Are High Stock Market Valuations A Cause For Concern? BofA Weighs In

Table of Contents

Keywords: High stock market valuations, stock market valuation, BofA, Bank of America, market analysis, investment strategy, market risk, stock market outlook, high P/E ratios, economic outlook

High stock market valuations have become a dominant theme in recent financial discussions. Are these elevated valuations a cause for concern, or simply a reflection of a healthy economy? Bank of America (BofA), a major player in the financial world, offers valuable insights into this complex question. This article analyzes BofA's perspective on current stock market valuations, examining the contributing factors, potential risks, and recommended investment strategies.

BofA's Assessment of Current Stock Market Valuations

BofA's recent reports have consistently highlighted the elevated nature of current stock market valuations. While they haven't issued a blanket "sell" signal, their analysis reveals a cautious optimism. Key metrics like Price-to-Earnings (P/E) ratios and price-to-sales ratios are frequently cited as being above historical averages, suggesting that stocks may be priced higher than their fundamentals justify.

- Quote: (Insert a relevant quote directly from a recent BofA research report regarding market valuations. Ensure you properly cite the source).

- Sectoral Analysis: BofA often highlights specific sectors that appear overvalued (e.g., technology during certain periods) and others that appear undervalued (e.g., cyclical sectors during economic downturns). (Provide specific examples based on recent BofA reports, if available).

- Overall Sentiment: Based on their recent publications, BofA's overall sentiment leans towards (state whether BofA's sentiment is bullish, bearish, or neutral, and support this with evidence from their reports).

Factors Contributing to High Stock Market Valuations

Several factors contribute to the current high stock market valuations. Understanding these elements is crucial for making informed investment decisions.

- Low Interest Rates: Historically low interest rates have fueled investment flows into the stock market, as returns from bonds and other fixed-income instruments have been relatively unattractive. This increased demand for equities has driven prices higher.

- Quantitative Easing: Central bank policies like quantitative easing (QE) have injected massive liquidity into the market, further supporting asset prices, including stocks.

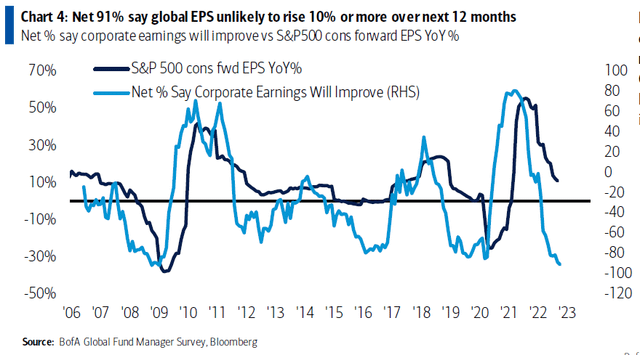

- Corporate Earnings: Strong corporate earnings, especially in certain sectors, have also contributed to high valuations. However, the sustainability of these earnings needs to be carefully assessed. (Mention whether BofA's analysis suggests strong or weak earnings growth and its impact on valuations).

- Investor Sentiment: Positive investor sentiment and market psychology play a crucial role. Optimism about future growth prospects can push valuations to elevated levels.

- Geopolitical Factors: Global geopolitical events and uncertainties can significantly influence investor sentiment and market behavior, impacting stock valuations. (Mention any relevant geopolitical factors highlighted by BofA).

The Role of Inflation in Stock Market Valuations

Inflation is a critical factor influencing stock market valuations.

- Inflation's Impact on Earnings: High inflation can erode corporate earnings, impacting P/E ratios. Conversely, controlled inflation can sometimes support earnings growth.

- Federal Reserve Response: The Federal Reserve's response to inflation, particularly interest rate hikes, has a significant bearing on market valuations. Rising interest rates can make equities less attractive relative to bonds, potentially leading to lower valuations.

- BofA's Inflation Predictions: (State BofA's predictions regarding future inflation and how this may affect stock valuations. Cite the source).

Potential Risks Associated with High Valuations

Investing in a highly valued market carries inherent risks.

- Market Corrections: High valuations increase the likelihood of market corrections or even crashes. A sudden drop in prices can significantly impact investors' portfolios.

- Increased Volatility: A highly valued market is often associated with increased volatility and uncertainty, making it harder to predict market movements.

- Rising Interest Rates: As mentioned earlier, rising interest rates can negatively impact stock valuations by reducing the relative attractiveness of equities.

- Bubble Burst: The potential for a market bubble burst is a significant concern when valuations are exceptionally high.

Investment Strategies in a High-Valuation Market

Given the current high valuations, investors need a carefully considered strategy. While BofA doesn't offer specific stock picks, their general advice usually emphasizes caution and diversification.

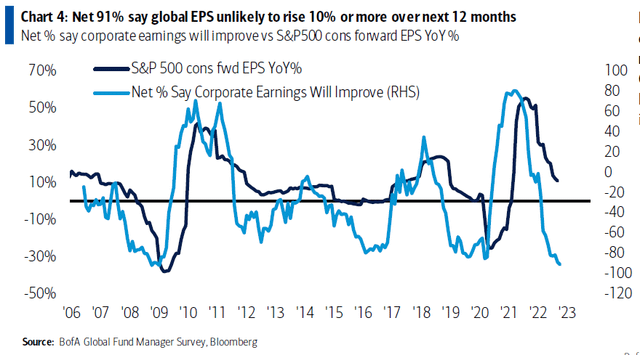

- Diversification: Diversifying across different asset classes (stocks, bonds, real estate, etc.) and sectors is crucial to mitigate risk.

- Sector-Specific Opportunities: While the overall market may be overvalued, certain sectors might still present attractive opportunities. (If available, mention sectors BofA considers relatively undervalued).

- Defensive Strategies: Considering defensive investment strategies, focusing on companies with stable earnings and less susceptibility to market fluctuations, might be prudent.

- Long-Term Perspective: Maintaining a long-term investment horizon can help weather short-term market fluctuations and benefit from long-term growth.

Conclusion

BofA's analysis suggests that high stock market valuations are a cause for some caution, but not necessarily outright panic. While several factors contribute to these elevated valuations, the potential risks associated with them cannot be ignored. Investors should carefully consider the potential for market corrections, increased volatility, and the impact of rising interest rates. By diversifying their portfolios, employing defensive strategies, and maintaining a long-term perspective, investors can navigate this challenging environment. Understanding the nuances of high stock market valuations is crucial for making informed investment decisions. Stay informed about the evolving landscape of stock market valuations by regularly reviewing market analysis from reputable sources like BofA and adjusting your investment strategy accordingly.

Featured Posts

-

Understanding The Delays In Kentuckys Storm Damage Assessments

Apr 29, 2025

Understanding The Delays In Kentuckys Storm Damage Assessments

Apr 29, 2025 -

Predicting Trumps Next 100 Days Focus On Trade Agreements Deregulation And Executive Orders

Apr 29, 2025

Predicting Trumps Next 100 Days Focus On Trade Agreements Deregulation And Executive Orders

Apr 29, 2025 -

Is Tremors Returning To Netflix News And Updates

Apr 29, 2025

Is Tremors Returning To Netflix News And Updates

Apr 29, 2025 -

Reliances Earnings A Potential Catalyst For Indian Large Cap Growth

Apr 29, 2025

Reliances Earnings A Potential Catalyst For Indian Large Cap Growth

Apr 29, 2025 -

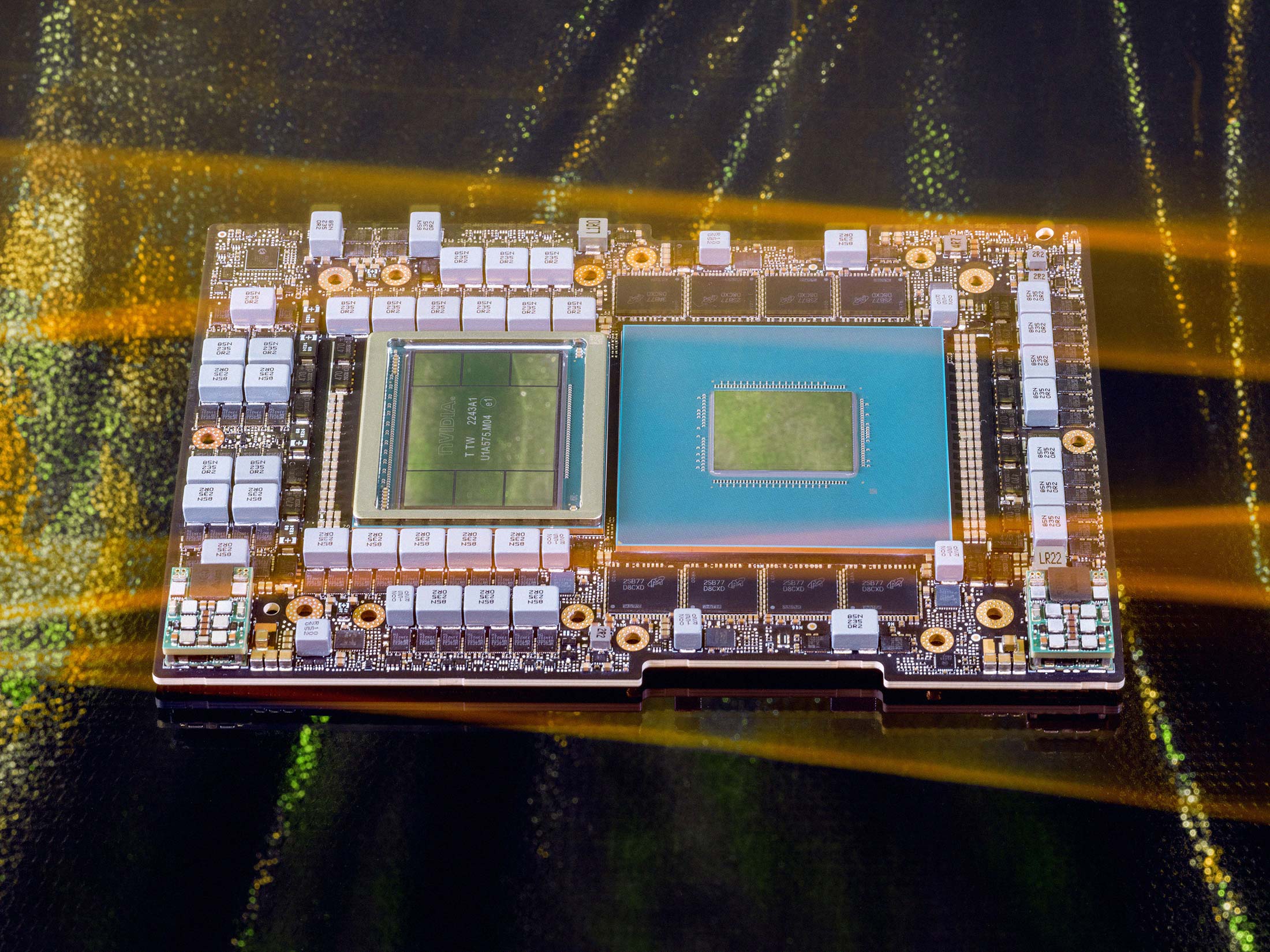

Exclusive Huaweis Ai Chip Breakthrough Aims To Rival Nvidia

Apr 29, 2025

Exclusive Huaweis Ai Chip Breakthrough Aims To Rival Nvidia

Apr 29, 2025