Analysis: Operation Sindoor And Its Fallout On The Pakistan Stock Exchange

Table of Contents

Understanding Operation Sindoor and its Context

Operation Sindoor, a [Insert brief, neutral description of the operation's nature – e.g., large-scale crackdown on financial crimes], launched in [Insert date], significantly impacted Pakistan's political and economic landscape. Its objective was ostensibly to [Insert stated objective of the operation], targeting individuals and entities suspected of [Insert specific targets of the operation]. The methods employed included [Insert methods used, e.g., raids, arrests, asset freezes].

The operation unfolded against a backdrop of [Describe the prevailing political and economic climate in Pakistan at the time – e.g., political instability, economic uncertainty, inflation]. This context is crucial to understanding the market's heightened sensitivity to the news.

- Key players involved in Operation Sindoor: [List key individuals and organizations involved].

- Timeline of events: [Provide a concise timeline of key events leading up to and following Operation Sindoor].

- Immediate public reaction: [Describe the initial public response, noting any widespread fear, uncertainty, or speculation].

Immediate Impact on the Pakistan Stock Exchange (PSX)

The announcement of Operation Sindoor triggered an immediate and substantial decline in the KSE-100 index. Within [Number] days, the index plummeted by [Percentage]%, representing a loss of [Rupees amount] in market capitalization. Trading volume [Increased/Decreased] significantly, indicating [Explain the implication of the change in trading volume – e.g., panic selling, investor hesitancy]. Market volatility soared, reaching a [Number]-year high, reflecting the uncertainty surrounding the operation's implications.

The downturn disproportionately affected certain sectors. The banking sector, for example, experienced a [Percentage]% drop, while the energy and technology sectors also suffered significant losses.

- Specific examples of stock price drops: [List examples of major companies and the percentage drop in their share prices].

- Investor sentiment indicators: Foreign investor outflows amounted to [Amount], further exacerbating the decline. [Mention any other relevant investor sentiment indicators].

- Comparison to previous market fluctuations: [Compare the magnitude and speed of the decline to previous market downturns in Pakistan].

Long-Term Effects and Recovery

The long-term effects of Operation Sindoor on the PSX were considerable. While the market eventually recovered, it took [Number] months/years to regain its pre-operation levels. [Insert graph or chart illustrating the KSE-100 index performance before, during, and after Operation Sindoor]. The government responded with [Mention government interventions and policy changes – e.g., fiscal stimulus measures, regulatory adjustments].

Foreign investment in Pakistan, already facing challenges, experienced a further setback in the aftermath of the operation. Investor confidence remained fragile for an extended period, hindering economic growth.

- Investor confidence levels over time: [Describe how investor confidence evolved over time after Operation Sindoor].

- Assessment of the long-term economic impact: [Discuss the broader economic consequences of the operation beyond the PSX].

Lessons Learned and Future Implications

Operation Sindoor served as a stark reminder of the interconnectedness of political actions and market stability. The incident highlighted the importance of transparent and timely communication from the government to investors to mitigate panic and uncertainty. The lack of clear information amplified negative sentiment and exacerbated the market's reaction.

Moving forward, several measures are crucial to enhance resilience:

- Recommendations for improving regulatory frameworks: [Suggest specific improvements to regulatory frameworks].

- Suggestions for enhancing investor protection mechanisms: [Suggest ways to improve investor protection].

- Strategies for promoting long-term economic stability: [Suggest strategies for overall economic stability].

Conclusion

The impact of Operation Sindoor on the Pakistan Stock Exchange was profound, resulting in a significant decline in the KSE-100 index and broader economic ramifications. The analysis reveals the immediate and long-term consequences, highlighting the vulnerability of the PSX to political and economic shocks. The lessons learned underscore the crucial need for transparent governance, robust regulatory frameworks, and effective communication to maintain investor confidence and promote long-term economic stability. Further analysis of Operation Sindoor and the Pakistan Stock Exchange is crucial for understanding the complex interplay between political action and market behavior, enabling policymakers and investors to better prepare for and mitigate future crises. Understanding the impact of Operation Sindoor on the PSX is vital for shaping policies that foster sustainable economic growth and investor confidence in Pakistan.

Featured Posts

-

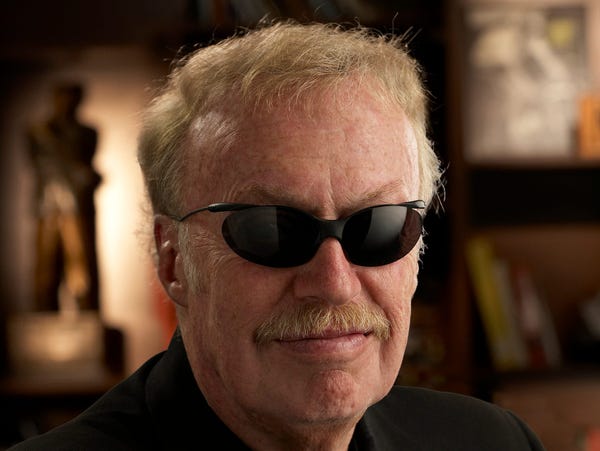

How Many Billions Did Musk Bezos And Zuckerberg Lose Since Trumps Inauguration

May 10, 2025

How Many Billions Did Musk Bezos And Zuckerberg Lose Since Trumps Inauguration

May 10, 2025 -

Ray Epps Sues Fox News For Defamation Jan 6th Claims At The Center Of Lawsuit

May 10, 2025

Ray Epps Sues Fox News For Defamation Jan 6th Claims At The Center Of Lawsuit

May 10, 2025 -

100 Days Of Trump How Did It Affect Elon Musks Net Worth

May 10, 2025

100 Days Of Trump How Did It Affect Elon Musks Net Worth

May 10, 2025 -

Sensex And Nifty Live Tracking Todays Market Movement Up 100 Points

May 10, 2025

Sensex And Nifty Live Tracking Todays Market Movement Up 100 Points

May 10, 2025 -

How Middle Managers Drive Company Growth And Employee Engagement

May 10, 2025

How Middle Managers Drive Company Growth And Employee Engagement

May 10, 2025