How Many Billions Did Musk, Bezos, And Zuckerberg Lose Since Trump's Inauguration?

Table of Contents

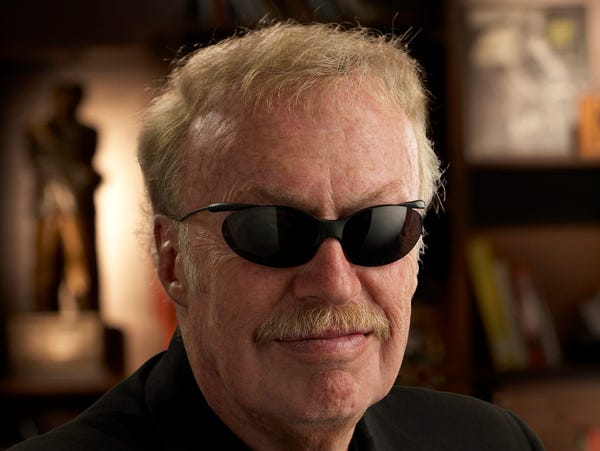

Elon Musk's Net Worth Fluctuations Since 2017

Elon Musk, the visionary behind Tesla and SpaceX, experienced a period of both astronomical growth and significant dips in his net worth during Trump's presidency. His fortune is intrinsically linked to the performance of Tesla, making the electric vehicle market a crucial factor in his wealth trajectory.

Tesla Stock Performance and its Impact

Tesla's stock price saw extreme volatility between 2017 and 2021. Early in the period, the company consolidated its position in the electric vehicle market, enjoying periods of substantial growth. However, production challenges, regulatory hurdles, and shifts in market sentiment all played a role in periods of decline.

- 2017: Steady growth, setting the stage for future expansions.

- 2018-2019: Significant stock price fluctuations, reflecting both successes and challenges in production and market competition.

- 2020-2021: Explosive growth fueled by increased demand for electric vehicles and Tesla's growing market share. However, this period also saw some notable dips related to specific events, such as controversies surrounding Musk's tweets.

- Post-2021: A more moderated growth trajectory with continued volatility related to broader market trends and Tesla's ongoing expansion.

Analyzing the precise amount gained or lost requires access to daily stock data and a complex calculation factoring in all Musk's investments. However, it's undeniable that Tesla's stock price directly impacted his billions, swinging wildly between substantial gains and notable losses. Keywords: Elon Musk net worth, Tesla stock price, electric vehicle market.

SpaceX and Other Ventures

SpaceX, Musk's space exploration company, has also played a role, albeit less direct, in his net worth. Successful launches and contracts have undoubtedly contributed positively to his overall financial standing, increasing his valuation. However, the specific financial impact of SpaceX is less transparent than that of Tesla. His other ventures, while contributing to his overall entrepreneurial legacy, haven't significantly influenced the magnitude of changes observed in his net worth during this period. Keywords: SpaceX valuation, Musk investments, entrepreneurial success.

Jeff Bezos's Net Worth Changes Since 2017

Jeff Bezos, the founder of Amazon, witnessed a period of largely consistent growth in his net worth throughout Trump's presidency, though not without its complexities. Amazon's dominance in e-commerce played a significant role in this trend.

Amazon's Stock Performance and Market Dominance

Amazon's stock generally performed well during this period, reflecting its continued growth and market dominance. However, it wasn't immune to market fluctuations and faced increased scrutiny from regulators regarding antitrust issues and its market power.

- 2017-2019: Steady growth, driven by the expansion of Amazon's e-commerce business and its diversification into cloud computing (AWS).

- 2020-2021: A significant boost in stock price due to the surge in online shopping during the COVID-19 pandemic.

- Post-2021: A more moderate but still positive trend, with fluctuations related to broader economic factors and increased regulatory attention.

While Bezos's overall wealth grew substantially, specific calculations of billion-dollar gains or losses require detailed financial analysis accounting for stock splits and other financial transactions. Keywords: Amazon stock, Jeff Bezos net worth, e-commerce market share.

Blue Origin and Other Investments

Blue Origin, Bezos's space exploration venture, has been a substantial investment but hasn't had the same direct impact on his net worth as Amazon. While it represents a significant long-term investment, its current contribution to his overall wealth is relatively smaller compared to Amazon's market capitalization. His other investments have contributed to his overall financial diversification but haven't substantially altered the overall trajectory of his billions during this period. Keywords: Blue Origin, Bezos investments, space exploration.

Mark Zuckerberg's Net Worth Trajectory Since 2017

Mark Zuckerberg, the CEO of Meta (formerly Facebook), saw a more complex trajectory for his net worth since 2017. Facebook's performance was intertwined with controversies and regulatory pressures that significantly influenced its stock price.

Facebook (Meta) Stock and Regulatory Pressures

Facebook's stock price experienced both periods of growth and significant drops during Trump's presidency. Controversies such as the Cambridge Analytica scandal and ongoing concerns about data privacy and misinformation significantly impacted investor confidence. Regulatory scrutiny from both the US and the EU also played a significant role.

- 2017-2018: Significant growth, followed by a sharp decline in the wake of the Cambridge Analytica scandal.

- 2019-2020: Recovery and relatively stable growth.

- 2021-Present: Fluctuations driven by concerns about competition, regulatory pressure, and the company's pivot to the metaverse.

The calculation of gains and losses in billions requires detailed financial data analysis, taking into account stock performance and other investments. Keywords: Facebook stock price, Mark Zuckerberg net worth, social media regulation.

Metaverse Investments and Future Prospects

Meta's massive investments in the metaverse represent a significant bet on the future, but its impact on Zuckerberg's current net worth remains to be seen. The long-term potential is substantial, but the short-term financial results are yet to materialize significantly. This is a crucial factor in understanding the complexities of his financial trajectory during and after Trump's presidency. Keywords: Metaverse investments, virtual reality, future of social media.

Conclusion

The net worth of Elon Musk, Jeff Bezos, and Mark Zuckerberg experienced significant fluctuations since Trump's inauguration in 2017. While Bezos generally saw substantial growth, Musk and Zuckerberg experienced periods of both dramatic increases and significant declines, highlighting the volatility of the tech sector and its susceptibility to market forces, regulatory pressures, and company-specific events. The precise billion-dollar figures require a detailed financial analysis beyond the scope of this article, but the key takeaway is the dramatic impact of various factors on their massive fortunes. Learn more about the net worth changes of these tech moguls by subscribing to our newsletter and staying updated on how much these billionaires have gained or lost.

Featured Posts

-

Lynk Lee Chuyen Gioi Nhan Sac Thang Hang Tinh Yeu Vien Man

May 10, 2025

Lynk Lee Chuyen Gioi Nhan Sac Thang Hang Tinh Yeu Vien Man

May 10, 2025 -

Analysis Trump Teams Consideration Of Expedited Nuclear Power Plant Construction

May 10, 2025

Analysis Trump Teams Consideration Of Expedited Nuclear Power Plant Construction

May 10, 2025 -

Call For Regulatory Reform Indian Insurers And Bond Forwards

May 10, 2025

Call For Regulatory Reform Indian Insurers And Bond Forwards

May 10, 2025 -

Dijon Deces D Un Jeune Ouvrier Suite A Une Chute D Immeuble

May 10, 2025

Dijon Deces D Un Jeune Ouvrier Suite A Une Chute D Immeuble

May 10, 2025 -

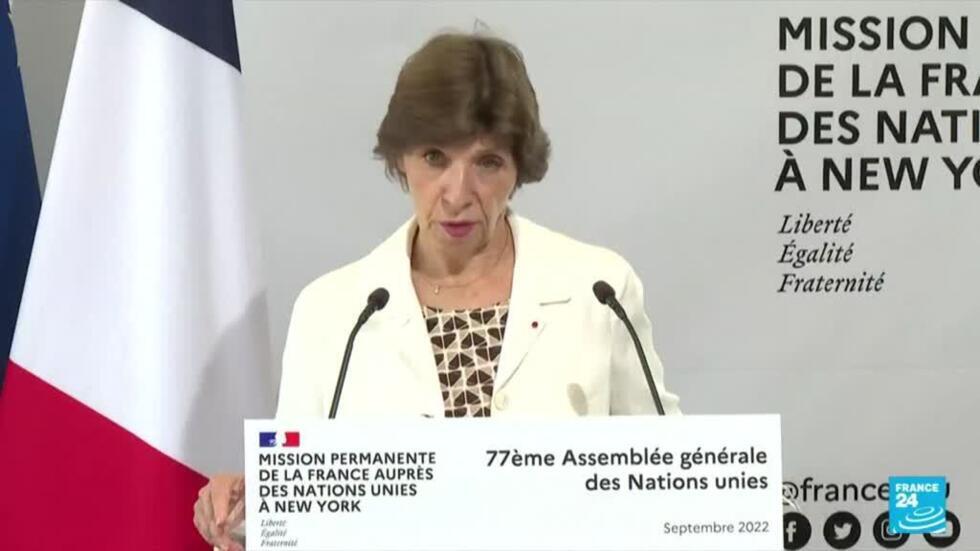

French Minister Advocates For Shared European Nuclear Power

May 10, 2025

French Minister Advocates For Shared European Nuclear Power

May 10, 2025