Are Thames Water Executive Bonuses Justified? An Analysis

Table of Contents

Thames Water's Financial Performance

Profitability and Investment

Were Thames Water's profits sufficient to warrant substantial executive bonuses, or were these bonuses disproportionate to financial performance? Analyzing profitability requires looking beyond headline numbers. While Thames Water may report profits, a crucial aspect is how those profits are generated and utilized.

- Profit Margins: Data on Thames Water's profit margins over the past few years is needed to assess profitability. Are these margins competitive within the UK water industry? Higher-than-average margins might suggest greater capacity for executive bonuses, but only if accompanied by demonstrable investment in infrastructure improvements.

- Return on Investment (ROI): A strong ROI indicates efficient use of capital. However, a high ROI achieved while neglecting infrastructure maintenance is unsustainable and detrimental in the long run. We need transparency on how Thames Water allocates its capital.

- Shareholder Dividends: While shareholder returns are important, prioritizing dividend payouts over crucial infrastructure investment raises questions about long-term sustainability and responsibility. The balance between shareholder returns and investment in service improvements is critical.

- Comparison to Peers: Benchmarking Thames Water's financial performance and executive compensation against other water companies in the UK is vital. This provides context and reveals whether the bonuses are out of line with industry norms.

Debt Levels and Financial Stability

High debt levels can hinder a company's ability to invest in infrastructure improvements and maintain service quality. Did Thames Water's executive bonuses come at the expense of financial stability?

- Debt-to-Equity Ratio: This key financial indicator reveals the company's reliance on debt financing. A high ratio suggests increased financial risk, potentially jeopardizing future investments. Transparency regarding this ratio is crucial.

- Credit Ratings: Credit rating agencies provide independent assessments of a company's financial health. A downgraded credit rating would signify increased financial risk and cast doubt on the justification for executive bonuses.

- Financial Analyst Concerns: Reports and analyses from financial analysts often highlight potential financial risks. Reviewing these reports provides valuable insights into Thames Water's financial standing.

- Impact on Future Investment: High debt levels can restrict future investments in critical infrastructure upgrades, leading to a vicious cycle of deferred maintenance and increased operational costs.

Environmental Performance and Regulatory Compliance

Thames Water's environmental record is a significant factor in evaluating the justification of executive bonuses. The frequency and severity of sewage spills and water leaks are crucial indicators of operational effectiveness and environmental responsibility.

Sewage Spills and Water Leaks

The impact of sewage spills and water leaks on the environment and public health is undeniable. A high number of incidents reflects poorly on operational management and undermines the justification for executive bonuses.

- Data on Spills and Leaks: Quantifiable data on the number and scale of incidents, sourced from reports by the Environment Agency and other regulatory bodies, is critical for a fair assessment.

- Environmental Impact: The environmental consequences of sewage spills, including damage to ecosystems and water quality, need to be considered.

- Fines and Penalties: Regulatory fines imposed on Thames Water for environmental violations should be factored into the assessment of its performance. These fines directly impact profitability and shareholder returns.

- Public Health Risks: Sewage spills pose significant risks to public health, further weakening the argument for executive bonuses in the face of such failures.

Investment in Infrastructure

Adequate investment in infrastructure is essential for preventing environmental incidents. Comparing investment levels to profits and executive bonuses is essential.

- Investment Levels: Transparent data on investments in upgrading and maintaining water infrastructure is necessary for evaluation.

- Correlation with Incidents: Analyzing the relationship between investment levels and the frequency of leaks and spills provides valuable insights into the effectiveness of infrastructure spending.

- Long-Term Planning: A lack of long-term planning in infrastructure investment can lead to increased incidents and higher costs in the future.

Customer Service and Public Perception

Customer satisfaction and public opinion are important indicators of overall performance, influencing the legitimacy of executive bonuses.

Customer Complaints and Satisfaction

High levels of customer complaints and low satisfaction scores reflect poorly on the company's performance and the effectiveness of its management.

- Data from Ofwat: Ofwat, the water services regulator, collects data on customer complaints and satisfaction levels. This data provides a valuable benchmark.

- Independent Surveys: Results from independent customer satisfaction surveys offer additional insights.

- Impact on Reputation: Poor customer service damages the company's reputation and reduces trust.

Public Opinion and Media Coverage

Negative public opinion and widespread media criticism regarding Thames Water's performance and executive bonuses cannot be ignored.

- News Articles and Social Media: Analysis of news articles and social media sentiment reveals public perception of the company.

- Public Opinion Polls: Polls gauging public opinion on Thames Water's performance provide quantitative data.

- Impact on Future Prospects: Negative public opinion can significantly harm the company's future prospects and ability to attract investment.

Conclusion

The evidence presented raises serious questions about the justification of Thames Water executive bonuses. While financial performance data is necessary for a complete analysis, the company's environmental record and poor customer service heavily weigh against the substantial payouts. The high frequency of sewage spills and water leaks, alongside significant customer dissatisfaction and negative public perception, suggest a disconnect between executive compensation and overall performance. Are Thames Water executive bonuses truly justified? The significant failures in environmental responsibility and customer service strongly suggest that they are not. We need greater transparency and accountability from water companies and must hold them responsible for delivering essential services effectively and sustainably. Join the conversation and share your thoughts! Let's demand better from Thames Water and other water companies regarding both performance and executive compensation.

Featured Posts

-

Caso Elias Rodriguez Acusacion En La Libertad Y Las Sospechas De Represalia Politica De App

May 23, 2025

Caso Elias Rodriguez Acusacion En La Libertad Y Las Sospechas De Represalia Politica De App

May 23, 2025 -

Character Ais Chatbots Exploring The Limits Of Free Speech Protection

May 23, 2025

Character Ais Chatbots Exploring The Limits Of Free Speech Protection

May 23, 2025 -

Data Breach Hacker Targets Executive Office365 Accounts Accumulates Millions

May 23, 2025

Data Breach Hacker Targets Executive Office365 Accounts Accumulates Millions

May 23, 2025 -

Karate Kid Legend Of The Karate Kid First Reactions Rave About Jackie Chan And Ralph Macchio

May 23, 2025

Karate Kid Legend Of The Karate Kid First Reactions Rave About Jackie Chan And Ralph Macchio

May 23, 2025 -

Harry Maguire Speaks Out After Losing Man Utd Captaincy

May 23, 2025

Harry Maguire Speaks Out After Losing Man Utd Captaincy

May 23, 2025

Latest Posts

-

Review Jonathan Groffs Just In Time Captures The Spirit Of Bobby Darin

May 23, 2025

Review Jonathan Groffs Just In Time Captures The Spirit Of Bobby Darin

May 23, 2025 -

Just In Time Musical Review Groffs Performance And The Shows Success

May 23, 2025

Just In Time Musical Review Groffs Performance And The Shows Success

May 23, 2025 -

Jonathan Groffs Just In Time A 1960s Style Musical Triumph

May 23, 2025

Jonathan Groffs Just In Time A 1960s Style Musical Triumph

May 23, 2025 -

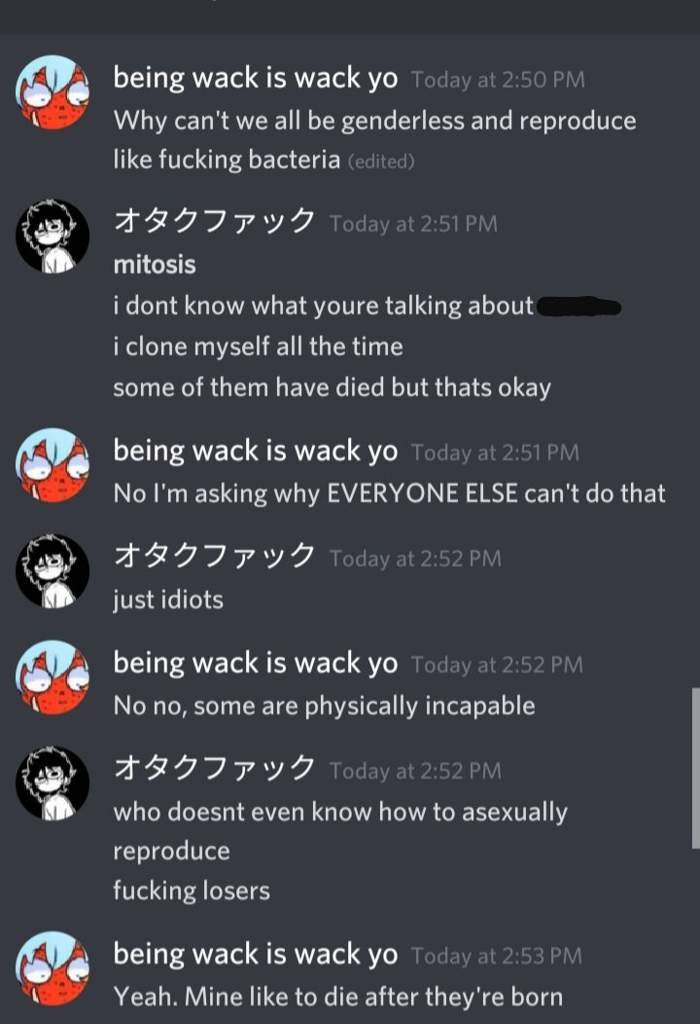

Jonathan Groff And Asexuality An Instinct Magazine Interview

May 23, 2025

Jonathan Groff And Asexuality An Instinct Magazine Interview

May 23, 2025 -

Jonathan Groffs Past An Open Conversation On Asexuality

May 23, 2025

Jonathan Groffs Past An Open Conversation On Asexuality

May 23, 2025