BigBear.ai Stock: Buy, Sell, Or Hold? Our Recommendation

Table of Contents

BigBear.ai's Financial Performance and Valuation

Analyzing BigBear.ai's financial health is crucial for any investment decision. Recent financial reports reveal a company striving for growth but facing challenges in achieving consistent profitability. We need to examine key metrics to understand its valuation compared to competitors.

- Revenue Growth: While BigBear.ai has shown periods of revenue growth, the consistency and sustainability of this growth need further scrutiny. Examining year-over-year and quarter-over-quarter growth rates provides a clearer picture.

- Earnings and Profitability: Profit margins and earnings per share (EPS) are vital indicators of financial health. Analyzing these figures reveals BigBear.ai's ability to translate revenue into profit. A comparison to industry benchmarks is essential.

- Valuation Metrics: Comparing BigBear.ai's Price-to-Earnings (P/E) ratio, Price-to-Sales (P/S) ratio, and other valuation metrics to competitors provides a benchmark for determining whether its stock is overvalued or undervalued.

- Debt and Cash Flow: A significant level of debt can hinder a company's growth potential. Analyzing BigBear.ai's debt-to-equity ratio and its cash flow from operations provides insight into its financial stability.

Competitive Landscape and Market Position

BigBear.ai operates in a fiercely competitive AI market. Understanding its competitive advantages and market position is essential.

- Key Competitors: Companies like Palantir Technologies, Booz Allen Hamilton, and other AI-focused firms are major competitors. We need to analyze their market share and strategies.

- Competitive Advantages: BigBear.ai's competitive advantages lie in its specialized AI solutions for government and commercial clients, its strong contracts, and its experienced team.

- Market Trends: The growth of the government and commercial AI market significantly impacts BigBear.ai's potential. Factors like increasing government spending on AI and the rising demand for cybersecurity solutions contribute to market growth.

- Unique Selling Propositions (USPs): Identifying what sets BigBear.ai apart—its specific technological capabilities, expertise in particular sectors, and its client relationships—is vital.

BigBear.ai's Growth Prospects and Future Potential

Evaluating BigBear.ai's future potential requires considering the long-term growth of the AI market and the company's strategic plans.

- AI Market Growth: The overall AI market is projected to experience significant expansion, offering ample growth opportunities for players like BigBear.ai.

- Expansion Plans: BigBear.ai's strategic initiatives to enter new markets or expand its product offerings greatly influence future performance. Potential diversification into new verticals should be analyzed.

- Risks and Uncertainties: Competition, technological advancements, regulatory changes, and economic downturns pose significant risks.

- Growth Drivers: Factors like increased government contracts, successful product launches, strategic partnerships, and innovative technological advancements could drive BigBear.ai's growth.

Analyst Ratings and Price Targets for BigBear.ai Stock

Understanding the consensus view among financial analysts helps shape investment decisions.

- Buy, Sell, or Hold Ratings: A summary of ratings from reputable analysts provides a snapshot of the market sentiment.

- Price Targets: Analysts often provide price targets, indicating their expectations for future stock prices. These targets should be considered with caution.

- Range of Opinions: Different analysts have different perspectives, reflecting the inherent uncertainty in the market. The variance in opinions should be noted.

Risk Assessment for Investing in BigBear.ai

Investing in BigBear.ai, or any AI company, carries inherent risks.

- Tech Sector Volatility: The technology sector is inherently volatile, making BigBear.ai stock susceptible to market fluctuations.

- Competition: Intense competition could limit market share and profitability.

- Financial Performance Risks: Inconsistency in financial performance poses a risk to investment returns.

- Regulatory Risks: Changes in government regulations could impact BigBear.ai's operations.

- Mitigation Strategies: Diversification of investment portfolios and thorough due diligence can help mitigate risks.

Conclusion: BigBear.ai Stock: Our Recommendation

Based on our analysis of BigBear.ai's financial performance, competitive position, growth prospects, analyst ratings, and inherent risks, we currently recommend a Hold rating for BigBear.ai stock. While the company operates in a high-growth sector with potential for future expansion, its inconsistent financial performance and the competitive landscape warrant caution. Further improvement in profitability and a more consistent demonstration of growth are needed before a stronger buy recommendation can be justified. The risks associated with investing in a volatile AI stock should also be carefully considered.

Continue your BigBear.ai stock research by consulting additional financial news sources and analyst reports before making any investment decisions. Learn more about investing in BigBear.ai by visiting [link to relevant resource, e.g., BigBear.ai investor relations page]. Remember, this analysis is for informational purposes only and does not constitute financial advice.

Featured Posts

-

I Tzenifer Lorens Kai Koyki Maroni Deytero Paidi Gia To Zeygari

May 20, 2025

I Tzenifer Lorens Kai Koyki Maroni Deytero Paidi Gia To Zeygari

May 20, 2025 -

Nou Nascutul Din Familia Schumacher Imagini Exclusive

May 20, 2025

Nou Nascutul Din Familia Schumacher Imagini Exclusive

May 20, 2025 -

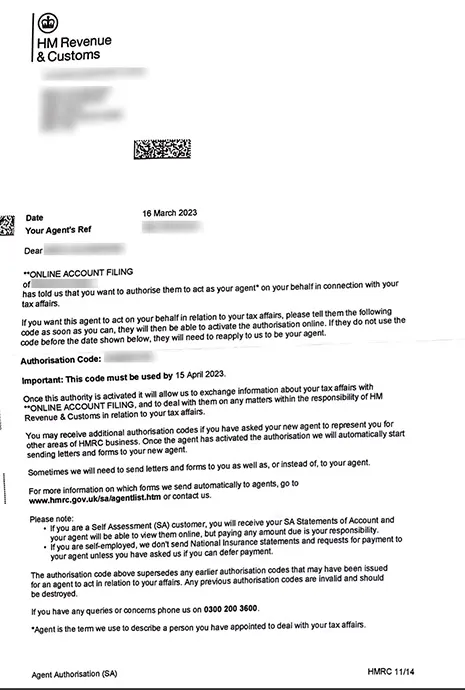

Tax Code Changes From Hmrc How Your Savings Are Affected

May 20, 2025

Tax Code Changes From Hmrc How Your Savings Are Affected

May 20, 2025 -

Femicide In Spotlight Colombian Models Death Follows Mexican Influencers Live Stream Murder

May 20, 2025

Femicide In Spotlight Colombian Models Death Follows Mexican Influencers Live Stream Murder

May 20, 2025 -

Wayne Gretzky Fast Facts For Hockey Fans

May 20, 2025

Wayne Gretzky Fast Facts For Hockey Fans

May 20, 2025