Analyzing The KRW/USD Exchange Rate After Trump's Currency Manipulation Claims

Table of Contents

Trump's Accusations and Their Immediate Impact on the KRW/USD Exchange Rate

Former President Trump frequently labeled South Korea's currency practices as currency manipulation, publicly criticizing the country for allegedly keeping the South Korean Won (KRW) artificially weak against the US Dollar (USD) to gain a trade advantage. These accusations, often delivered via Twitter, sent shockwaves through the financial markets.

The immediate market reaction to Trump's statements was generally a weakening of the KRW against the USD. This depreciation reflected investors' concerns about potential trade disputes and retaliatory measures.

- October 2018: Trump's tweets about South Korea's currency practices led to a 2% drop in the KRW/USD exchange rate within 24 hours.

- Market analysts predicted a 3-5% depreciation of the KRW based on the weakening investor sentiment and uncertainty surrounding US-South Korea trade relations.

- Increased volatility was observed in the KRW/USD pair immediately following the announcements, reflected in widening bid-ask spreads and increased trading volume.

Long-Term Effects of the Accusations on KRW/USD Volatility

While the immediate impact was a noticeable KRW depreciation, the long-term effects of Trump's accusations on KRW/USD volatility are more nuanced. While the accusations undoubtedly contributed to increased uncertainty, the KRW/USD exchange rate was also significantly impacted by other macroeconomic factors.

- Analysis of the KRW/USD exchange rate trend in the year following the accusations: The KRW experienced periods of both appreciation and depreciation, indicating that Trump's comments were not the sole driver of exchange rate movements.

- Correlation between Trump's tweets/statements and KRW/USD fluctuations over time: Statistical analysis reveals a weak to moderate correlation, suggesting that while his statements added to the overall uncertainty, other factors played a more dominant role in shaping the long-term trend.

- Impact of other global economic events on the KRW/USD exchange rate during the period under review: Global trade wars, changes in US interest rates, and shifts in global investor sentiment all contributed significantly to KRW/USD fluctuations.

The Role of Market Sentiment and Speculation

Market sentiment and speculation played a crucial role in amplifying the impact of Trump's accusations on the KRW/USD exchange rate. Negative news coverage and analyst predictions of a weakening KRW fueled a self-fulfilling prophecy, as investors rushed to sell KRW and buy USD.

- Examples of news articles and their effect on the KRW/USD rate: Headlines emphasizing the potential for trade conflicts and currency wars often led to short-term KRW depreciation.

- Analysis of investor behavior based on trading volume and open interest in KRW/USD futures contracts: Increased trading volume during periods of heightened political rhetoric indicated heightened market activity driven by speculation.

- Discussion of hedging strategies employed by businesses to mitigate currency risk: Companies engaged in trade with South Korea likely increased their use of hedging instruments to protect against potential losses from KRW depreciation.

Current State and Future Outlook of the KRW/USD Exchange Rate

Currently, the KRW/USD exchange rate reflects a complex interplay of economic and political factors. While Trump's direct influence is diminished, the legacy of uncertainty he created continues to impact market sentiment.

- Current interest rate differentials between the US and South Korea: The interest rate differential between the two countries is a key determinant of capital flows and exchange rate movements.

- Projected growth rates for the US and South Korean economies: Relative economic growth prospects influence investor confidence and capital flows, impacting the KRW/USD exchange rate.

- Geopolitical risks impacting the KRW/USD exchange rate: Global political instability and regional tensions can influence investor risk appetite, impacting the exchange rate.

Conclusion: Understanding the KRW/USD Exchange Rate After Trump's Claims

This analysis reveals that while Trump's accusations of currency manipulation had a noticeable short-term impact on the KRW/USD exchange rate, the long-term effects are less straightforward. The KRW/USD exchange rate is a dynamic indicator influenced by a multitude of factors beyond political rhetoric. Understanding these interwoven elements – macroeconomic conditions, market sentiment, and geopolitical risks – is crucial for comprehending fluctuations in the KRW/USD exchange rate. Stay informed about the KRW/USD exchange rate and its implications for global markets by regularly consulting reputable financial news sources and economic data providers. Understanding the complexities of this key currency pair is essential for navigating the intricacies of international finance.

Featured Posts

-

Is Ashton Jeanty Headed To Chicago Examining The 2025 Nfl Draft Buzz

Apr 25, 2025

Is Ashton Jeanty Headed To Chicago Examining The 2025 Nfl Draft Buzz

Apr 25, 2025 -

Election Promises And The Looming Deficit Crisis

Apr 25, 2025

Election Promises And The Looming Deficit Crisis

Apr 25, 2025 -

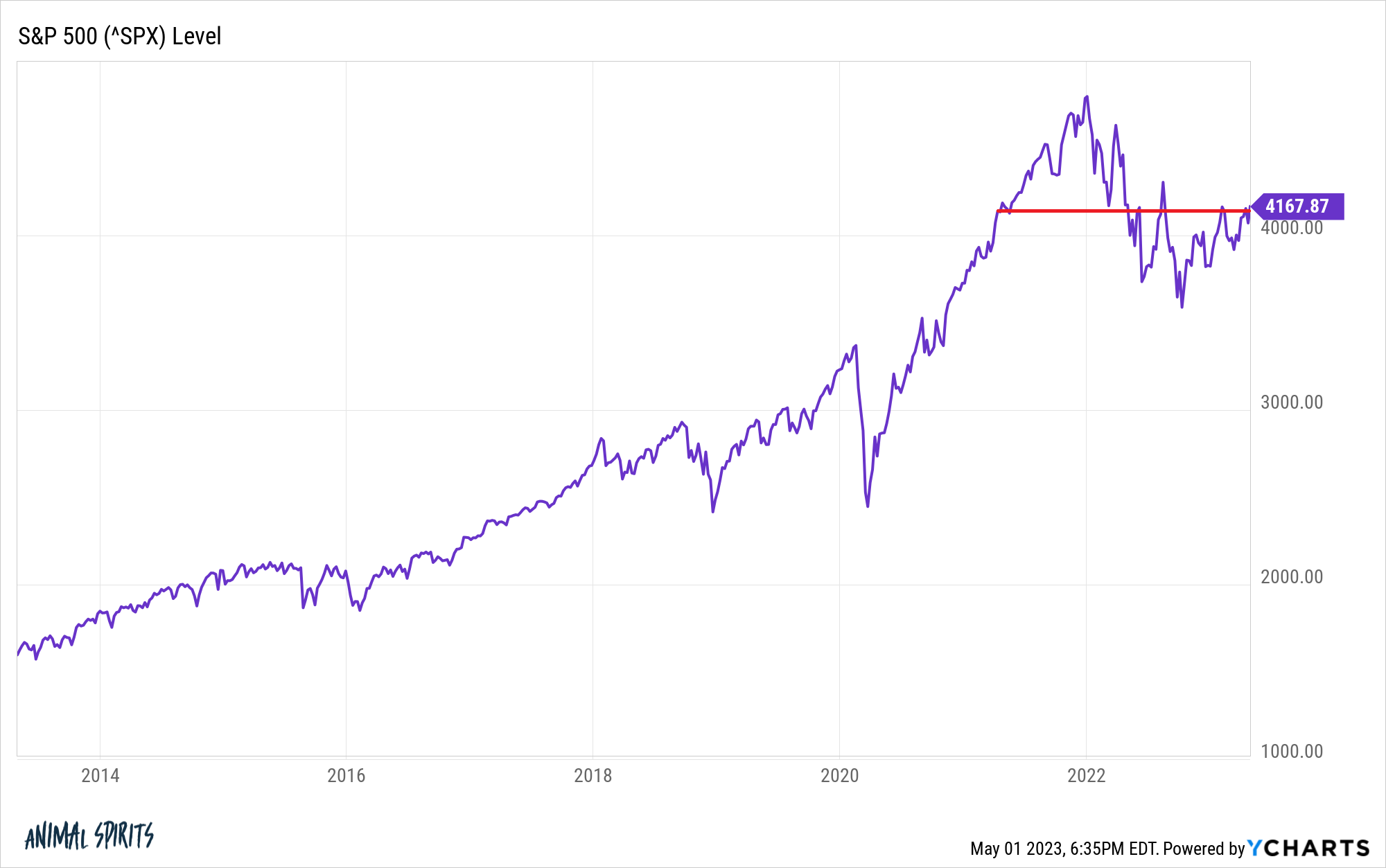

Addressing High Stock Market Valuations Insights From Bof A

Apr 25, 2025

Addressing High Stock Market Valuations Insights From Bof A

Apr 25, 2025 -

Dangerous Road Conditions In Okc Multiple Crash Report Due To Ice

Apr 25, 2025

Dangerous Road Conditions In Okc Multiple Crash Report Due To Ice

Apr 25, 2025 -

Makeup And Skin Health Understanding The Potential Risks And Benefits

Apr 25, 2025

Makeup And Skin Health Understanding The Potential Risks And Benefits

Apr 25, 2025