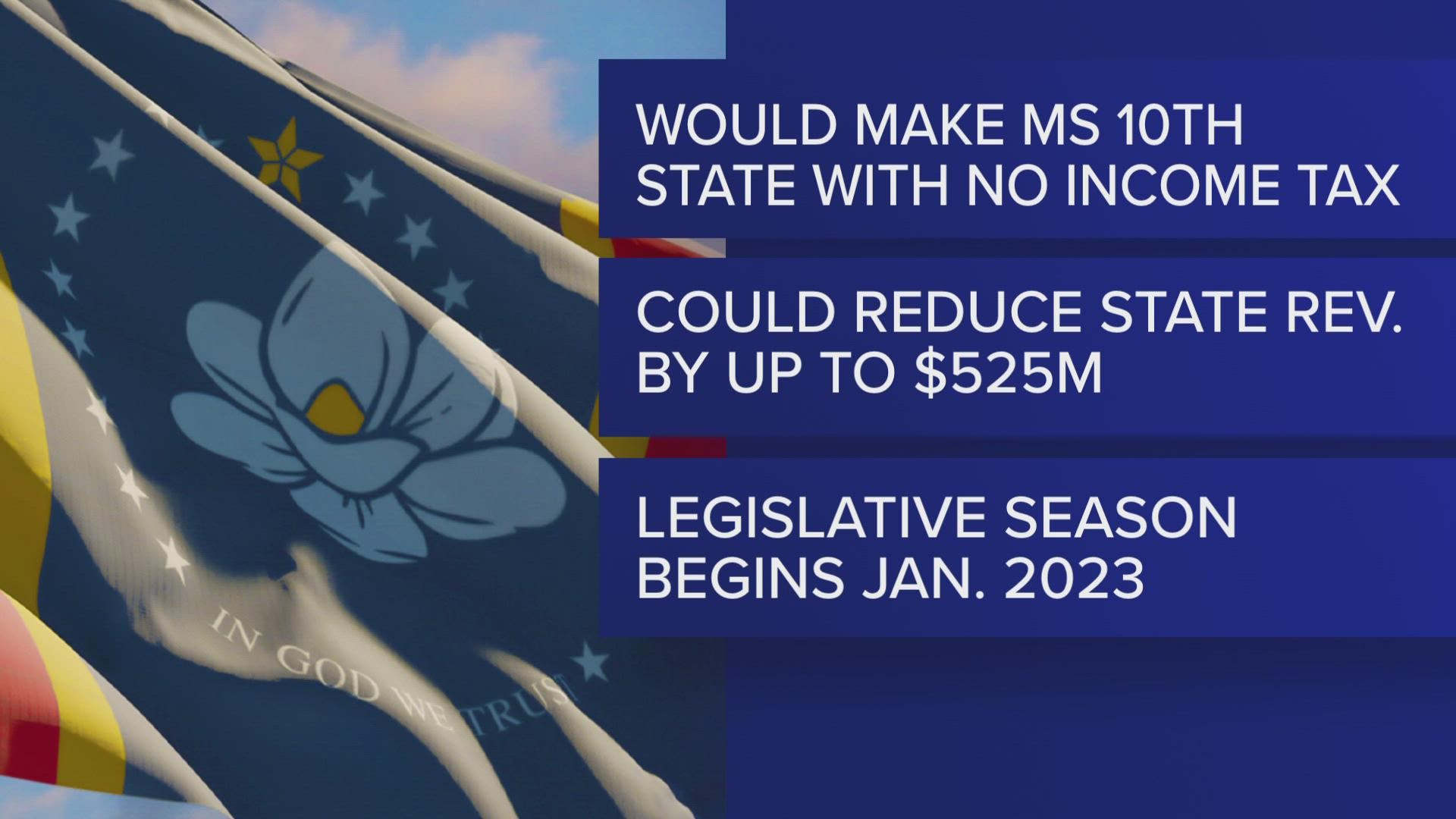

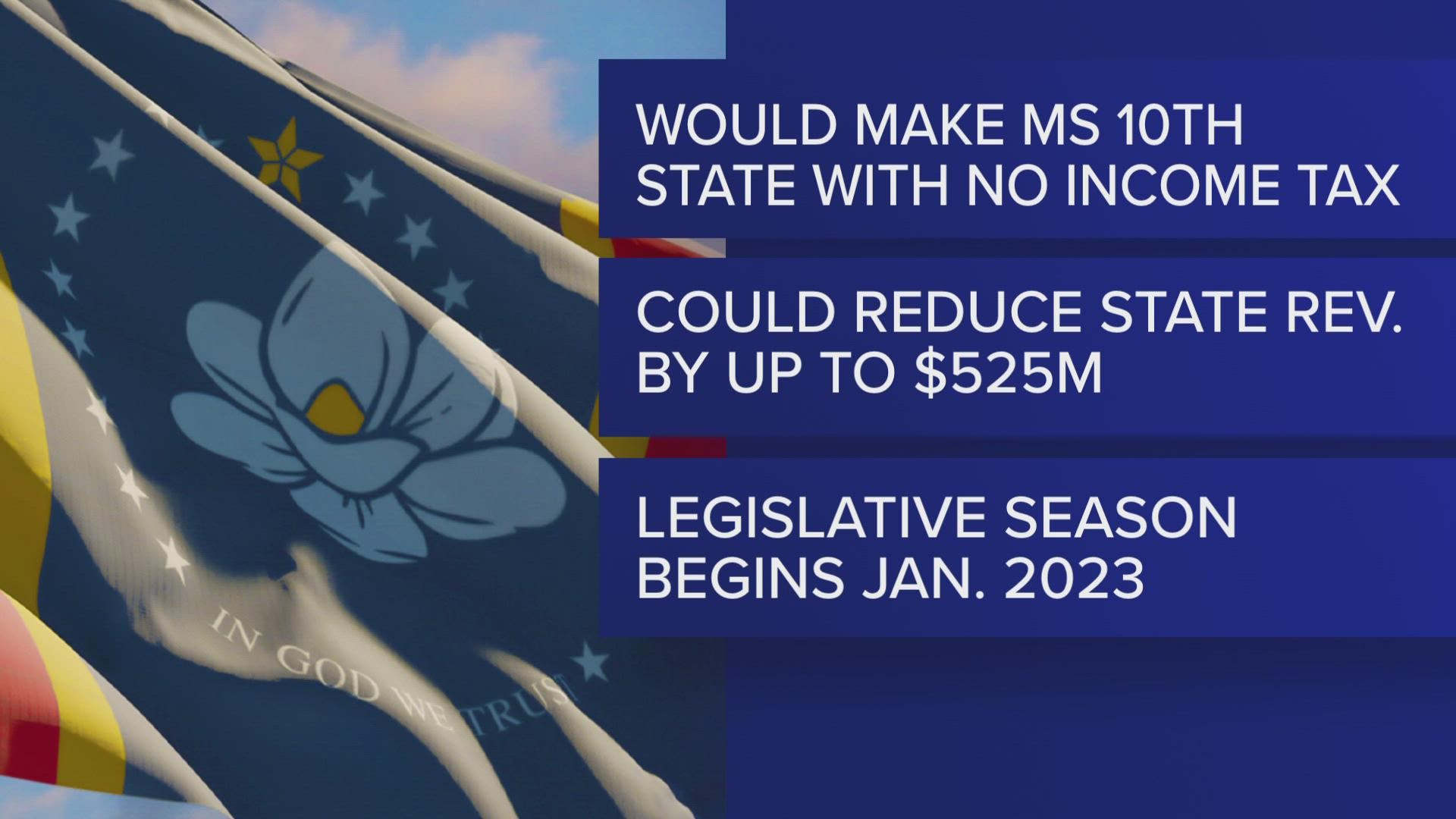

Analyzing The Potential Effects Of Income Tax Elimination On Hernando, Mississippi

Table of Contents

Economic Impacts of Income Tax Elimination in Hernando, MS

Potential Economic Growth and Stimulation

Income tax elimination in Hernando, MS, could potentially stimulate economic growth through several key mechanisms. Increased disposable income for residents would likely lead to higher consumer spending, boosting local businesses and creating a ripple effect throughout the economy. This increased spending power could revitalize local businesses and potentially attract new investment. Lower taxes could also entice businesses, particularly small businesses and tech startups, to relocate to Hernando, creating jobs and further stimulating the local economy. This influx of businesses and investment could lead to increased property values, creating a positive feedback loop of economic growth.

- Examples of attracted businesses: Tech startups leveraging Mississippi's growing tech infrastructure, small retail businesses drawn to a lower tax environment, and possibly even light manufacturing attracted by a business-friendly climate.

- Data point example: If the average household in Hernando sees a $5,000 increase in disposable income due to income tax elimination, a conservative estimate suggests a significant increase in local consumer spending, potentially boosting sales tax revenue and overall economic activity.

Potential Negative Economic Consequences

While the potential upsides are significant, eliminating income tax in Hernando also presents considerable economic risks. The most immediate concern is the drastic reduction in government revenue. This loss of income could necessitate deep cuts in essential public services, including education, infrastructure maintenance, and public safety. The resulting decline in these services could negatively impact the quality of life and long-term economic prospects of the community.

Furthermore, the benefits of income tax elimination may not be evenly distributed. Increased income inequality could emerge if the benefits disproportionately accrue to higher-income earners, potentially exacerbating existing social and economic divides. Another risk is the potential outflow of high-income earners to states with even lower tax burdens, negating some of the intended economic benefits. Finally, a sudden surge in consumer spending without a corresponding increase in production could lead to inflation, eroding the purchasing power of residents.

- Examples of potential public service cuts: Reduced funding for schools leading to larger class sizes and fewer resources, deferred road maintenance and infrastructure upgrades, and potential cuts to law enforcement and emergency services.

- Data point example: An analysis of Hernando's current budget and the proportion of revenue derived from income tax would highlight the scale of the potential revenue shortfall and the severity of required budget cuts.

Social Impacts of Income Tax Elimination in Hernando, MS

Improved Quality of Life for Residents

A key argument in favor of income tax elimination is the potential improvement in residents' quality of life. With more disposable income, families could invest more in healthcare, education, and leisure activities. This could lead to better health outcomes, improved educational attainment, and increased overall well-being. Furthermore, increased investment in the community due to economic growth could foster community revitalization projects, improving infrastructure and creating more attractive public spaces.

- Statistics showcasing current healthcare/education access in Hernando: Data on healthcare access, school performance metrics, and access to recreational facilities would provide a baseline to measure potential improvements.

- Examples of community projects: Improved parks, upgraded community centers, and investments in local arts and cultural programs could significantly enhance the quality of life.

Potential Negative Social Consequences

Conversely, the elimination of income tax could also have detrimental social consequences. Cuts to public services could disproportionately impact vulnerable populations, reducing access to essential healthcare and education. Increased competition for limited resources – due to potential government budget cuts - could lead to social tension and conflict. Finally, if the economic benefits are not equitably distributed, lower-income residents might face out-migration to communities offering better opportunities, potentially altering the demographics of Hernando significantly.

- Examples of social programs that might be affected: Affordable housing initiatives, food assistance programs, and mental health services could face significant funding cuts.

- Data points illustrating the demographic breakdown of Hernando: Understanding the socioeconomic makeup of Hernando will help assess the potential impact of income tax elimination on different segments of the population.

Practical Considerations for Income Tax Elimination in Hernando, MS

Feasibility and Implementation Challenges

Implementing income tax elimination in Hernando presents significant practical challenges. Finding replacement revenue sources is paramount. Alternative taxation methods, such as increased property taxes or sales taxes, would need careful consideration, weighing their potential economic and social impacts. A gradual implementation, phasing out income tax over several years, could help mitigate sudden economic shocks. Robust economic modeling and forecasting are critical for predicting the short-term and long-term consequences of this policy change. Finally, navigating the political landscape and securing public support for this drastic measure would be crucial.

- Discussion of the pros and cons of different alternative revenue sources: A detailed analysis of the advantages and disadvantages of increased property taxes versus increased sales taxes is essential.

- Examples of successful/unsuccessful tax elimination models in other areas: Learning from the experiences of other jurisdictions that have implemented similar policies (or failed to do so successfully) is vital for informed decision-making.

Long-Term Sustainability and Economic Resilience

For income tax elimination to be sustainable in the long term, Hernando must focus on economic diversification and resilience. Reducing over-reliance on specific sectors is vital to mitigating economic vulnerability. Investing in infrastructure and human capital—improving roads, schools, and access to quality education and job training—will contribute significantly to long-term economic growth. Strategic planning, regularly reviewing the impact of the policy change, and adjusting based on the outcomes are essential.

- Examples of long-term economic planning strategies: Investing in workforce development programs to prepare the community for emerging industries, developing a strategic plan for attracting diverse businesses, and building a robust tourism sector.

- Discussion of how to promote economic diversification: Incentivizing the growth of multiple industries and supporting entrepreneurship will increase resilience to economic downturns.

Conclusion

The potential effects of income tax elimination on Hernando, Mississippi, are complex and far-reaching. While the prospect of economic stimulation and improved quality of life is appealing, the potential risks to public services, social equity, and long-term economic stability cannot be ignored. A thorough cost-benefit analysis, exploring alternative revenue streams and developing a comprehensive implementation plan, is crucial. Further research, community engagement, and open dialogue are essential to inform a decision about the future of income tax elimination in Hernando, Mississippi. Careful consideration of all aspects is vital before embarking on such a significant policy shift.

Featured Posts

-

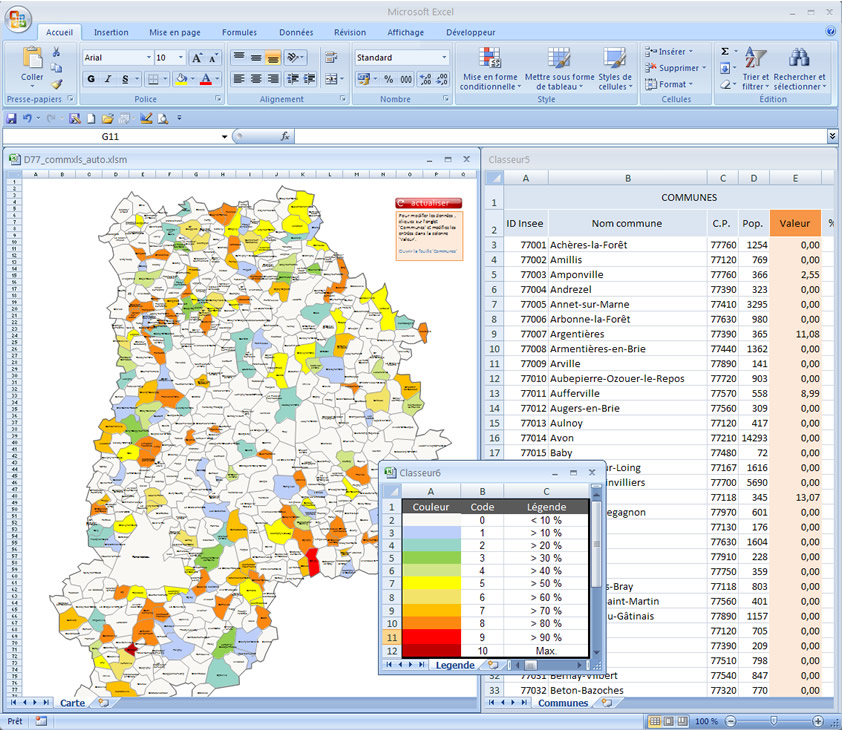

Prix Des Maisons En France Carte Interactive Et Donnees Notariales

May 19, 2025

Prix Des Maisons En France Carte Interactive Et Donnees Notariales

May 19, 2025 -

Fatih Erbakandan Kibris Aciklamasi Sehitlerimizin Kaniyla Cizilmis Kirmizi Cizgi

May 19, 2025

Fatih Erbakandan Kibris Aciklamasi Sehitlerimizin Kaniyla Cizilmis Kirmizi Cizgi

May 19, 2025 -

Erling Haaland Police Report Filed After Man City Mascot Suffers Whiplash

May 19, 2025

Erling Haaland Police Report Filed After Man City Mascot Suffers Whiplash

May 19, 2025 -

Sygkrisi Timon Kaysimon Eyresi Ton Kalyteron Prosforon

May 19, 2025

Sygkrisi Timon Kaysimon Eyresi Ton Kalyteron Prosforon

May 19, 2025 -

Californias Ev Mandate Automakers Aggressive Pushback

May 19, 2025

Californias Ev Mandate Automakers Aggressive Pushback

May 19, 2025