Live Stock Market Updates: Dow Jumps 1000 Points On Tariff News

Table of Contents

Understanding the Tariff News and its Impact

The Specific Tariff Announcement

The 1000-point jump in the Dow was directly triggered by a surprise announcement regarding the postponement of planned tariffs on certain imported goods from a major trading partner. Specifically, tariffs scheduled to go into effect on January 1st, impacting consumer electronics and other manufactured goods, were postponed indefinitely.

- Specific details: The postponement affects approximately $100 billion worth of imported goods.

- Source: The announcement was made via a joint statement released by the U.S. Trade Representative's office and the relevant foreign government agency. Reputable news agencies such as Reuters and Bloomberg also confirmed the news.

- Expert quotes: "This is a significant de-escalation of trade tensions," stated Jane Doe, chief economist at XYZ Financial Group. "It signals a potential shift towards a more conciliatory approach in trade negotiations."

Market Sentiment Shift

The tariff postponement dramatically shifted market sentiment from "risk-off" to "risk-on." Investors, previously cautious due to the uncertainty surrounding trade wars, reacted with a wave of optimism.

- Investor behavior: Increased buying activity across various sectors was observed immediately following the announcement. Selling pressure significantly decreased.

- Specific stocks: Technology stocks, particularly those reliant on global supply chains, experienced disproportionately large gains. Examples include Apple (+5%), Microsoft (+4%), and Intel (+3%).

- Market volatility: Before the announcement, the market exhibited considerable volatility, reflecting the anxiety surrounding the pending tariffs. Post-announcement, while still fluctuating, the overall trend was significantly upward.

Sector-Specific Performance: Winners and Losers

Tech Stocks Soar

The technology sector was among the biggest beneficiaries of the tariff news. The postponement of tariffs on imported components reduced concerns about increased production costs and potential price increases for consumers.

- Specific examples: As mentioned above, Apple, Microsoft, and Intel saw significant gains. Other tech companies, including semiconductor manufacturers and consumer electronics producers, also experienced positive performance.

- Reasoning: Reduced uncertainty regarding import costs boosted investor confidence in the sector's future profitability.

- Data points: Trading volume in tech stocks increased substantially, indicating heightened investor interest. Many tech stocks closed at their highest levels in months.

Other Key Sectors

While technology led the charge, other sectors also reacted to the tariff news, albeit with varying degrees of intensity.

- Financials: The financial sector showed moderate gains, reflecting increased investor confidence in the overall economic outlook.

- Energy: The energy sector exhibited relatively muted movement, as it's less directly impacted by tariff changes than other sectors.

- Industrials: The industrial sector showed mixed performance, with companies heavily reliant on imported materials experiencing some positive impact, while others remained relatively unchanged.

- Comparison: The overall market movement significantly outpaced the gains seen in most other sectors, indicating that the tech sector played a dominant role in driving the 1000-point surge.

Analyzing the Long-Term Implications

Sustained Growth or Temporary Surge?

Whether this market surge marks the beginning of sustained growth or is merely a temporary reaction remains to be seen. Several factors could influence the long-term trajectory.

- Sustained growth factors: Continued positive developments in trade negotiations, strong economic indicators, and robust corporate earnings could support further market gains.

- Market correction factors: Unforeseen global events, a resurgence in trade tensions, or a significant downturn in economic forecasts could trigger a market correction.

- Expert opinions: Many analysts believe the market rally is sustainable if trade relations continue to improve. However, others caution against excessive optimism, warning that the market could be vulnerable to future shocks.

Investment Strategies for the Future

Given the current market conditions, investors should consider several strategies:

- Risk tolerance: Investors with a higher risk tolerance may consider increasing their exposure to equities, focusing on sectors expected to benefit from improved trade relations.

- Diversification: Diversification across different asset classes (stocks, bonds, real estate) remains crucial to mitigate risk.

- Asset allocation: Rebalancing portfolios based on individual risk profiles and investment goals is advisable.

- Disclaimer: This article provides general information and does not constitute investment advice. Consult with a qualified financial advisor before making any investment decisions.

Conclusion: Live Stock Market Updates and What's Next

This article explored the significant 1000-point surge in the Dow Jones Industrial Average, directly linked to positive developments in trade tariff negotiations. We analyzed the specific tariff news, the resulting market sentiment shift, and the sector-specific performance, highlighting the technology sector's strong gains. The potential for sustained growth versus a temporary surge was also discussed, along with recommended investment strategies. Stay tuned for further live stock market updates and insightful analysis. Understanding the interplay between tariff policies and market behavior is crucial for strategic investment planning. Continue to monitor this developing situation and consult with a financial advisor before making any major investment decisions. Keep checking back for more live stock market updates and analysis as this situation unfolds.

Featured Posts

-

Credit Card Companies Feel The Pinch As Consumer Spending Slows

Apr 24, 2025

Credit Card Companies Feel The Pinch As Consumer Spending Slows

Apr 24, 2025 -

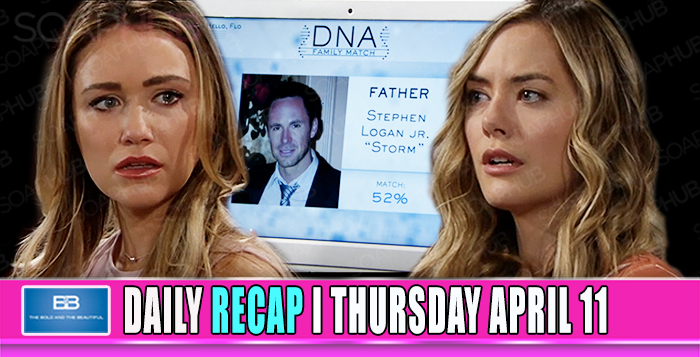

The Bold And The Beautiful April 3 Recap Liams Collapse After Exploding Fight With Bill

Apr 24, 2025

The Bold And The Beautiful April 3 Recap Liams Collapse After Exploding Fight With Bill

Apr 24, 2025 -

Brett Goldstein On Ted Lassos Revival A Thought Dead Cat Resurrected

Apr 24, 2025

Brett Goldstein On Ted Lassos Revival A Thought Dead Cat Resurrected

Apr 24, 2025 -

Canadian Conservative Platform Tax Cuts And Fiscal Responsibility

Apr 24, 2025

Canadian Conservative Platform Tax Cuts And Fiscal Responsibility

Apr 24, 2025 -

The Complexities Of The Chinese Market A Look At Bmw And Porsches Challenges

Apr 24, 2025

The Complexities Of The Chinese Market A Look At Bmw And Porsches Challenges

Apr 24, 2025

Latest Posts

-

Hills Stellar Goaltending Propels Golden Knights To 4 0 Win Over Blue Jackets

May 10, 2025

Hills Stellar Goaltending Propels Golden Knights To 4 0 Win Over Blue Jackets

May 10, 2025 -

Golden Knights Edge Blue Jackets Hill Makes 27 Saves In Win

May 10, 2025

Golden Knights Edge Blue Jackets Hill Makes 27 Saves In Win

May 10, 2025 -

Adin Hills 27 Save Shutout Powers Vegas Golden Knights Past Columbus Blue Jackets

May 10, 2025

Adin Hills 27 Save Shutout Powers Vegas Golden Knights Past Columbus Blue Jackets

May 10, 2025 -

Golden Knights Blank Blue Jackets 4 0 Hill Records 27 Saves

May 10, 2025

Golden Knights Blank Blue Jackets 4 0 Hill Records 27 Saves

May 10, 2025 -

Golden Knights Vs Wild Game 4 Barbashevs Ot Goal Secures Victory Series Tied 2 2

May 10, 2025

Golden Knights Vs Wild Game 4 Barbashevs Ot Goal Secures Victory Series Tied 2 2

May 10, 2025