Bajaj Twins Weigh On Indian Markets: Sensex, Nifty 50 End Flat

Table of Contents

Bajaj Auto's Performance and its Market Ripple Effect

Bajaj Auto's performance today directly influenced the overall market sentiment. While a detailed breakdown requires accessing real-time financial data, let's hypothetically consider a scenario for illustrative purposes. Imagine Bajaj Auto experienced a moderate price fluctuation, perhaps closing slightly lower than the previous day despite healthy trading volume.

- Hypothetical Price Change: Let's assume a 1% decrease in Bajaj Auto's stock price.

- Trading Volume: A high trading volume could indicate significant investor activity, suggesting that the price movement held substantial weight.

- Analyst Opinions: Analysts might have attributed the price dip to various factors such as profit-booking after a recent rally, concerns about upcoming regulatory changes, or a broader downturn in the auto sector.

- Impact on Related Sectors: A decline in Bajaj Auto could also trigger a negative ripple effect on auto ancillary companies, impacting the broader auto sector's performance. This interconnectedness is a key element of Indian market volatility.

This hypothetical scenario highlights how even a seemingly small movement in a large-cap stock like Bajaj Auto can impact the overall market. Real-time data analysis is crucial for a complete understanding.

Bajaj Finserv's Influence on Overall Market Sentiment

Bajaj Finserv, the financial services arm of the Bajaj group, also played a crucial role in shaping the market's trajectory. The financial sector is particularly sensitive to various economic indicators.

- Hypothetical Price Movements: Let's imagine Bajaj Finserv's stock experienced a slight increase, perhaps counteracting some of the negative pressure from Bajaj Auto. A hypothetical 0.5% increase could be significant given its weight in the market.

- Trading Volume Analysis: High trading volume in Bajaj Finserv could signal investor confidence or uncertainty, depending on the context.

- Impact on Investor Confidence: The performance of Bajaj Finserv, a major player in the Indian financial sector, significantly impacts overall investor confidence. Positive news from Bajaj Finserv could offset negative news elsewhere.

- Correlation with Other Financial Stocks: Its performance might correlate with other financial stocks, creating a broader impact on the financial sector's performance within the broader Indian stock market.

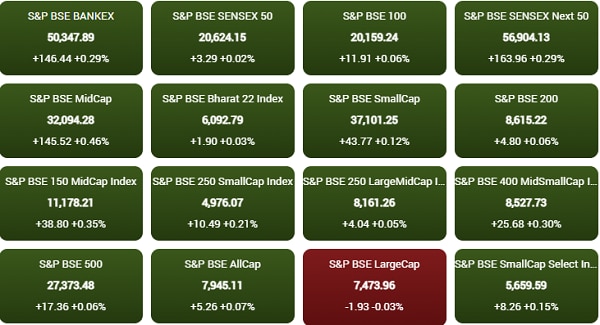

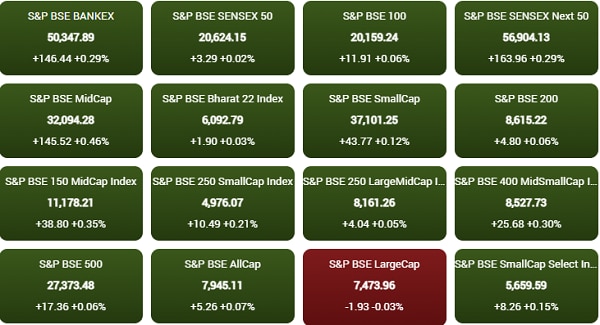

Sensex and Nifty 50: A Detailed Look at the Flat Trajectory

Despite the potential impact of the Bajaj twins, the Sensex and Nifty 50 indices closed flat. This indicates a balancing act of various market forces.

- Closing Values: Let's assume the Sensex and Nifty 50 closed within a narrow range of their opening values, reflecting market stability despite some individual stock movements.

- Intraday Highs and Lows: Analyzing intraday highs and lows can reveal the extent of market fluctuation and the influence of various factors throughout the trading day.

- Overall Market Volume: The overall market volume can provide insights into overall investor participation and sentiment. High volume with flat indices might indicate indecision.

- Comparison with Previous Day's Performance: Comparing the day's performance with previous days’ can highlight trends and patterns that influence market behavior.

Expert Opinions and Future Market Predictions

Expert opinions are crucial in understanding the Bajaj twins' impact and predicting future trends.

- Analyst Quotes: Financial analysts might highlight factors such as global market trends, the rupee's performance against the dollar, inflation data, and geopolitical events, as factors influencing the overall market stability alongside the Bajaj twins' performance.

- Future Price Predictions: Analysts might offer predictions on future price movements for both Bajaj twins and the broader market indices, providing investors with valuable insights.

- Investment Strategies: Experts could recommend investment strategies based on the current market scenario, considering the influence of Bajaj twins and other relevant factors.

Conclusion: Understanding the Bajaj Twins' Ongoing Influence on Indian Markets

The performance of Bajaj Auto and Bajaj Finserv significantly impacts the Indian stock market. Their combined influence, along with other factors, contributed to the Sensex and Nifty 50's flat trajectory today. Understanding the dynamics of large-cap companies like the Bajaj twins is crucial for navigating the Indian stock market.

To make informed investment decisions in the dynamic Indian Stock Market, continue monitoring the performance of the Bajaj twins and other key players. Further research into Bajaj twins' analysis, Indian Stock Market Investment strategies, and Sensex and Nifty 50 trends is recommended. Stay updated with market news and expert opinions to make sound investment choices.

Featured Posts

-

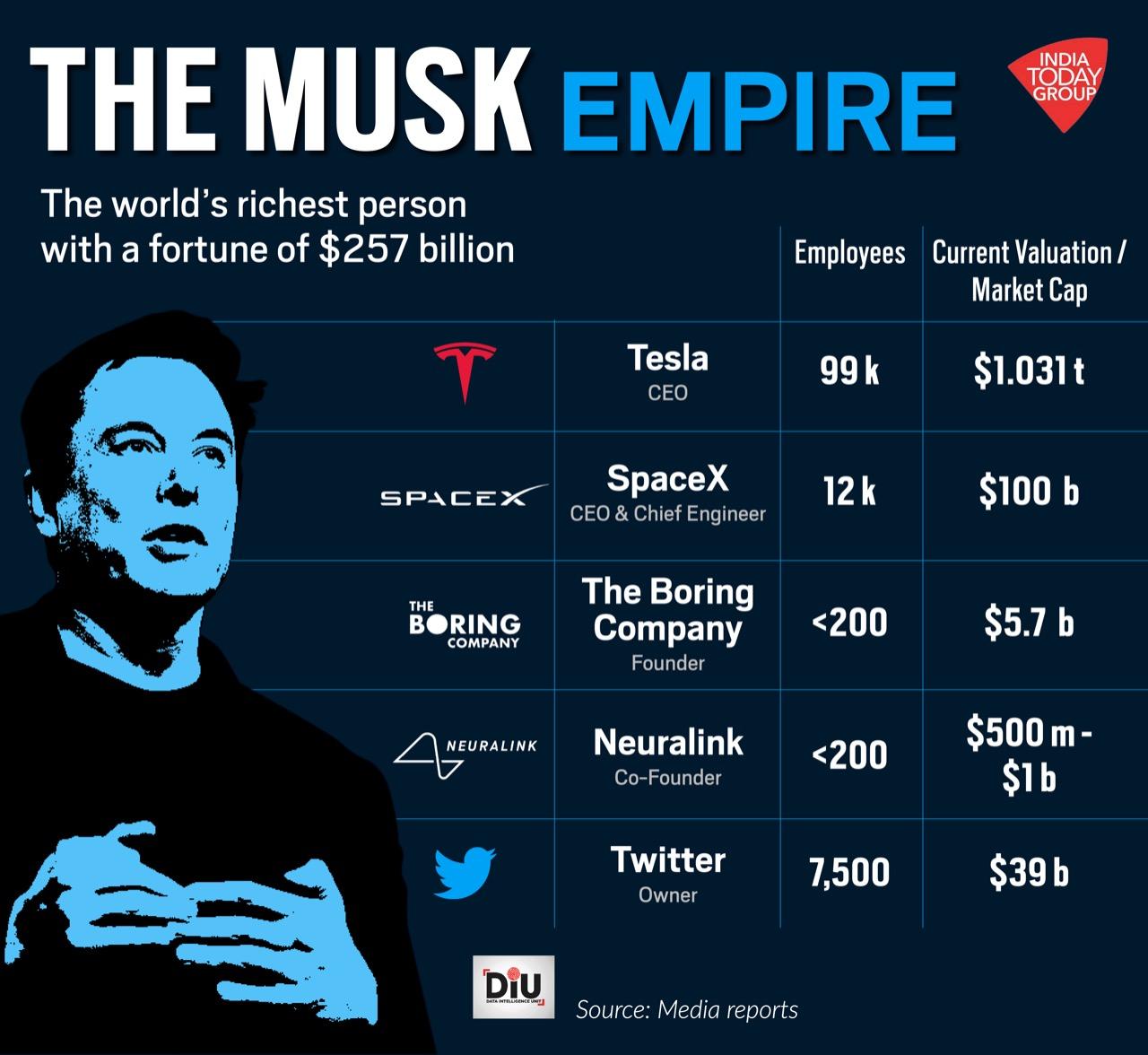

Analyzing Elon Musks Net Worth The Role Of Us Economic Conditions

May 09, 2025

Analyzing Elon Musks Net Worth The Role Of Us Economic Conditions

May 09, 2025 -

Attorney Generals Fentanyl Display A Deep Dive Into The Implications

May 09, 2025

Attorney Generals Fentanyl Display A Deep Dive Into The Implications

May 09, 2025 -

Legendata Bekam Zoshto E Nenadminliv

May 09, 2025

Legendata Bekam Zoshto E Nenadminliv

May 09, 2025 -

Suncors Record Production Inventory Buildup Impacts Sales Volumes

May 09, 2025

Suncors Record Production Inventory Buildup Impacts Sales Volumes

May 09, 2025 -

Elon Musk Net Worth The Influence Of Us Politics On Tesla And Space X

May 09, 2025

Elon Musk Net Worth The Influence Of Us Politics On Tesla And Space X

May 09, 2025