Apple To $254? A Wall Street Analyst's Perspective And Investment Implications

Table of Contents

The Analyst's Rationale Behind the $254 Apple Stock Price Target

Leading the charge is [Analyst Name] from [Investment Firm], whose recent report projects Apple's stock price reaching $254. [Link to report, if available]. Their prediction hinges on several key factors:

-

Strong iPhone Sales and Anticipated Growth: The iPhone remains Apple's flagship product, and projections show continued strong sales, particularly in emerging markets. Sustained demand, coupled with anticipated upgrades and new model releases, fuels this optimistic forecast for Apple stock. This is a critical component of any Apple stock forecast.

-

Success of New Product Launches (e.g., Apple Watch, AirPods, Services): Apple's ecosystem extends beyond the iPhone. The consistent success of wearables like the Apple Watch and AirPods, along with the rapidly expanding Apple Services revenue stream (including iCloud, Apple Music, and Apple TV+), contributes significantly to the overall financial health and projected growth of Apple stock.

-

Expanding Market Share in Key Sectors (e.g., wearables, services): Apple continues to dominate the wearable tech market and is aggressively expanding its services portfolio. This growing market share indicates a strong foundation for future growth, enhancing the potential for the Apple stock price prediction to materialize.

-

Positive Market Sentiment and Investor Confidence: Currently, investor sentiment towards Apple is generally positive, reflecting confidence in the company's innovative capacity and consistent financial performance. This positive sentiment contributes to the bullish Apple stock price prediction.

-

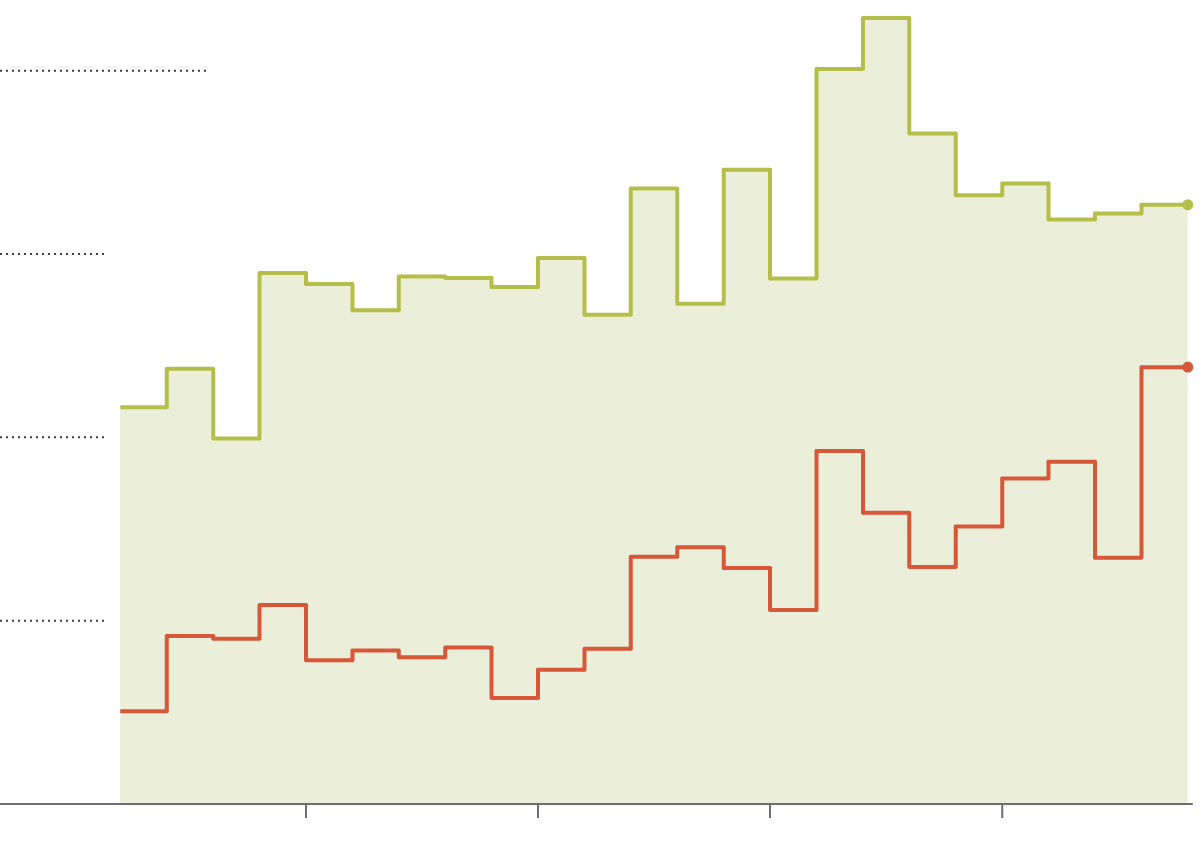

Financial Projections and Earnings Estimates Supporting the Price Target: The analyst's $254 prediction is rooted in robust financial projections and earnings estimates that indicate significant growth in the coming years. These figures underpin the analyst’s confidence in the potential for Apple stock to reach this level. The detailed Apple earnings reports are crucial in supporting these projections.

Market Conditions and Their Impact on the Apple Stock Price Prediction

While the analyst's rationale is compelling, the broader macroeconomic environment significantly impacts the Apple stock price prediction.

-

Interest Rate Hikes and Their Effect on Investor Behavior: Rising interest rates often lead to decreased investor risk appetite, potentially affecting investments in growth stocks like Apple.

-

Global Economic Growth or Recessionary Fears: A global recession or significant economic slowdown could negatively impact consumer spending, potentially dampening demand for Apple products and affecting the Apple stock forecast.

-

Geopolitical Factors Affecting the Tech Sector: Geopolitical instability and trade tensions can influence the tech sector, creating uncertainty and impacting the Apple stock price.

-

Competition from Other Tech Companies: Intense competition from other tech giants, particularly in the smartphone and services markets, poses a constant challenge to Apple's market dominance. Analyzing competitors' strategies is vital when forecasting Apple stock.

Investment Implications: Should You Buy, Sell, or Hold Apple Stock?

The $254 Apple stock price prediction presents both opportunities and risks.

-

Potential Upside if the Prediction is Accurate: Reaching $254 represents significant potential returns for investors.

-

Downside Risks if the Prediction Fails to Materialize: There’s always risk involved in any stock investment. Factors like macroeconomic conditions and competitive pressures could prevent Apple stock from reaching $254.

-

Diversification Strategies for Managing Risk: Diversifying your investment portfolio across different asset classes is crucial to manage risk associated with any single stock investment, including Apple stock.

-

Consideration of Alternative Investment Options: Investors should always compare Apple stock with other investment options to ensure they're making the most strategic investment decisions.

Alternative Analyst Perspectives on Apple's Future

Not all analysts share the same optimistic outlook. Some predict a lower price target for Apple stock, citing concerns about slowing growth or heightened competition. Understanding these differing perspectives is key to forming a comprehensive view. Analyzing a range of Apple stock analysts' opinions provides a more balanced perspective on the future of Apple stock. This is crucial for informed investment decisions.

Conclusion: Making Informed Decisions About Apple Stock at $254 (or Not)

The potential for Apple stock to reach $254 is a compelling prospect, driven by strong iPhone sales, successful new product launches, and positive investor sentiment. However, macroeconomic factors, competition, and varying analyst opinions necessitate caution. Thorough due diligence, considering diverse perspectives, and understanding your own risk tolerance are crucial before making any investment decisions. Is Apple reaching $254 a realistic goal for your investment portfolio? Learn more and make informed decisions about Apple stock today!

Featured Posts

-

Almanya Alshrtt Tshn Hmlt Ela Mshjeyn

May 24, 2025

Almanya Alshrtt Tshn Hmlt Ela Mshjeyn

May 24, 2025 -

Sharp Decline In Amsterdam Stock Exchange Aex Index At 1 Year Low

May 24, 2025

Sharp Decline In Amsterdam Stock Exchange Aex Index At 1 Year Low

May 24, 2025 -

Ftc Seeks To Overturn Ruling Allowing Microsoft Activision Merger

May 24, 2025

Ftc Seeks To Overturn Ruling Allowing Microsoft Activision Merger

May 24, 2025 -

Bmw And Porsches China Challenges A Growing Trend

May 24, 2025

Bmw And Porsches China Challenges A Growing Trend

May 24, 2025 -

Wildfires Drive Record Breaking Global Forest Loss

May 24, 2025

Wildfires Drive Record Breaking Global Forest Loss

May 24, 2025

Latest Posts

-

Open Ai And Jony Ive The Rumored Ai Hardware Acquisition

May 24, 2025

Open Ai And Jony Ive The Rumored Ai Hardware Acquisition

May 24, 2025 -

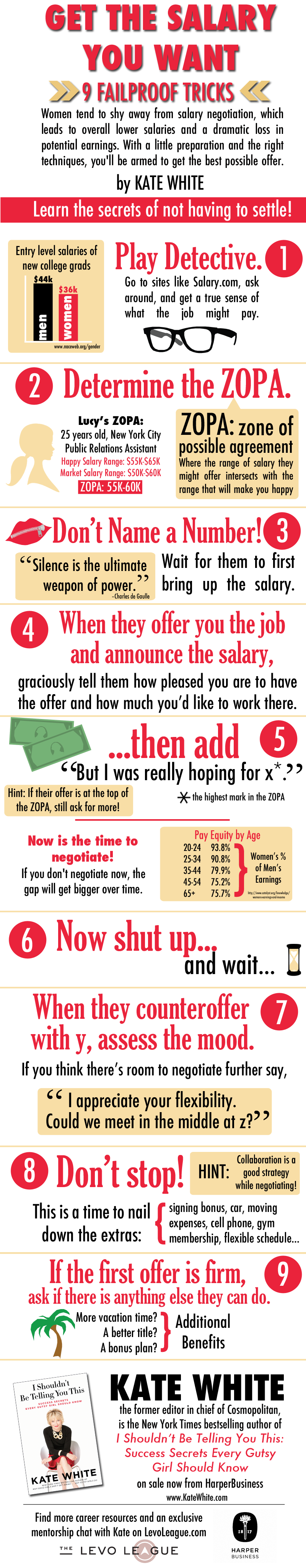

Getting More Than The Best And Final Job Offer A Practical Guide

May 24, 2025

Getting More Than The Best And Final Job Offer A Practical Guide

May 24, 2025 -

Is Open Ai Acquiring Jony Ives Ai Startup Analysis And Implications

May 24, 2025

Is Open Ai Acquiring Jony Ives Ai Startup Analysis And Implications

May 24, 2025 -

Beyond The Best And Final Offer Tips For Successful Salary Negotiation

May 24, 2025

Beyond The Best And Final Offer Tips For Successful Salary Negotiation

May 24, 2025 -

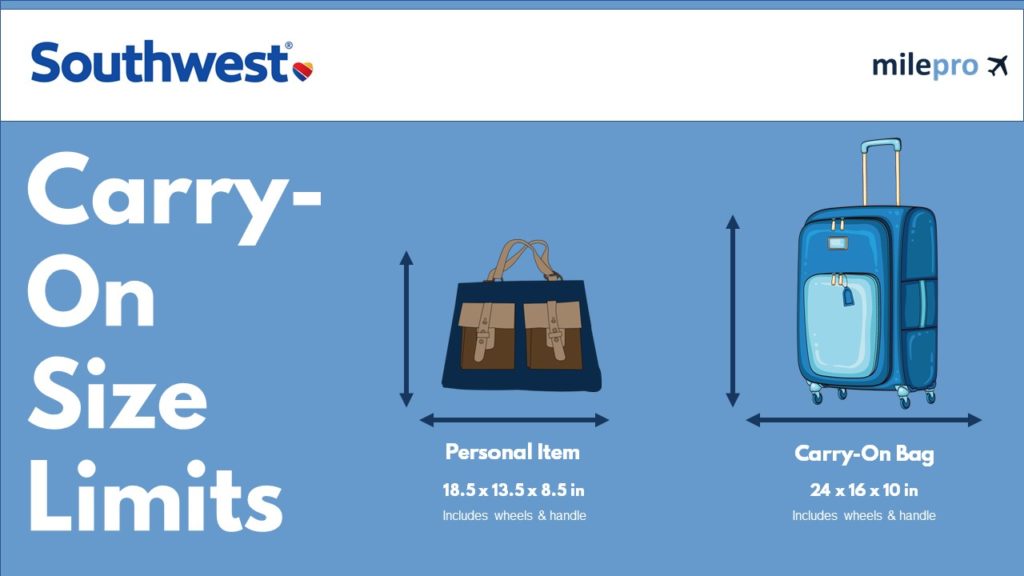

Understanding Southwest Airlines New Carry On Rules For Portable Chargers

May 24, 2025

Understanding Southwest Airlines New Carry On Rules For Portable Chargers

May 24, 2025