Russian Gas Phaseout: EU Discusses Spot Market Strategies

Table of Contents

The Urgency of Diversifying Gas Supplies

The dependence on Russian gas has left the EU vulnerable to geopolitical pressures and price volatility. The war in Ukraine starkly highlighted this vulnerability, exposing the risks of relying heavily on a single supplier for a critical resource. This over-reliance necessitates a rapid diversification of gas sources and a reduction in overall gas consumption. The EU must act decisively to mitigate future energy crises.

- The need to rapidly decrease reliance on a single supplier: This is paramount to enhancing energy security and reducing geopolitical leverage held by Russia. Diversification minimizes the impact of supply disruptions from any single source.

- Exploring alternative sources: The EU is actively seeking alternative LNG (Liquefied Natural Gas) imports from the US, Qatar, and Norway, among others. These imports require significant investment in port infrastructure and regasification terminals.

- Accelerated development of renewable energy sources: Reducing overall gas demand through a substantial increase in renewable energy generation (solar, wind, etc.) is crucial for long-term energy independence. This involves massive investments in renewable energy infrastructure and grid modernization.

- Increased investment in pipeline infrastructure from diverse suppliers: Expanding pipeline connections with reliable alternative suppliers in regions like the Caspian Sea and North Africa will further enhance the EU's energy security and reduce its reliance on Russian pipelines.

Spot Market Mechanisms: A Key Element of the Transition

Spot markets offer price transparency and flexibility, enabling the EU to source gas from various suppliers based on real-time demand and availability. This contrasts sharply with the traditional long-term contracts, which often lack flexibility and are heavily influenced by political considerations. The increased reliance on spot markets for natural gas is a significant strategic shift for the EU.

- Increased liquidity and competition in the gas spot market: A more liquid spot market fosters competition among suppliers, potentially leading to lower prices and a more efficient allocation of resources.

- Opportunities for price discovery and hedging against price volatility: Spot markets allow for better price discovery, reflecting real-time supply and demand dynamics. This facilitates hedging strategies to mitigate price risks for both producers and consumers.

- Challenges associated with spot market volatility, including price spikes during periods of high demand: While spot markets offer flexibility, they are also susceptible to price swings, particularly during periods of high demand or unexpected supply disruptions. Effective regulatory frameworks are needed to manage these fluctuations.

- The necessity of robust market infrastructure and regulatory frameworks: A functioning spot market requires significant investment in infrastructure, including pipelines, storage facilities, and trading platforms, alongside robust regulatory frameworks to ensure market transparency and prevent manipulation.

Challenges and Obstacles to Implementing Spot Market Strategies

The transition to a more spot-market-driven system presents considerable challenges for the EU, demanding a coordinated and strategic approach across member states.

- Potential for price volatility and its impact on consumers: Price fluctuations in spot markets can significantly impact consumer energy bills, requiring mechanisms to protect vulnerable households. Government intervention and social safety nets might be necessary.

- The need for significant investment in infrastructure to accommodate increased LNG imports and spot market transactions: This includes substantial investment in port infrastructure, regasification terminals, pipelines, and storage facilities to handle the increased volume of LNG imports and spot market transactions.

- Ensuring sufficient storage capacity to manage supply fluctuations: Adequate storage capacity is crucial for mitigating the risks associated with spot market volatility, providing a buffer against supply disruptions and price spikes.

- Coordination between member states to achieve a unified approach: A successful transition requires close collaboration among EU member states to harmonize regulations, share infrastructure, and establish common market rules.

Regulatory Frameworks and Market Design

Developing appropriate regulations and market designs is crucial to ensure the effectiveness and stability of the spot market. This includes issues of transparency, market access, and consumer protection, all vital for a smoothly functioning energy market.

- Harmonizing regulations across member states: A unified regulatory framework is essential for creating a single, integrated EU gas market, fostering competition and preventing fragmentation.

- Strengthening market surveillance to prevent manipulation and ensure fair competition: Robust market surveillance mechanisms are needed to detect and deter market manipulation and ensure fair competition among suppliers.

- Investing in advanced market data and analytics tools: Real-time data and sophisticated analytical tools are crucial for informed decision-making, risk management, and efficient market operation.

Conclusion

The Russian gas phaseout demands a proactive and multifaceted approach from the EU. A transition towards greater reliance on spot markets is a crucial element of this strategy, offering opportunities for diversification and increased competition. While challenges remain, particularly regarding price volatility and infrastructure investment, the long-term benefits of diversifying gas supplies and creating a more flexible and competitive energy market are undeniable. The EU must continue its efforts to develop robust regulatory frameworks, invest in necessary infrastructure, and foster cooperation among member states to ensure a smooth and successful Russian gas phaseout and a secure energy future for its citizens. Understanding the intricacies of spot market strategies is essential for navigating this critical period and securing a resilient energy future. Effective implementation of spot market strategies is key to achieving a successful Russian gas phaseout.

Featured Posts

-

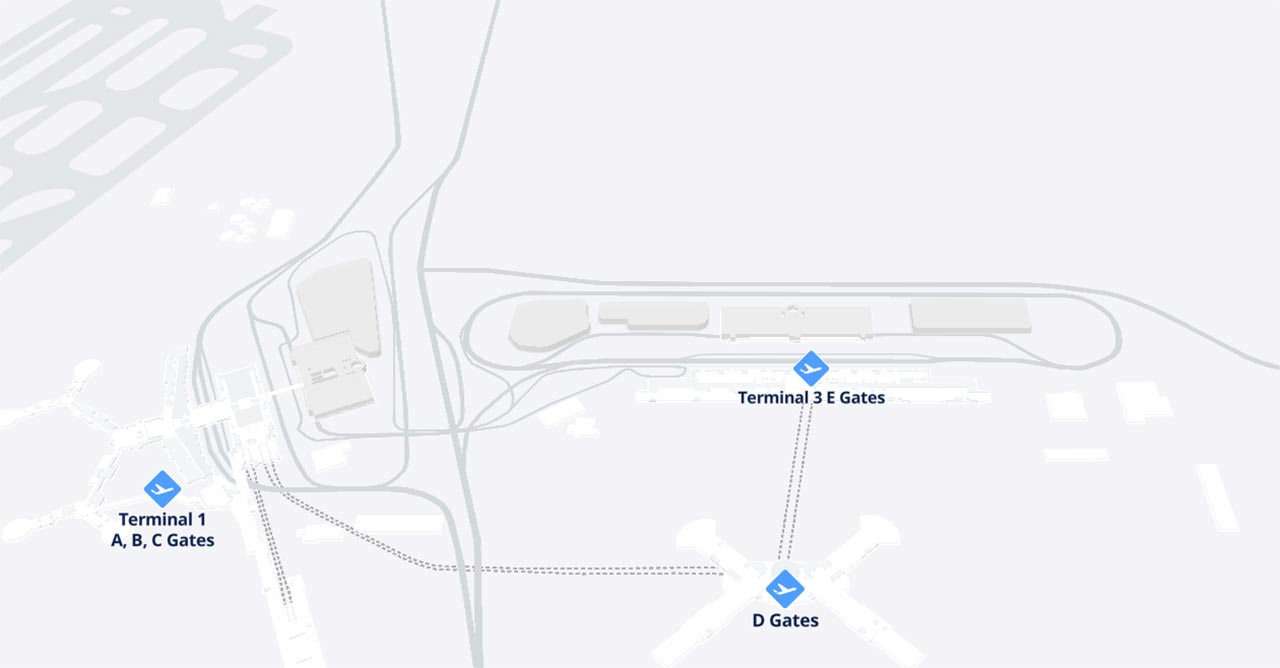

Las Vegas Airport Faa Examines Potential Collision Hazards

Apr 24, 2025

Las Vegas Airport Faa Examines Potential Collision Hazards

Apr 24, 2025 -

Teslas Q1 Financial Report Profit Plunge And The Musk Controversy

Apr 24, 2025

Teslas Q1 Financial Report Profit Plunge And The Musk Controversy

Apr 24, 2025 -

Israeli Beachs Shark Infestation Leads To Tragedy Swimmer Vanishes Body Discovered

Apr 24, 2025

Israeli Beachs Shark Infestation Leads To Tragedy Swimmer Vanishes Body Discovered

Apr 24, 2025 -

Technical Glitch Delays Blue Origin Rocket Launch

Apr 24, 2025

Technical Glitch Delays Blue Origin Rocket Launch

Apr 24, 2025 -

Pope Francis A Divided Church In A Globalized World

Apr 24, 2025

Pope Francis A Divided Church In A Globalized World

Apr 24, 2025

Latest Posts

-

Sudden Shift White House Withdraws Nomination Chooses Maha Influencer For Surgeon General

May 10, 2025

Sudden Shift White House Withdraws Nomination Chooses Maha Influencer For Surgeon General

May 10, 2025 -

Real Id Act Impacts On Summer Travel Plans

May 10, 2025

Real Id Act Impacts On Summer Travel Plans

May 10, 2025 -

Real Id Enforcement Your Summer Travel Guide

May 10, 2025

Real Id Enforcement Your Summer Travel Guide

May 10, 2025 -

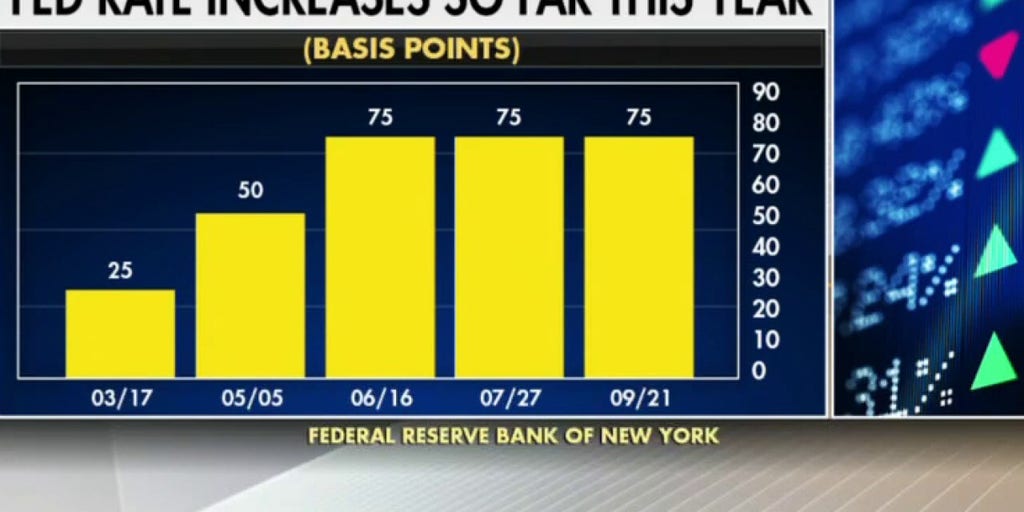

Why The Federal Reserve Lags Behind On Interest Rate Cuts

May 10, 2025

Why The Federal Reserve Lags Behind On Interest Rate Cuts

May 10, 2025 -

Police Save Choking Toddler Bodycam Footage Shows Dramatic Rescue

May 10, 2025

Police Save Choking Toddler Bodycam Footage Shows Dramatic Rescue

May 10, 2025