Apple Stock Suffers Setback Amidst $900 Million Tariff Projection

Table of Contents

The $900 Million Tariff Projection: A Deep Dive

The $900 million figure representing the potential tariff increase on Apple products stems from a recent report by [Insert Source – e.g., a reputable financial news outlet, analyst firm, etc. Include a hyperlink to the source]. This report projects that new or increased tariffs, primarily originating from [Insert Country/Countries – e.g., China], will significantly impact Apple's bottom line. The analysis focuses on the increased costs associated with importing key components and finished products, particularly impacting several of Apple's flagship devices.

The specific Apple products expected to bear the brunt of these increased tariffs include:

- iPhones: A significant portion of iPhone manufacturing and assembly occurs in [Insert Country/Countries], making them highly vulnerable to tariff increases.

- AirPods: The wireless earphones are also likely to be affected due to their manufacturing location and imported components.

- iPads: Similar to iPhones, iPads' manufacturing processes are sensitive to changes in international trade policies.

- MacBooks: Certain components sourced from affected countries could contribute to increased costs.

- Apple Watches: The intricate manufacturing process could make this product sensitive to tariff increases on components.

The reasons behind these tariff increases are multifaceted, ranging from [Insert Reasons – e.g., geopolitical tensions, trade disputes, protectionist policies]. These tariffs, depending on the final implementation, could potentially increase costs by [Insert Percentage – e.g., 10-20%] for affected products. The anticipated timeline for the full implementation of these tariffs is [Insert Timeline – e.g., within the next quarter, or a specific date].

Impact on Apple's Financial Performance and Stock Price

The projected $900 million increase in tariff costs poses a considerable threat to Apple's financial performance. This could translate to a significant decrease in revenue, potentially impacting [Insert Projected Revenue Decrease Percentage or Amount]. Furthermore, the increased production costs may force Apple to either absorb the increased expenses, impacting profit margins, or pass the added costs on to consumers, potentially affecting sales volumes.

The uncertainty surrounding the tariff situation has already created volatility in Apple's stock price. Since the initial reports, Apple's stock has experienced [Insert Description of Stock Price Fluctuations – e.g., a decline of X%, increased volatility]. This reflects the apprehension among investors concerning the long-term implications of these tariffs on the company's profitability and future growth prospects. Analyst ratings for Apple stock have shown [Insert Changes in Ratings – e.g., a mixture of downgrades and holds, indicating uncertainty].

- Projected revenue decrease due to tariffs: [Insert Percentage or Amount]

- Changes in profit margins: [Insert Percentage or Amount – positive or negative]

- Stock price fluctuations since the tariff announcement: [Insert Details – e.g., percentage changes, high and low points]

- Analyst predictions and ratings for Apple stock: [Summarize Analyst Opinions]

Apple's Response and Mitigation Strategies

Apple has yet to issue an official and detailed statement directly addressing the $900 million tariff projection specifically. However, [Insert any public statements or actions]. The company might consider several strategies to mitigate the negative impacts:

- Price adjustments: Apple could choose to increase the prices of affected products to offset the higher costs.

- Shifting production locations: Relocating manufacturing to countries with more favorable trade agreements could reduce tariff costs.

- Lobbying efforts: Engaging with policymakers to influence trade policies and potentially lessen the tariff impact is a possible course of action.

- Component Sourcing Diversification: Exploring alternative suppliers from countries without tariffs imposed.

The effectiveness of these strategies is yet to be seen and will depend on various factors, including the magnitude and duration of the tariffs, consumer reaction to price increases, and the feasibility of relocating production.

Investor Sentiment and Market Reactions

The news of the potential tariffs has understandably caused a wave of uncertainty among investors. Trading volume for Apple stock has [Insert Description – e.g., increased, remained steady, decreased]. This heightened activity reflects investors reassessing their holdings in light of the potential financial impact. Apple's market capitalization has been [Insert Description – e.g., affected negatively, showing resilience]. Expert opinions on the matter are divided, with some suggesting [Insert Expert Opinions – e.g., a short-term correction, long-term resilience].

- Changes in trading volume for Apple stock: [Insert Data]

- Impact on Apple's market capitalization: [Insert Data]

- Expert opinions on the long-term implications for Apple: [Summarize Expert Opinions]

Conclusion: Navigating the Uncertainty: Apple Stock and Tariffs

The $900 million tariff projection presents a significant challenge to Apple's financial health. The potential impact on revenue, profit margins, and stock price is substantial. While Apple might employ various mitigation strategies, the ultimate outcome remains uncertain. The situation highlights the complexities of global trade and its profound effects on even the most successful multinational corporations.

Stay updated on the latest developments regarding Apple stock and the ongoing tariff situation. Monitor financial news and analyst reports for further insights into how this may impact your investments. Further research into "Apple stock forecast," "tariff impact on tech stocks," and "global trade implications for Apple" will provide a more comprehensive understanding of this evolving situation.

Featured Posts

-

Avoid Memorial Day Travel Chaos Best And Worst Flight Days In 2025

May 24, 2025

Avoid Memorial Day Travel Chaos Best And Worst Flight Days In 2025

May 24, 2025 -

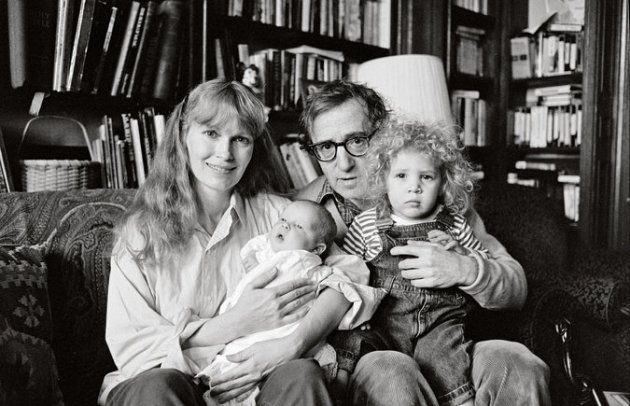

A Different Perspective Sean Penn On The Woody Allen And Dylan Farrow Case

May 24, 2025

A Different Perspective Sean Penn On The Woody Allen And Dylan Farrow Case

May 24, 2025 -

Manny Garcias Lego Masterclass At Veterans Memorial Elementary School Photos

May 24, 2025

Manny Garcias Lego Masterclass At Veterans Memorial Elementary School Photos

May 24, 2025 -

Almanya Alshrtt Tshn Hmlt Ela Mshjeyn

May 24, 2025

Almanya Alshrtt Tshn Hmlt Ela Mshjeyn

May 24, 2025 -

Rekordnoe Kolichestvo Svadeb Na Kharkovschine 40 Par Skazali Da Foto

May 24, 2025

Rekordnoe Kolichestvo Svadeb Na Kharkovschine 40 Par Skazali Da Foto

May 24, 2025

Latest Posts

-

2025s Best Us Beaches Dr Beachs Top 10

May 24, 2025

2025s Best Us Beaches Dr Beachs Top 10

May 24, 2025 -

Revised Carry On Policy Southwest Airlines Limits Portable Chargers

May 24, 2025

Revised Carry On Policy Southwest Airlines Limits Portable Chargers

May 24, 2025 -

The Promise Of Space Crystals Revolutionizing Drug Development Through Orbital Research

May 24, 2025

The Promise Of Space Crystals Revolutionizing Drug Development Through Orbital Research

May 24, 2025 -

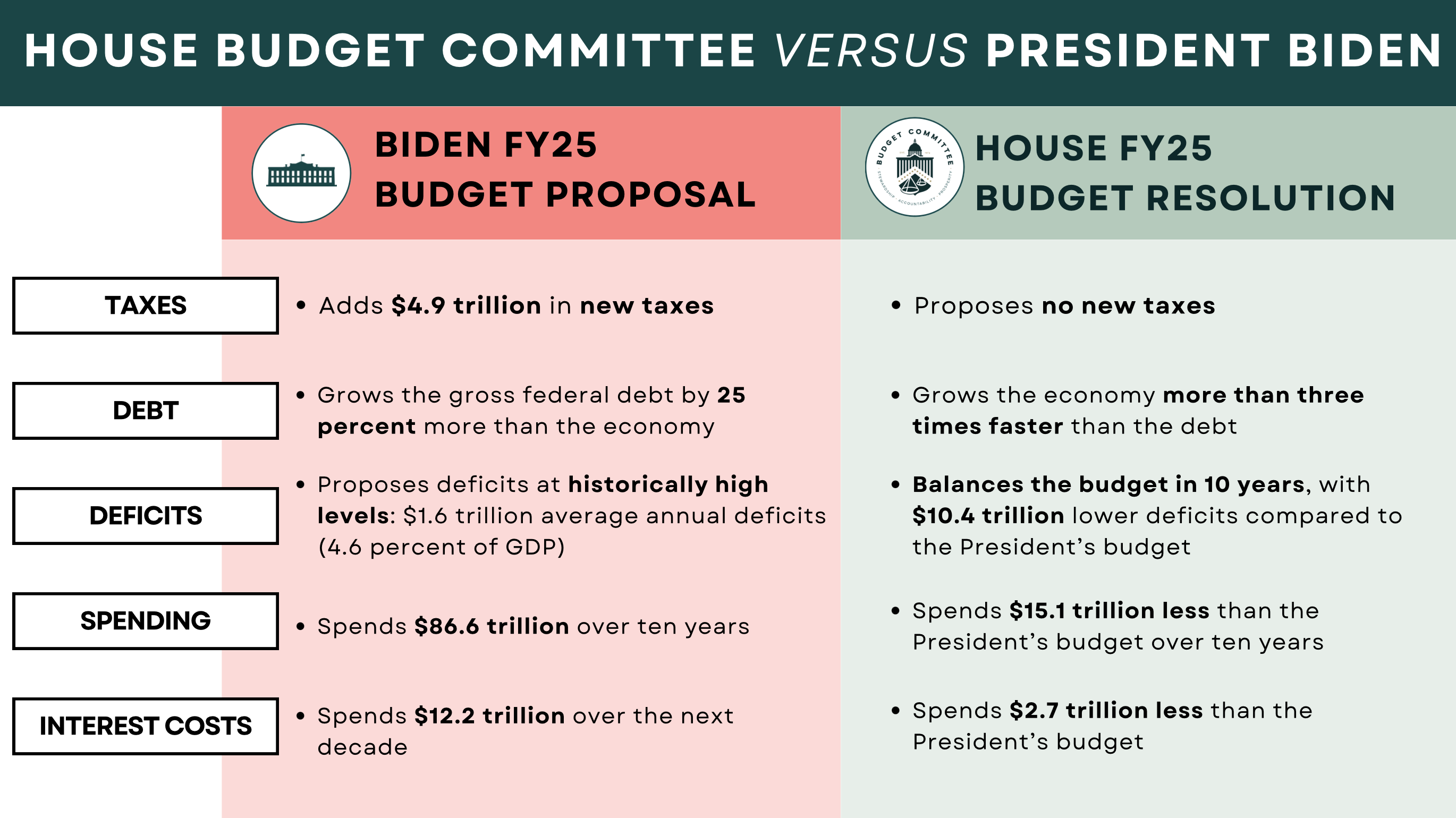

The Trump Tax Bill Final Version Passes The House

May 24, 2025

The Trump Tax Bill Final Version Passes The House

May 24, 2025 -

Southwest Airlines Announces New Restrictions For Portable Chargers In Carry On

May 24, 2025

Southwest Airlines Announces New Restrictions For Portable Chargers In Carry On

May 24, 2025