BigBear.ai Holdings, Inc. (BBAI) Suffers Significant Losses: Causes And Analysis

Table of Contents

Financial Performance and Revenue Shortfalls

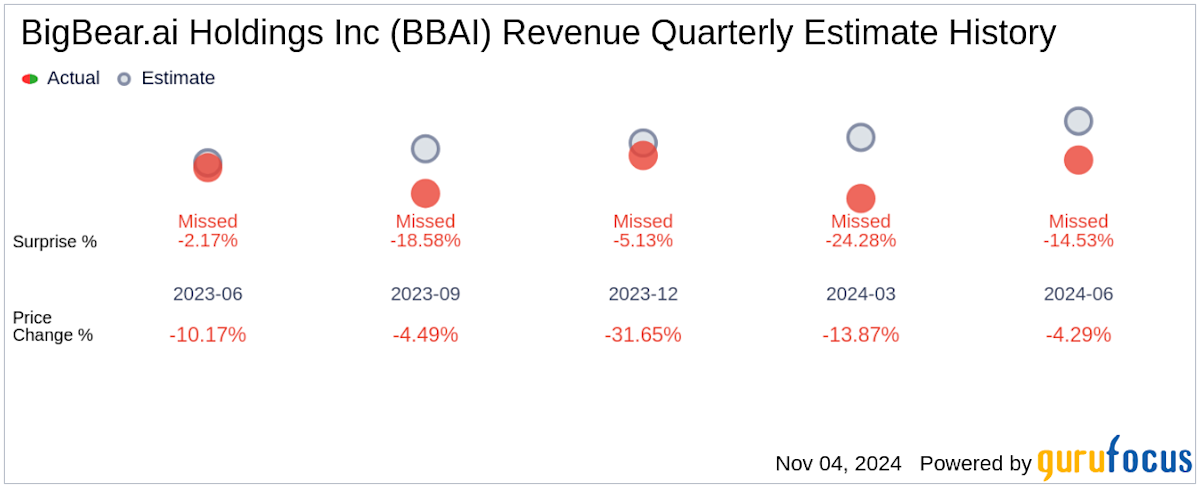

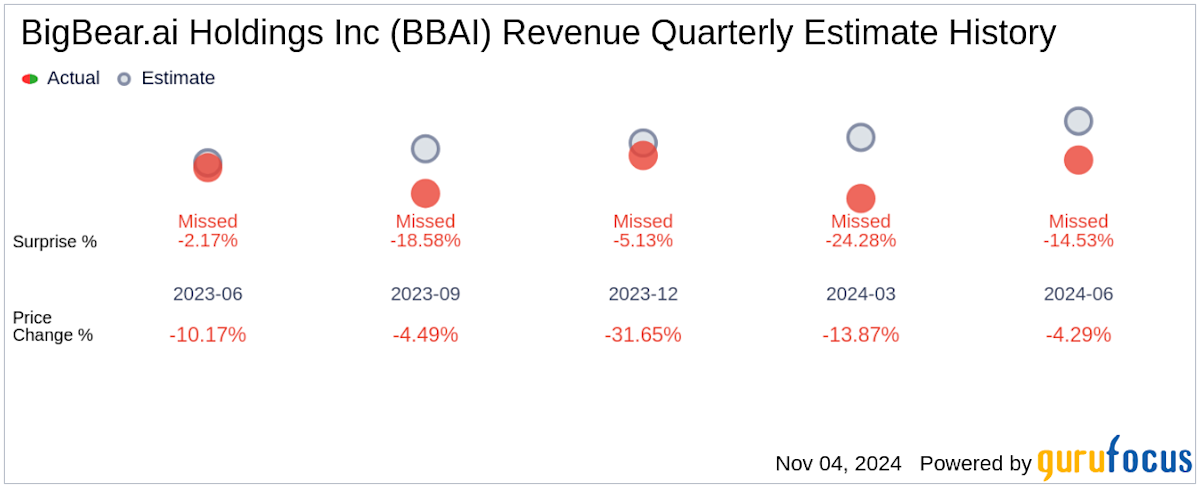

BBAI's recent financial reports paint a concerning picture. The company has consistently missed earnings expectations, triggering a decline in investor confidence. A detailed analysis reveals several key areas of concern regarding BBAI financials:

- Decreased Revenue Compared to Projections: Revenue growth has fallen significantly short of projected targets, indicating potential issues with sales, marketing, or product adoption.

- Net Losses Exceeding Expectations: BBAI has reported net losses that significantly surpass analysts' forecasts, raising questions about the company's ability to achieve profitability in the near term.

- Negative Cash Flow: Negative cash flow is a critical indicator of financial instability, raising concerns about the company's ability to fund operations and future growth initiatives.

- Decreased Operating Margin: A shrinking operating margin demonstrates increasing costs relative to revenue, further highlighting the pressure on BBAI's profitability. This BBAI financials data clearly signals significant challenges. The combination of revenue shortfall, earnings miss, and negative cash flow presents a serious situation for investors.

These BBAI financials paint a troubling picture regarding the company's financial performance and its profitability.

Market Sentiment and Investor Confidence

The decline in BBAI's stock price is not solely attributable to internal factors. The overall market sentiment towards the company, and the AI sector as a whole, has played a significant role. Several factors have eroded investor confidence:

- Increased Competition in the AI Market: BBAI faces intense competition from larger, more established players in the rapidly evolving AI market. This competition puts pressure on pricing and market share.

- Concerns about the Company's Long-Term Growth Prospects: Investors are increasingly concerned about BBAI's ability to sustain long-term growth, given its current financial performance and competitive landscape. This impacts growth prospects.

- Negative Analyst Ratings and Price Target Reductions: Several analysts have downgraded their ratings for BBAI stock and reduced their price targets, further fueling negative investor sentiment. This shift in analyst ratings reflects the growing concerns.

- Lack of Significant New Contracts or Partnerships: The absence of major contract wins or strategic partnerships signals a potential struggle to secure new business and revenue streams. This lack of significant new business impacts stock volatility.

These factors have created a negative feedback loop, impacting market conditions and further depressing the BBAI stock price.

Macroeconomic Factors and Industry Trends

Broader macroeconomic factors and industry trends have also contributed to BBAI's struggles. The current economic climate presents several challenges:

- Impact of Rising Interest Rates on Investment in Tech Stocks: Increased interest rates make borrowing more expensive, impacting investment in growth-oriented technology stocks like BBAI.

- Overall Market Correction Affecting Growth Stocks: The overall market correction has disproportionately impacted high-growth stocks, including many in the AI sector. This market correction has negatively influenced BBAI.

- Competition from Larger, More Established Tech Companies: Established tech giants with substantial resources pose a significant competitive threat to smaller players like BBAI.

- Changes in Government Regulations Affecting the AI Industry: Emerging government regulations related to AI could create additional uncertainty and challenges for companies in this sector.

These macroeconomic factors and industry trends significantly impact the technology sector and companies such as BBAI.

Company-Specific Challenges and Strategic Issues

Internal challenges within BigBear.ai have further exacerbated the situation. Several factors suggest potential strategic missteps:

- Leadership Changes Impacting Company Strategy: Changes in leadership can lead to disruptions in strategic direction and execution.

- Delayed Product Launches or Development Issues: Delays in product development can hinder market penetration and revenue generation.

- Ineffective Marketing and Sales Strategies: Ineffective marketing and sales efforts can limit the company's ability to reach its target market and generate sales.

- Internal Restructuring or Cost-Cutting Measures: While necessary in some cases, internal restructuring or cost-cutting can lead to short-term disruptions and potential negative impacts on morale and productivity.

These company-specific challenges require immediate attention and effective strategic solutions. Improving operational efficiency is crucial.

Conclusion: Navigating the Future of BigBear.ai (BBAI) Investment

BBAI's significant stock decline is a result of a confluence of factors: weak financial performance, negative market sentiment, unfavorable macroeconomic conditions, and internal company-specific challenges. While the situation is undeniably challenging, BBAI's future is not entirely bleak. The company operates in a rapidly growing sector with long-term potential. However, investors need to carefully assess the risks and monitor BBAI's progress in addressing these challenges. Understanding the reasons behind BigBear.ai's (BBAI) stock decline is crucial for informed investment decisions. Continue your research and stay updated on BBAI's performance to make strategic choices regarding your portfolio. Careful risk assessment is essential when considering BBAI investment and its future stock outlook.

Featured Posts

-

Tyler Bates Wwe Return When And How To Watch

May 20, 2025

Tyler Bates Wwe Return When And How To Watch

May 20, 2025 -

Dealerships Step Up Opposition To Electric Vehicle Regulations

May 20, 2025

Dealerships Step Up Opposition To Electric Vehicle Regulations

May 20, 2025 -

Big Bear Ai Bbai Deep Dive Into The Recent Stock Market Decline

May 20, 2025

Big Bear Ai Bbai Deep Dive Into The Recent Stock Market Decline

May 20, 2025 -

Pracovny Priestor Home Office Alebo Kancelaria Analyza Preferencii Manazerov

May 20, 2025

Pracovny Priestor Home Office Alebo Kancelaria Analyza Preferencii Manazerov

May 20, 2025 -

Cassidy Hutchinsons Memoir Key Jan 6 Witness To Detail Capitol Attack

May 20, 2025

Cassidy Hutchinsons Memoir Key Jan 6 Witness To Detail Capitol Attack

May 20, 2025