Analyzing Bitcoin's Potential For A 1,500% Rise

Table of Contents

Factors Potentially Driving a 1,500% Bitcoin Rise

Several factors could contribute to a significant increase in Bitcoin's price, potentially reaching a 1500% surge. Let's examine some key drivers:

Increased Institutional Adoption

The growing acceptance of Bitcoin by large financial institutions is a crucial factor. The entry of institutional investors brings substantial capital into the market, increasing demand and price.

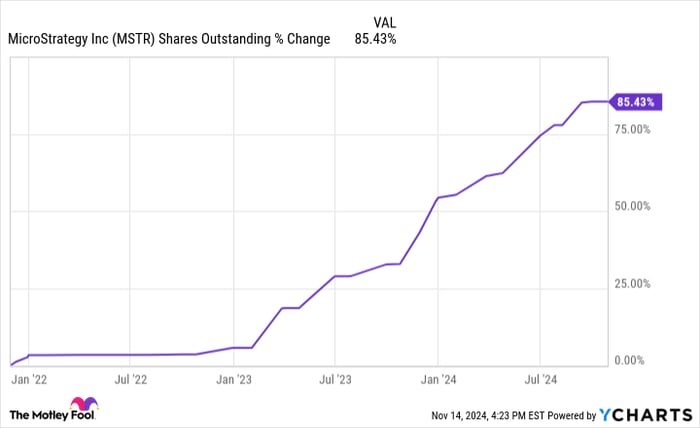

- Examples of institutional investments: Grayscale Bitcoin Trust, MicroStrategy's Bitcoin holdings, and the increasing involvement of pension funds and endowments.

- Impact of ETFs: The approval of Bitcoin exchange-traded funds (ETFs) would significantly boost institutional investment by making Bitcoin more accessible to a wider range of investors. This could lead to a substantial influx of capital, impacting Bitcoin price prediction models dramatically.

- Regulatory clarity: Increased regulatory clarity in major jurisdictions would further encourage institutional investment, reducing uncertainty and risk. This shift in the Bitcoin regulatory landscape is vital for long-term growth.

Global Macroeconomic Uncertainty

Global economic instability often drives investors towards safe-haven assets. Bitcoin's decentralized nature and limited supply make it an attractive alternative to traditional assets during times of uncertainty.

- Examples of recent global events impacting Bitcoin's price: The COVID-19 pandemic, the war in Ukraine, and persistent inflation have all contributed to increased demand for Bitcoin as a hedge against risk.

- Safe-haven asset status of Bitcoin: As traditional financial systems face challenges, investors are increasingly viewing Bitcoin as a store of value, pushing up demand and the Bitcoin price. This perception of Bitcoin as an inflation hedge is a significant factor in its price appreciation.

Technological Advancements in Bitcoin

Ongoing technological improvements enhance Bitcoin's functionality and usability, making it more attractive to a wider range of users.

- Improved scalability: The Lightning Network, a layer-2 scaling solution, significantly increases Bitcoin's transaction speed and reduces fees.

- Transaction speed and reduced fees: These improvements make Bitcoin more practical for everyday transactions, potentially leading to greater adoption.

- Bitcoin Taproot: This upgrade enhances privacy and smart contract capabilities, opening up new possibilities for Bitcoin's use cases. These advancements in Bitcoin scalability and functionality are crucial for mass adoption and its long-term success.

Challenges and Risks to a 1,500% Bitcoin Rise

While the potential for a significant Bitcoin price increase is real, several challenges and risks could hinder its progress.

Regulatory Crackdowns

Governments worldwide are increasingly scrutinizing cryptocurrencies. Stricter regulations could dampen investor enthusiasm and negatively impact Bitcoin's price.

- Examples of countries implementing restrictive policies: China's ban on cryptocurrency trading and other nations' stringent regulations demonstrate the potential for regulatory headwinds.

- Potential negative effects on price: Regulatory uncertainty and restrictive policies can trigger market sell-offs and suppress price appreciation. This is a significant risk to Bitcoin price prediction models.

Market Volatility and Correction

Bitcoin's price is notoriously volatile. Significant corrections are a regular part of its market cycle, posing substantial risks to investors.

- Previous market cycles and crashes: History demonstrates the potential for sharp price drops, highlighting the importance of understanding and managing risk.

- Bitcoin risk management: Diversification, disciplined investing strategies, and a long-term perspective are crucial for mitigating risk in this volatile market.

Competition from Other Cryptocurrencies

Bitcoin faces increasing competition from other cryptocurrencies, or altcoins, offering alternative technologies and functionalities.

- Emergence of new technologies and platforms: Innovations in other cryptocurrencies could potentially erode Bitcoin's dominance in the market.

- Potential for market share erosion: The competition from altcoins is a factor that could impact Bitcoin's price and future prospects. Maintaining its dominance is vital for Bitcoin's future.

Conclusion: Assessing the Likelihood of a 1,500% Bitcoin Surge and the Path Forward

A 1,500% rise in Bitcoin's price is a bold prediction. While several factors could drive such an increase, significant challenges and risks exist. Increased institutional adoption, macroeconomic uncertainty, and technological advancements could be powerful catalysts. However, regulatory crackdowns, inherent market volatility, and competition from altcoins pose substantial headwinds. A balanced assessment suggests that while a substantial price increase is possible, the likelihood of reaching 1500% within a reasonable timeframe needs careful consideration. The path forward for Bitcoin is complex, involving both significant rewards and considerable risk. Before investing in Bitcoin, thorough research and an understanding of the long-term implications are paramount. Consider exploring resources on Bitcoin analysis and understand the Bitcoin price potential before making any decisions regarding Bitcoin investment. Weigh the Bitcoin future prospects carefully.

Featured Posts

-

Is A 1 500 Bitcoin Increase Possible Within 5 Years

May 08, 2025

Is A 1 500 Bitcoin Increase Possible Within 5 Years

May 08, 2025 -

Xrps Legal Battle Implications For Crypto Commodity Classification

May 08, 2025

Xrps Legal Battle Implications For Crypto Commodity Classification

May 08, 2025 -

Is This Hot New Spac Stock The Next Micro Strategy Investor Analysis

May 08, 2025

Is This Hot New Spac Stock The Next Micro Strategy Investor Analysis

May 08, 2025 -

Ai Driven Podcast Creation Transforming Repetitive Documents Into Engaging Content

May 08, 2025

Ai Driven Podcast Creation Transforming Repetitive Documents Into Engaging Content

May 08, 2025 -

Is The 2 Support Level A True Reversal Signal For Xrp Price Prediction Analysis

May 08, 2025

Is The 2 Support Level A True Reversal Signal For Xrp Price Prediction Analysis

May 08, 2025