom Hoa Ket Trai

May 10, 2025

Lynk Lee Chuyen Gioi Thanh Cong Tinh Yeu Dom Hoa Ket Trai

May 10, 2025 -

Tragic Fate Of Americas First Nonbinary Person

May 10, 2025

Tragic Fate Of Americas First Nonbinary Person

May 10, 2025 -

Chuyen Tinh Dep Cua Lynk Lee Sau Khi Chuyen Gioi

May 10, 2025

Chuyen Tinh Dep Cua Lynk Lee Sau Khi Chuyen Gioi

May 10, 2025 -

Technical Skill Development Program For Transgenders In Punjab

May 10, 2025

Technical Skill Development Program For Transgenders In Punjab

May 10, 2025