BigBear.ai (BBAI) Stock Decline In 2025: Understanding The Factors

Table of Contents

Macroeconomic Factors Influencing BBAI Stock Performance

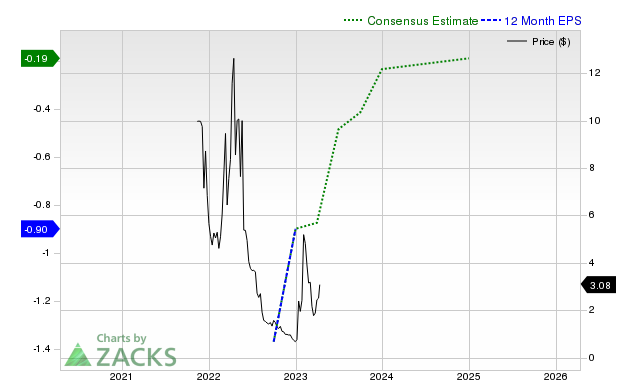

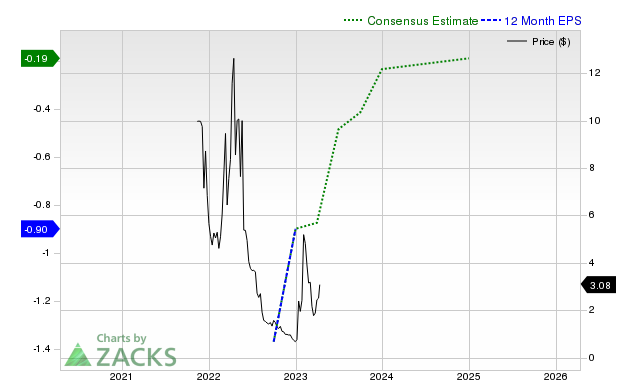

The 2025 stock market, in this hypothetical scenario, was significantly impacted by broader macroeconomic headwinds. These conditions had a ripple effect on the tech sector, particularly impacting growth-oriented companies like BigBear.ai. The interplay of several factors contributed to the challenging environment:

-

Increased borrowing costs impacting growth-oriented companies like BBAI: Interest rate hikes implemented to combat inflation increased the cost of capital, making it more expensive for BBAI to finance growth initiatives, acquisitions, and research and development. This directly affected their ability to scale operations and meet investor expectations.

-

Reduced investor appetite for riskier assets during economic uncertainty: A potential recession or economic slowdown led investors to shift towards safer, more stable investments. Growth stocks like BBAI, often perceived as riskier, saw reduced demand as investors sought to protect their capital.

-

Impact of global economic slowdown on BBAI's target markets and contracts: A weakening global economy impacted BBAI's target markets, leading to reduced demand for their services and potentially delayed or canceled contracts. This reduced revenue stream contributed to the negative impact on the BBAI stock price.

Keywords: economic downturn, interest rate risk, market volatility, tech stock performance, BBAI stock price.

Company-Specific Challenges Affecting BBAI Stock Price

Beyond the macroeconomic environment, internal factors also played a role in the hypothetical BBAI stock decline. These company-specific challenges eroded investor confidence and contributed to the negative price movement:

-

Missed earnings expectations or revenue targets: Failure to meet projected earnings and revenue targets is a major catalyst for stock price declines. If BBAI missed these expectations in 2025, it would have significantly impacted investor sentiment.

-

Challenges in scaling operations or integrating acquisitions: Rapid expansion can be challenging. If BBAI struggled to efficiently integrate acquisitions or effectively scale its operations to meet the growing demand, this operational inefficiency could have negatively impacted profitability and, consequently, the stock price.

-

Increased competition in the AI market: The AI market is highly competitive. The emergence of new competitors with innovative offerings or aggressive pricing strategies could have eroded BBAI's market share and impacted its valuation.

-

Negative news or controversies impacting investor confidence: Any negative news or controversies, whether related to financial irregularities, ethical concerns, or product failures, would have likely caused a significant drop in investor confidence, leading to a decline in the BBAI stock price.

Keywords: BBAI earnings, revenue growth, competition analysis, AI market share, company performance, BBAI stock.

Sector-Specific Trends Impacting BigBear.ai's Valuation

The broader artificial intelligence market trends also had a bearing on BBAI's valuation. These trends highlight the dynamic nature of the AI industry and its influence on individual companies:

-

Changes in investor sentiment towards AI stocks: Shifts in investor sentiment toward the AI sector as a whole could lead to widespread sell-offs, even for companies with solid fundamentals. Any negative perception of the AI market could drag down even strong performers like BBAI.

-

Emerging technologies impacting BBAI's core offerings: The rapid pace of technological advancements means that even established companies can be disrupted. If newer, more efficient AI technologies emerged, rendering some of BBAI's core offerings less competitive, it would negatively impact their valuation.

-

Regulatory changes affecting the AI industry: Increased regulatory scrutiny or changes in regulations surrounding AI data usage or deployment could significantly affect BBAI's operations and profitability, leading to a decline in its stock price.

Keywords: AI investment, artificial intelligence trends, technological disruption, AI regulation, BBAI valuation.

Analyzing Investor Sentiment and Market Speculation

Investor sentiment and market speculation played a significant role in the hypothetical BBAI stock price decline of 2025. Several factors contributed to the negative sentiment:

-

Impact of analyst ratings and price target changes: Downgrades from financial analysts and reduced price targets would have created negative momentum, encouraging investors to sell their shares.

-

Influence of social media and news coverage on BBAI stock: Negative news coverage or social media sentiment could significantly impact investor perception and drive down the stock price, even if the underlying fundamentals remain strong.

-

Short-selling activity and its potential effect on the price: An increase in short-selling activity, where investors bet against the stock price, could exert downward pressure, potentially exacerbating the decline.

Keywords: investor confidence, stock market sentiment, analyst predictions, short interest, BBAI stock performance.

Conclusion: Forecasting the Future of BigBear.ai (BBAI) Stock

The hypothetical decline in BigBear.ai (BBAI) stock in 2025 can be attributed to a combination of macroeconomic headwinds, company-specific challenges, sector-specific trends, and negative investor sentiment. While the future performance of BBAI stock is uncertain, understanding these contributing factors is crucial for making informed investment decisions. It's important to remember that investing in any stock, especially in a rapidly evolving sector like AI, involves inherent risks.

Therefore, before making any decisions regarding investing in BigBear.ai (BBAI) stock or related artificial intelligence stocks, conduct thorough due diligence, carefully assess the risks, and develop a well-informed investment strategy. Keep abreast of macroeconomic conditions, company performance, sector trends, and investor sentiment to make the most informed choices for your portfolio. Remember, investing in BBAI stock or any other stock involves risk, and past performance is not indicative of future results. Keywords: BBAI stock outlook, future of AI, investment strategy, risk assessment, stock market analysis, BBAI stock investment.

Featured Posts

-

Eksereynontas To Oropedio Evdomos Tin Protomagia

May 21, 2025

Eksereynontas To Oropedio Evdomos Tin Protomagia

May 21, 2025 -

Healing From A Love Monster Rebuilding Self Esteem After A Toxic Relationship

May 21, 2025

Healing From A Love Monster Rebuilding Self Esteem After A Toxic Relationship

May 21, 2025 -

Factors Contributing To The Big Bear Ai Bbai Stock Fall In 2025

May 21, 2025

Factors Contributing To The Big Bear Ai Bbai Stock Fall In 2025

May 21, 2025 -

Peppa Pigs Expanding Family The Newborns Debut

May 21, 2025

Peppa Pigs Expanding Family The Newborns Debut

May 21, 2025 -

The Goldbergs A Nostalgic Look At 80s Family Life

May 21, 2025

The Goldbergs A Nostalgic Look At 80s Family Life

May 21, 2025