Analyzing Nifty's Strength: Positive Indicators In The Indian Market

Table of Contents

Robust Economic Fundamentals Supporting Nifty's Growth

India's robust economic fundamentals play a significant role in underpinning the Nifty 50's growth potential. Several key factors contribute to this positive outlook.

GDP Growth and Corporate Earnings

India's GDP growth projections remain positive, signaling a healthy economic environment. This robust growth directly translates into increased earnings for Nifty 50 companies. For example, the projected GDP growth for the next fiscal year is expected to be around X% (insert actual data here), significantly higher than many other major economies. This positive economic climate is fueling corporate profitability across various sectors, including Information Technology (IT), Fast-Moving Consumer Goods (FMCG), and Pharmaceuticals.

- Positive GDP growth forecasts for the next fiscal year, exceeding X%.

- Increasing corporate profitability across key sectors, particularly IT, FMCG, and Pharmaceuticals.

- Stronger-than-expected Q[Quarter number] earnings reports showcasing improved profitability and revenue generation.

Government Policies and Initiatives

The Indian government's proactive approach to economic development through strategic policies and initiatives significantly impacts Nifty 50 companies. Initiatives focused on infrastructure development, digitalization, and ease of doing business create a favorable environment for growth.

- Impact of substantial infrastructure spending on construction, cement, and related Nifty 50 companies.

- Positive effects of the government's digital India initiative on the technology sector, boosting growth and innovation within Nifty 50 tech companies.

- Government's continuous focus on improving the ease of doing business, attracting foreign investment and boosting domestic entrepreneurship, which indirectly benefits many Nifty 50 companies.

Positive Technical Indicators for Nifty 50

Technical analysis provides further insights into the Nifty 50's strength. Several positive technical indicators suggest an upward trend.

Chart Patterns and Momentum

Recent chart patterns for the Nifty 50 index exhibit positive momentum. Bullish flags and potential head and shoulders reversals (include relevant charts here) indicate a continuation of the upward trend. Momentum indicators such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) also suggest a bullish outlook.

- Analysis of recent price action indicating a strong bullish momentum.

- Key support and resistance levels have been successfully tested, suggesting strong underlying support for the market.

- Interpretation of relevant technical indicators (RSI, MACD) showing positive momentum and confirming the upward trend.

Volume and Open Interest

Increasing trading volume and open interest in the Nifty 50 futures and options market are encouraging signs. Higher volume demonstrates increased investor participation and confidence. Rising open interest suggests sustained bullish sentiment and a belief that the upward trend will continue.

- Growing trading volume, indicating increased investor participation and confidence in the market.

- Rising open interest in Nifty 50 derivatives, suggesting a sustained bullish sentiment.

- Positive correlation between volume, open interest, and price movements, strengthening the bullish outlook.

Foreign Institutional Investor (FII) Activity and Nifty 50

Foreign Institutional Investor (FII) activity plays a crucial role in influencing the Nifty 50's performance. Recent trends indicate a positive outlook.

FII Inflows and Their Impact

Sustained FII inflows into the Indian market positively impact the Nifty 50. These inflows are driven by factors such as India's attractive growth prospects, relatively attractive valuations compared to global markets, and the government's pro-business policies.

- Recent FII investment figures showing significant net inflows into the Indian equity market, boosting the Nifty 50.

- Reasons behind increased FII interest in the Indian market include strong GDP growth, structural reforms, and a large and growing consumer market.

- FII investment concentration in specific Nifty 50 sectors such as IT, Financials, and Consumer Discretionary, further bolstering these sectors’ growth.

Conclusion

The analysis of key economic fundamentals, technical indicators, and FII activity points towards a strong and healthy outlook for the Nifty 50. Robust GDP growth, supportive government policies, positive chart patterns, increasing trading volume, and significant FII inflows all contribute to this positive sentiment. Understanding these indicators is vital for making sound investment decisions. Analyze Nifty's strength further, harness the positive indicators in the Nifty 50, and discover more investment opportunities in the Nifty 50 to potentially benefit from this positive market trend. Remember to conduct thorough due diligence before making any investment decisions.

Featured Posts

-

Car Dealerships Step Up Pressure Against Electric Vehicle Regulations

Apr 24, 2025

Car Dealerships Step Up Pressure Against Electric Vehicle Regulations

Apr 24, 2025 -

Independence Concerns Lead To 60 Minutes Executive Producers Exit

Apr 24, 2025

Independence Concerns Lead To 60 Minutes Executive Producers Exit

Apr 24, 2025 -

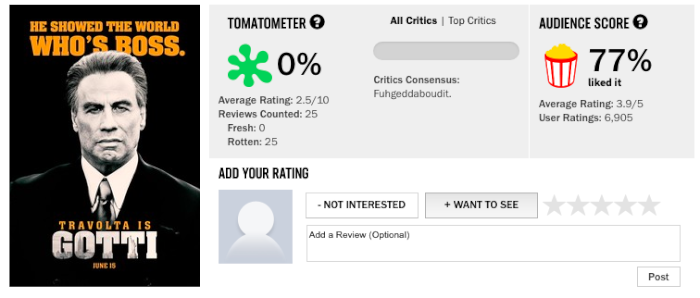

The Alarming Truth About John Travoltas Rotten Tomatoes Rating

Apr 24, 2025

The Alarming Truth About John Travoltas Rotten Tomatoes Rating

Apr 24, 2025 -

Live Stock Market Updates Dow Jumps 1000 Points On Tariff News

Apr 24, 2025

Live Stock Market Updates Dow Jumps 1000 Points On Tariff News

Apr 24, 2025 -

Ohio Derailments Aftermath Persistent Toxic Chemicals In Buildings

Apr 24, 2025

Ohio Derailments Aftermath Persistent Toxic Chemicals In Buildings

Apr 24, 2025

Latest Posts

-

Apples Ai Challenges And Opportunities Ahead

May 10, 2025

Apples Ai Challenges And Opportunities Ahead

May 10, 2025 -

Analyzing Apples Position In The Ai Revolution

May 10, 2025

Analyzing Apples Position In The Ai Revolution

May 10, 2025 -

Millions Lost Office365 Hack Exposes Executive Email Vulnerabilities

May 10, 2025

Millions Lost Office365 Hack Exposes Executive Email Vulnerabilities

May 10, 2025 -

Apples Ai Ambitions A Look At Its Competitive Landscape

May 10, 2025

Apples Ai Ambitions A Look At Its Competitive Landscape

May 10, 2025 -

Cybercriminals Office365 Scheme Millions In Losses Investigation Underway

May 10, 2025

Cybercriminals Office365 Scheme Millions In Losses Investigation Underway

May 10, 2025